Giants compete for the distribution rights of Hyperliquid stablecoin USDH—who will claim the tens of billions in ecosystem revenue?

Original: Odaily (@OdailyChina)

Author: Wenser (@wenser 2010)

Original Title: Hyperliquid Stablecoin USDH Becomes the "Industry Darling," Giants Launch Battle for Distribution Rights

Benefiting from the pre-market, launch, and overall market volatility of XPL and WLFI, Hyperliquid achieved $106 million in revenue in August, a 23% month-on-month increase; the monthly contract trading volume approached $400 billion, with a DEX Perp market share of about 70%. As the undisputed "cash cow" in the industry today, the official focus on the "high-performance L1 public chain" concept has also brought infinite imagination to Hyperliquid's stablecoin landscape.

On September 5, Hyperliquid officially announced that the protocol-reserved stablecoin code USDH would be released through an on-chain validator voting process, with voting conducted entirely on Hyperliquid L1, similar to the delisting vote process. The selected team must participate in the regular spot deployment gas auction. The official statement said that USDH, as a highly demanded standard code, will be used to build a compliant, Hyperliquid-prioritized native stablecoin. Following the news, major stablecoin issuers quickly presented their own "USDH issuance proposals." In this article, Odaily will briefly analyze the different proposals for Hyperliquid's native stablecoin USDH and the competition among issuers behind them.

USDH Becomes a Battleground for Stablecoin Issuers, Giants Like Paxos and Agora Join the Fray

On September 5, Hyperliquid's official Discord community posted an announcement stating:

1. In the next network upgrade, the spot market structure will be optimized. The taker fees, maker rebates, and user trading volume contributions between two spot quoted assets will be uniformly reduced by 80% to improve liquidity and reduce user friction.

2. The currently protocol-reserved USDH stablecoin code will be released through a transparent on-chain validator voting process. Voting will be conducted entirely on-chain via the ultra-liquid L1, just like the delisting vote process. As USDH is a highly demanded standard token code, validators will vote to select the team most capable of building a natively minted, Hyperliquid-prioritized stablecoin. Teams interested in using the code can submit proposals in the new "usdh forum sub-channel," and should include the user address of the selected validator quorum, which will be used to deploy USDH. Note that approved teams must still participate in the usual spot deployment gas auction. Additionally, the official statement emphasized: "The USDH code is very suitable for a Hyperliquid-prioritized, Hyperliquid-consistent, and compliant USD stablecoin; after the next network upgrade, validators will be able to vote to allow user addresses to purchase the USDH stablecoin code."

3. For context, starting from the testnet, spot quoted assets will become permissionless in the future. Staking requirements and slashing standards will be announced later.

Subsequently, the official account added: "This vote is only for the USDH code. USDH will not receive any special privileges due to its code nature. Hyperliquid's native financial primitives and general programmability constitute a chain uniquely optimized for stablecoin issuance and payments. There will continue to be multiple stablecoins on the Hyperliquid blockchain, with new stablecoin teams joining the Hyperliquid ecosystem. USDH is just one of many stablecoins. As previously mentioned, becoming a quoted asset will become permissionless pending technical implementation."

Regarding timing: Proposals should be posted before 10:00 UTC on September 10; validators should indicate who they will vote for before 10:00 UTC on September 11; validators should vote between 10:00-11:00 UTC on September 14, to allow users time to stake to validators matching their votes.

Voting is based on staking shares. Validators will vote by submitting the address corresponding to the team they support. Foundation validators will vote for the non-foundation team with the most votes, based on validator commitments made on September 11 (weighted by stake as of September 14), effectively abstaining themselves."

Contestants: 3 Major Stablecoin Issuers + 2 Project Teams Showcase Their Strengths

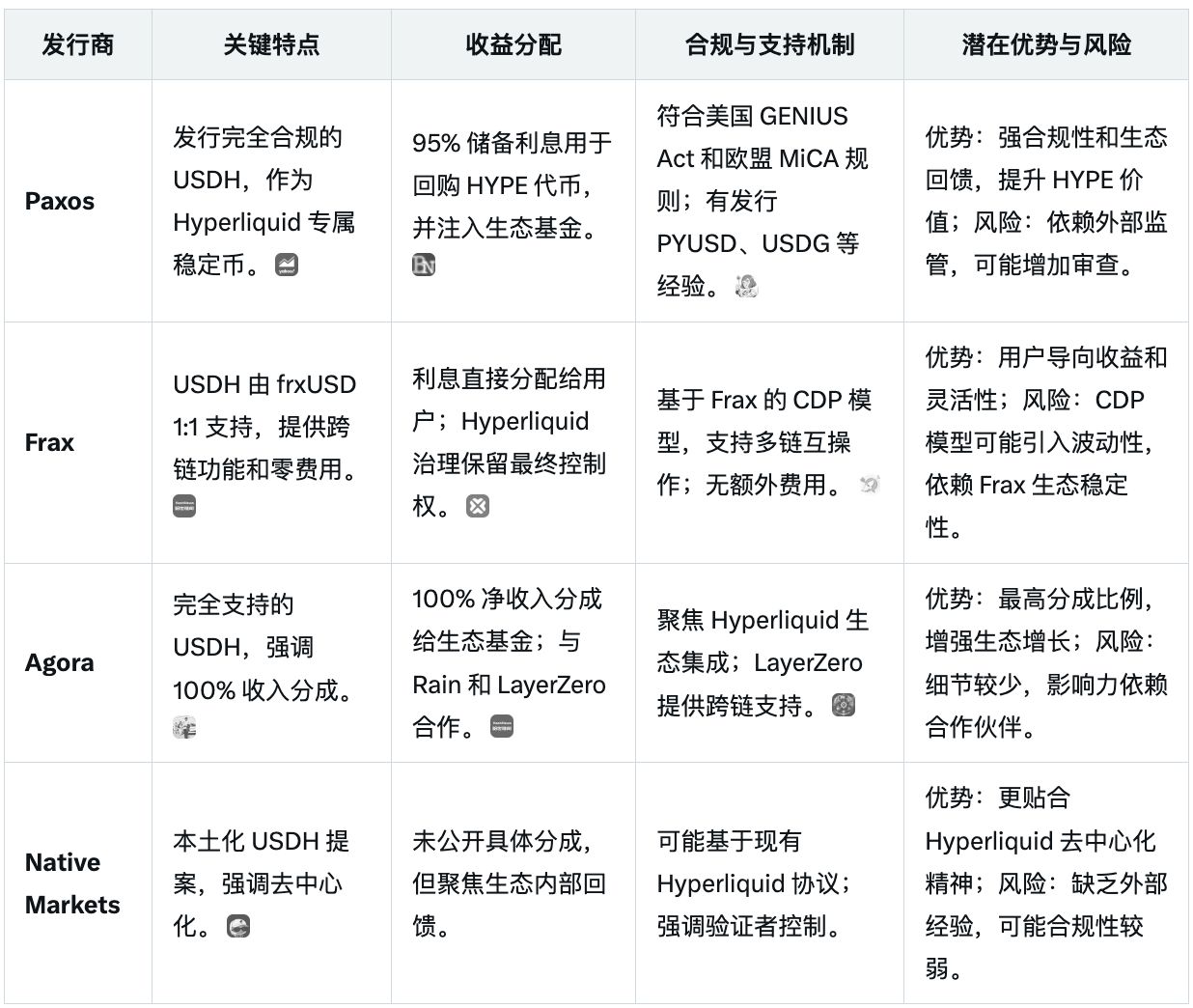

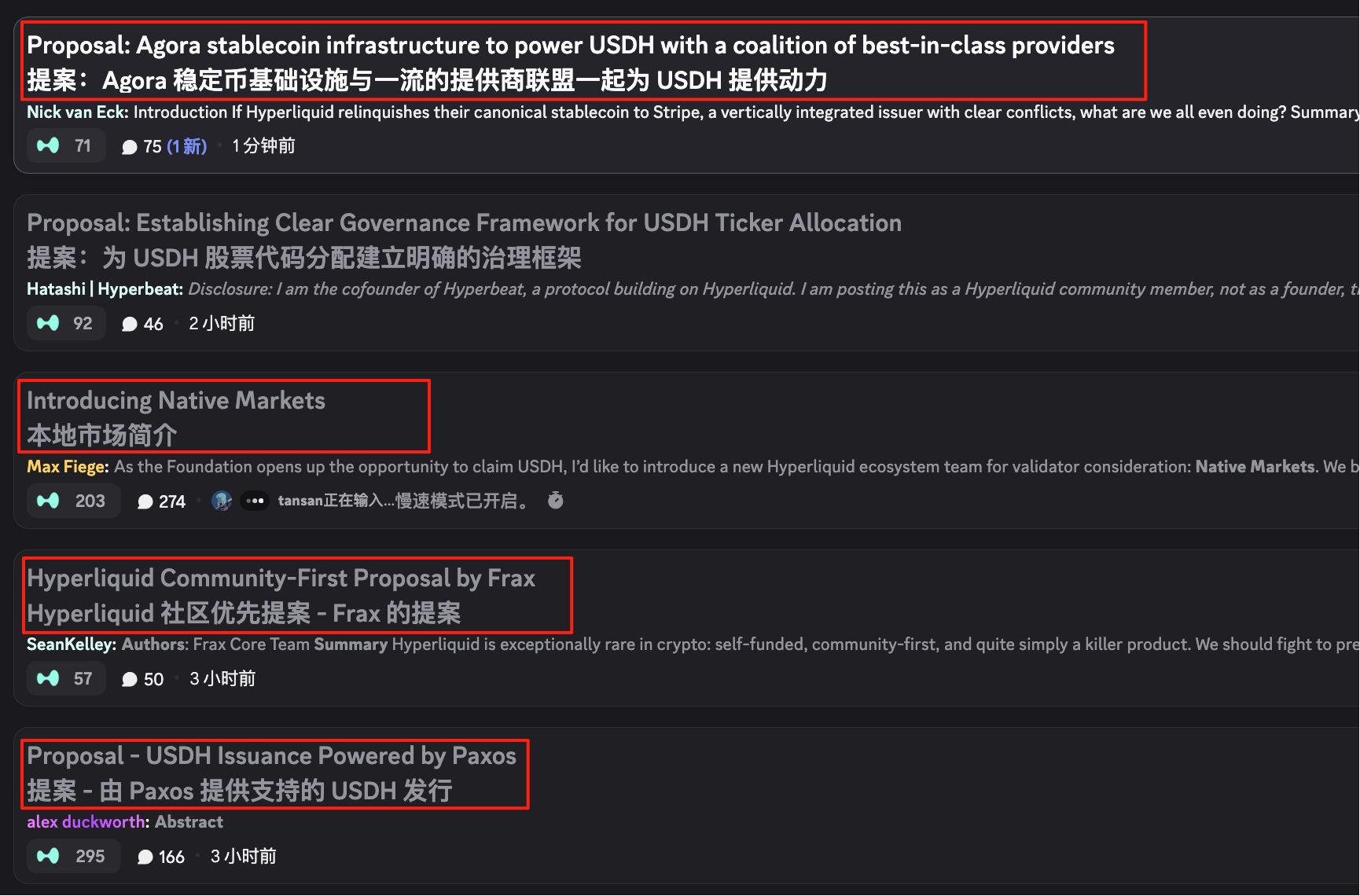

As of now, the Hyperliquid community's USDH sub-channel has received five stablecoin issuance proposals. In addition to well-known issuers like Paxos, Agora, and Frax, Native Markets led by Max Fiege and the Konelia team have also submitted their own USDH issuance plans.

Based on current information, major stablecoin issuers have mature issuance plans and extensive compliance experience, so the ultimate winner is likely to emerge from among them.

In addition, each issuer briefly introduced their own advantages in their proposals—

-

Paxos emphasized its global compliance expertise and strong partnership network. According to Paxos Labs team members, Paxos has already begun establishing partnerships within the Hyperliquid ecosystem in preparation for a successful USDH deployment. Its initial partners include: FalconX, Looping Collective, HyperLend, Pendle, HybraSwap, Hyperswap, Neko, HypurrFi, DotHYPE, RubFi, Nunchi, and others.

-

The Frax team highlighted its shared "decentralization vision" with Hyperliquid, stating: "Frax has designed, shipped, and operated multiple stablecoins at the multi-billion-dollar scale across cycles, with zero security incidents. Our strengths are strict incentive and mechanism design, and a strong track record. We are committed to decentralization and unlocking all potential in the long term, not just for extraction, which is why the collateral yield for USDH will be returned at a 0% acceptance rate."

-

Agora spokesperson Nick van Eck emphasized its backing by asset management giant VanEck and its partnerships with the credit card payment network Rain (with 2 billion users), interoperability infrastructure LayerZero, EtherFi, and other well-known platforms. He also stressed Agora's neutrality as an issuer, taking the opportunity to jab at Paxos, saying: "Agora does not have its own settlement network or brokerage business (unlike Paxos)."

-

Native Markets, led by Max Fiege, emphasized its "localization attribute," planning to "donate a significant portion of its reserve yield to aid funds; USDH will be minted directly on HyperEVM, with HyperCore transfers enabled from day one; USDH will also inherit the global compliance attributes and issuance channels of its issuer Bridge (a Stripe subsidiary)." Thanks to Max's deep involvement and reputation in the Hyperliquid community, this proposal has received considerable support in the comments section.

-

The stablecoin issuance plan proposed by the Konelia team was met with skepticism and even ridicule from community members, as it relies on "automatic compounding yields from short-term US Treasuries" and emphasizes MEV protection, which is currently not a priority in the Hyperliquid ecosystem.

The following are the deployment addresses for the current stablecoin issuer proposals:

Paxos——0x999000B7c80550C5D3858a9C9505dd9A3654B339 ;

Frax——0x6e74053a3798e0fc9a9775f7995316b27f21c4d2;

Agora——0x8010f766AA84bB0Cc57e7C0bf13149cF9BC62b65;

Native Markets——0xc4bb9B6FdA3112B381Cb94f571bc72db541e7577;

Konelia——0x274f2c145B413f76cD3ED52C05221ddAb0E582A1.

Since on-chain voting has not yet started, based on community proposal feedback, the proposals from stablecoin issuers Paxos and Max Fiege have relatively high support.

Hyperliquid community USDH sub-channel page

It is worth noting that Frax has faced criticism from Hyperliquid community members due to its previous collaboration with Luna algorithmic stablecoin UST, although someone later clarified: "The partnership was a 4-token pool on Curve: USDC/USDT/UST/Frax, which were the top four stablecoins in EVM at the time."

Hyperliquid community members question Frax

Mixed Attitudes Among Hyperliquid Ecosystem Projects: Some Cry Unfair, Others Abstain Directly

Regarding the USDH proposal vote, projects within the Hyperliquid ecosystem have expressed different attitudes:

Liquid staking protocol Kinetiq officially announced that from 12:00 noon ET on September 10 to 12:00 noon ET on September 15, all stakes will be redelegated to the Hyperliquid Foundation node, effectively abstaining from this vote.

The Hyperliquid ecosystem's over-collateralized stablecoin project Hyperstable team stated that they had planned since the end of last year to launch a decentralized and over-collateralized stablecoin supported by HYPE, HYPE LST, etc., but at that time all tokens starting with USD were blacklisted, including USDH. The sudden opening of USDH issuance now highlights that many teams (such as Max Fiege) received advance notice, which is extremely unfair. They suggest that the USDH code should remain on the blacklist.

USDH About to Launch, Circle Behind USDC Gets Anxious

The battle for USDH issuance has not officially begun, but Circle, the company behind USDC—the only stablecoin currently in the Hyperliquid ecosystem—has already shown concern. Circle co-founder and CEO Jeremy Allaire stated, "Don't be fooled by the hype. Circle will be a major participant and contributor in the Hyperliquid ecosystem. It's great to see others buying new USD stablecoin codes and joining the competition, but USDC, with its deep liquidity and near-instant cross-chain interoperability, will surely be warmly welcomed by the market."

It is worth mentioning that as early as July, Circle officially announced that native USDC and CCTP V2 would soon be deployed on the Hyperliquid chain. However, more than a month later, native USDC has still not launched, and the emergence of USDH has undoubtedly made Circle feel threatened. CEO Jeremy Allaire's response seems somewhat weak. Amusingly, stablecoin USDe issuer Ethena Labs officially posted on X today, hinting that they had sent a USDH proposal to Circle's CEO but received no response.

Stablecoin Issuers Battle: All for Distribution and Market Share

With the US stablecoin regulatory bill "GENIUS Act" about to be implemented, the stablecoin track is set for another boom, and the emergence of USDH provides a new opportunity for major stablecoin issuers.

For the currently somewhat saturated stablecoin market, Hyperliquid—with hundreds of thousands of high-frequency trading users and monthly trading volumes in the hundreds of billions—will undoubtedly bring significant incremental growth to the stablecoin market. This is why so many issuers are vying for the USDH code deployment rights. BitMEX co-founder Arthur Hayes previously pointed out that the key to stablecoin success lies in distribution channels.

As Frax founder Sam Kazemian said, "For stablecoin issuers and infrastructure companies, the key point of competing to submit Hyperliquid stablecoin USDH issuance proposals is not about revenue sharing. The real value lies in achieving interoperability and deep 1:1 integration with Hyperliquid's massive distribution scenario. In fact, all shortlisted proposals (Frax, Paxos, Agora) have stated their willingness to return 100% of the yield." (Odaily note: Paxos's proposal is to use 95% of the interest generated from USDH reserves to buy back HYPE tokens and distribute them to users, validators, and partner protocols.)

To use a retail analogy, Hyperliquid is like a beverage brand with its own retail channel, while Paxos, Agora, and Frax are like beverage manufacturing OEMs. What they're fighting for now is this massive retail channel network.

For the Hyperliquid community, the main concern remains how the issuance of USDH will serve the development of the Hyperliquid ecosystem, especially the allocation of corresponding income for HYPE token buybacks, and the previous activity of project team members in the Hyperliquid ecosystem and community.

It is worth mentioning that the issuance and application of USDH could bring Hyperliquid up to $220 million in potential annual revenue. According to BitMEX co-founder Arthur Hayes, the stablecoin market is expected to reach $10 trillion by 2028. By then, with the development of the native stablecoin USDH, the price growth of HYPE as the ecosystem token is highly promising.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.