Ethereum Price Tests Breakout Zone With 2 Metrics Pointing Toward the Upside

Ethereum price is consolidating inside a symmetrical triangle, but key metrics are flashing bullish. Profit supply has dropped to a local low, while short-term holders are adding. On-balance volume also shows steady accumulation, pointing toward a potential upside breakout if buyers defend key support levels.

Ethereum has gained more than 68% over the past three months, putting most near-term holders firmly in profit. Yet over the past week, the asset has stalled — losing 4.7% and trading flat in the last 24 hours.

This consolidation has pushed the Ethereum price inside a pattern of indecision where bulls and bears battle for control. While such setups can resolve in either direction, two on-chain metrics suggest the next move may favor the upside.

Metric 1: Profit Supply Drop Points To Seller Exhaustion

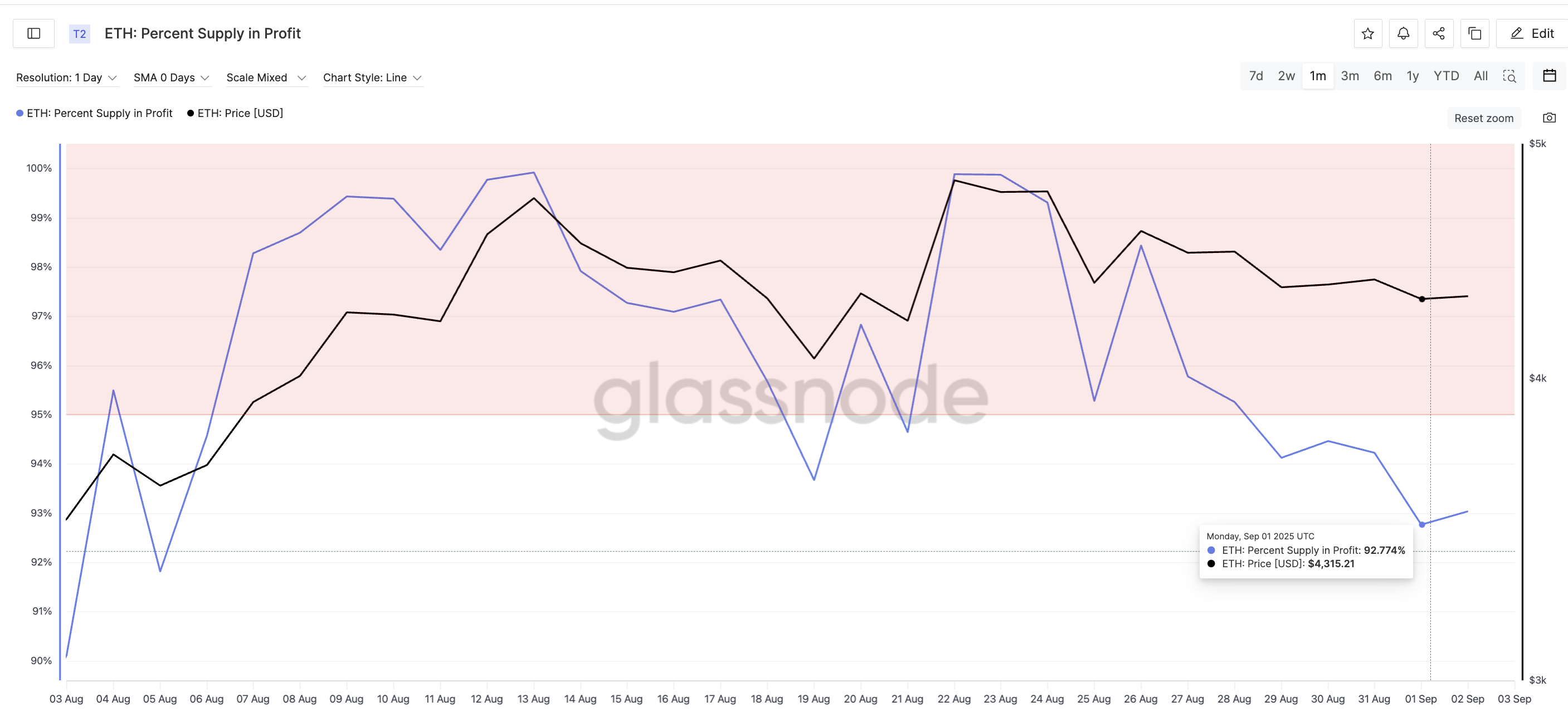

The percentage of ETH supply in profit dropped from 98.4% on August 26 to a local bottom of 92.7% on September 1 — its second-lowest reading in a month. Normally, such declines reflect heavy profit-taking. But once profit supply hits local bottoms, ETH has historically rallied. For example, when the ratio fell to 91.8% earlier in August, ETH surged from $3,612 to $4,748 (over 31%) in just eight days.

ETH Profit Takers Have Dropped:

Glassnode

ETH Profit Takers Have Dropped:

Glassnode

This drop means a wave of sellers may already be out of the market, leaving ETH with fewer profit-sensitive holders who might panic-sell. In other words, selling intensity has likely weakened at a time when the Ethereum price is already consolidating at a breakout zone. And that’s a bullish sign.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Metric 2: Short-Term Holders Accumulate Despite Gains

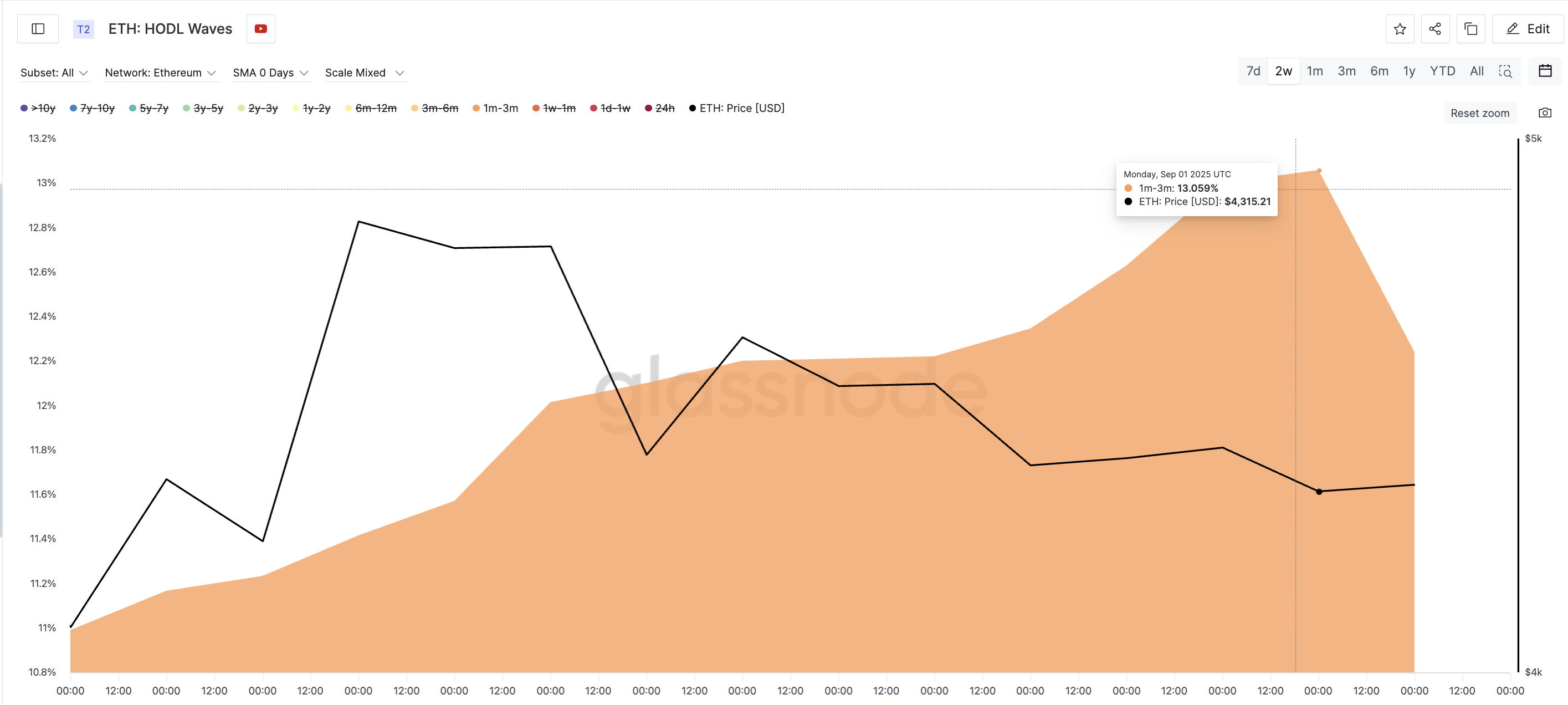

The more surprising detail is that the group most prone to profit-taking — one- to three-month holders — has been adding supply. Their share rose from 10.9% to 13% in just two weeks, even though ETH delivered over 20% monthly gains and more than 68% in three months.

ETH Buying Continues:

Glassnode

ETH Buying Continues:

Glassnode

This shows that traders who usually flip positions quickly are instead accumulating, signaling confidence in further upside. Combined with the low profit-supply reading, this HODL Waves finding paints a picture of reduced sell pressure and hidden demand building up behind ETH’s consolidation.

HODL Waves measure the distribution of a cryptocurrency’s supply by the age of coins held in wallets.

Ethereum Price Action And OBV Confirm Accumulation

On the chart, the ETH price trades inside a symmetrical triangle with support near $4,211 and resistance at $4,386. While price has made lower lows during this consolidation, On-Balance Volume (OBV) has made higher lows. OBV tracks whether trading volume is dominated by buyers or sellers, and this divergence suggests accumulation continues beneath the surface.

The OBV metric confirms what we saw earlier, while dicussing HODL waves.

ETH Price Analysis:

TradingView

ETH Price Analysis:

TradingView

The alignment of Ethereum price action and volume signals strengthens the case for a bullish breakout.

A close above $4,494 would unlock $4,669 as the next hurdle and $4,794 as the extended target. A drop below $4,211 would weaken the setup, while $4,058 remains the deeper support if bears take over.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes’ New Article: BTC May Drop to 80,000 Before Kicking Off a New Round of “Money Printing” Rally

The bulls are right; over time, the money printer will inevitably go “brrrr.”

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.