Bitget Daily Digest(September 12)|First US Spot XRP ETF Launches Today; Grayscale Applies to Convert Multi-Asset Trusts to ETFs; BTC Longs Face Increasing High Leverage Risk

Bitget2025/09/12 03:00

By:Bitget

Today's Preview

1. Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 08:00 (UTC+8 )on September 13, 2025, accounting for 3.13% of the current circulating supply, with an estimated value of $56 million.

2. The REX-Osprey Spot XRP ETF will be launched on September 12, 2025, becoming the first spot XRP exchange-traded fund in the United States.

3. ETHTokyo 2025 will take place in Tokyo, Japan from September 12 to September 15, 2025, focusing on Ethereum and Web3 hackathons and conferences.

Macro & Hot Topics

1.Grayscale has applied to the US SEC to convert its closed-end trusts for BCH, HBAR, and LTC into ETFs.

2.US Secretary of Commerce Luttig stated that cryptocurrencies need a regulatory framework to thrive.

3.There are frequent updates in global regulatory policies and continuous innovation in ETF products, creating positive expectations for mainstream crypto asset trading and compliance environments.

4.Web3 and crypto technologies continue to receive investments from traditional finance and major enterprises in regions such as Japan and the United States.

Market Updates

1.BTC/ETH have been trading sideways over the past four hours, with neutral market sentiment. In the past 24 hours, total liquidations across the network reached approximately

$11 million, with both long and short positions affected.

2.All three major US stock indexes closed higher on Thursday: the Dow Jones surged

1.36% and surpassed the

46,000 mark for the first time, the Nasdaq rose

0.72%, and the S&P 500 increased by

0.85%, all setting new record highs. Global market optimism is notable.

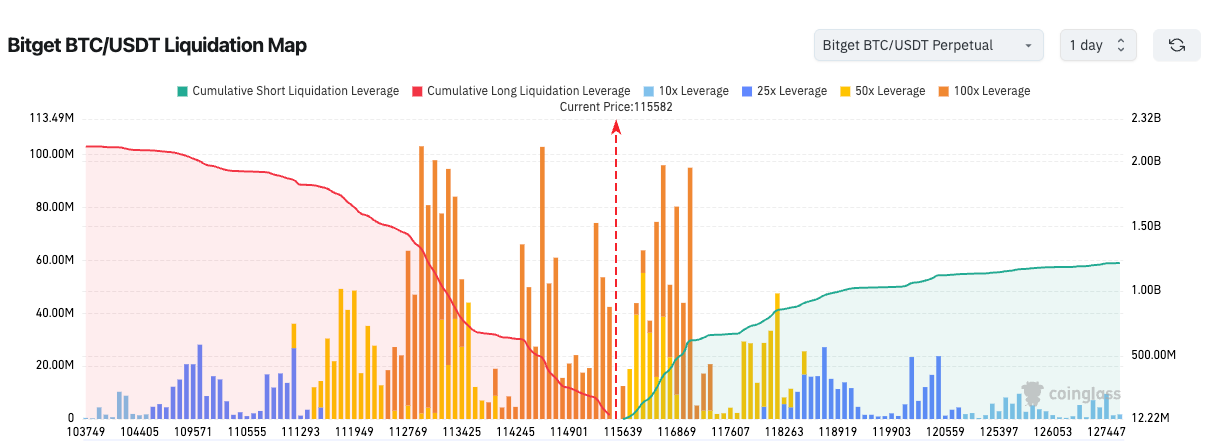

3.According to the Bitget BTC/USDT liquidation map, the current price is

115,588, with a concentration of high-leverage long liquidations nearby. Short-term long positions face elevated risks, and a drop below this range may trigger larger-scale liquidations.

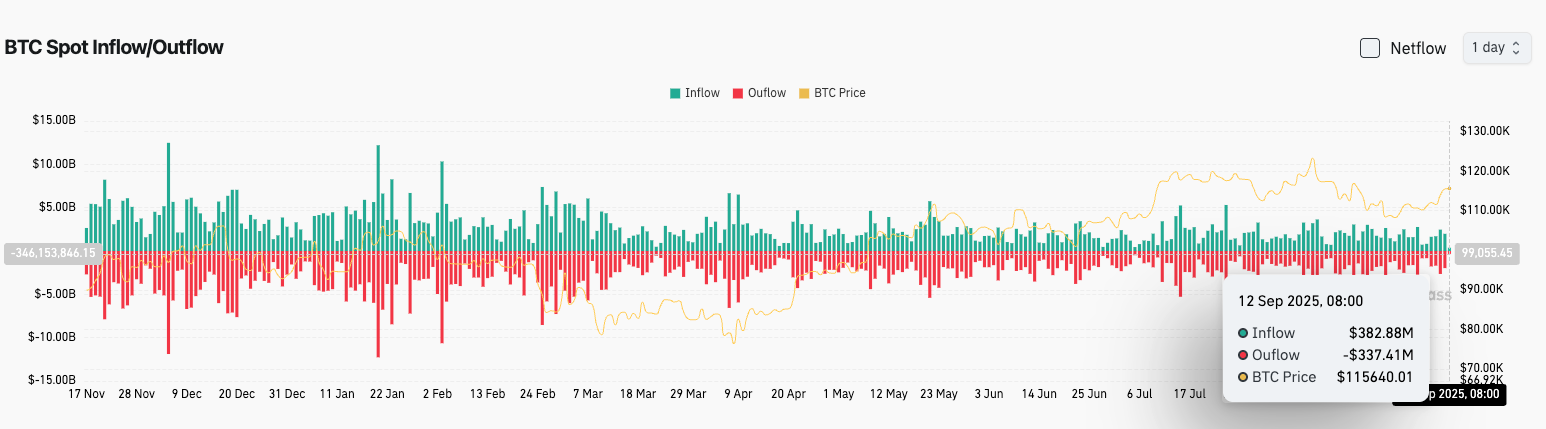

4.In the past 24 hours, BTC spot inflows reached

$381 million, outflows were

$337 million, resulting in a net inflow of

$44 million.

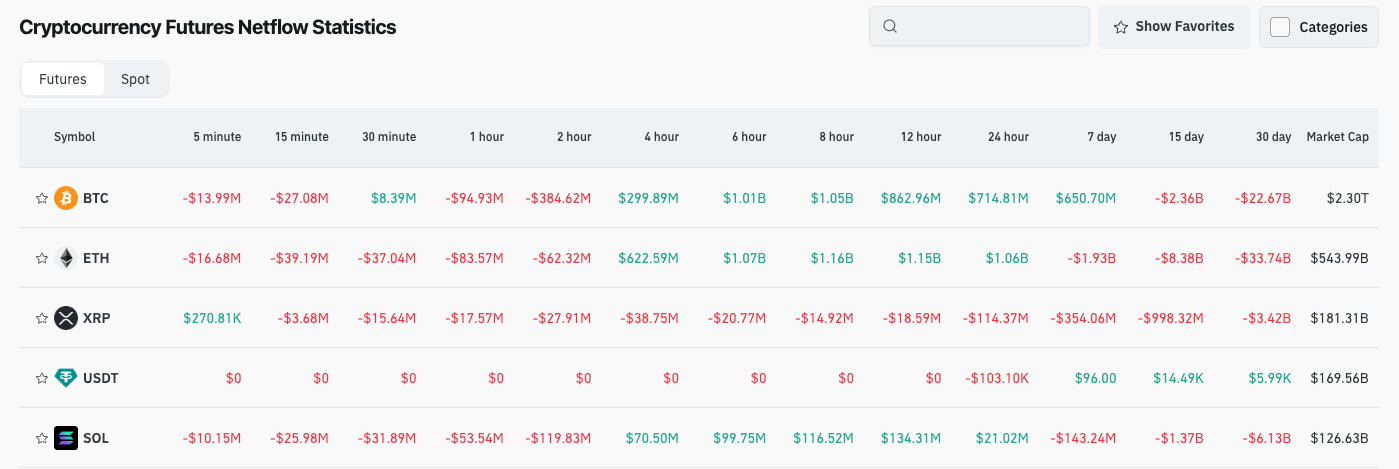

5.Over the past 24 hours, contract trading net outflows were led by BTC, ETH, XRP

, and SOL, indicating potential trading opportunities.

News Updates

- Grayscale has applied to convert its closed-end BCH, HBAR, and LTC trusts into ETFs, actively expanding its ETF offerings for major cryptocurrencies.

- The U.S. Secretary of Commerce stated that a regulatory framework for cryptocurrencies is necessary to promote their healthy development, signaling an accelerated compliance process.

- On its first day of trading, Figure, known as the “first RWA stock,” soared over 24% on its successful debut on the Nasdaq.

Project Developments

1.Starknet: BTC staking functionality will go live on the mainnet on September 30.

2.Polygon: The foundation has completed a hard fork to implement transaction finality upgrades.

3.Solana: Ecosystem total TVL has risen to

$12.2 billion, reaching a new all-time high.

4.Linea: A total of

9.36 billion LINEA tokens are available for airdrop, with a 90-day claim period.

5.MOGU Street: The board has approved up to

$20 million investment in cryptocurrencies.

6.BONK: Safety Shot has established BONK Holdings and acquired

228.9 billion BONK tokens.

7.dYdX: Will soon launch on-chain trading features based on Telegram.

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

12

4

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Cointribune•2025/11/30 11:03

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Cointribune•2025/11/30 11:03

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

Coinpedia•2025/11/30 03:39

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$91,298.46

+0.74%

Ethereum

ETH

$3,010.08

+0.46%

Tether USDt

USDT

$1

-0.01%

XRP

XRP

$2.19

-0.88%

BNB

BNB

$879.82

+0.22%

Solana

SOL

$136.94

-0.16%

USDC

USDC

$1

+0.01%

TRON

TRX

$0.2813

+0.03%

Dogecoin

DOGE

$0.1494

-0.12%

Cardano

ADA

$0.4191

+0.17%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now