$5,940,000,000 XRP Activity Surge Shocks Market as Price Flips Direction

The crypto market saw whipsaw price action in the early Friday session, with various crypto assets seeing a surge in trading activity.

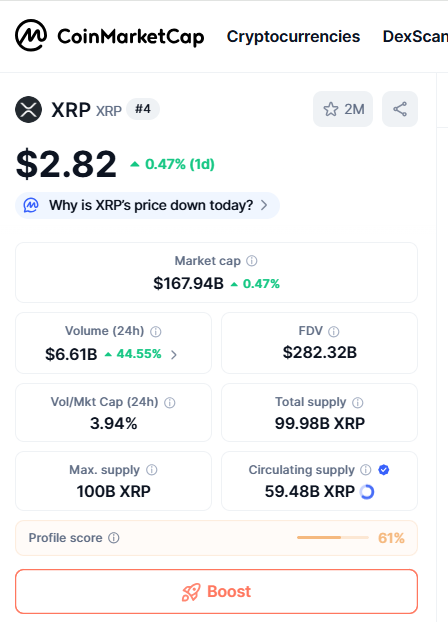

XRP likewise saw its volume rise as much as 44% to reach $6.57 billion, according to CoinMarketCap data.

The broader crypto market rose in response to a weaker jobs report released Friday, which seemed to boost the potential of a rate cut in the upcoming Fed meeting scheduled for September.

Cryptocurrencies returned to green afterward, but the rise was shortlived, followed by a drop.

At press time, XRP was down 0.85% in the last 24 hours to $2.80 after reaching an intraday high of $2.88.

XRP news

CME futures recently gave a recap of August growth, which saw a record $36 billion in OI for Crypto futures and options. XRP stole the spotlight as it reached an all-time high in open interest as institutional activity expanded beyond Bitcoin.

Ripple CEO Brad Garlinghouse took to X to highlight the recent milestone, noting XRP's impressive surge in open interest: "Per CMEGroup data, XRP Futures contracts were the fastest-ever (just over 3 months) to hit $1B in open interest."

This week, the credentials amendment was activated on the XRP Ledger mainnet. Credentials (XLS-70) are designed to be a lightweight feature additive to the DID standard and are a framework for issuing, managing and verifying user credentials directly on the XRP Ledger. This standard introduces a new "Credential" ledger object along with new transaction types for creating, accepting and deleting credentials.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?

Bitcoin catches a bid, but data shows pro traders skeptical of rally above $92K

Bitcoin's dormant capital has finally awakened

In recent years, a completely new ecosystem has been forming around bitcoin.

Privacy concerns have become the biggest obstacle for enterprises using blockchain for commercial payments.

What is preventing enterprises from applying blockchain technology to business scenarios?