Bitcoin and One Large-Cap Ethereum Rival Are Flashing Bullish Signals, According to Analytics Platform Santiment

Analytics platform firm Santiment says that Bitcoin ( BTC ) is primed to break out based on historic correlations with two other asset classes.

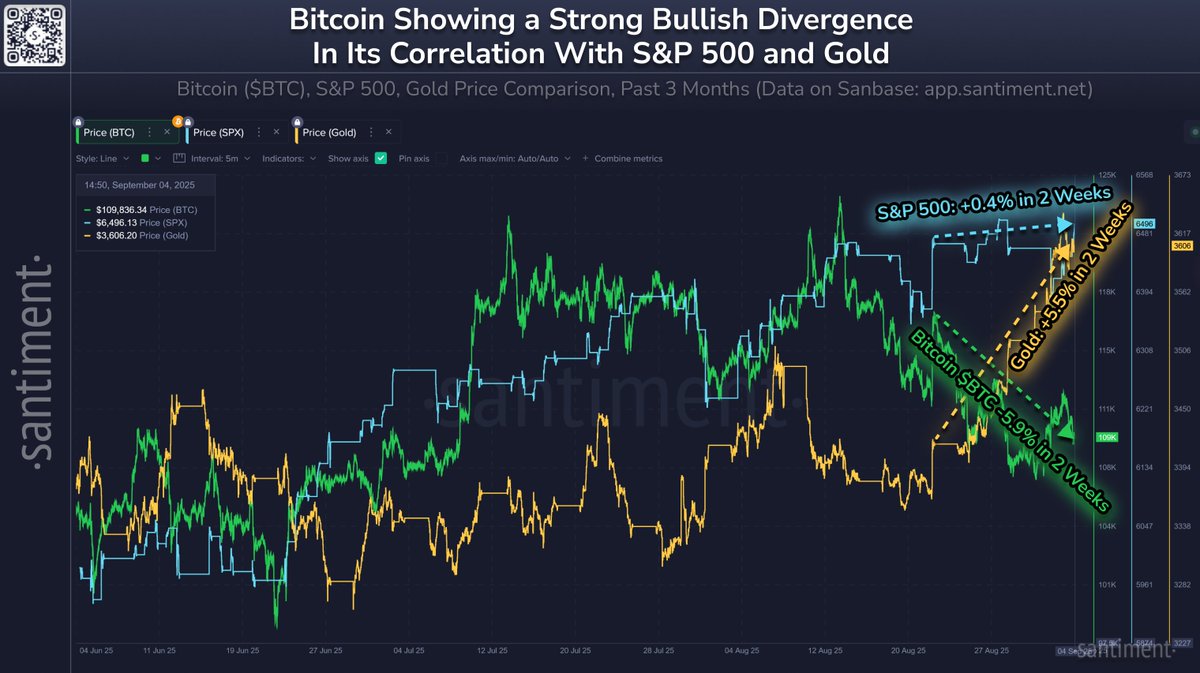

Santiment says that Bitcoin is forming a bullish divergence against the S&P 500 and gold, signaling the flagship crypto asset may be on the verge of an explosive move to the upside.

A bullish divergence occurs when the price of an asset is forming lower lows while an oscillator is forming higher highs.

“There is a major bullish divergence that has been forming over the past two weeks:

- Bitcoin’s market value has dropped -5.9% since August 22nd.

- S&P 500 has risen +0.4% since August 22nd.

- Gold has risen +5.5% since August 22nd.

Since early 2022, cryptocurrencies have been especially correlated with equities, as institutionals have increasingly added exposure to them alongside their stock holdings. In cases like this divergence over the past two weeks, Bitcoin (and altcoins) have a high probability of playing ‘catch up’ when they trail world economy price trends for a sustained period of time. The larger the gap between equities and BTC gets, the stronger the argument there is for an upcoming crypto bounce.”

Source: Santiment/X

Source: Santiment/X

Bitcoin is trading for $110,839 at time of writing, up marginally on the day.

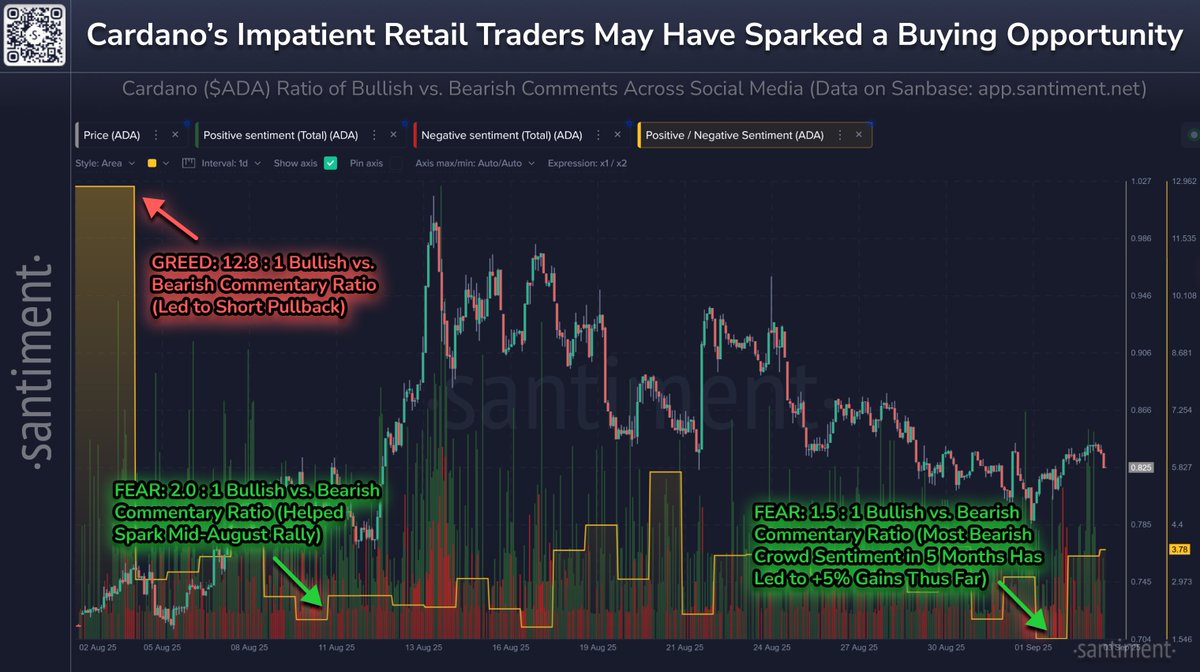

Next up, Santiment says that the increasing negative sentiment on social media for smart contract platform Cardano is a bullish signal for ADA .

“Cardano has quietly seen its normally optimistic crowd start to turn bearish. After the lowest sentiment recorded in five months, ADA’s price is +5%. Patient holders and dip buyers during this three-week downswing should root for this trend of bearish retailers to continue. Prices typically move in the opposite direction of the crowd’s expectations. When small traders sell off their bags out of impatience and frustration, it is generally the key stakeholders who accumulate and drive up prices again.”

Source: Santiment/X

Source: Santiment/X

ADA is trading for $0.825 at time of writing, up 2.1% in the last 24 hours.

Featured Image: Shutterstock/Giovanni Cancemi/Andy Chipus

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.