Bitcoin Mining Difficulty Hits New Record As Miner Revenues Fall

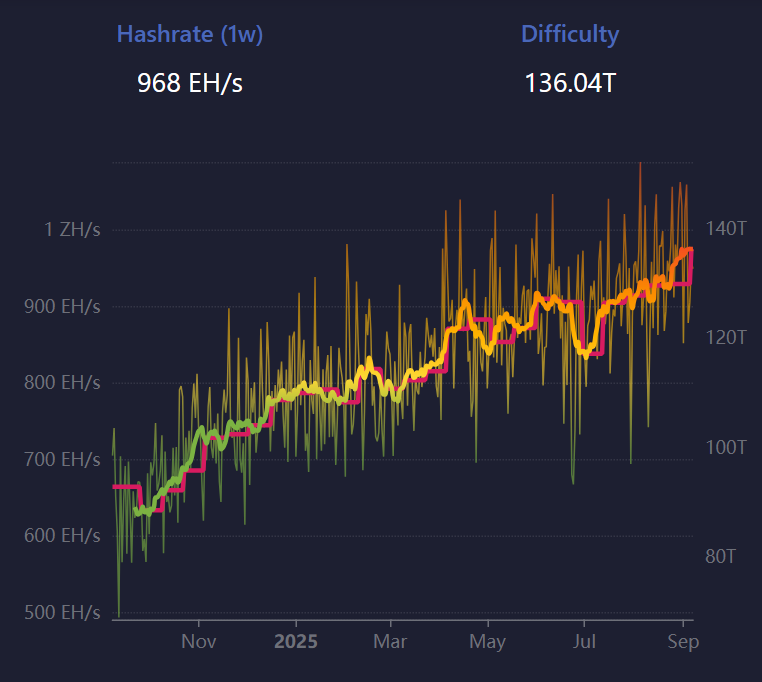

Bitcoin’s network difficulty climbed above 136 trillion, marking its fifth consecutive increase since June and creating tougher conditions for miners.

Bitcoin’s network difficulty has surged to a record high above 136 trillion, creating tougher conditions for miners already dealing with shrinking revenues.

The adjustment, logged at block height 913,248, marked a 4% rise from 129.6 trillion and extended a run of five consecutive increases since June, according to figures from Mempool.

Bitcoin Miners Face Tight Margins With Record Difficulty And Weakening Income

This mechanism is central to Bitcoin’s design. Difficulty levels are recalibrated every 2,016 blocks—roughly once every two weeks—to keep block production close to the ten-minute target.

A rise signals that more computing power has joined the network, while a drop reflects miner exits. In both cases, the adjustment ensures stability in the pace of new block creation.

Bitcoin Mining Difficulty. Source:

Mempool

Bitcoin Mining Difficulty. Source:

Mempool

Meanwhile, the rising threshold comes at a challenging time for Bitcoin miners.

Data from Hashrate Index shows that hashprice—the benchmark for miner revenue per unit of computing power—has slipped to around $51.

That level is the weakest since June, underscoring how revenue pressure is building even as competition intensifies.

Bitcoin Hashprice Index. Source:

Hashrate Index.

Bitcoin Hashprice Index. Source:

Hashrate Index.

According to Hashrate Index, August’s numbers highlighted this squeeze. During the month, Bitcoin’s hashprice average across the period settled at $56.44, about 5% lower than July.

At the same time, the firm noted that BTC’s transaction fees offered little to no support during the period.

Hashrate Index pointed out that BTC miners collected just 0.025 BTC per block on average—a 19.6% slide from July and the weakest performance since late 2011. In dollar terms, that translated to $2,904 in average daily fee income, down nearly 20% month-on-month and the lowest since early 2013.

Considering the above, Bitcoin miners are in a bind as the combination of record difficulty levels and weaker revenue streams leaves their operations on tight margins.

This means miners may face mounting pressure to maintain profitability through the remainder of the year unless Bitcoin’s price climbs meaningfully or on-chain activity generates higher fees.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.

Alphabet’s TPUs Emerge as a Potential $900 Billion Chip Business

Ethereum Loses 25% of Validators After Fusaka: The Network Nears a Critical Failure

US Stablecoin Rules Are Splitting Global Liquidity, CertiK Warns