Research Report | Avantisfi Project Overview & AVNT Market Valuation Analysis

1. Project Introduction

AvantisFi is an innovative platform focused on decentralized finance (DeFi), aiming to build the “universal leverage layer for global assets.” Through blockchain technology, AvantisFi brings real-world assets (RWA) on-chain, promoting the implementation of transparent and efficient financial infrastructure. The platform has achieved over $7.5 billion in assets under management, with cumulative trading volume surpassing $10 billion, and has raised $12 million in funding. Its core strengths lie in supporting cross-asset leveraged trading—including cryptocurrencies, forex, commodities, and more—with leverage up to 500x and a zero-fee model, combined with loss rebate and positive slippage mechanisms to protect traders. The platform also supports permissionless creation of synthetic markets, showcasing full decentralization.

From a technical perspective, AvantisFi is deployed on Base (an Ethereum Layer 2 solution), integrating Chainlink and Pyth oracles to ensure high availability and accuracy for price data. The platform adopts a modular architecture to optimize on-chain settlement and liquidity, and supports LayerZero cross-chain capabilities, significantly improving multi-chain interoperability.

In terms of tokenomics, the native token $AVNT is primarily used for protocol governance and as an incentive for liquidity providers and traders. Specific details of token allocation and supply are yet to be officially disclosed.

In summary, based on its innovative leverage trading mechanism and RWA on-chain model, AvantisFi features flexible and efficient technological architecture as well as scalability, and is committed to becoming a core infrastructure connecting traditional finance and Web3.

2. Project Highlights

1)Universal Leverage Trading Layer Covering Diverse Asset Classes

AvantisFi aims to build a universal leveraged trading layer in DeFi, bringing the multi-trillion-dollar real-world asset market onto the blockchain. The platform supports not only mainstream cryptocurrency trading but also gold, forex, oil, stocks, and other real assets, as well as non-traditional categories like sports. It currently supports perpetual trading of over 22 assets, with open interest reaching $25 million. By bridging on-chain and off-chain assets, AvantisFi offers users 24/7 permissionless on-chain trading, demonstrating outstanding asset expansion capabilities and market potential.

2)High Leverage and Zero Fee Mechanism to Boost Capital Efficiency**

The platform offers up to 500x leveraged perpetual contracts, greatly enhancing capital efficiency, reducing trading costs, and increasing yield potential. It adopts a zero-fee trading model and incorporates robust risk management and loss protection mechanisms for liquidity providers, ensuring a balance of interests between traders and providers. This efficient capital operation model gives AvantisFi a strong competitive edge in the DeFi leverage trading market.

3)Technological Innovation, On-Chain Low-Latency Experience**

AvantisFi’s mainnet Beta is deployed on the Base chain, leveraging its low cost and high scalability to support large-scale user participation and high-speed trading. By integrating the Base chain’s Flashblocks technology, it delivers a low-latency trading experience akin to that of centralized exchanges, while maintaining the transparency of on-chain operations—a solid foundation for on-chain real asset trading.

4)Community-Driven and Sustainable Development

Since the testnet launch in November 2023, AvantisFi has attracted more than 52,000 unique traders, with cumulative trading volume of $5.4 billion, reflecting strong user base and market appeal. With multi-quarter $AVNT XP campaigns, airdrop programs, and leaderboard incentives in collaboration with Wallchain, the platform continuously boosts community engagement. The $8 million Series A round completed in June 2025, led by Pantera Capital and Founders Fund, provides robust support for the project’s long-term development.

3. Valuation Expectation

As an essential hub for DeFi leverage trading infrastructure, AvantisFi is receiving significant market attention for its support of perpetual contracts for both crypto and real-world assets (RWA). Its unique zero-fee perpetual contract mechanism (ZFP) and high leverage have driven cumulative trading volume to over $12 billion since its launch in February 2024. The project is backed by top institutions including Pantera and Coinbase, and has become the largest decentralized exchange (DEX) by trading volume on the Base chain.

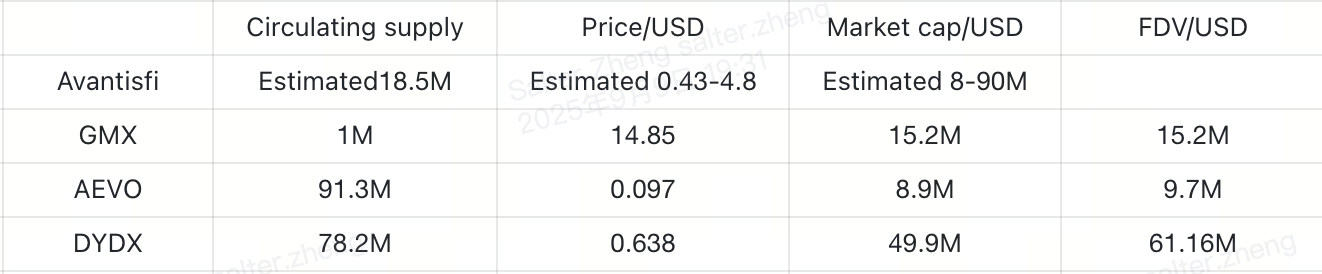

With the token generation event (TGE) approaching, the market expects its fully diluted valuation (FDV) to be in the $100–$150 million range, with the initial token price estimated at $0.10–$0.15. As the narrative of DeFi leverage trading continues to gain traction, AvantisFi is poised to become the key bridge between crypto and traditional financial markets, offering significant potential for future market cap growth.

Value Comparison:

4. Tokenomics

Total Supply

Total supply is 1 billion tokens. The initial circulation is expected to be 18.5M, accounting for 18.5% of the total supply.

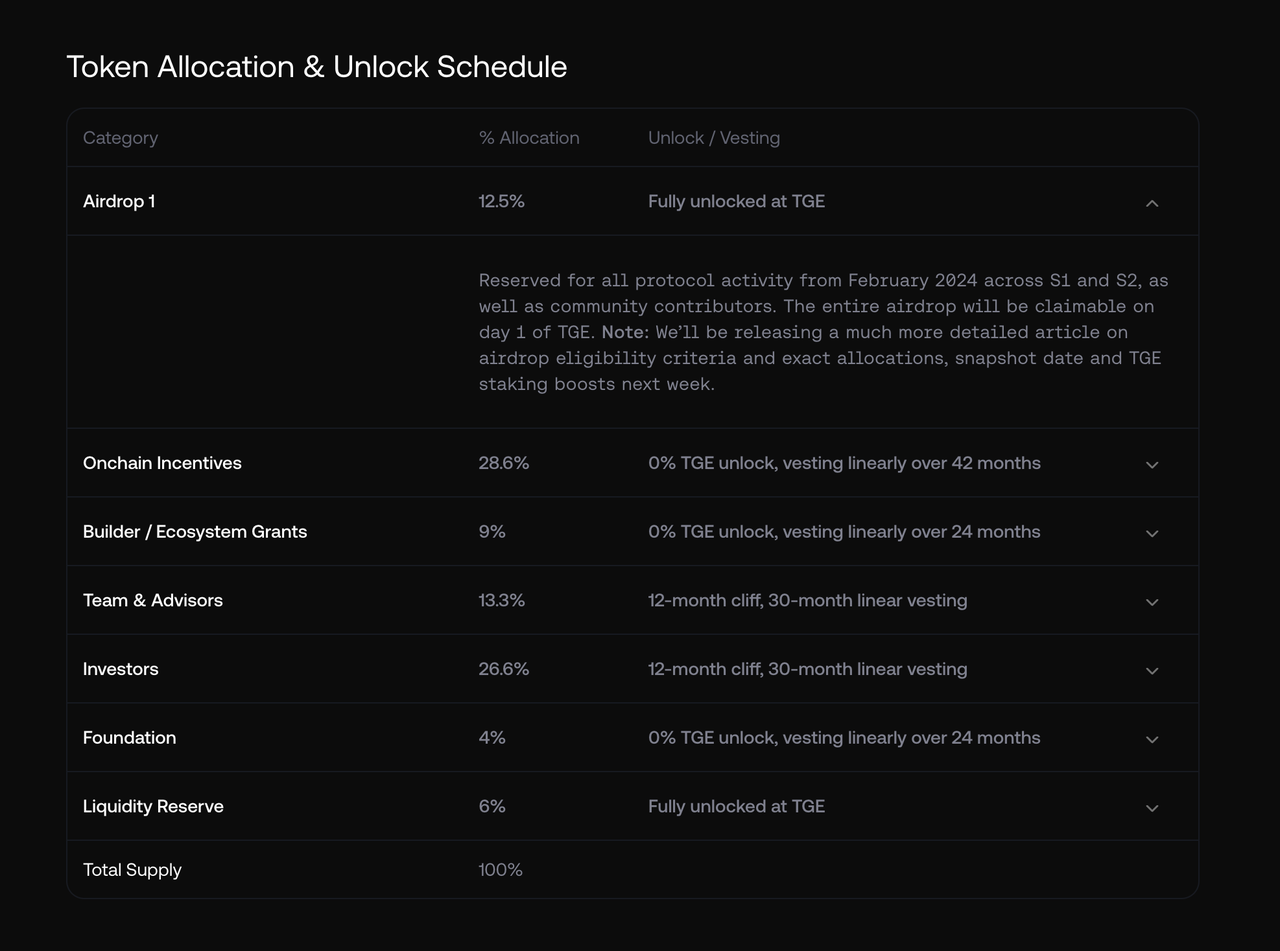

Allocation Structure

- Initial Airdrop: 12.5%, fully unlocked at TGE;

- On-Chain Incentives: 28.6%, 0% at TGE, linear vesting over 42 months;

- Builders and Ecosystem Grants: 9%, 0% at TGE, linear vesting over 24 months;

- Team and Advisors: 13.3%, vesting starts 12 months after TGE, linear vesting over 30 months;、

- Investors: 26.6%, vesting starts 12 months after TGE, linear vesting over 30 months;

- Foundation: 4%, 0% at TGE, linear vesting over 24 months;

- Liquidity Reserve: 6%, fully unlocked at TGE.

Token Utilities

- Governance Vote:** Token holders can participate in protocol governance and decide on project direction and parameter adjustments.

- Staking Rewards:** Users can stake tokens to earn rewards, improving network security and token demand.

- Liquidity Provision:** Tokens can be used in liquidity pools to earn fees and enhance ecosystem trading activity.

- In-Ecosystem Payments:** Serve as the payment instrument for platform service fees and trading costs.

- Incentive Mechanism:** Tokens are distributed as mining or task rewards to encourage community activity and ecosystem expansion.

5. Team and Fundraising Information

Team

The AvantisFi team comprises experienced crypto natives, with core members having over 20 years of combined backgrounds in engineering, investment banking, consulting, venture capital, and product design, focusing on building DeFi leverage trading infrastructure.

AvantisFi was co-founded in February 2023 by **Harsehaj Singh** and **Brank**. Harsehaj Singh serves as founder and CEO (Avantis, core contribution by Lumena Labs); he was previously an investment banking analyst at Lazard, focusing on M&A, later became an economic designer at Illuvium (leading the design of a $50 million land sale), and also served as an investment associate at Pantera Capital overseeing Web3, gaming, and DeFi infrastructure investments, participating in more than 14 seed and Series A deals.

Currently, team members' backgrounds span investment banking, hedge fund trading, management consulting, venture capital, crypto-native product design, and DeFi engineering, combining experience in both traditional finance and blockchain. With ongoing fundraising and ecosystem partnerships, the team has become internationally oriented with New York as a core hub, capable of leveraging traditional finance resources and building strong ties with crypto developers and institutions to support the construction of a global, multi-asset leveraged trading infrastructure.

Fundraising

The project has raised a total of $12 million, including:

Seed Round: Raised $4 million on September 26, 2023, with investors including Base Ecosystem Fund, Pantera Capital, Founders Fund, Salt Fund, Symbolic Capital, Flowdesk, and other top institutions;

Series A: Raised $8 million in June 2025, co-led by Pantera Capital and Founders Fund, with other participants such as Symbolic Capital.

The Base Ecosystem Fund, operated by Coinbase, gives AvantisFi the opportunity to obtain support from Coinbase and the Base chain ecosystem.

6. Potential Risks

1)High Leverage and Market Volatility Risks

Supporting leverage up to 500x is attractive, but during periods of sharp market volatility, it is prone to large-scale liquidations, especially for highly volatile assets, making these risks particularly acute.

Additionally, the platform is highly dependent on oracle-provided real-time and accurate price data. In the event of oracle failure or delay, liquidation risks could be exacerbated and user fund security affected.

2)Sell Pressure Risk

- The initial token TGE has a release ratio of 18.5%; there is potential sell pressure after the airdrop.

- Risk of sell pressure as investors and team tokens are linearly released monthly.

- Sell pressure risk from the team and foundation portions.

- The on-chain incentive portion, accounting for 28.6%, may potentially see sell pressure from recipients upon unlocking.

7. Official Links

* Website: https://www.avantisfi.com

* Twitter: https://x.com/avantisfi

* Discord: None

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Crypto Market Watch (11.10-11.17): Extreme Market Panic, Privacy Sector Stands Out

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.

Multiple grand rewards are coming, TRON ecosystem Thanksgiving feast begins

Five major projects within the TRON ecosystem will jointly launch a Thanksgiving event, offering a feast of both rewards and experiences to the community through trading competitions, community support activities, and staking rewards.

Yala Faces Turmoil as Stability Falters Dramatically

In Brief Yala experienced a dramatic 52.9% decline, challenging its stability. Liquidity management emerged as a critical vulnerability in stablecoins. Investor skepticism deepened despite major fund support.