Key Notes

- CEO Paolo Ardoino attributes the mint to Binance's cross-chain swap from Tron to Ethereum without corresponding burns yet recorded.

- The timing mirrors December's $2 billion mint during Bitcoin's pullback from its $100,000 milestone breakthrough.

- Historical patterns suggest potential Bitcoin recovery toward $118,000 ahead of the September 17 Federal Reserve meeting.

Tether, the issuer of the largest stablecoin by market capitalization, USDT, just minted $2 billion worth of the token on the Ethereum network. This is the single largest mint by the company since December 2024, sending positive waves of capital inflow as the crypto market dips.

Whale Alert on X was the first to report this activity on September 4, followed by posts from many other intelligence entities like Arkham and Solid Intel . Paolo Ardoino, Tether’s CEO, disclosed it is due to Binance swapping 2 billion USDT on Tron for the same amount of the token on Ethereum. However, by the time of this writing, no proportional burning activities have been recorded on Tron, which would be expected from a cross-chain swap operation.

Binance has swapped 2B USDt on Tron for 2B USDt on ETH

— Paolo Ardoino 🤖 (@paoloardoino) September 4, 2025

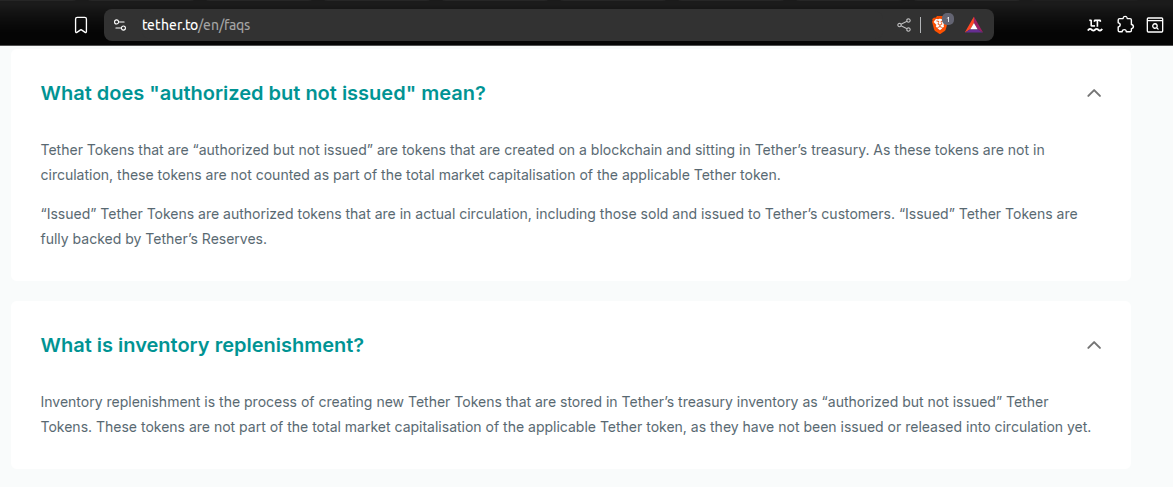

Looking at the account’s history , Coinspeaker only found a similar single mint volume on December 6, 2024. At that time, Paolo Ardoino disclosed it was a 2 billion USDT “inventory replenishment” on Ethereum, highlighting it was “an authorized but not issued transaction.”

PSA: 2B USDt inventory replenish on Ethereum Network. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.

— Paolo Ardoino 🤖 (@paoloardoino) December 6, 2024

According to the FAQs on Tether’s official website , this type of activity does not immediately put these tokens in circulation, as they are not necessarily backed by real capital inflow via the company—making inventory for future potential demand.

USDT FAQs: “authorized but not issues” and “inventory replenishment” | Source: Tether

Usually, Tether goes with mints of 1 billion USDT for “inventory replenishment” disclosed activities, which may happen more than once per day and in different blockchain networks like Tron or Solana. Yet, Ethereum appears to be the most used chain by the company for this goal.

Bitcoin Price Analysis, Historical Context for Tether’s 2B USDT Mints

Bitcoin BTC $110 666 24h volatility: 0.9% Market cap: $2.20 T Vol. 24h: $38.23 B experienced a notable pullback on December 6, 2024, closing around $98,343, down about 4% from the previous day. This came immediately after a historic milestone: on December 5, Bitcoin surpassed $100,000 for the first time ever, briefly touching highs around $100,000 before closing at approximately $99,513.

Bitcoin 1D historical price chart against the US dollar, December 6, 2024, highlighted | Source: TradingView

The surge to six figures was driven by several factors building throughout late 2024, including institutional and political momentum with Donald Trump’s promises and reelection and market supply dynamics, with the halving happening a few months before that.

Moreover, the pullback coincided with the US November jobs report, a key economic indicator that influenced markets globally.

Interestingly, the most recent $2 billion mint happened following another market pullback amid high institutional and political activities, together with the US August jobs report, published on the same day as Tether’s unusual mint, on September 4, 2025.

Back then, BTC quickly recovered from the pullback, printing 8% gains 11 days after Tether’s $2 billion mint, reaching $108,367 per coin . With Bitcoin currently trading at $109,483, a similar movement would send the leading cryptocurrency to around $118,000—still $6,000 below the $124,000 all-time high.

The timeframe would also match the Federal Reserve’s FOMC meeting, happening on September 17 and expected to result in the first interest rate cut since December 18, 2024 , highlighting another similarity with Tether’s historical context. Interest rate cuts are usually seen as bullish news for crypto and Bitcoin.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.