Lion Group Shifts $5M in Solana and Sui Holdings Into Hyperliquid’s HYPE

Contents

Toggle- Quick Breakdown

- Lion Group Moves to Accumulate HYPE

- Bet on Institutional Custody and DeFi Growth

- $600M Crypto Treasury Backing the Move

- Stock Market Reaction

Quick Breakdown

- Lion Group reallocates $5M in SOL and SUI into HYPE to strengthen its crypto treasury.

- BitGo’s new custody solution adds institutional backing to HYPE’s growing adoption.

- Stock price surges over 20%, reflecting investor confidence in the move.

Singapore-based Nasdaq-listed Lion Group Holding is reallocating its crypto reserves into Hyperliquid’s HYPE token, marking a strategic bet on decentralized finance.

Lion Group Moves to Accumulate HYPE

Lion Group Holding revealed on Monday that it will gradually convert its Solana (SOL) and Sui (SUI) holdings into Hyperliquid’s HYPE token. The firm said it would take a phased approach, leveraging market volatility to acquire HYPE at favorable entry points.

CEO Wilson Wang described the transition as a “disciplined accumulation process” aimed at boosting portfolio efficiency and positioning the company for “sustained growth.”

Bet on Institutional Custody and DeFi Growth

The company’s shift aligns with the launch of institutional custody services for HYPE in the U.S. by crypto custodian BitGo. Wang noted that Hyperliquid’s on-chain order book and advanced trading infrastructure represent “the most compelling opportunity in decentralized finance.”

HYPE’s strong momentum reinforces that conviction on Monday, the token hit a fresh all-time high of $51.84, according to CoinGecko.

Source:

CoinGhecko

Source:

CoinGhecko

$600M Crypto Treasury Backing the Move

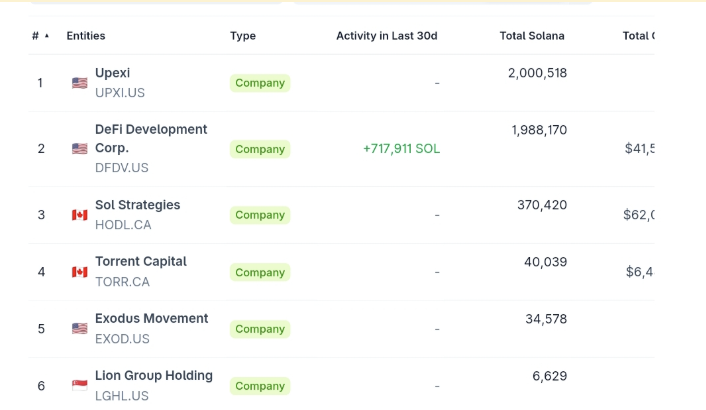

Lion Group previously secured a $600 million facility from ATW Partners in June to build its crypto treasury, with HYPE, SOL, and SUI identified as core assets. The company holds around 6,629 SOL (worth $1.4M) and over 1M SUI tokens (worth $3.5M). A full divestment into HYPE at current prices could net the firm more than 96,000 tokens, adding to its existing stash of over 128,000 HYPE.

Other corporates are also piling into Hyperliquid. Hyperliquid Strategies, formerly Sonnet BioTherapeutics, announced plans to acquire 12.6M HYPE in July, while U.S.-based Hyperion DeFi has already accumulated more than 1.5M tokens.

Stock Market Reaction

News of the strategic pivot triggered a sharp rally in Lion Group’s stock. Shares closed Monday’s session up 11% and extended gains by another 10% in after-hours trading, reaching $1.65 according to GoogleFinance data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne

Arthur Hayes Warns Monad Could Face Sharp Downturn as Debate Grows Over High-FDV Tokens

After 18 Days of Anxiety, The Crypto Market Sends a First Reassuring Signal