Ondo Global Markets Goes Live with 100+ Tokenized Stocks

Ondo Global Markets debuted with tokenized US stocks, surging trade volumes and ONDO activity, but US restrictions may limit wider market influence.

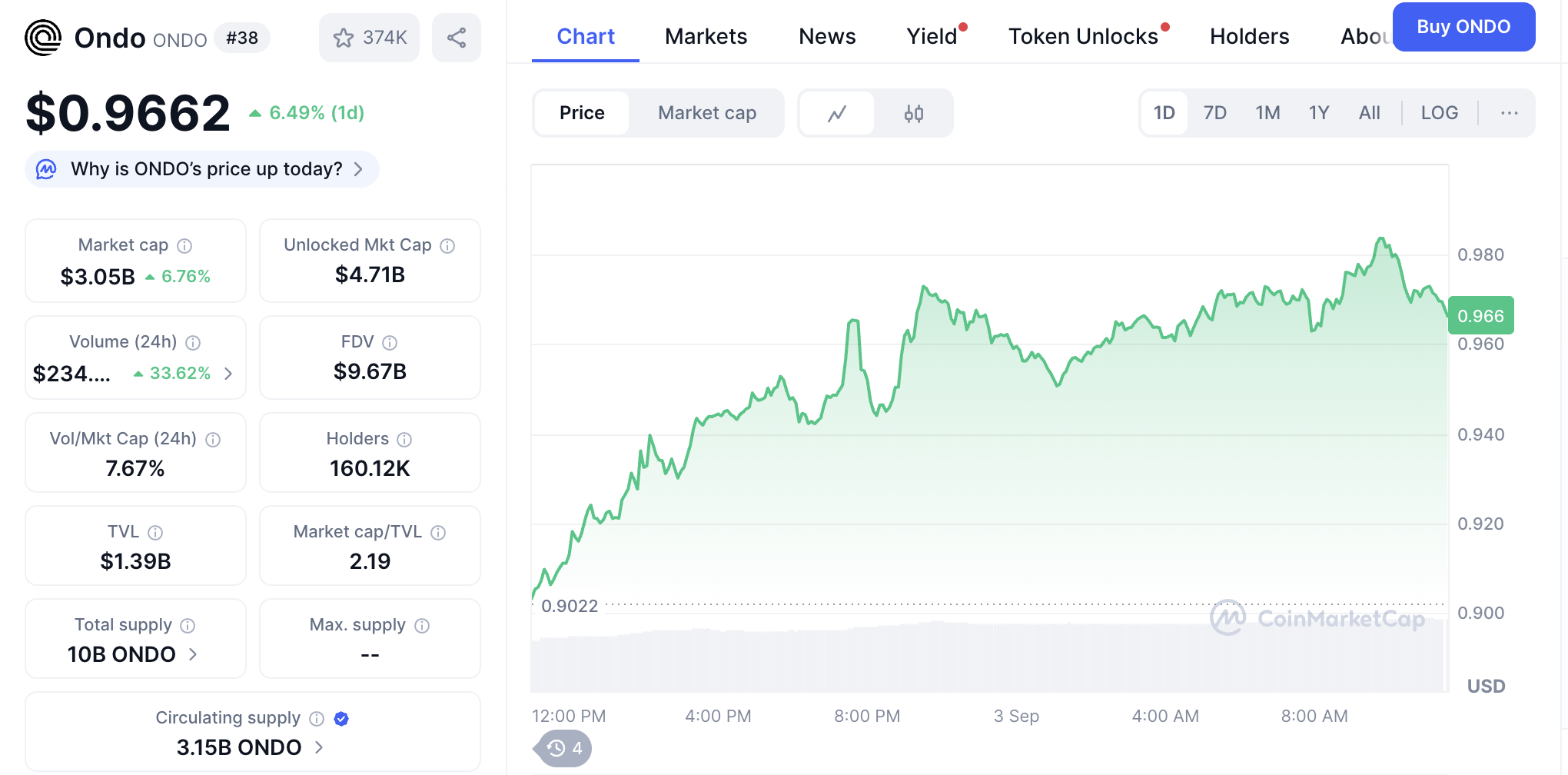

Ondo launched its new Global Markets today, offering tokenized versions of 100+ US-based stocks and ETFs. The firm’s ONDO token saw modest increases in price and a 33% spike in volume at launch.

Some of these RWAs have been very successful, generating upwards of $70 million in trade volume this morning alone. Still, Ondo remains inaccessible in the United States, potentially limiting its ability to move TradFi markets.

Ondo Global Markets

As part of its diversified business strategy, Ondo announced that it would offer 100+ tokenized stocks earlier this week. The RWA firm claimed that Ondo Global Markets would bring a huge array of US stocks onto the blockchain, and this development is now live:

1/ Wall Street 2.0 is here.Ondo Global Markets is now live, providing one of the largest-ever selections of tokenized U.S. stocks & ETFs onchain with the liquidity of traditional finance, starting on @Ethereum.100+ assets now live, with hundreds more on the way.

— Ondo Finance (@OndoFinance) September 3, 2025

Ondo Global Markets has an immense level of support from the crypto industry, with over 27 major exchanges, wallets, data platforms, and more facilitating the launch. The firm is trading these RWAs on Ethereum’s blockchain, and ONDO reacted well to the launch according to several metrics, including spot price, trade volume, and more.

Ondo Price Performance. Source:

CoinMarketCap

Ondo Price Performance. Source:

CoinMarketCap

Although Ondo isn’t available in the United States, it’s tokenizing dozens of US stocks to offer them on Global Markets. Some traders have theorized that this capital influx will allow international Web3 traders to have a new influence on Wall Street.

TradFi and Web3 Coming Together

Some of the largest US companies, like Google and Nvidia, have already seen more than $60 million in fresh trade volume on Ondo Global Markets. Although both these firms have market caps in the trillions of dollars, this is still a remarkable wave of interest for a single morning.

Still, Ondo Global Markets isn’t the only firm that’s bringing Web3 and TradFi closer together. While the company is trying to offer US stocks on the blockchain, leading US markets are preparing to launch unprecedented access to crypto on their own platforms.

These markets won’t directly compete, but there’s still a lot of overlapping interest here. Ondo Global Markets may have a lot of advantages for bringing TradFi exposure to the blockchain, but crypto is attracting a lot of new backers. It might be best to mitigate expectations a little, at least as far as global market impact is concerned.

In short, this is looking like a remarkably successful product, but we’ll have to see how much these RWAs can move the entire market. For now, Ondo’s new service seems worth paying attention to.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OracleX Global Public Beta: Restructuring Prediction Market Incentive Mechanisms with "Proof of Behavior Contribution"

OracleX is a decentralized prediction platform based on the POC protocol. It addresses pain points in the prediction market through a dual-token model and a contribution reward mechanism, aiming to build a collective intelligence decision-making ecosystem. Summary generated by Mars AI The content of this summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Bitcoin is not "digital gold"—it is the global base currency of the AI era

The article refutes the argument that bitcoin will be replaced, highlighting bitcoin's unique value as a protocol layer, including its network effects, immutability, and potential as a global settlement layer. It also explores new opportunities for bitcoin in the AI era. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?