MemeCore Rockets to All-Time High, But Market Signals Warn of a Crash Ahead

MemeCore rocketed to a new all-time high, but on-chain signals and bearish derivatives positioning point to correction risks ahead.

Layer-1 (L1) coin MemeCore (M) has emerged as today’s top gainer, bucking the broader market’s lackluster performance over the past 24 hours. The token’s price has surged nearly 30% on the day, briefly climbing to a new all-time high of $1.176 during early trading hours.

Despite the rally, on-chain and technical indicators suggest the market may be overheating. The emerging signs of buyer exhaustion are raising the risk of a near-term reversal.

Traders Brace for Correction Despite Price Surge

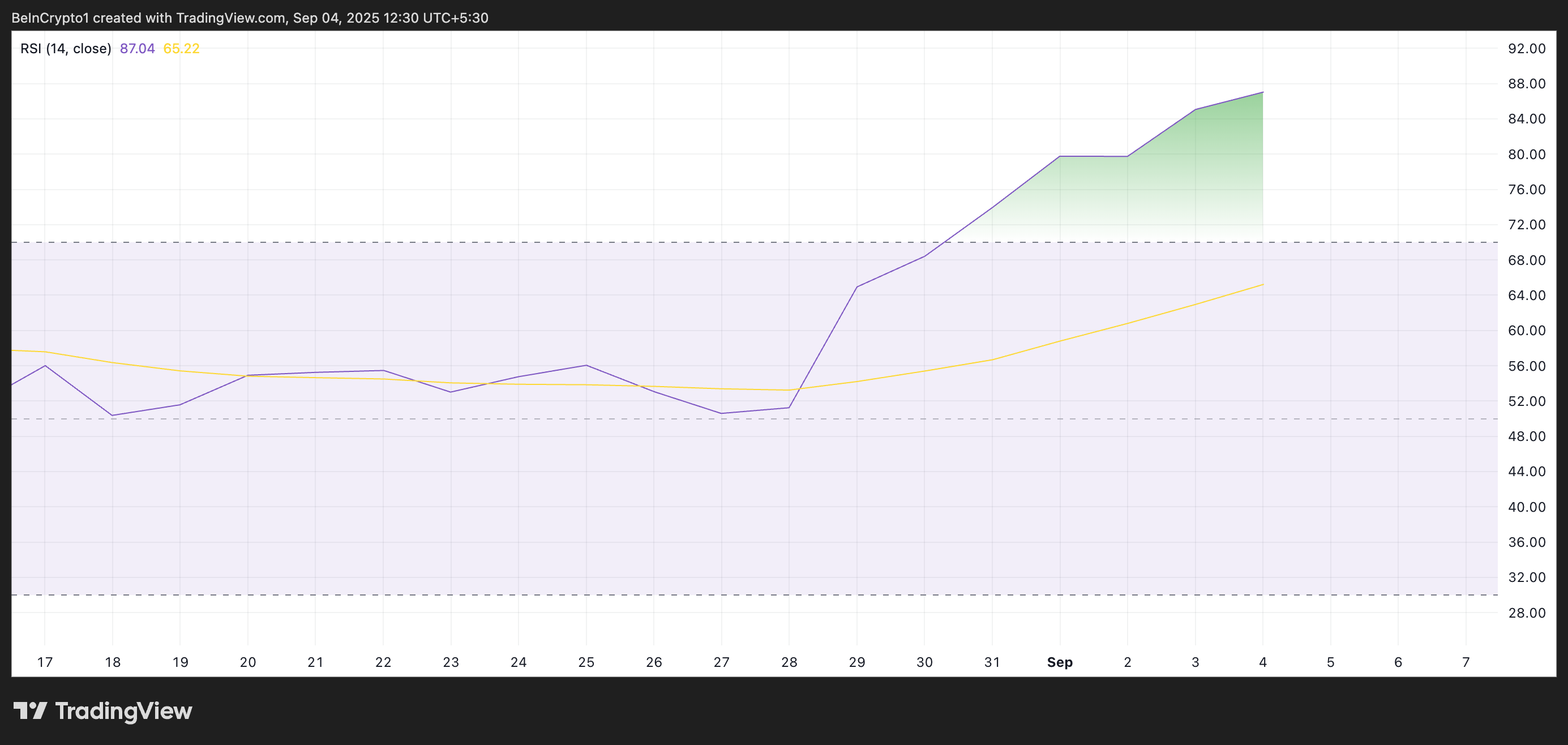

Readings from the M/USD one-day chart show its Relative Strength Index (RSI) flashing overbought conditions, indicating bullish momentum could be losing steam. As of this writing, this key indicator is 87.04 and remains in an uptrend.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

MemeCore RSI. Source:

TradingView

MemeCore RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

M’s current RSI of 87.04 places it deep into the overbought zone. Such extreme readings usually precede profit-taking by traders, which can trigger price pullbacks. If selling pressure builds, M may struggle to hold on to its recent gains, raising the possibility of a short-term correction.

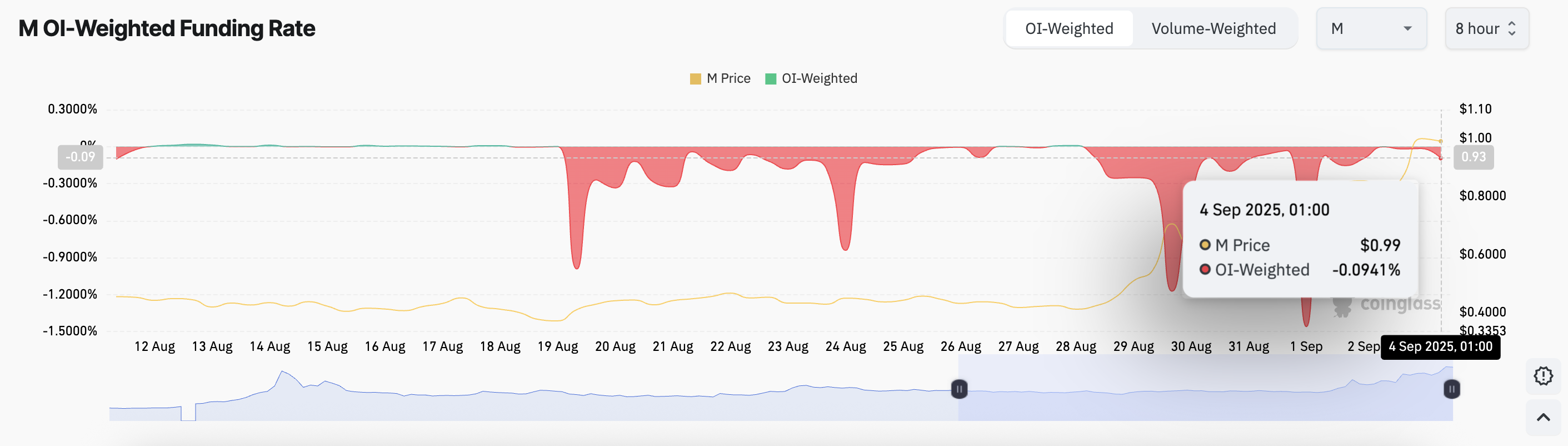

Additionally, M’s funding rate across the derivatives markets has remained significantly negative, reflecting that traders are still heavily positioned against the asset. At press time, per Coinglass data, this stands at 0.094%.

MemeCore Funding Rate. Source:

Coinglass

MemeCore Funding Rate. Source:

Coinglass

The funding rate is used in perpetual futures contracts to keep the contract price aligned with the spot price. When the rate turns negative, short traders dominate and are paid by long traders to maintain their positions.

M’s persistently poor funding rate highlights the strong bearish bias against it in the derivatives market. Despite its price rally over the past week, its futures traders continue overwhelmingly positioning for a downside move, showing a lack of confidence.

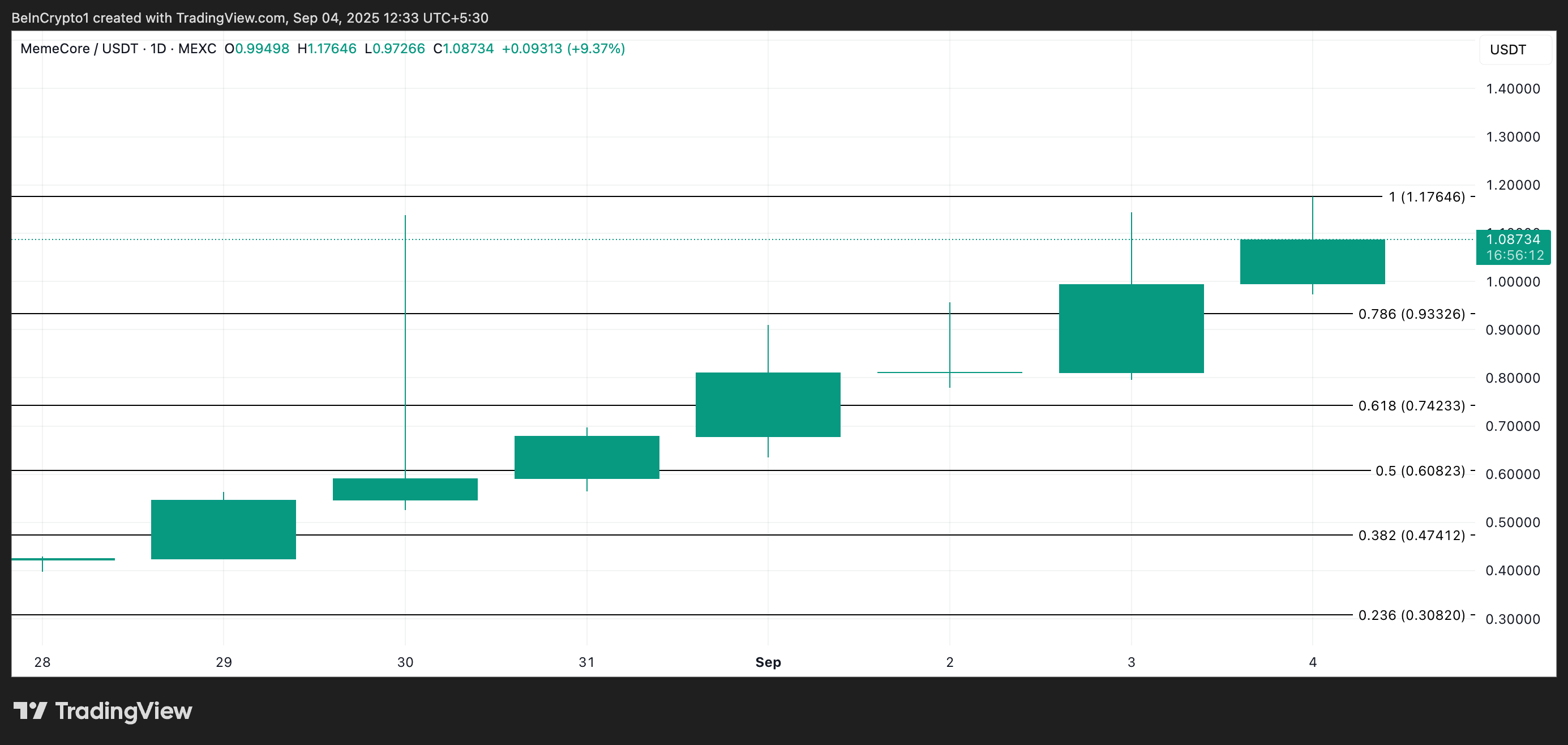

M Could Rally to $1.17 or Slide Toward $0.74

At press time, M hovers above the support formed at $0.93. Once buyers’ exhaustion sets in, M may attempt to test this support floor. The bulls’ failure to defend this price level could trigger a decline toward $0.74.

MemeCore Price Analysis. Source:

TradingView

MemeCore Price Analysis. Source:

TradingView

However, if the bulls maintain dominance, they could drive M to reclaim its all-time high of $1.17, and even attempt a rally above it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025