The rise of Sei's EVM rewrites the growth curve between performance and ecosystem

Sei once surpassed Solana in active users. By leveraging EVM compatibility and a high-performance architecture, Sei is propelling itself onto a new growth trajectory and becoming a focal point in the industry narrative.

ETH is approaching its all-time high under the new treasury narrative, while traditional financial forces represented by Stripe and Circle have announced their entry into building their own Layer1s. The EVM ecosystem has been enjoying a period of great prosperity recently.

As development tools, liquidity, and user networks in the Ethereum ecosystem gradually become the industry default, EVM compatibility has shifted from a nice-to-have to a basic requirement. Against this backdrop, Sei, once renowned for its high-performance order book chain, has chosen a different path. This article reviews the key milestones in Sei’s technical upgrades and ecosystem expansion over the past year and explores its long-term competitiveness as the multi-chain landscape is reshaped.

EVM Upgrade and Infrastructure Integration

In mid-2024, Sei launched its V2 upgrade, officially introducing parallelized EVM to the mainnet. Architecturally, it retains the modular advantages of the Cosmos SDK while enabling seamless interaction with Ethereum applications, maintaining existing network consensus and governance mechanisms, and bridging to the world’s largest smart contract ecosystem. This move was somewhat counter-cyclical in the then multi-chain environment—while most public chains were slowing down R&D, Sei was adding both performance and compatibility.

One of the supporting measures for the upgrade was establishing wallet compatibility with MetaMask, the most widely used wallet globally. MetaMask integration greatly lowered the barriers for user migration and asset management, allowing users from Ethereum, Arbitrum, and other chains to enter Sei with virtually zero learning curve.

Soon after, the leading block explorer in the VM ecosystem, Etherscan, officially launched on Sei, providing Sei users and developers with the customized Seiscan block explorer. This not only marks a significant improvement in the developer toolchain but also means on-chain data transparency will match that of Ethereum mainnet, providing a unified standard interface for debugging, auditing, and analysis. Rather than being a passive shift, this is Sei’s proactive positioning in the reshaping of the multi-chain landscape—by enhancing performance, wallet access, and data visualization, it simultaneously broadens developer coverage and liquidity radius.

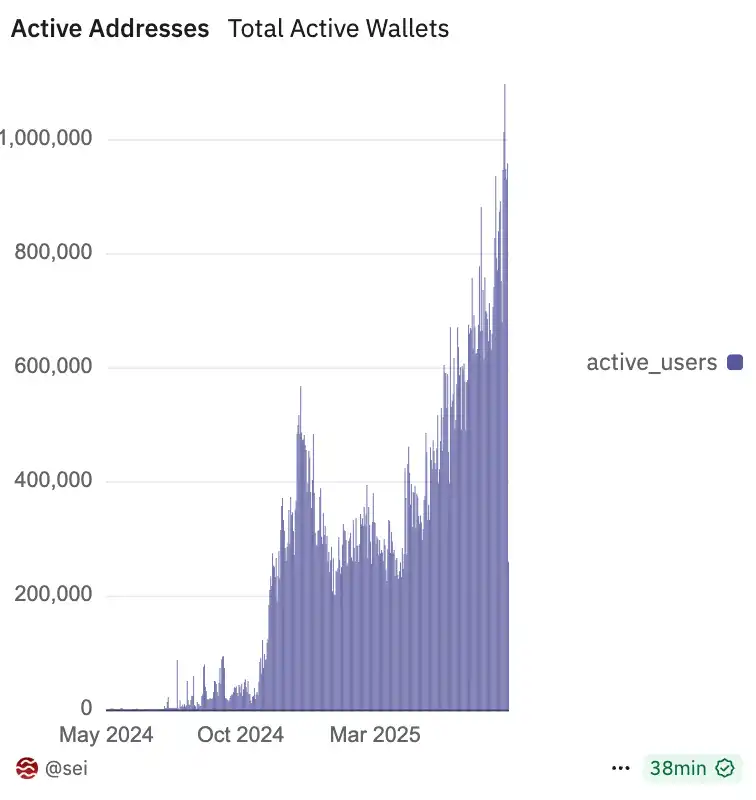

Since the launch of Sei V2, the Sei ecosystem has experienced explosive growth: daily active users soared from 1,300 to nearly 900,000, daily transaction volume increased from 57,000 to 1.65 million, and TVL climbed from $100 million to a recent peak of $687 million. For a public chain that was once deeply rooted in the Cosmos world but proactively opened up to a larger ecosystem, this is not just a reshaping of its growth curve, but also a new chapter in its strategic narrative.

Why Upgrade?

Previously, Sei supported both EVM and CosmWasm execution environments, attempting to meet the needs of different developer groups with a "dual-track parallel" approach. This strategy provided flexibility in the early stages and made Sei one of the few networks capable of native interoperability between EVM and WasmVM-based applications.

However, as the network scaled and the ecosystem structure evolved, the costs of this architecture became apparent. Users had to manage two sets of addresses, infrastructure providers had to write custom logic for cross-environment interactions, and at the code level, there was a long-term maintenance burden for cross-compatibility. Sei Labs co-founder Jay Jog admitted that this complexity not only slowed iteration speed but also diluted performance advantages.

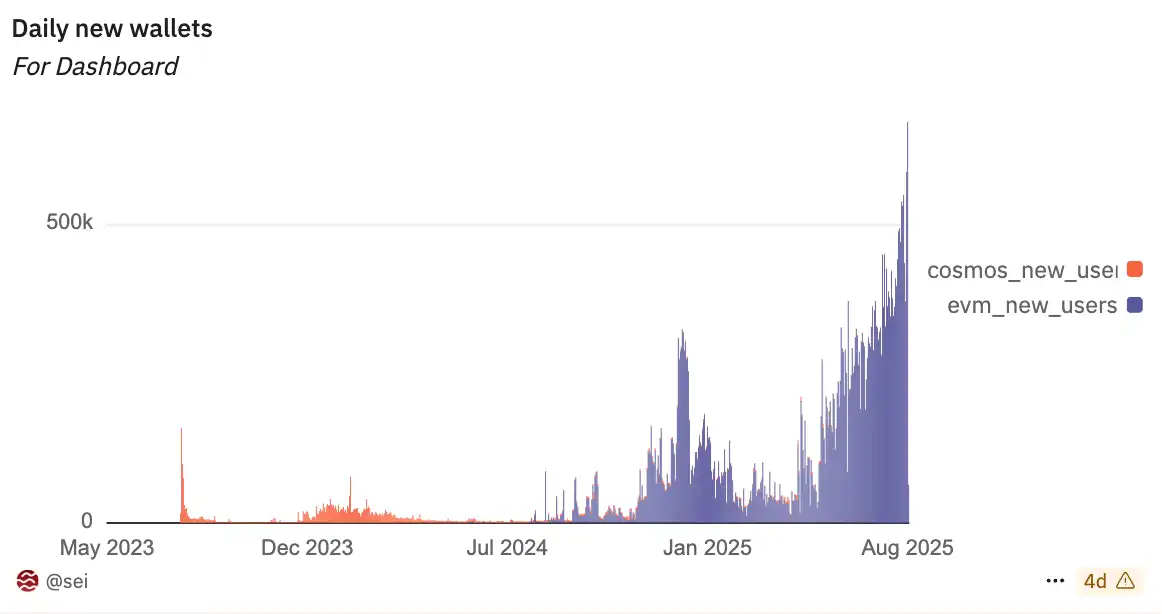

Since Sei v2 introduced parallelized EVM, EVM usage has quickly dominated network activity. On-chain data from Dune Analytics shows that most new users and newly deployed applications have chosen the EVM environment, while CosmWasm’s share of transaction volume and developer activity has continued to decline.

For developers accustomed to Solidity and the Ethereum toolchain, EVM is not only a familiar programming interface but also comes with mature debugging tools, a vast open-source component library, and cross-chain portability—advantages that CosmWasm cannot easily replace in the short term.

From developer psychology to ecosystem network effects, EVM has formed an unshakable stickiness. In this context, maintaining a dual architecture not only loses its original strategic significance but also consumes valuable R&D and maintenance resources.

Thus, the SIP-3 proposal was introduced. This proposal from Sei Labs directly targets a single goal—to shift Sei to an EVM-only architecture, fully deprecating CosmWasm contracts and native Cosmos transactions.

The plan will be implemented in phases: first, a pointer mechanism will be established on the EVM side to allow access to existing Cosmos and CosmWasm assets; then, new CosmWasm deployments and inbound IBC asset inflows will be frozen; finally, execution of old contracts and support for non-EVM address transactions will be discontinued.

Sei addresses will not disappear entirely—they will still play a role in validator identity, staking, and governance within the protocol. These functions will be implemented via EVM precompiles to ensure continuity of on-chain governance.

Proactive Breakthrough: How Does Sei Integrate with EVM?

The core of the upgrade lies in the dual management of technical execution and ecosystem migration. The Sei team has clearly broken down the process into manageable phases to minimize impact on the existing ecosystem. Technically, Optimistic Parallelization remains Sei’s performance core, allowing transactions to run simultaneously and only reverting to sequential execution when conflicts are detected.

The Twin Turbo consensus mechanism compresses block finality time to about 360 milliseconds, thousands of times faster than Ethereum, providing a solid performance guarantee for high-frequency DeFi, gaming, and order book applications, meaning users experience virtually no latency. SeiDB’s layered storage structure continues to support efficient state access and historical data queries.

In terms of infrastructure adaptation, MetaMask has become an important user entry point for Sei, while Etherscan has filled the gap in on-chain data browsing and developer debugging.

The parallel development of these two facilities, along with cross-chain bridges, data indexing, and multi-signature accounts, enables Sei to offer a development experience comparable to or even surpassing Ethereum mainnet in a short period. For CosmWasm developers, the official team will provide migration guides and technical support to ensure a smooth transition to EVM compatibility. Asset holders can transfer native Cosmos assets to EVM wallets via cross-chain bridges or swaps, reducing liquidity loss.

Sei’s EVM-only Era: The Bet on Speed and Compatibility

The data changes validate the effectiveness of this transformation. Since the V2 upgrade, Sei’s daily active wallets have increased from 1,300 to nearly 900,000, daily transaction volume has soared from 57,000 to 1.65 million, and TVL has climbed from $100 million to a peak of $687 million.

This growth is not only reflected in on-chain data but is also gradually being transmitted to the traditional financial system. In May 2025, Canary Capital submitted an S-1 filing for a Staked SEI ETF, meaning Sei is likely to become one of the few blockchains that can be included in compliant asset portfolios. The Sei Development Foundation, based in the United States, ensures robust development direction, policy alignment, and compliance advancement in governance.

In early August, according to monitoring by @EmberCN, Sei’s daily active users surpassed those of Solana for the first time on August 2. Sei recently launched native USDC, introduced Ondo and Backpack, and massive adoption has doubled Sei’s daily active users in the past three months—from 380,000 to the current 752,000. In just 10 days, the issuance of native USDC on Sei reached $108 million, surpassing zkSync, Algorand, Polkadot, and other chains.

Related reading: "When the First Stablecoin Stock Meets High-Performance Layer1, Why Does Sei Stand Out?"

In this way, Sei is poised to become a truly on-chain platform for traditional capital markets. Against the backdrop of the emergence of next-generation on-chain assets such as stablecoins, RWA, and DePIN, Sei’s "high throughput + regulatory compliance + easy access" features have given it the initiative in ecosystem evolution.

It aligns with the dominant position of the EVM ecosystem among developers and leverages Sei’s technical accumulation in parallel execution and low-latency consensus, seeking a new balance between performance and ecosystem. Ultimately, the success or failure of this upgrade depends not only on the smoothness of technical implementation but also on the degree of ecosystem migration cooperation—whether existing users and applications can switch with minimal friction and continue to expand under the new EVM-only architecture.

From a broader perspective, Sei’s transformation reflects an industry-wide trend: in a multi-chain landscape, EVM remains the default standard for developers. Whether due to technical familiarity, toolchain maturity, or ecosystem network effects, EVM’s appeal has led many emerging chains to actively pursue compatibility. Sei’s innovation on this basis is to use faster performance and lower latency to fill the gaps of Ethereum and its L2s in high-frequency application scenarios. For developers and capital seeking the best combination of speed and compatibility in the Web3 world, this may be exactly what they are looking for.

As the Giga architecture plan progresses, Sei hopes to further enhance performance and continue to expand application boundaries in high-frequency scenarios such as finance, AI, gaming, and social. In the reshuffling of the multi-chain landscape, speed, liquidity, and ecosystem breadth may determine the future of a public chain.

Sei’s choice is to place itself at the most competitive center of the industry—where opportunities are huge, but the margin for error is minimal for those who fail. Its next growth curve depends on whether it can not only survive in the EVM world’s red ocean but also become a key infrastructure driving the next wave of applications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Q3 earnings season: Diverging strategies among 11 Wall Street financial giants—some are selling off, while others are doubling down

Technology stocks led by Nvidia have become a key reference signal for global capital allocation strategies.

Highlights from the Ethereum Argentina Developers Conference: Technology, Community, and Future Roadmap

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at the developer conference: scalability, security, privacy, and institutional adoption.

Compliance Privacy: What is Kohaku, Ethereum’s Latest Major Privacy Upgrade?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."

Ethereum Argentina Developers Conference: Towards a New Decade of Technology and Applications

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at its developer conference: scalability, security, privacy, and institutional adoption.