Dogecoin price is consolidating near $0.22 with short-term breakout signals pointing to $0.30–$0.32 and a long-term Fibonacci-based target of $2.28 if historical cycle patterns repeat. Monitor $0.21–$0.19 support and $0.26–$0.32 resistance for confirmation of momentum.

-

Short-term breakout target: $0.30–$0.32 following accumulation and trendline breakout.

-

Long-term Fibonacci extension puts a theoretical target near $2.28 based on cycle repetition analysis.

-

Support levels: $0.21 and $0.19; resistance zones: $0.26, $0.32 and $0.40.

Dogecoin price analysis: DOGE consolidates at $0.22 with breakout potential; track support/resistance levels and Fibonacci targets for entries — read the outlook and trade plan.

What is the current Dogecoin price outlook?

Dogecoin price is consolidating around $0.22 after breaking short-term resistance, suggesting a potential push to $0.30–$0.32 in the near term. Key support at $0.21 and $0.19 must hold to maintain bullish momentum toward the mid-cycle Fibonacci targets.

How do historical cycles inform DOGE targets?

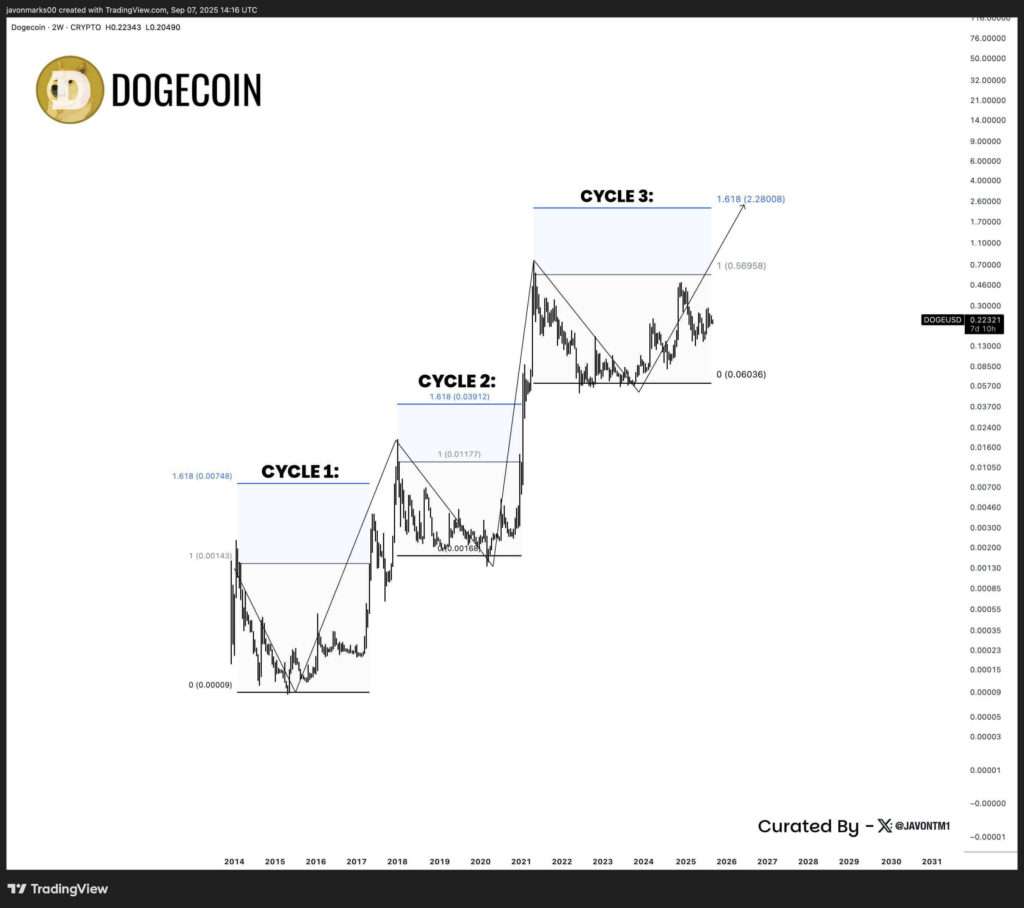

Analysis of prior Dogecoin cycles shows repeated moves beyond the Fibonacci 1 level then toward the 1.618 extension. Cycle 1 and Cycle 2 established templates where DOGE advanced from deep lows to multi-fold gains. Analyst Javon Marks maps the current structure to a potential 1.618 extension near $2.28008, assuming similar market behavior.

Dogecoin consolidates near $0.22 as analysts project a long term $2.28 target, with breakout signals pointing to $0.30 in the short term.

- Analyst Javon Marks sees Dogecoin aiming for $2.28, over 860% higher, if historical cycle patterns repeat.

- DOGE recently broke out of consolidation, with analyst targeting $0.30–$0.32 after sustained accumulation.

- Strong support is near $0.21 and $0.19, while resistance zones appear around $0.26, $0.32, and $0.40.

Dogecoin is trading near $0.2231 after consolidating above recent structural lows, with analysts outlining possible parabolic upside scenarios. Javon Marks cites repeating Fibonacci structures as the basis for a long-term target near $2.28, while short-term observers highlight a breakout that could drive prices to $0.30–$0.32 if momentum continues.

Why do Fibonacci extensions matter to Dogecoin price forecasts?

Fibonacci extensions provide objective levels to measure impulse moves versus prior cycle highs. Dogecoin’s historical behavior—surpassing the Fibonacci 1 point and later pushing to the 1.618 extension—supports using these levels as scenario anchors. This method informs risk-reward and target planning without implying certainty.

How strong is the short-term breakout signal?

Recent price action shows a breakout from converging trendlines after weeks of accumulation. Higher lows near $0.175–$0.180 since mid-July indicate buyer interest. A decisive close above $0.25 would increase the likelihood of testing $0.30–$0.32; failure to hold $0.21 risks a pullback toward $0.19 or lower.

Dogecoin 2-week price chart, Source: Javon Marks on X

What are the immediate technical levels to watch?

Key levels: support at $0.21 and $0.19; immediate resistance at $0.26 and $0.32; stronger supply between $0.36–$0.40. Use these as stop, entry, and scale-out points in risk-managed trade plans.

How should traders interpret the longer-term $2.28 projection?

The $2.28 figure represents a 1.618 Fibonacci extension mapped from the current cycle structure. It is a theoretical target contingent on multiple macro and market-cycle factors aligning. Treat it as a scenario, not a guaranteed outcome, and size positions accordingly.

DOGE/USDT 12-hour price chart, Source: World of Charts on X

Frequently Asked Questions

What is the short-term target for Dogecoin?

Short-term target is $0.30–$0.32 following a trendline breakout and accumulation; confirmation requires a sustained move above $0.25 and increasing volume.

How reliable is the $2.28 Fibonacci target?

The $2.28 target is a Fibonacci 1.618 extension based on historical cycle repetition. It is a theoretical long-term scenario and should be used with risk management, not as a certainty.

Key Takeaways

- Breakout potential: Short-term momentum targets $0.30–$0.32 if $0.25 is reclaimed.

- Cycle-based target: Fibonacci analysis yields a long-term scenario near $2.28, contingent on repeating prior cycles.

- Risk levels: Maintain stops near $0.21 and consider deeper support at $0.19; monitor resistance bands for scale-out.

Conclusion

Dogecoin price is in a consolidation phase with a confirmed short-term breakout that could push DOGE toward $0.30–$0.32. Long-term Fibonacci scenarios place a theoretical extension near $2.28, but traders should prioritize structural support at $0.21–$0.19 and manage risk. Watch for confirmed closes above $0.25 as a momentum signal; review positions accordingly and follow updates from COINOTAG for ongoing coverage.