Mega Matrix is using a $2 billion SEC shelf registration to accumulate Ethena’s ENA governance token, aiming to capture yield from the synthetic stablecoin USDe via Ethena’s fee-switch and to secure governance influence in the protocol.

-

Mega Matrix targets ENA to access USDe protocol revenues.

-

USDe is a synthetic, yield-bearing stablecoin backed by hedged collateral and derivatives funding rates.

-

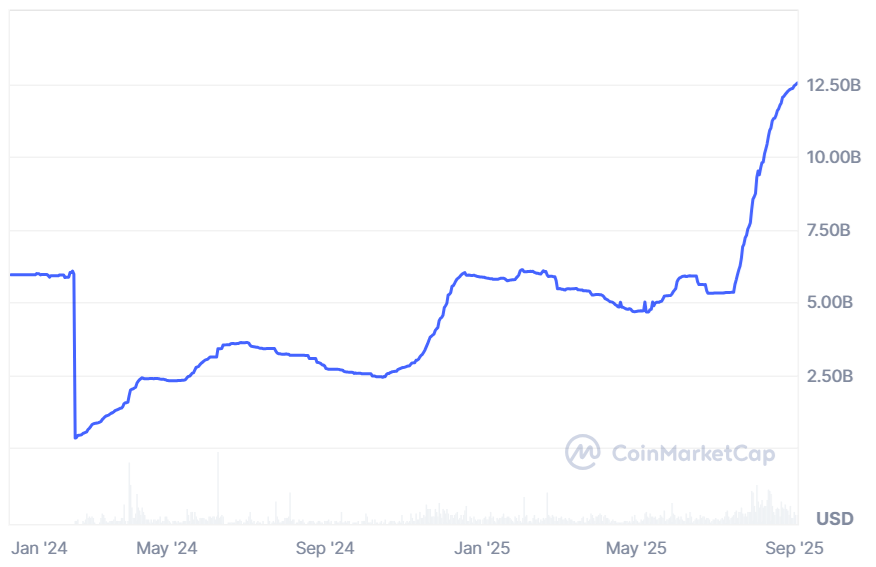

Ethena reports over $500M cumulative interest revenue and USDe has a $12.5B market cap.

Primary keyword: Mega Matrix ENA — Mega Matrix files $2B shelf to buy ENA and capture USDe yield; read key implications for treasuries.

Mega Matrix has filed a $2 billion shelf registration with the SEC to acquire ENA, Ethena’s governance token, aiming to capture yield generated by the synthetic stablecoin USDe and to build governance influence within the protocol.

What is Mega Matrix’s ENA strategy?

Mega Matrix ENA strategy centers on using a $2 billion shelf registration to buy the ENA governance token rather than holding USDe directly. The company expects revenue exposure via Ethena’s fee-switch and seeks governance influence while diversifying its treasury into yield-bearing digital assets.

How does Ethena’s USDe generate yield?

USDe is a synthetic stablecoin that keeps its dollar peg through a mix of collateral hedged with perpetual futures. The protocol generates yield from derivatives funding rates and fee revenues. Ethena Labs reported cumulative gross interest revenue above $500 million; CoinMarketCap lists USDe at about $12.5 billion market capitalization.

Mega Matrix, a small-cap holding company with a market capitalization near $113 million, said the shelf registration will fund an Ethena-focused treasury allocation. The filing lets Mega Matrix register securities for future issuance and sell them over time to build a concentrated position in ENA.

Ethena USDe’s market capitalization growth. Source: CoinMarketCap

Ethena USDe’s market capitalization growth. Source: CoinMarketCap

The company explained the strategy is aimed “exclusively on ENA, concentrating influence and yield in a single digital asset.” Instead of holding USDe itself, Mega Matrix plans to own ENA, which could receive protocol revenue distributions if Ethena activates its onchain fee-switch.

Why are firms shifting to digital asset treasuries?

Digital asset treasury strategies have grown as companies seek yield and alternative returns. Mega Matrix’s move follows its June purchase of Bitcoin and mirrors other small firms pivoting to crypto holdings. The trend is driven by rising stablecoin adoption, new yield-bearing stablecoin models, and regulatory shifts like the US GENIUS Act that restricts direct yield payments by issuers to stablecoin holders.

Experts note both opportunities and risks. Julio Moreno, head of research at CryptoQuant, observed that prohibitions on issuer-paid yield have pushed investors toward synthetic, yield-bearing alternatives. Josip Rupena, CEO of Milo, warned that engineered treasury strategies can obscure exposures, comparing some structures to complex collateralized products.

Mega Matrix (MPU) stock. Source: Yahoo Finance

Mega Matrix (MPU) stock. Source: Yahoo Finance

While Ethena remains smaller than major collateralized stablecoins, its model allows protocol-level revenue capture for token holders. In August, Ethena Labs reported cumulative gross interest revenue surpassed $500 million, highlighting the protocol’s ability to monetize funding-rate income.

Protocol illustration. Source: CoinMarketCap

Protocol illustration. Source: CoinMarketCap

How should companies evaluate digital asset treasury exposure?

Evaluate concentration risk, governance influence, tokenomics, onchain revenue mechanisms, counterparty and smart‑contract risk, and regulatory uncertainty. Use scenario analysis and third-party custodial controls. Maintain clear disclosure and stress-test treasury allocations under volatility and regulatory-change scenarios.

Frequently Asked Questions

Will Mega Matrix hold USDe or ENA?

Mega Matrix plans to accumulate ENA rather than holding USDe directly to seek revenue distributions and governance influence via Ethena’s fee-switch, per the company’s SEC filing.

Is USDe widely adopted?

USDe is a rapidly growing synthetic stablecoin that reached roughly $12.5 billion market capitalization and has generated over $500 million in cumulative gross interest revenue, signaling notable adoption among yield-focused users.

Key Takeaways

- Concentrated ENA bet: Mega Matrix filed a $2B shelf to buy ENA and target Ethena protocol revenues.

- Synthetic stablecoin yield: USDe generates yield from derivatives funding rates and protocol fees.

- Risk vs. reward: Corporate treasuries gain yield exposure but face concentration, smart-contract and regulatory risks; stress testing is essential.

Conclusion

Mega Matrix’s ENA-focused shelf registration highlights the growing trend of digital asset treasury strategies and the appeal of synthetic, yield-bearing stablecoins like USDe. Corporations considering similar moves should weigh governance benefits against concentration and regulatory risks and adopt robust risk frameworks. COINOTAG will continue monitoring developments and reporting updates.