HBAR Traders May Face $35 Million Liquidations Thanks To Bitcoin

Hedera’s price decline appears to have reached a saturation point, and the altcoin is showing signs of potential recovery.

At $0.216, HBAR is attempting to stabilize after recent drawdowns. This recovery could trigger significant market liquidations, creating both opportunity and risk for traders.

Hedera Traders Should Be Worried

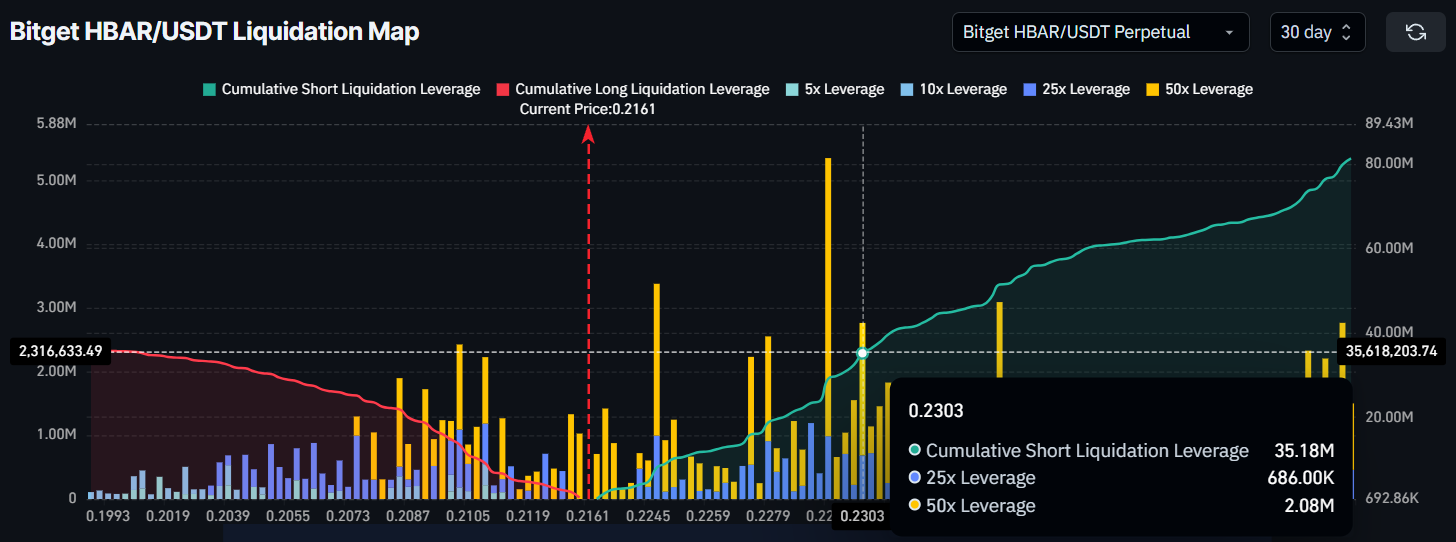

The liquidation map shows that more than $35 million in short positions could be liquidated if HBAR climbs to $0.230. Such a development would create a large-scale short squeeze, potentially driving further bullish momentum across the market. This would provide an opportunity for HBAR to extend its rebound.

For traders, this means that a move past $0.230 could bring heightened volatility. While liquidations would add fuel to upward momentum, they also represent a critical price zone.

A successful push through this level could increase capital inflows as bullish investors attempt to capture the upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

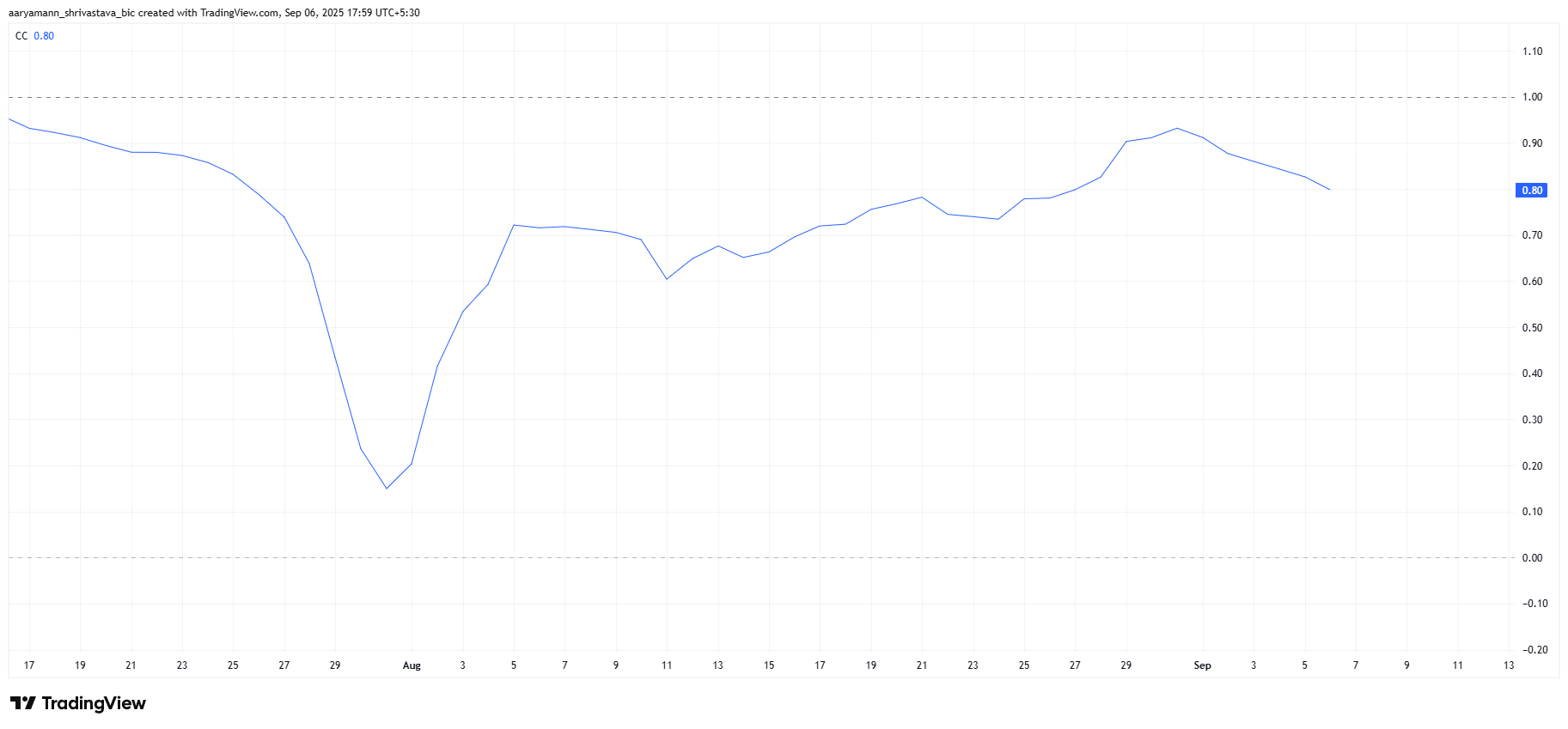

On a broader scale, Hedera’s trajectory is closely tied to Bitcoin. The altcoin shares a 0.80 correlation with BTC, indicating a strong price relationship.

As long as Bitcoin maintains support above $110,000, HBAR’s price is likely to benefit from positive spillover effects.

This correlation gives HBAR some cushion against downside risk. With Bitcoin stabilizing in the six-figure range, Hedera could leverage this momentum to test higher resistance zones. The BTC trend will play a crucial role in determining whether HBAR sustains recovery or remains rangebound.

HBAR Price Is Facing Resistance

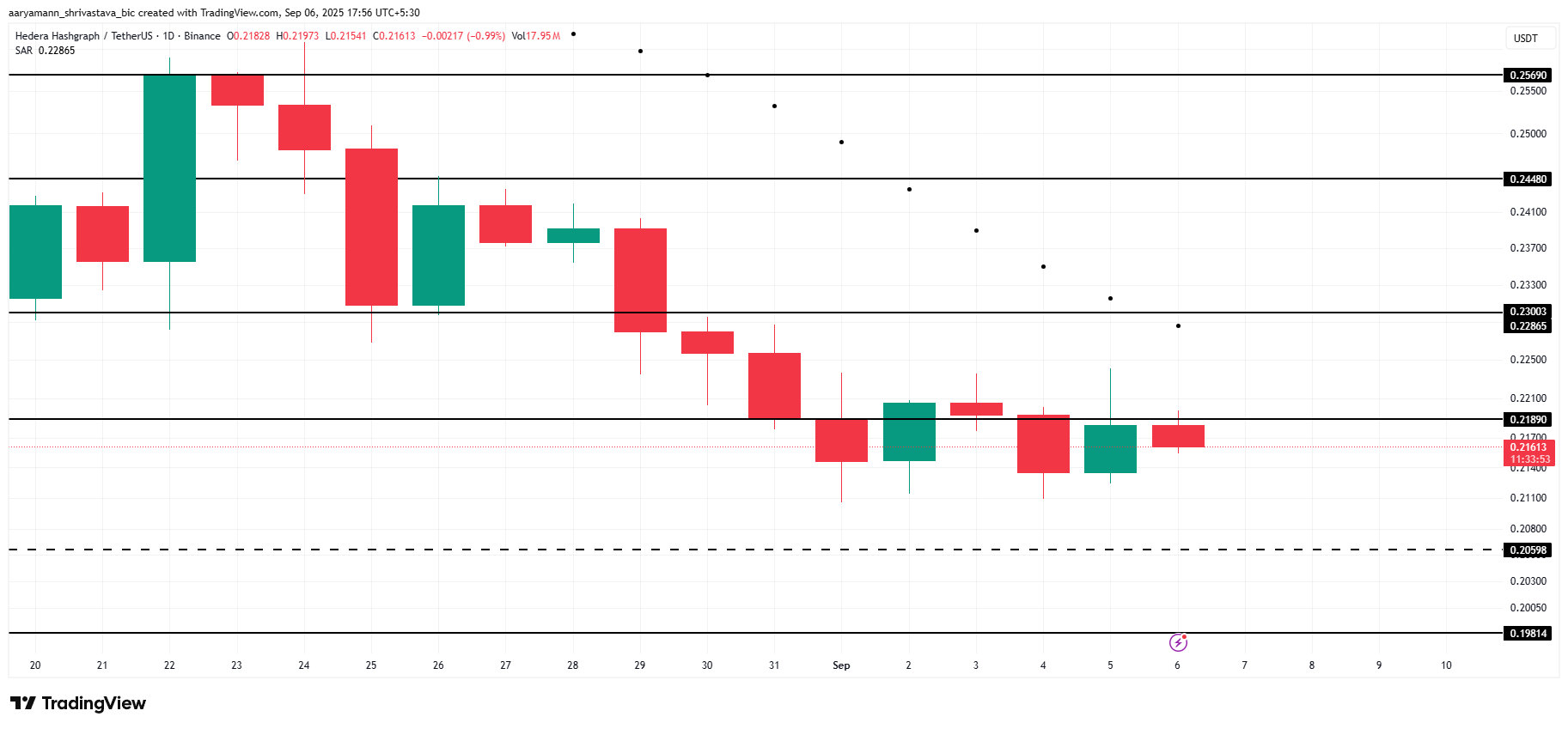

HBAR is trading at $0.216, sitting just below the $0.218 resistance level. This barrier has proven difficult to breach in recent days, but a breakout could allow HBAR to build momentum toward higher targets.

The next key resistance lies at $0.230. If HBAR manages to reach this level, the liquidation of short positions worth over $35 million could occur. This short squeeze scenario has the potential to drive the altcoin higher, pushing it toward $0.244.

However, if bullish momentum stalls, HBAR may consolidate within the $0.218 to $0.205 range. This sideways movement would invalidate the immediate bullish outlook and delay the potential breakout, leaving HBAR vulnerable to further stagnation.

The post HBAR Traders May Face $35 Million Liquidations Thanks To Bitcoin appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.