Bitcoin, Ethereum slips amid US payrolls report

Crypto markets pulled back after the US Labor Department revised payroll figures down by 911,000 jobs for the year ending March 2025. This is recorded as the largest annual adjustment in history, surpassing the 2009 financial crisis.

Bitcoin price dropped back to $111K zone after trading above $113k in the evening. Ethereum also took a hit as the cumulative crypto market cap dropped below $3.9 trillion. Ether has been a dominant force among the top 10 cryptos lately. However, it remained to trade under increased selling pressure. Coinglass data shows that more than 169K traders got liquidated over the last 24 hours. The total liquidations (both long and short bets) breached the $342 million mark.

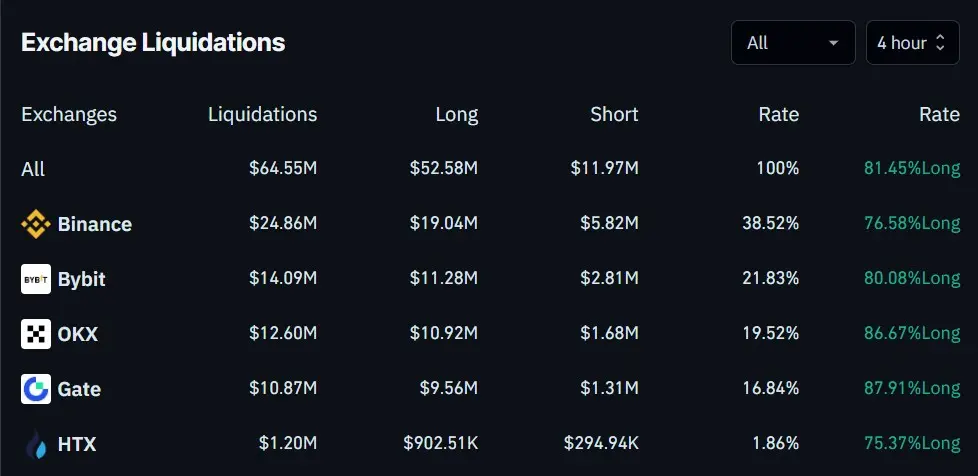

The last 24 hours saw more than $64 million worth of long and short positions being liquidated. Around $52 million worth of liquidated positions (81%) turned out to be long bets. This suggests that traders were hoping the crypto market would recover, but the jobs data pulled it down.

The market also saw several top cryptos decouple from the BTC price momentum. Solana and Dogecoin remained marginally up. Ethena price jumped by 8% over the last 24 hours to trade around $0.82. It is running up by 21% in the past 7 days. Hyperliquida price spiked 6% in the same time, maintaining its bullish rally.

Fed rate cut bets surge

The adjustment shows the labor market was significantly weaker than previously suggested by the government’s monthly nonfarm payrolls reports. According to the Kobeissi Letter, the sharpest losses were concentrated in consumer-facing sectors. This includes 176,000 jobs down in Leisure and Hospitality, and 226,000 jobs in Trade, Transportation, and Utilities. Private hiring alone was overstated by 880,000 jobs. This is a scale of weakness not seen outside the Great Depression and the 2020 pandemic shock.

Last month, May and June payrolls were cut by 258,000, with another 27,000 subtracted this week. This marks the largest two-month net revision outside of 2020. Excluding healthcare, the U.S. economy has lost more than 142,000 jobs over the past four months.

This now marks the largest revision in history, even above 2009 levels.

In 2009, the US revised -902,000 jobs out of 12 months of already reported data.

We are now seeing revisions that are larger than the largest financial crisis outside of the US Great Depression. pic.twitter.com/rLPYTtCl7H

— The Kobeissi Letter (@KobeissiLetter) September 9, 2025

The report highlights that a 25 basis point cut is expected by the Federal Reserve at its meeting next week. If it happens, then this would mark the first Fed rate cut in over 30 years with PCE inflation at or above 2.9%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Faces Vitalik Buterin’s Challenge: What Lies Ahead?

In Brief Vitalik Buterin warns Zcash against token-based governance. Zcash community is divided over future governance approach. ZEC Coin struggles with market negativity and volatile price movements.

70M$ inflows this week: Bitcoin ETFs rise again

BlackRock Downplays IBIT Outflows as Bitcoin ETF Market Shows Signs of Recovery