SUI Momentum Builds as Social Dominance and Volumes Surge

SUI’s fundamentals look strong with low fees, high volumes, and institutional backing. But with $4.3 resistance looming, traders await confirmation of whether this rally continues or cools off.

SUI has become the center of attention after being listed on Robinhood Legend and seeing a massive $300 million accumulation by a publicly listed company.

With record-low transaction fees and huge token volumes, SUI shows strong breakout potential. However, the key challenge remains whether it can surpass the critical $4.3 resistance.

A Chain of Positive Fundamentals

In short, Sui blockchain (SUI)’s story blends bullish news and heavy resistance levels.

Recently, SUI Group Holdings announced it had purchased an additional 20 million SUI, raising its total holdings to more than 101.7 million (worth around $332 million at the time of disclosure). In addition, Robinhood confirmed that SUI (and HBAR) is now available on Robinhood Legend, broadening access for retail investors in the US.

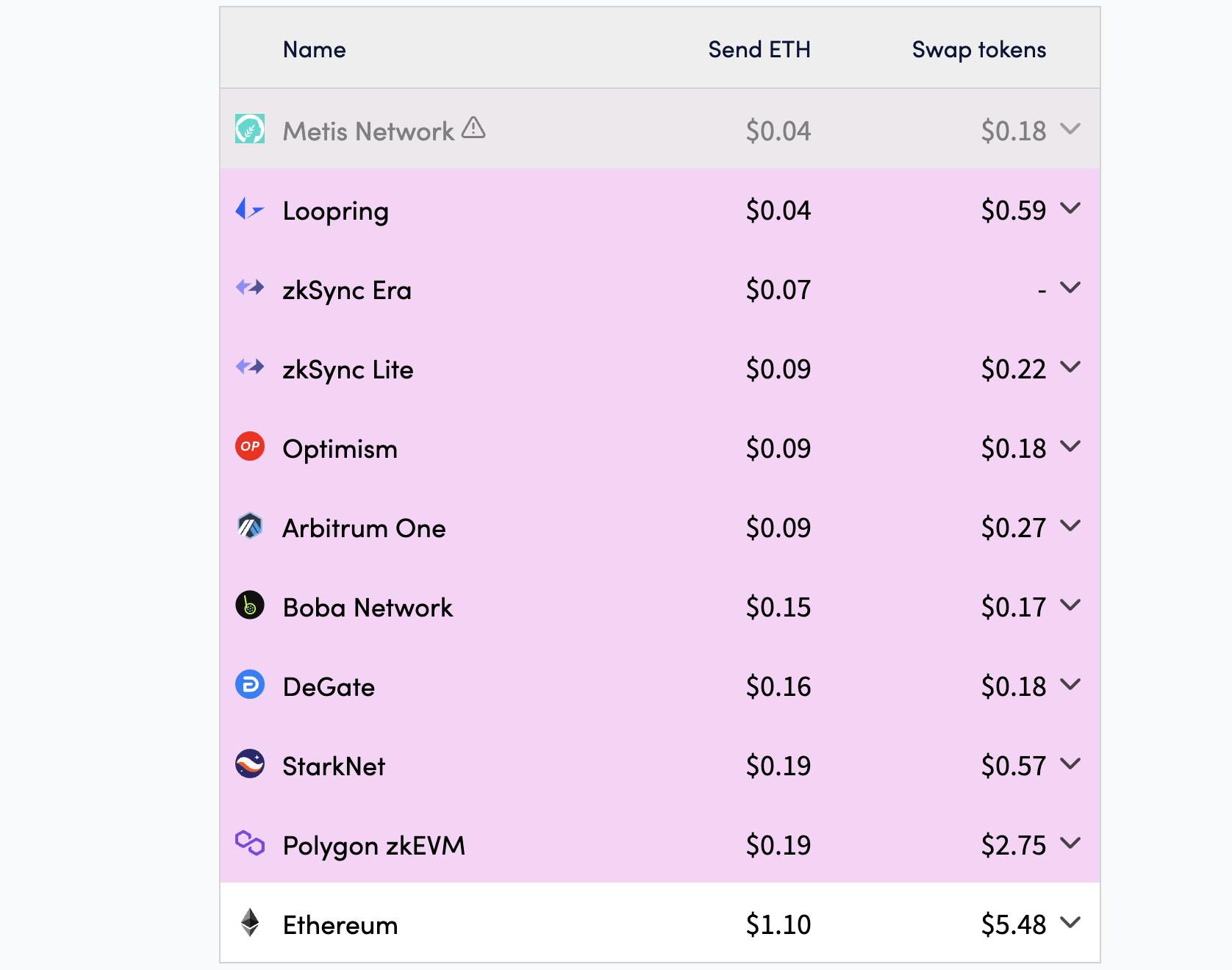

On the fundamentals, transaction fees stand out as the native token’s significant strength. The average transaction in August cost only about $0.00799. With ETH transfers on the Ethereum network costing around $1.1, this fee is nearly 140 times cheaper. The team explained in their blog that this fee structure was designed to remain stable across epochs, preventing spikes during network congestion.

Ethereum fee chart. Source:

Ethereum fee chart. Source:

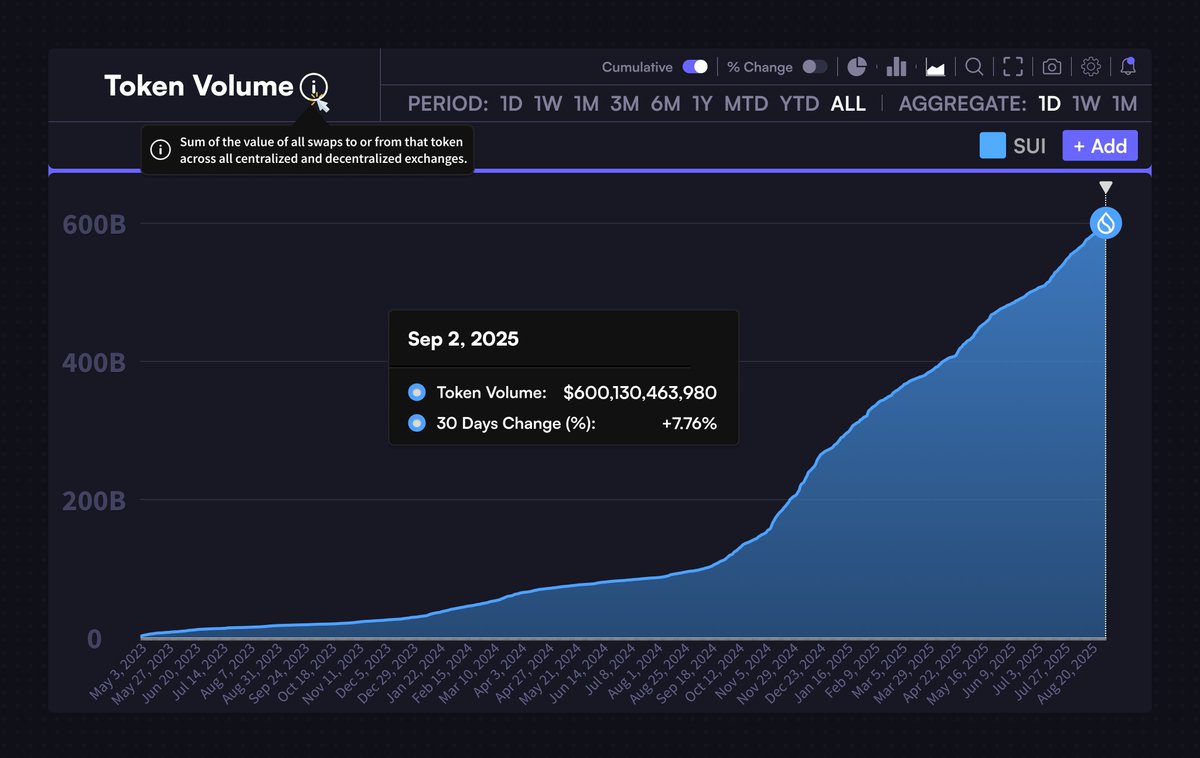

Low and stable fees improve the end-user experience and enable high-throughput use cases like gaming, DeFi, or micropayments. Sui’s total token volume has reached $600 billion, marking a +7.76% increase in the past 30 days.

SUI token volume. Source:

SUI token volume. Source:

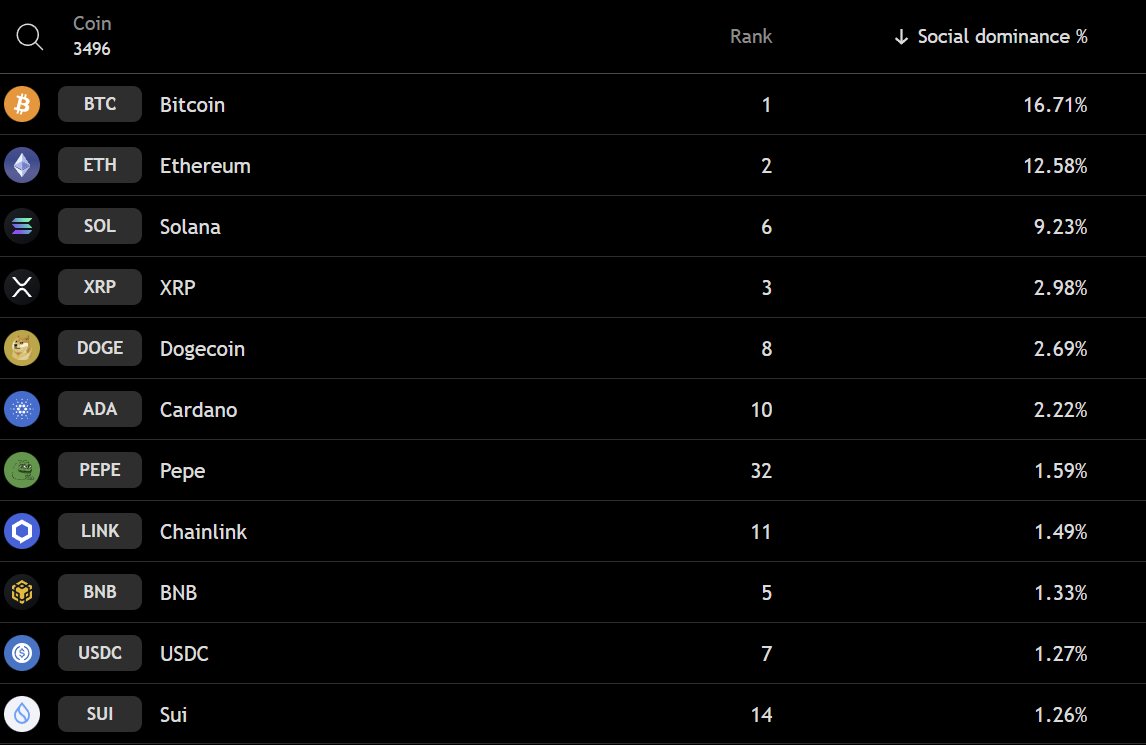

Market sentiment and brand visibility also show positive signals. Data indicates that SUI’s “social dominance” (a metric for discussion frequency) continues to rise and is now approaching the top 10.

Social dominance for SUI. Source:

Social dominance for SUI. Source:

Breakout or Breakdown at $4.3?

According to BeInCrypto Market, SUI trades around $3.3–$3.4 currently, still 37% below its January 2025 all-time high of $5.35.

From a technical standpoint, the picture is both compressed and noisy. Some analysts highlight an Ascending Triangle with resistance near $4.3 on the weekly chart. A decisive breakout could set higher-level targets, with some optimistic projections eyeing the $10 mark.

“The longer we stay below the $4.3 Resistance, the better, but it’s time to finally break out,” an analyst commented.

SUI 1W chart. Source:

SUI 1W chart. Source:

Conversely, on the 4-hour chart, others argue that the altcoin remains trapped in a Descending Triangle, showing weakness around the 50SMA. This could drag the price to test $3.42 and even the $3 zone — considered the first central demand area.

SUI 4H chart. Source:

SUI 4H chart. Source:

In other words, the market is awaiting its next “directional move.” A weekly close above $4.3 would confirm a breakout, while losing $3.42 increases the probability of revisiting the lower accumulation range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?