Russian adviser Anton Kobyakov alleges the US may use dollar-backed stablecoins and gold to reduce or devalue its roughly $37.4 trillion national debt by shifting obligations into crypto instruments; the claim is presented as an allegation and lacks public, detailed policy documentation.

-

Allegation: US using stablecoins to devalue debt — reported by a Kremlin adviser.

-

US officials say stablecoin policy aims to preserve dollar dominance and support demand for U.S. debt instruments.

-

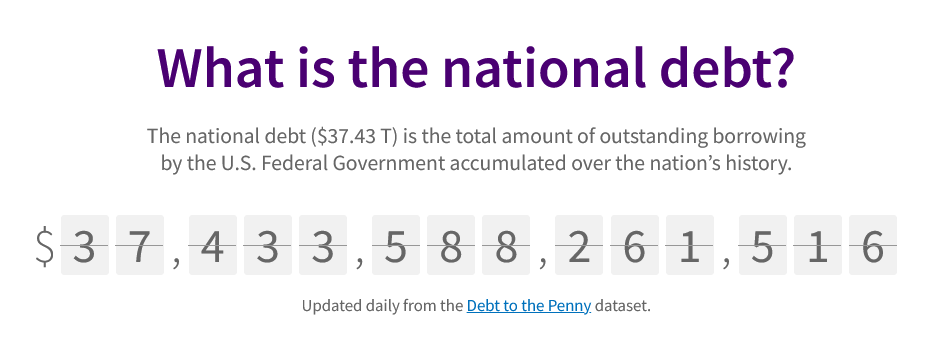

US national debt stands at approximately $37.43 trillion (US Treasury data); stablecoin policy and legislation such as the GENIUS Act are central to the debate.

stablecoins devalue US debt: Russian adviser claims US may use dollar stablecoins and gold to reduce $37.4T debt—read analysis, data, and expert responses.

An adviser to Russian President Vladimir Putin is accusing the Trump administration of using stablecoins and gold to devalue its $37 trillion in outstanding debt.

An adviser to Russian President Vladimir Putin said the US is strategically using crypto and gold to devalue its debt to “urgently address the declining trust in the dollar.”

What did the Russian adviser claim about stablecoins and US debt?

stablecoins devalue US debt is the core phrase used by the adviser Anton Kobyakov, who said Washington could move federal obligations into dollar-backed stablecoins or leverage gold to reduce the real burden of outstanding debt. The claim frames this as a strategic response to declining trust in the dollar, but it is presented as an allegation without detailed policy evidence.

How did Kobyakov describe the proposed mechanism?

Kobyakov suggested shifting debt into US dollar stablecoins and pushing global markets toward crypto and gold as alternatives to the traditional currency system. He compared the approach to historical debt-management shifts in the 1930s and 1970s, but provided no operational details on how tokenization would legally or technically devalue debt.

How could stablecoins theoretically affect U.S. debt valuation?

Any mechanism to move sovereign obligations into stablecoins would require legal changes, market adoption, and custodial arrangements. Below are potential steps often discussed in policy and academic circles, presented as conditional mechanisms rather than confirmed policy actions:

- Issuance or conversion: Government or authorized entities issue dollar-backed tokens representing claims on Treasury assets.

- Redenomination: Existing debt instruments could be exchanged or linked to tokenized instruments under new legislation or accounting rules.

- Market effect: If widely adopted, tokenized instruments could change liquidity dynamics or price discovery for US debt, affecting yields and valuation.

These steps are hypothetical frameworks frequently referenced in expert commentary; they do not constitute documented US policy implementing debt redenomination via stablecoins.

Why are U.S. officials supportive of stablecoin frameworks?

US officials have publicly framed stablecoin policy as a tool to preserve the dollar’s global role and enhance payment innovation. US Treasury commentary and congressional debate—alongside legislation—emphasize maintaining dollar dominance, regulatory clarity, and market stability.

Officials and former lawmakers have argued stablecoins could boost demand for U.S. public debt by providing dollar-backed private money instruments that interact with Treasury markets.

When did Washington make legislative moves on stablecoins?

Recent legislative activity has advanced stablecoin frameworks. The Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) was signed into law in July, marking a notable milestone in formalizing a US regulatory approach to dollar-backed tokens. Discussion of proposals such as Senator Cynthia Lummis’ Bitcoin Act has also entered the public record as part of wider crypto policy debate.

Does Russia have its own stablecoin plans?

Russian outlets have reported development of a ruble-backed stablecoin, named A7A5, planned for deployment on Tron, intended to reduce reliance on US-dollar stablecoins used in commodity settlement. Russia’s policy toward crypto has shifted from broad bans to conditional openings for financial institutions and accredited investors.

US national debt. Source: US Treasury

US national debt. Source: US Treasury

Frequently Asked Questions

Can stablecoins legally change how national debt is recorded?

Not without new legislation and accounting standards. Converting sovereign obligations into tokenized assets would require congressional authorization, changes to redemption and settlement frameworks, and coordination with regulators and market infrastructure providers.

Are there examples of governments using gold or currency redenomination to reduce debt?

Historically, countries have used currency reforms and gold-standard adjustments to manage liabilities. Those moves typically involved legal and economic restructuring, not straightforward debt “write-offs.” Experts caution against direct parallels with modern tokenization without substantial legal frameworks.

What is the current size of U.S. national debt?

US national debt is approximately $37.43 trillion, per US Treasury data; this figure has grown markedly since the early 1980s and is central to debates over fiscal and monetary strategy.

Key Takeaways

- Allegation vs. evidence: The Russian adviser alleged a plan but provided no operational proof.

- Policy context: US legislative and regulatory moves — including the GENIUS Act — prioritize dollar stability and market clarity.

- Technical hurdles: Tokenizing sovereign debt would require major legal, accounting, and infrastructure changes.

Conclusion

The claim that the US will use stablecoins and gold to devalue its $37.4 trillion debt is an assertion reported from a Kremlin adviser and framed as strategic rhetoric. Policymakers in Washington emphasize regulatory frameworks to preserve the dollar and enable innovation. Close monitoring of legislation and official guidance is required to separate allegation from enacted policy.