Crypto, Stocks, Bonds: A Perspective on the Leverage Cycle

Stocks, bonds, and cryptocurrencies support each other; gold and BTC jointly underpin US Treasuries as collateral, while stablecoins support the global adoption rate of the US dollar, making the losses in the deleveraging process more socialized.

Crypto, stocks, and bonds serve as mutual pillars; gold and BTC jointly support US Treasuries as collateral, while stablecoins underpin the global adoption rate of the US dollar, making the deleveraging process more socialized in terms of losses.

Written by: Zuoye

Cycles originate from leverage. From fast-growing, short-lived meme coins to 80-year-long technological Kondratiev waves, humanity always finds some force, belief, or organizational method to create more wealth. Let’s briefly review our current historical coordinates to frame why the intertwining of crypto, stocks, and bonds is so important.

Since the Age of Discovery at the end of the 15th century, the core economies of capitalism have undergone the following changes:

- Spain and Portugal — physical gold and silver + brutal colonial plantations

- Netherlands — stocks + corporate system (Dutch East India Company)

- Britain — gold standard + colonial scissors difference (military rule + institutional design + imperial preferential system)

- United States — US dollar + US Treasuries + military outposts (abandoning direct colonization, controlling key outposts)

It’s important to note that latecomers absorb the strengths and weaknesses of their predecessors. For example, Britain also adopted the corporate and stock systems, and the US also engaged in military rule. Here, the focus is on the innovations of new hegemons. Based on the above, we can see two major characteristics of the classic capitalist trajectory:

- Cop’s Law of Hegemony: Just as animals tend to grow larger through evolution, the scale of core economies keeps expanding (Netherlands → Britain → US);

- Economic debt cycle: Physical assets and commodity production give way to finance. The trajectory of a classic capitalist power is to profit through new financial innovations and fundraising;

- Leverage eventually collapses: From Dutch stocks to Wall Street financial derivatives, the pressure for returns tarnishes collateral, debts cannot be cleared, and new economies take over.

The US is already at the extreme scale of global dominance. What follows will be a long ending of “you in me, me in you.”

US Treasuries will eventually become uncontrollable, just like the British Empire after the Boer War. However, to maintain a dignified end, financial products like crypto, stocks, and bonds are needed to extend the countdown to debt collapse.

Crypto, stocks, and bonds serve as mutual pillars; gold and BTC jointly support US Treasuries as collateral, while stablecoins underpin the global adoption rate of the US dollar, making the deleveraging process more socialized in terms of losses.

Six Ways Crypto, Stocks, and Bonds Combine

Everything that brings happiness is nothing but an illusion.

Becoming bigger and more complex is the natural law of all financial instruments and even living organisms. When a species reaches its peak, disorderly internal competition follows, and increasingly elaborate horns and feathers are responses to heightened mating difficulty.

Tokenomics began with Bitcoin, creating an on-chain financial system out of nothing. With a $2 trillion BTC market cap compared to the nearly $40 trillion scale of US Treasuries, its role is destined to be only alleviating. Ray Dalio’s frequent calls for gold to hedge the dollar are similar in logic.

Stock market liquidity has become a new pillar for tokens. The Pre-IPO market is seeing tokenization possibilities, and stocks on-chain are becoming a new vehicle post-electronization. DAT (treasury) strategy is the main theme for the first half of 2025.

However, note that while on-chain US Treasuries are a given, token-based bond issuance and on-chain corporate bonds are still in the experimental phase, though small-scale practices have begun.

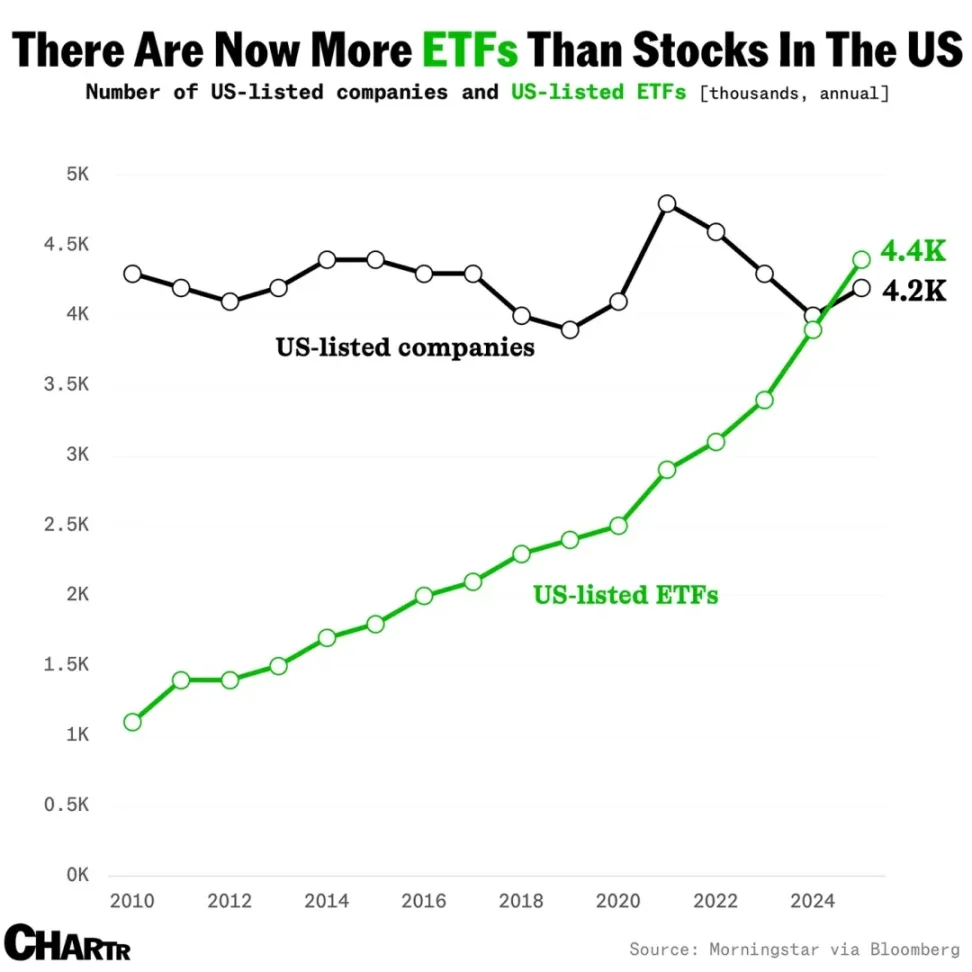

Image description: Growth in ETF numbers, image source: @MarketCharts

Stablecoins have become an independent narrative. Tokenized funds and debts will become new synonyms for RWA, while index funds and comprehensive ETFs pegged to more crypto, stocks, and bonds concepts are starting to attract capital. Will the traditional ETF/index story of swallowing liquidity play out again in crypto?

We can’t make that judgment, but forms like altcoin DAT and staking ETFs have already signaled the official start of a new leverage upcycle.

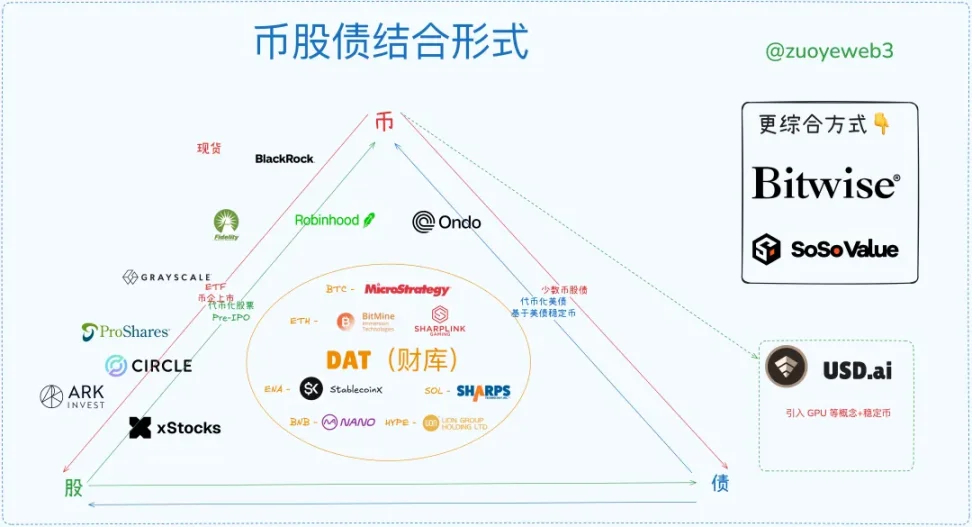

Image description: Forms of crypto, stocks, and bonds combinations, image source: @zuoyeweb3

Tokens as collateral are becoming increasingly weak in both DeFi and traditional finance. On-chain, USDC/USDT/USDS are needed, which are, in some form, just variants of US Treasuries. Off-chain, stablecoins are becoming the new trend. Before this, ETFs and RWA have already made their own attempts.

To summarize, the market has roughly six ways of combining crypto, stocks, and bonds:

- ETF (futures, spot, staking, general)

- Crypto-stocks (financialization methods transforming on-chain use)

- Crypto company IPO (Circle represents the “hard cap” stage of the stablecoin trend)

- DAT (MSTR crypto-stocks-bonds vs ETH crypto-stocks vs ENA/SOL/BNB/HYPE tokens)

- Tokenized US Treasuries, funds (Ondo RWA theme)

- Pre-IPO market tokenization (not yet scaled, dangerous dormant period, on-chain transformation of traditional finance)

The end and exit timing of the leverage cycle is unpredictable, but the basic outline of the cycle can be sketched.

Theoretically, when altcoin DAT appears, it’s already the top of the long cycle. However, just as BTC can range around $100,000, the complete virtualization of the dollar/US Treasuries releases momentum that takes the market a long time to digest—often calculated in 30-year spans: Boer War to Britain abandoning the gold standard (1931-1902=29), Bretton Woods system (1973-1944=29).

Ten thousand years is too long; seize the day. At least until the 2026 midterm elections, crypto still has a good year ahead.

Image description: Current state of the crypto-stocks-bonds market, image source: @zuoyeweb3

Looking at the current market structure, crypto company IPOs are the highest-end and most niche track. Only a handful of crypto companies can complete a US stock IPO, which also shows that selling oneself as an asset is the hardest.

Second best is reselling existing quality assets, which is relatively easier. For example, BlackRock has become the undisputed giant in the spot BTC and ETH ETF field. Newer staking ETFs and general ETFs will become the new highs and lows of the competition.

Next, DAT (treasury) strategy companies are far ahead, being the only players to achieve three-way rotation among crypto, stocks, and bonds. That is, based on BTC, they can issue debt, thereby supporting stock prices, and use surplus funds to continue buying BTC. This shows the market recognizes BTC’s safety as collateral and also recognizes Strategy’s own asset value as a “representative” of BTC.

In the ETH treasury company field, BitMine and Sharplink at most only achieve crypto-stocks linkage. They haven’t convinced the market of their ability to issue debt (excluding the part where debt is issued for capital operations when buying tokens). That is, the market partially recognizes ETH’s value but not the value of ETH treasury companies themselves. mNAV below 1 (total stock value below held asset value) is just the result.

But as long as ETH’s value is widely recognized, high-leverage competition will produce winners. Ultimately, only long-tail treasury companies will fall, and the remaining ones will gain ETH’s representativeness. After the leverage up/down cycle, they will be the winners.

Currently, tokenized stocks are smaller in scale than DAT, IPO, or ETF, but have the most application potential. Today’s stocks are electronic, stored on various servers. In the future, stocks will circulate directly on-chain—stocks will be tokens, and tokens can be any asset. Robinhood is building its own ETH L2, xStocks is coming to Ethereum and Solana, and SuperState’s Opening Bell helps Galaxy tokenize stocks on Solana.

In the future, tokenized stocks will compete between Ethereum and Solana, but this scenario has the least imagination space and highlights technical service attributes. It represents the market’s recognition of blockchain technology, but the ability to capture assets will be transmitted to $ETH or $SOL.

In the tokenized US Treasuries and funds field, there is a faint trend of Ondo becoming the sole player. The reason is the diversion between US Treasuries and stablecoins. RWA’s future needs to explore more non-US Treasury fields, just like non-USD stablecoins. In the long run, the market size is huge, but it will always be long-term.

Finally, Pre-IPO uses two methods: first, raise funds and then buy equity; second, buy equity first and then tokenize and distribute. Of course, xStocks is involved in both the secondary stock market and Pre-IPO. The core idea is to tokenize incentives in the unlisted market, thereby stimulating the publicization of the private market. Note this expression—this is the expansion path of stablecoins.

But under the current legal framework, will there still be room for regulatory arbitrage? There are expectations, but it will take a long period of adjustment. Pre-IPO will not be publicized quickly. The core of Pre-IPO is the issue of asset pricing rights, which is fundamentally not a technical problem. Wall Street’s many distributors will do everything to prevent it.

In contrast, the distribution of rights and incentives for tokenized stocks can be decoupled. “People in crypto don’t care about rights, they care more about incentives.” As for tax and regulatory issues on equity income, there is already global practice, and on-chain implementation is not a barrier.

In comparison, Pre-IPO involves Wall Street’s pricing power, while tokenized stocks amplify Wall Street’s returns, with more distribution channels and liquidity entering. These are two completely different situations.

Convergence in Upcycles, Squeezing in Downcycles

The so-called leverage cycle is a self-fulfilling prophecy. Any good news is worth two rallies, constantly stimulating leverage to rise. However, institutions cross-hold different collateral. In a downcycle, they will first sell secondary tokens and flee to safe collateral. Retail investors, with less freedom of action, ultimately bear all the losses, actively or passively.

When Jack Ma buys ETH, China Renaissance Capital buys BNB, and CMB International issues a Solana tokenized fund, a new era enters our time: global economies remain interconnected through blockchain.

The US is the extreme under Cop’s Law, already the lowest-cost, most efficient mode of governance, but faces an extremely complex, intertwined situation. The new era’s Monroe Doctrine does not fit objective economic laws. The internet can be segmented, but blockchain is miraculously and naturally unified. Any L2, node, and asset can be integrated on Ethereum.

From a more organic perspective, the combination of crypto, stocks, and bonds is a process of chip exchange between whales and retail, similar to “when Bitcoin rises, altcoins lag; when Bitcoin falls, altcoins fall harder”—a principle more common in on-chain ecosystems.

Let’s discuss this process:

- In upcycles, institutions use leverage to move into high-volatility assets with lower collateral prices. In downcycles, they first sell alt assets to maintain high-value asset holdings;

- Retail investors do the opposite. In upcycles, they sell more BTC/ETH and stablecoins to buy high-volatility assets, but due to limited capital, when the market turns bearish, they must further sell BTC/ETH and stablecoins to maintain high leverage on altcoins;

- Institutions can naturally withstand greater drawdowns. Retail’s high-value assets are sold to them, and retail’s leverage maintenance increases institutional resilience, forcing retail to keep selling assets;

- The cycle ends with leverage collapse. If retail can’t maintain leverage, the cycle ends. If institutions collapse and trigger a systemic crisis, retail still suffers the most, as high-value assets have already been transferred to other institutions;

- For institutions, losses will always be socialized. For retail, leverage is their own noose, and they even have to pay institutions. The only hope is to outrun other institutions and retail, which is as hard as going to the moon.

The grading and evaluation of collateral is just a surface phenomenon. The core is pricing leverage based on expectations for the collateral.

This process doesn’t fully explain why altcoins always fall harder. To add, retail is more eager for higher leverage than issuers. In other words, retail hopes every asset pair is 125x, but in a downcycle, the actual counterparty is retail themselves. Institutions often have more assets and more complex hedging strategies, and retail must bear this part too.

In summary, crypto, stocks, and bonds synchronize leverage and volatility. Tokens, stocks, and debt—let’s dive in from a financial engineering perspective. Imagine a hybrid stablecoin partially based on US Treasuries and using delta-neutral strategies. One stablecoin could link all three forms: crypto, stocks, and bonds. Only then can market volatility activate hedging mechanisms and even increase profits—i.e., synchronous ascent.

ENA/USDe already partially exhibit this feature. Let’s boldly predict the trajectory of the deleveraging cycle: higher leverage attracts more TVL and retail trading, eventually reaching a volatility tipping point. Project teams will prioritize protecting the USDe peg and abandon ENA price. Then DAT company stock prices will fall, institutions will exit first, and retail will be left holding the bag.

Afterward, even scarier multi-leverage cycles will appear. ENA treasury investors will sell stocks to maintain their value in ETH and BTC treasury companies, but some companies will inevitably fail, slowly imploding. First, small-token DATs will be liquidated, then large-token small DAT companies, and finally, the market will panic, watching for any sign from Strategy.

Under the crypto-stocks-bonds model, the US stock market becomes the ultimate source of liquidity, and will eventually be pierced by linkage effects. This is not alarmist—US stocks have regulation but still couldn’t stop the LTCM quant crisis. Now with Trump leading everyone to issue tokens, I don’t think anyone can stop the explosive linkage of crypto, stocks, and bonds.

Global economies are interconnected on blockchain, and will all explode together.

At this point, in reverse, any place with remaining liquidity—on-chain or off-chain, in any of the six crypto-stocks-bonds forms—will become an exit window. The scariest thing is that there is no Federal Reserve on-chain. When the ultimate liquidity provider is absent, the market can only fall to rock bottom, ending in heat death.

Everything will end, and everything will begin anew.

After a long “pain period,” retail gradually accumulates sparks of BTC/ETH/stablecoin purchases by delivering food, gifting institutions with new concepts for prairie fires. A brand new cycle begins again. After the financial magic is gone and debts are cleared, real labor-created value is still needed to bring closure.

Readers may notice: why not discuss the stablecoin cycle?

Because stablecoins themselves are just the external form of the cycle. BTC/gold supports the shaky US Treasuries, and stablecoins support the global adoption of the US dollar. Stablecoins cannot form a cycle on their own; they must be coupled with more fundamental assets to have real yield capability. However, stablecoins will increasingly bypass US Treasuries and peg to safer assets like BTC/gold, thus smoothing the leverage curve of the cycle.

Conclusion

From “the classics annotate me” to “I annotate the classics.”

On-chain lending has not yet been touched. The integration of DeFi and CeFi is indeed underway, but it’s not closely related to crypto-stocks. DAT is somewhat involved, and future articles will cover institutional lending and credit models.

The focus is on examining the structural relationships among crypto, stocks, and bonds, and what new varieties and directions they will create. ETFs are already solidified, DAT is still fiercely contested, stablecoins are expanding massively, and both on-chain and off-chain have the biggest opportunities. Crypto-stocks and Pre-IPO have unlimited potential, but it’s hard to transform traditional finance through compatibility, as they haven’t built their own internal circulation systems.

Crypto-stocks and Pre-IPO need to solve the rights issue, but “solving it through rights” won’t work. Economic effects must be created to break through regulation. Facing regulation only leads to bureaucratic shackles. The history of stablecoins is the clearest example—surrounding the cities from the countryside is most effective.

Crypto company IPOs are the process of traditional finance redeeming and pricing crypto. It will become increasingly bland. If you want to go public, do it early. Once the concept is exhausted, it’s all about quantitative valuation, just like Fintech and manufacturing. The imagination space will gradually decrease as listings increase.

Tokenized US Treasuries (funds) are a long-term play, hard to generate excess profits, and have little to do with retail, highlighting more the technical use of blockchain.

This article is mainly a static macro framework, lacking dynamic data, such as Peter Thiel’s participation in various DAT and ETF allocations and investments.

When leverage is withdrawn, whales and retail move in opposite directions. Whales sell secondary assets first and keep core assets, while retail must sell core assets to maintain leverage on secondary assets. That is, when Bitcoin rises, altcoins may not rise, but when Bitcoin falls, altcoins will definitely crash. All this needs data to illustrate, but for now, we can only set up a static framework to clarify the logic.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Bitcoin valuation metric projects 96% chance of BTC price recovery in 2026

Bitcoin's ‘more reliable’ RSI variant hits bear market bottom zone at $87K

XRP ETF inflows exceed $756M as bullish divergence hints at trend reversal