Sellers Tighten Grip on Pi Coin — Is a Breakdown Below All-Time Low Next?

Pi Coin remains stuck near its all-time low, with bearish momentum and a weakening Bitcoin correlation threatening further decline unless key support holds

Pi Coin’s recent price action shows persistent weakness, with the token struggling to recover from repeated failed breakouts. Despite attempts to establish momentum, the cryptocurrency remains vulnerable to further correction.

Over the past few days, Pi Coin’s decline has highlighted the difficulty it faces in distancing itself from historic lows.

Pi Coin Is Losing Its Strength

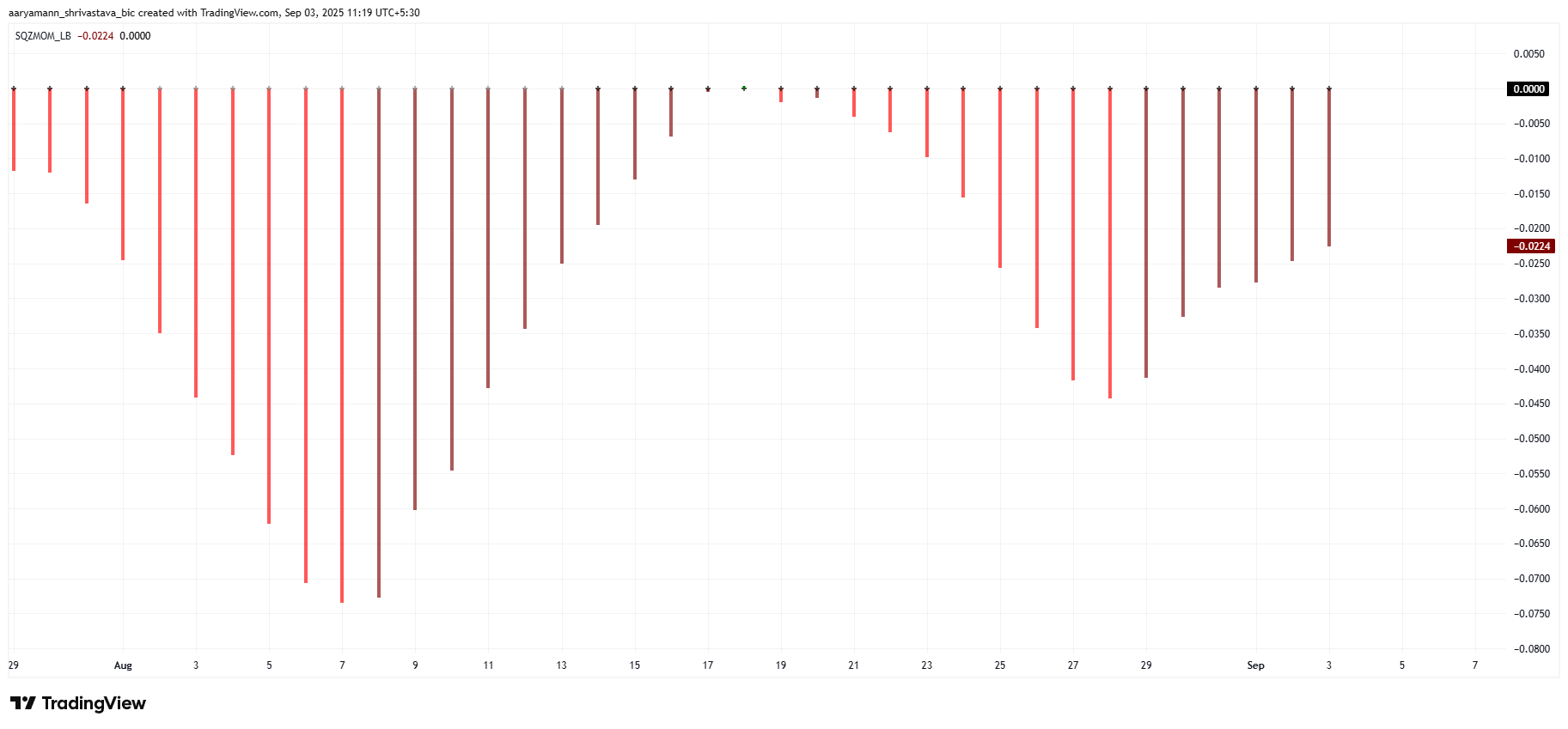

The Squeeze Momentum Indicator shows a squeeze forming on Pi Coin’s chart. Typically, a squeeze signals upcoming volatility, and with the indicator leaning bearish, the likelihood of downward pressure increases. When the squeeze resolves, the token may face a sharper drop if sellers dominate trading conditions.

This signals risk for Pi Coin holders. With bearish cues prevailing, a squeeze release could push prices closer to critical supports. Without meaningful buying activity, the cryptocurrency risks extended declines, leaving investors exposed to losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin Squeeze Momentum Indicator. Source:

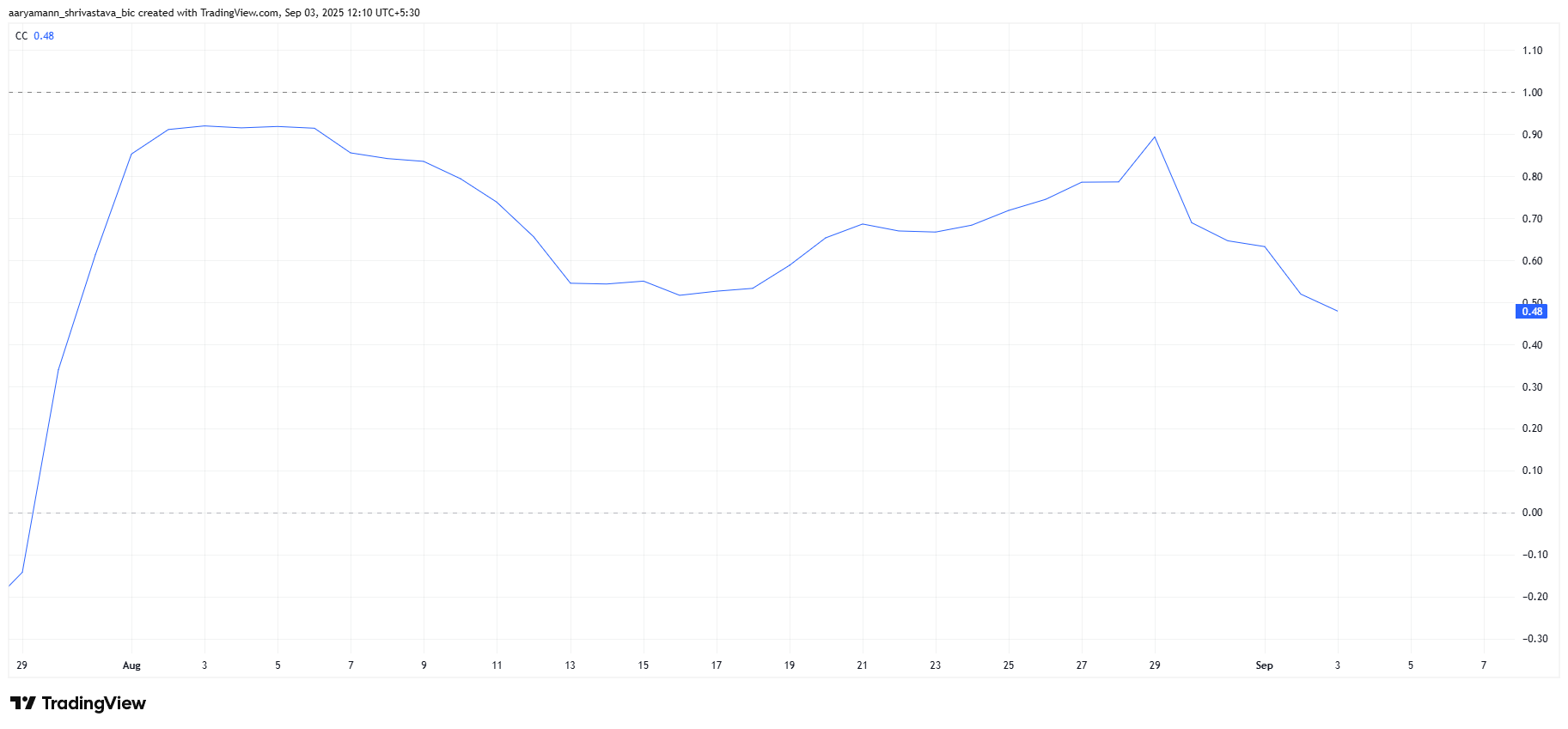

Pi Coin’s broader outlook is also dampened by a weakening correlation with Bitcoin. Currently, the correlation stands at 0.48, reflecting a divergence from BTC’s movement. Normally, Pi Coin follows Bitcoin’s trend more closely, but the recent break highlights its inability to capitalize on BTC’s upward trajectory this month.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin’s broader outlook is also dampened by a weakening correlation with Bitcoin. Currently, the correlation stands at 0.48, reflecting a divergence from BTC’s movement. Normally, Pi Coin follows Bitcoin’s trend more closely, but the recent break highlights its inability to capitalize on BTC’s upward trajectory this month.

Historically, Pi Coin’s correlation with Bitcoin strengthens during bearish cycles and weakens when BTC rises. This pattern is proving detrimental as Bitcoin gains while Pi Coin remains stagnant.

Pi Coin Correlation To Bitcoin. Source:

Pi Coin Correlation To Bitcoin. Source:

PI Price Is Struggling

At the time of writing, Pi Coin trades at $0.343, down 12.4% in the past three days. The token is holding above $0.344 support, a level that has repeatedly prevented further decline. However, this floor remains fragile as selling pressure continues to mount across the market.

If bearish factors dominate, Pi Coin could lose $0.344 support and retest its all-time low of $0.322. Any further decline below this threshold would likely push the token into new lows, creating a fresh all-time low and amplifying downside risk for holders.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

If Pi Coin rebounds from $0.344, it could rise to $0.360 in the short term. A stronger rally would allow the token to test $0.401, invalidating the bearish thesis. Such a move would provide temporary relief for investors while signaling renewed attempts at recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne