SignalPlus Macro Analysis Special Edition: September Scare?

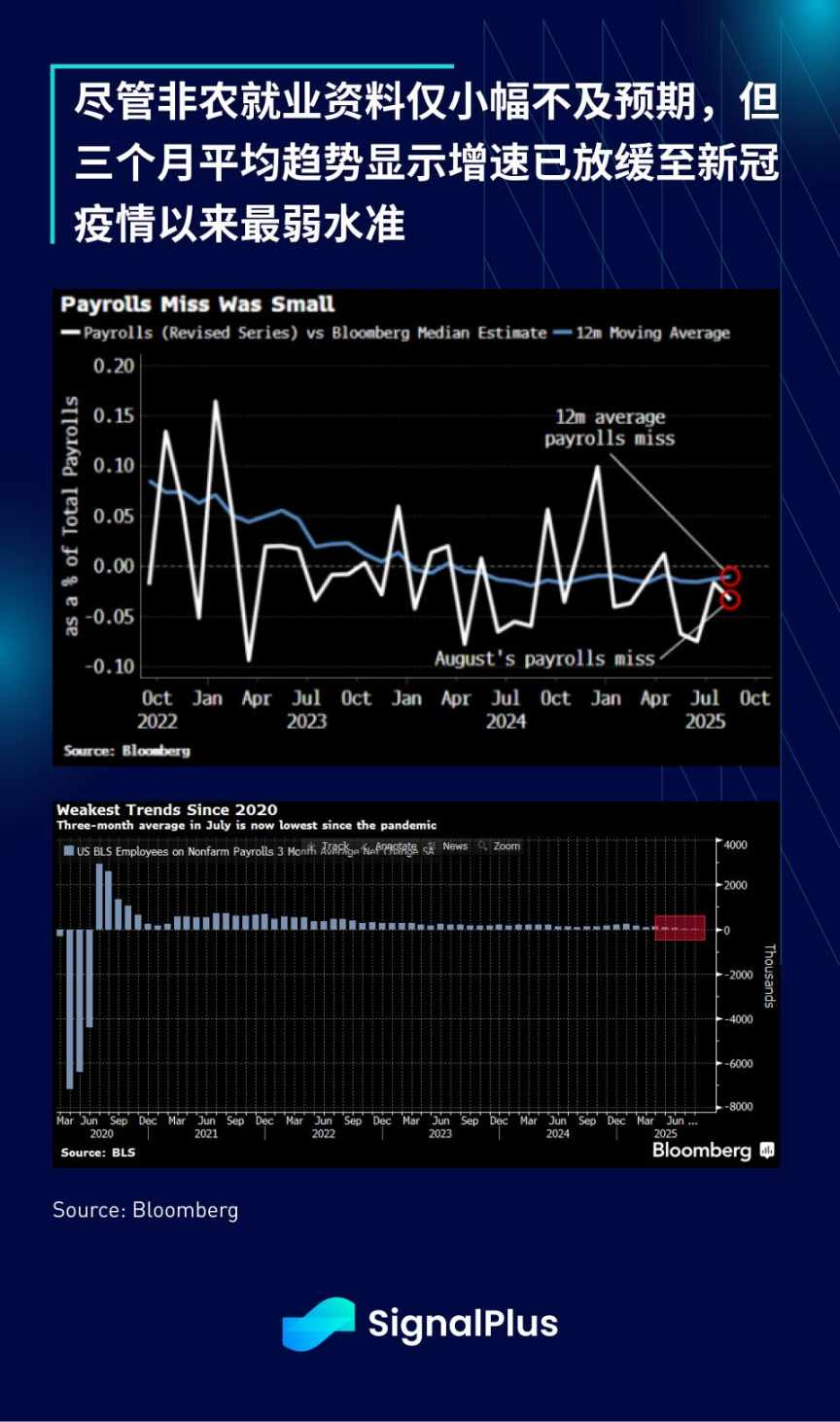

As expected, we have entered the seasonally volatile September cycle: Non-farm employment data was slightly below expectations, with the three-month average growth rate slowing to pre-pandemic levels...

As expected, we have entered the seasonally volatile September cycle: Nonfarm payroll data was slightly below expectations, with the three-month average growth rate slowing to its lowest level since the pandemic.

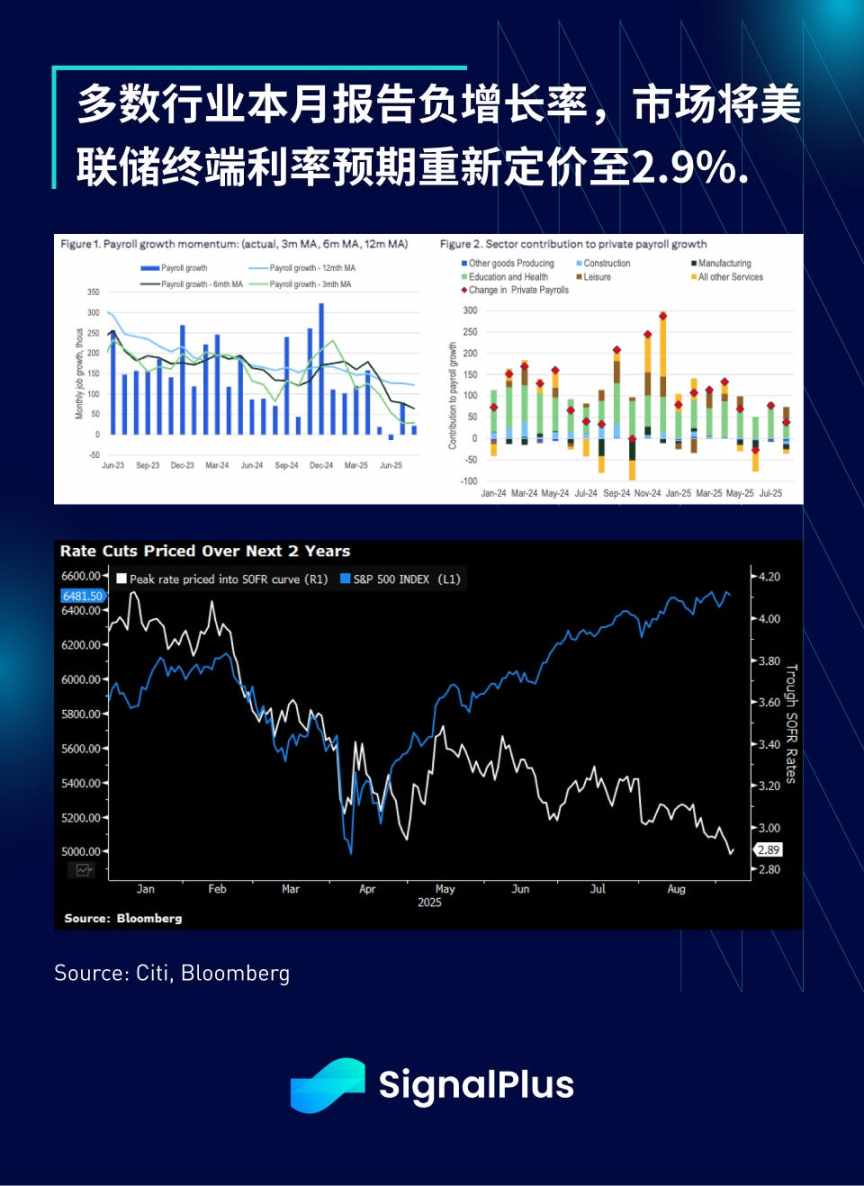

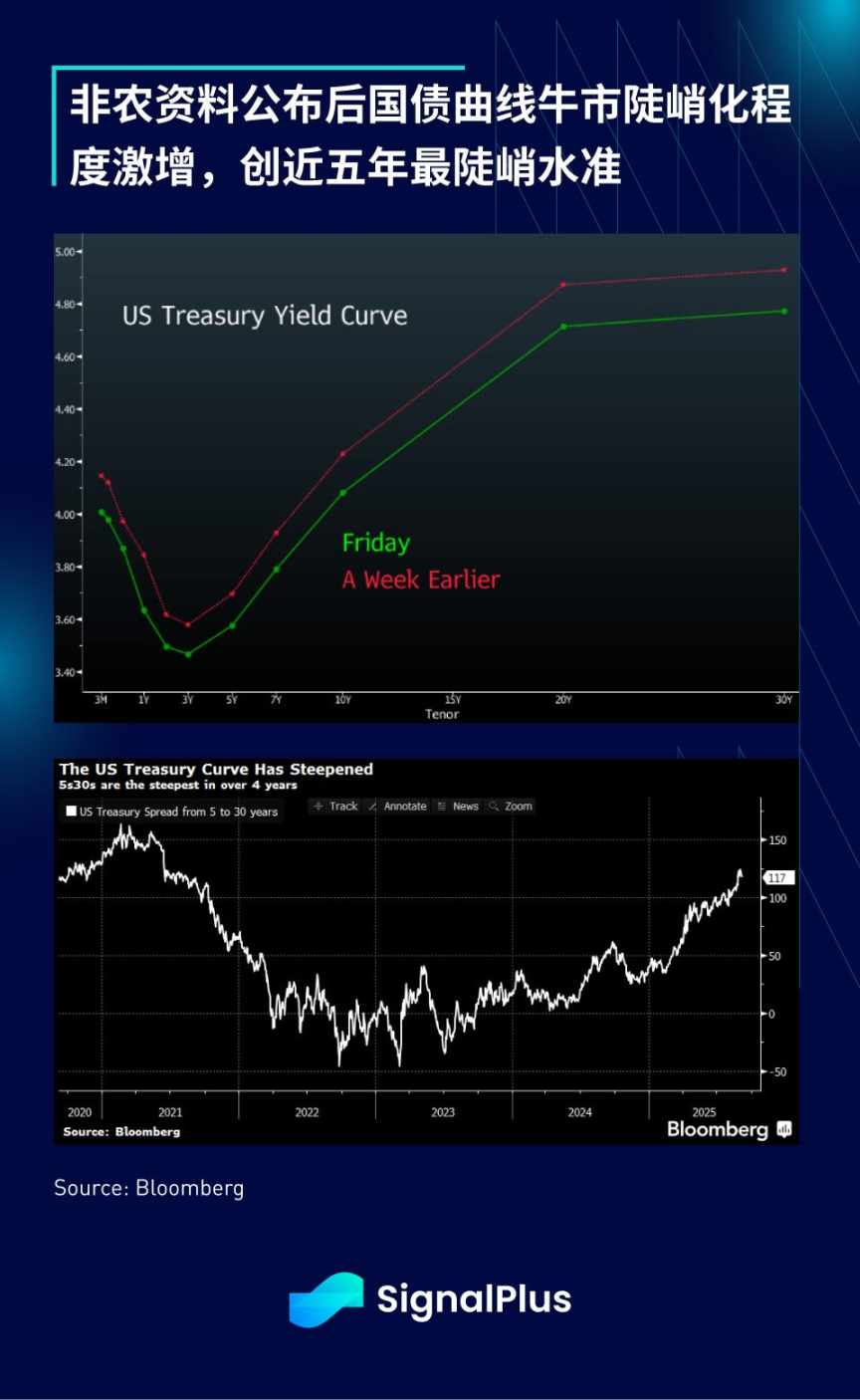

The core data from the report was also weak, with 80% of industries showing negative employment growth in August. This has reinforced expectations for a rate cut this month, bringing the Federal Reserve's terminal rate expectation down to 2.9%, the lowest point of the current cycle. This is a significant reduction of 50 basis points from the early summer rate of 3.4%.

After the release of nonfarm data, rate traders see a very low probability (about 5%) of a 50 basis point rate cut this month, but the probability of three cumulative rate cuts by the end of the year is as high as 92%. The 1-year forward September Fed futures (September 2026) fell 15 basis points on Friday, with market pricing indicating nearly three cumulative rate cuts by the end of 2026.

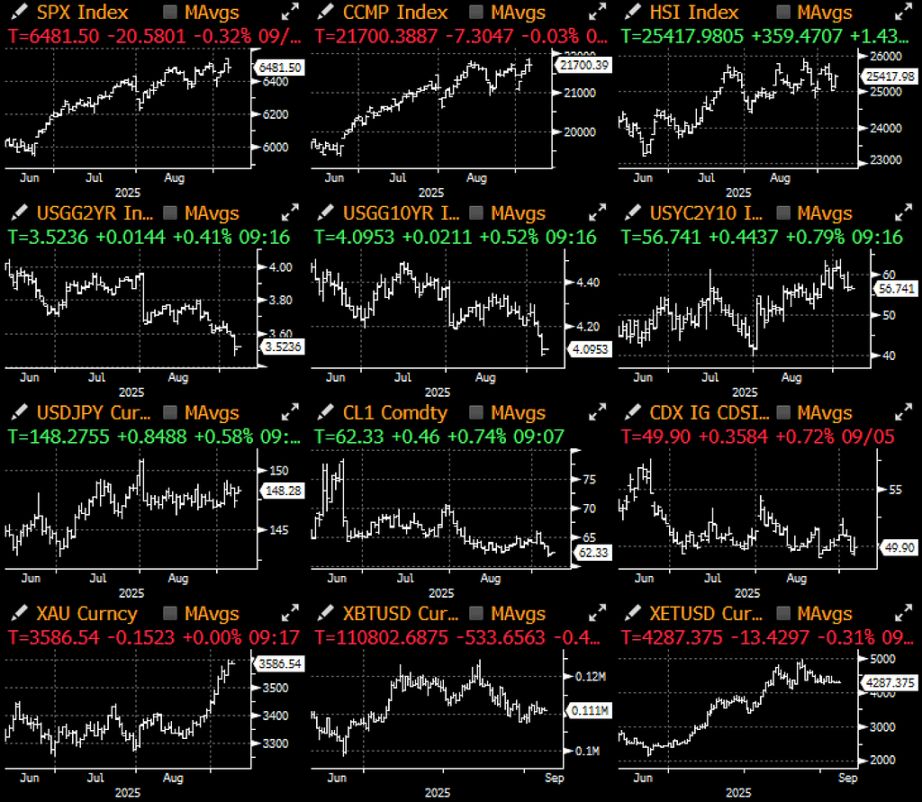

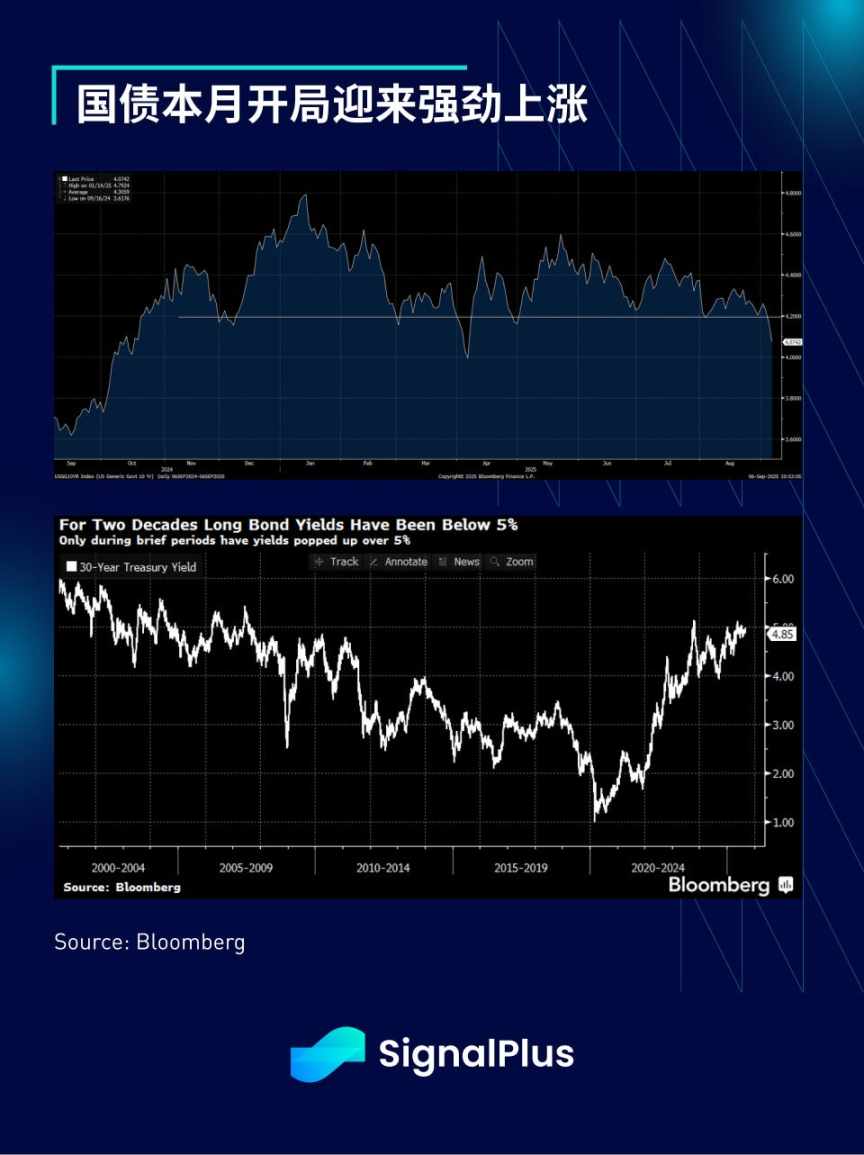

Inflation expectations are under control: As investors reassess expectations of an economic slowdown, both inflation swaps and long-term bond breakeven inflation rates have declined, with the market forecasting this week's CPI data at 2.92%. Traders will focus on confirmation signals of potential inflation slowdown to support the Federal Reserve's aggressive dovish pivot after the Jackson Hole meeting. Data in the coming months will reveal whether there are initial signs of tariff-related price pressures—at this point, any hawkish high inflation data would be unfavorable for risk assets.

The breakeven inflation rate edged down slightly on Friday, which is favorable for long-term bonds (previously, due to ongoing fiscal concerns, US Treasury yields once approached 5%). After testing the 5% threshold at the beginning of this week, the 30-year US Treasury rebounded, and the 10-year yield has dropped sharply and is now close to testing the 4% mark.

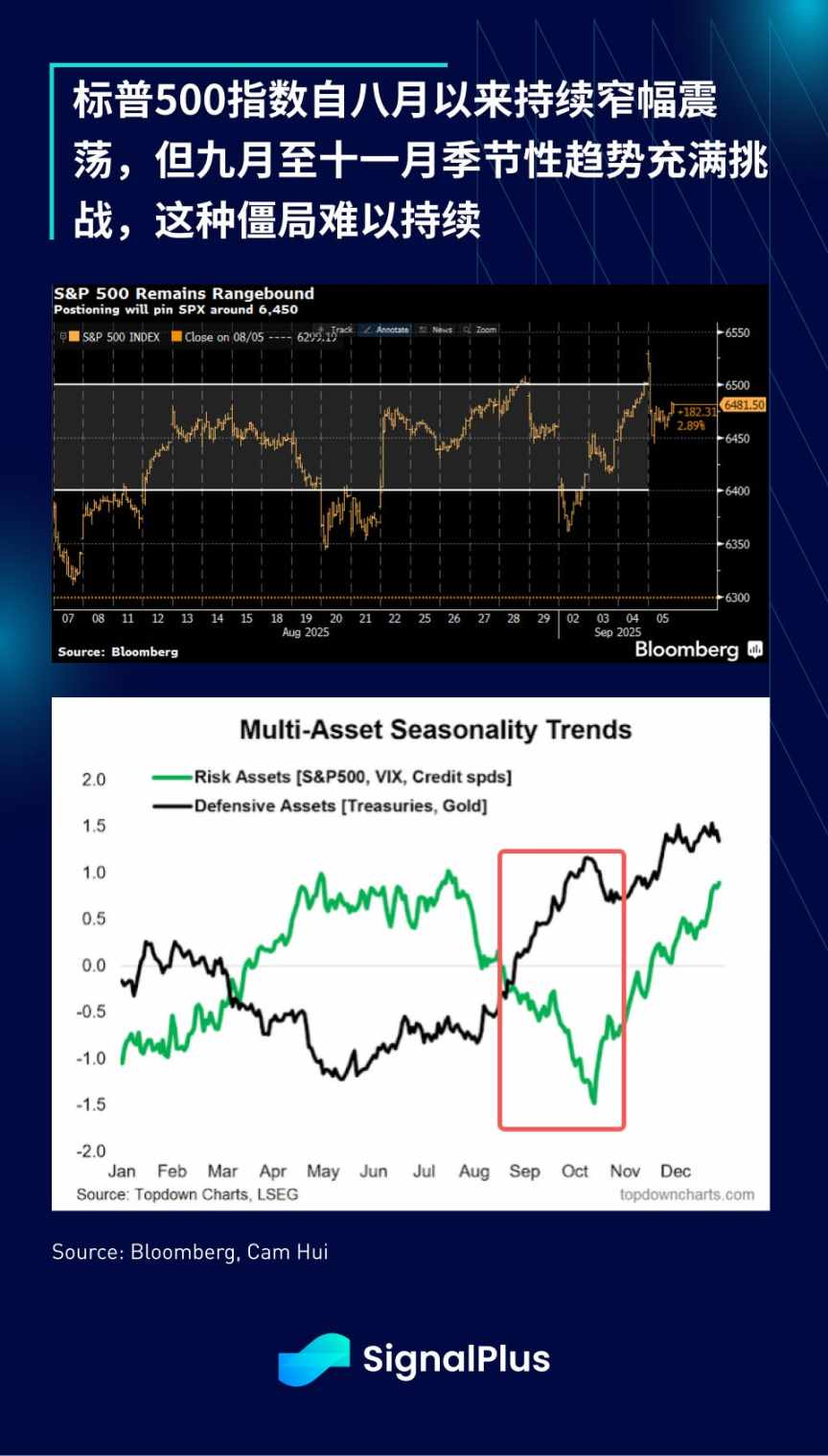

The stock market was overall flat last week: Nvidia's weakness was offset by other leading stocks and defensive sectors, with the S&P 500 returning to the middle of its late-summer trading range. As mentioned last week, given the challenges of seasonal trends and JPMorgan's report showing hedge fund net leverage at high levels, volatility is expected to increase over the next two months.

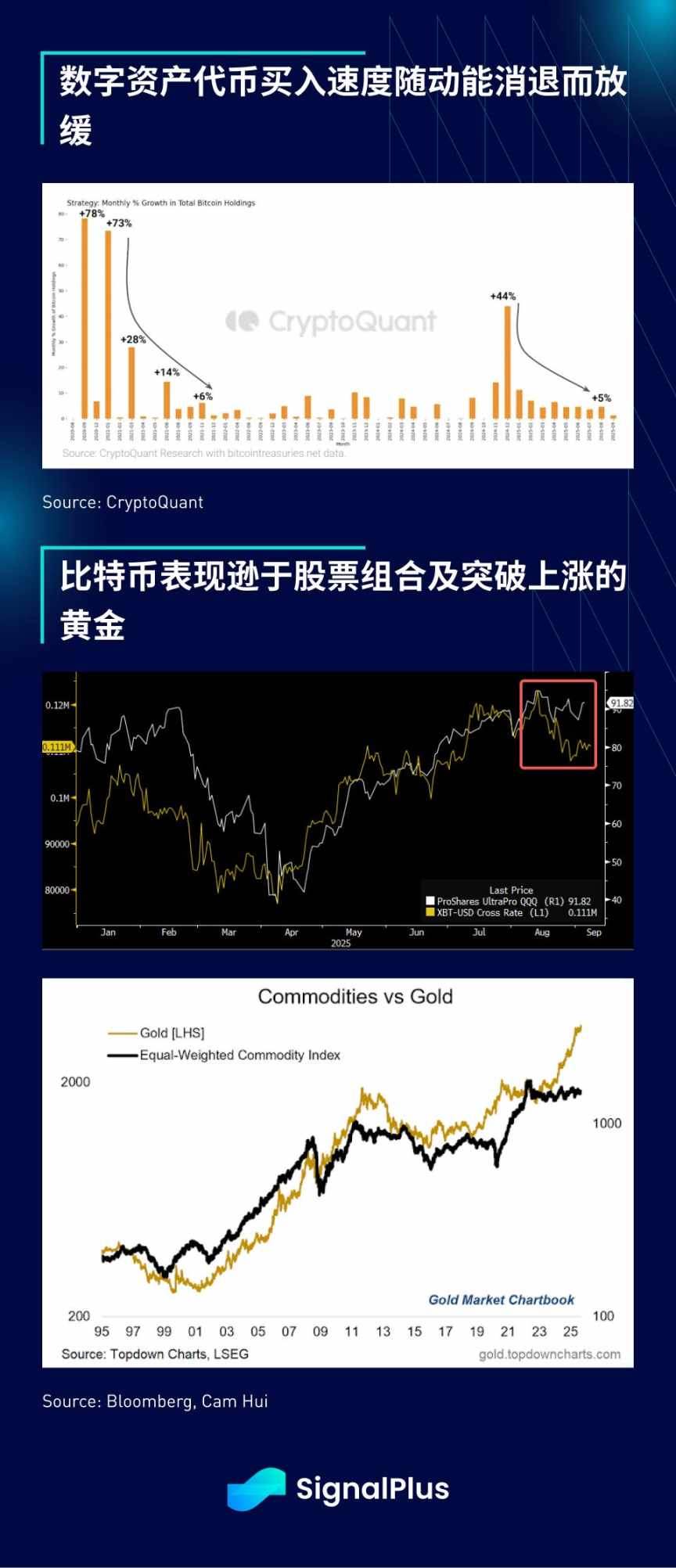

The cryptocurrency market consolidated sideways overall over the past week, but bitcoin significantly underperformed its peers, stocks, and spot gold. Net buying momentum has weakened: Token purchase volumes for digital assets have shrunk sharply, and reports from centralized exchanges show low willingness for new capital inflows, with investors preferring to hold and wait. The short-term outlook is more challenging, and a defensive strategy is recommended to cope with the seasonal volatility of risk assets. In addition, be alert to risks related to digital asset tokens: as net asset value premiums continue to narrow, concerns about negative convexity may intensify during the downturn.

Wishing you successful trading!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Citadel Urges SEC to Regulate DeFi Platforms Trading Tokenized Stocks

Cardano (ADA) Reclaims a Key Resistance—Is a Major Rally About to Begin?

Putin Adviser Demands Crypto in Russia’s Trade Data, Calls Bitcoin a “Hidden Export”

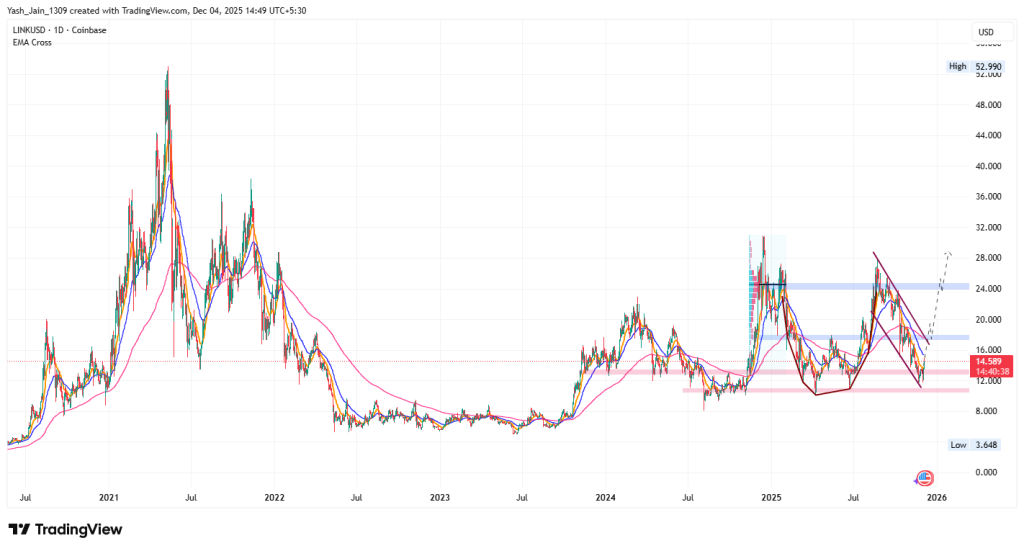

Chainlink Price Prediction 2025, 2026 – 2030: Will LINK Price Reach $100?