Sora Ventures Creates Billion-Dollar Fund to Expand Bitcoin Treasuries in Asia

- Sora Ventures Launches $1 Billion Bitcoin Fund

- Focus on Asian companies holding BTC in treasury

- Fund already has US$200 million in initial commitments

Taiwan-based venture capital firm Sora Ventures announced the creation of a $1 billion fund focused on supporting companies holding bitcoin on their balance sheets in Asia. The statement released Friday said the company has already secured $200 million in initial commitments from regional investors and partners, with the goal of completing the fundraising within the next six months.

The fund's goal is to strengthen the Bitcoin-based corporate treasury movement, a practice that has gained traction in Japan, Hong Kong, Thailand, and South Korea. Jason Fang, founder and managing partner of Sora Ventures, highlighted the initiative's relevance.

"We've seen a surge in institutional interest in Bitcoin Treasuries in the US and EU, while in Asia, efforts have been relatively fragmented. This is the first time in history that institutional money has come together, from the local to the regional and now to the global stage."

Sora Ventures' strategy builds on a recent track record of acquisitions and investments targeting companies already using bitcoin as a treasury asset. In April 2024, the firm supported Japan's Metaplanet in a 1 billion yen (approximately US$6,6 million) BTC purchase.

In early 2024, Sora acquired Hong Kong-based Moon Inc., which, after restructuring, ceased to be HK Asia Holdings and began investing in Bitcoin and Web3. In July, the company led a consortium to acquire Thai electronics retailer DV8, aiming to replicate Metaplanet's model in Southeast Asia. Later that month, together with partners, it took control of South Korean company BitPlanet, supporting its expansion into digital assets.

The launch of this fund reinforces Sora Ventures' position as a leading driver of the advancement of corporate Bitcoin treasuries in Asia, connecting institutional capital with local companies seeking to diversify their cryptocurrency holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

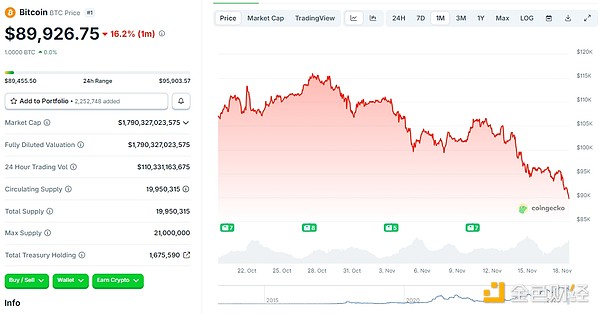

Is the crypto market bearish? See what industry insiders have to say

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave

![[Bitpush Daily News Selection] Strategy increased its holdings by purchasing 8,178 bitcoins last week at an average price of $102,171; CBOE will launch continuous futures contracts for bitcoin and ethereum on December 15; Federal Reserve Governor Waller: Supports risk-management rate cuts in December](https://img.bgstatic.com/multiLang/image/social/8ce218bf9e396bdadfada2b4ef95f3111763451361931.png)