What Crypto Whales Are Buying for Potential Gains in September 2025

As retail traders retreat, crypto whales are quietly accumulating WLD, PEPE, and TRUMP. Their aggressive buying hints at potential September rallies, though fading demand could trigger sharp reversals.

August was marked by a wave of selloffs across the crypto market, following July’s rally that pushed several assets to fresh price peaks.

However, while retail sentiment cooled, large holders have treated the dip as a buying opportunity, positioning themselves to capitalize on potential rebounds in September.

Worldcoin (WLD)

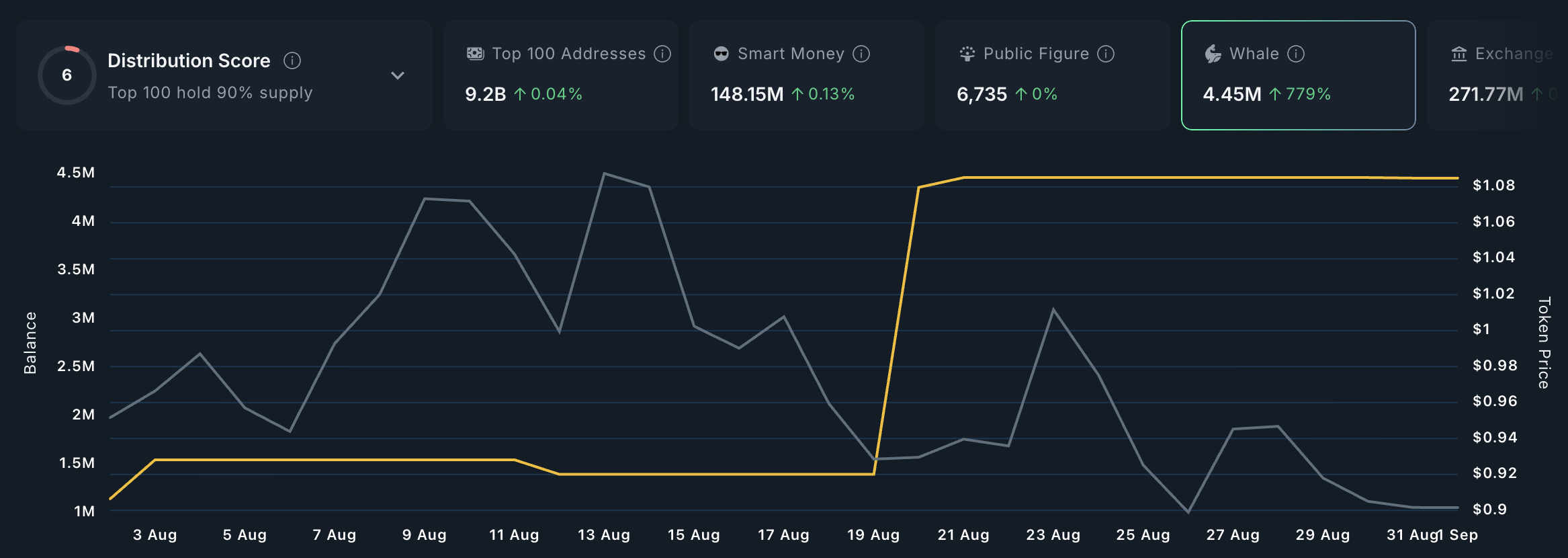

The Sam Altman-linked WLD is one of the assets that crypto whales are accumulating for gains this month. Per Nansen, whale wallets with WLD holdings valued above $1 million have increased their token supply by 779% over the past month.

WLD Whale Activity. Source:

WLD Whale Activity.

WLD Whale Activity. Source:

WLD Whale Activity.

This uptick in whale accumulation has strengthened the market’s bullish bias and could drive further gains if buying activity persists. As of this writing, this investor cohort controls 4.45 million WLD tokens.

If this whale accumulation persists, the altcoin could rally above $1.41.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

WLD Price Analysis. Source:

WLD Price Analysis.

WLD Price Analysis. Source:

WLD Price Analysis.

However, if demand falls, the token’s value could dip to $0.57.

PEPE

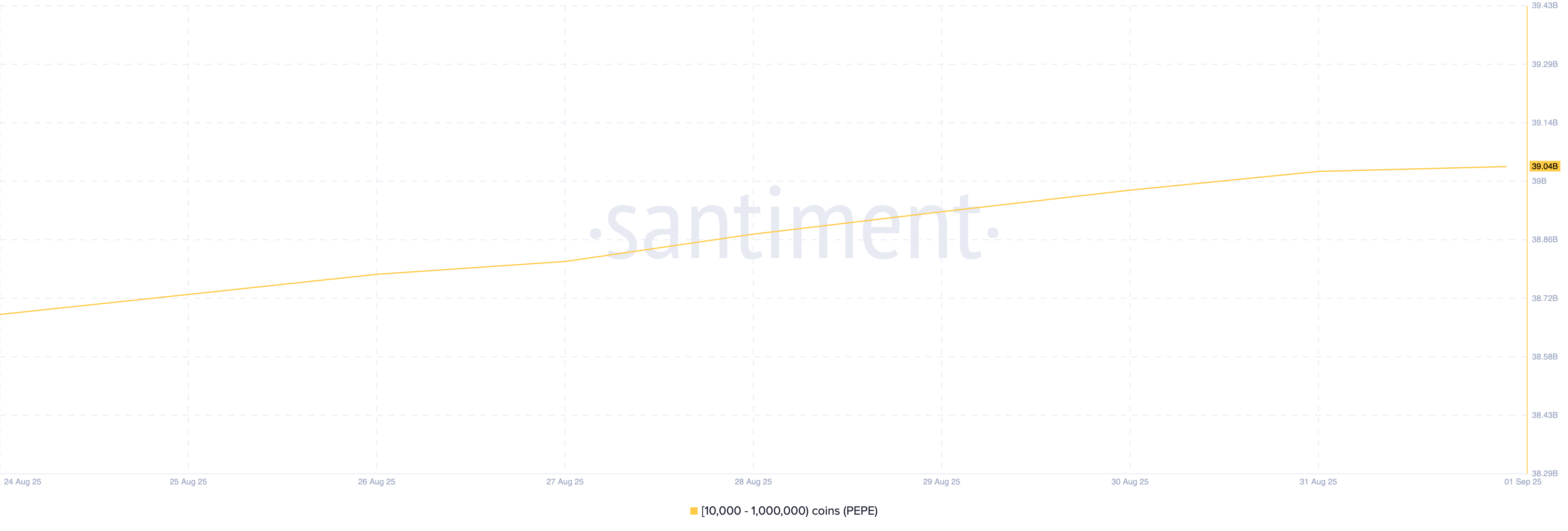

Solana-based meme coin PEPE has emerged as a top pick among crypto whales eyeing gains in September. On-chain data reveals that since August 24, large investors with wallets containing between 10,000 and 10 million PEPE have accumulated 360 million tokens.

PEPE Supply Distribution. Source:

PEPE Supply Distribution.

PEPE Supply Distribution. Source:

PEPE Supply Distribution.

This level of concentrated buying suggests that whales are positioning for a potential short-term rally, using the 5% dip in the meme coin’s price over the past week as an entry point to maximize returns.

If these whales continue to buy amid climbing volatility, their activity could trigger upward momentum, potentially pushing PEPE beyond the $0.00001070 mark.

WLD Price Analysis. Source:

WLD Price Analysis.

WLD Price Analysis. Source:

WLD Price Analysis.

On the other hand, if buying interest wanes and demand falls, the coin could face a correction, with its price slipping toward $0.00000830.

Official Trump (TRUMP)

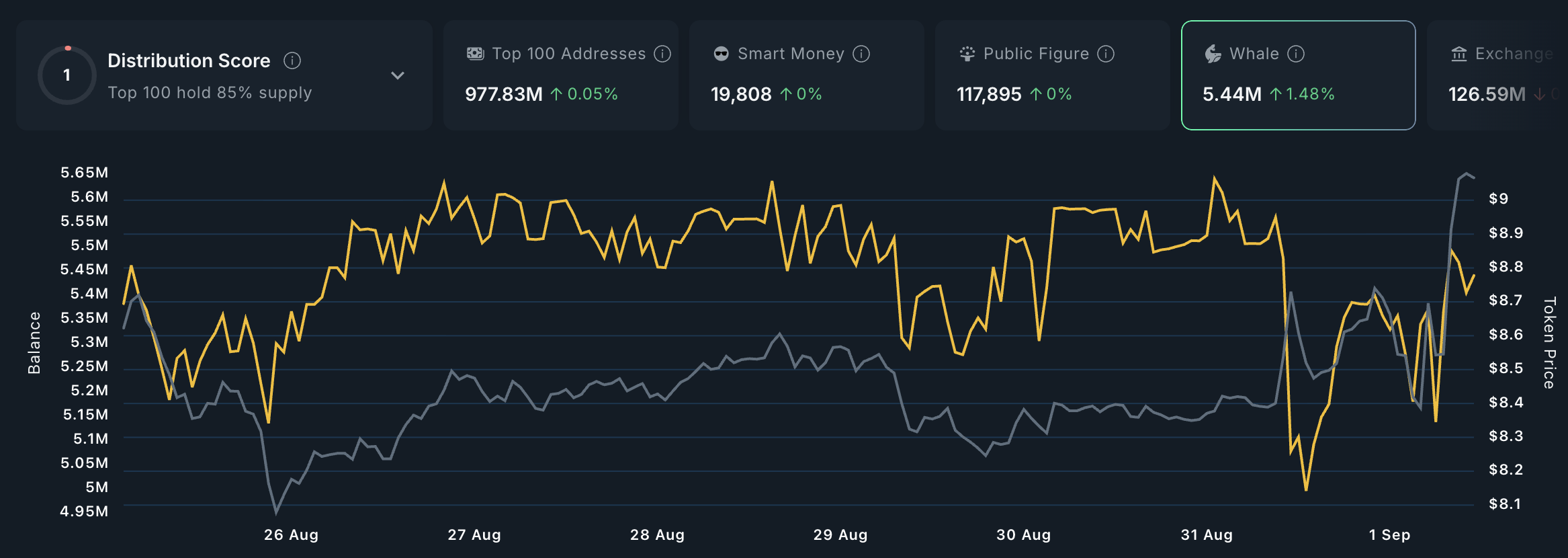

TRUMP is another asset that crypto whales are accumulating for potential gains this month. According to Nansen data, whale holdings of the meme coin have risen by 2% over the past week, signaling growing confidence among large investors.

TRUMP Whale Activity. Source:

TRUMP Whale Activity.

TRUMP Whale Activity. Source:

TRUMP Whale Activity.

This surge in whale activity has already begun to influence TRUMP’s market performance, helping the token climb nearly 10% in the past seven days.

If this buying momentum persists, TRUMP could extend its gains and rally toward $9.82.

TRUMP Price Analysis. Source:

TRUMP Price Analysis.

TRUMP Price Analysis. Source:

TRUMP Price Analysis.

Conversely, if whale demand wanes and buying activity slows, the token could face a pullback, with its price potentially declining to $8.02.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.