Grayscale Insights: When Fiat Credibility Falters, How Can Crypto Assets Become a Powerful Macro Hedge?

The article discusses the credibility crisis of fiat currencies and the potential of cryptocurrencies as an alternative store of value. It analyzes the impact of the U.S. debt problem on the credibility of the U.S. dollar and explores the transformative role of blockchain technology. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Key Points

- For fiat currencies, credibility is crucial. Today, due to high public debt, rising bond yields, and uncontrollable deficit spending, the U.S. government's commitment to ensuring low inflation may no longer be fully credible. In our view, strategies for managing the national debt burden are increasingly likely to involve at least moderately high inflation. If holders of U.S. Dollar-denominated assets begin to believe this, they may seek alternative stores of value.

- Cryptocurrencies like Bitcoin and Ethereum have the potential to serve this purpose. They are alternative monetary assets based on innovative technology. As stores of value, their most important characteristics are programmatic and transparent supply, as well as autonomy independent of any individual or institution. Like physical gold, their utility partly derives from their immutable and apolitical nature.

- As long as public debt continues to grow uncontrollably, governments cannot credibly commit to maintaining low inflation, and investors may question the viability of fiat currencies as stores of value. In this environment, macro demand for crypto assets may continue to rise. However, if policymakers take steps to bolster long-term confidence in fiat currencies, macro demand for crypto assets may decline.

Investing in the crypto asset class means investing in blockchain technology: networks of computers running open-source software to maintain public transaction databases. This technology is changing the way valuable items—money and assets—move across the internet. Grayscale believes that blockchain will revolutionize digital commerce and have broad impacts on our payment systems and capital markets infrastructure.

But the value of this technology—the utility it provides to users—goes beyond just improving the efficiency of financial intermediaries. Bitcoin and Ethereum are both payment systems and monetary assets. These cryptocurrencies have certain design features that can make them safe havens for avoiding traditional fiat money when needed. To understand how blockchain works, you need to know computer science and cryptography. But to understand why crypto assets have value, you need to understand fiat currencies and macroeconomic imbalances.

Fiat Currencies, Trust, and Credibility

Almost all modern economies use fiat currency systems: paper money (and its digital forms) with no intrinsic value. It may be surprising to realize that the foundation of most of the world’s wealth is a physically worthless object. But, of course, the point of fiat currency is not the paper itself, but the institutions surrounding it.

For these systems to function properly, expectations about the money supply need to be anchored—without any commitment to limiting supply, no one would use paper money. Thus, governments commit not to excessively increase the money supply, and the public judges the credibility of these commitments. This is a trust-based system.

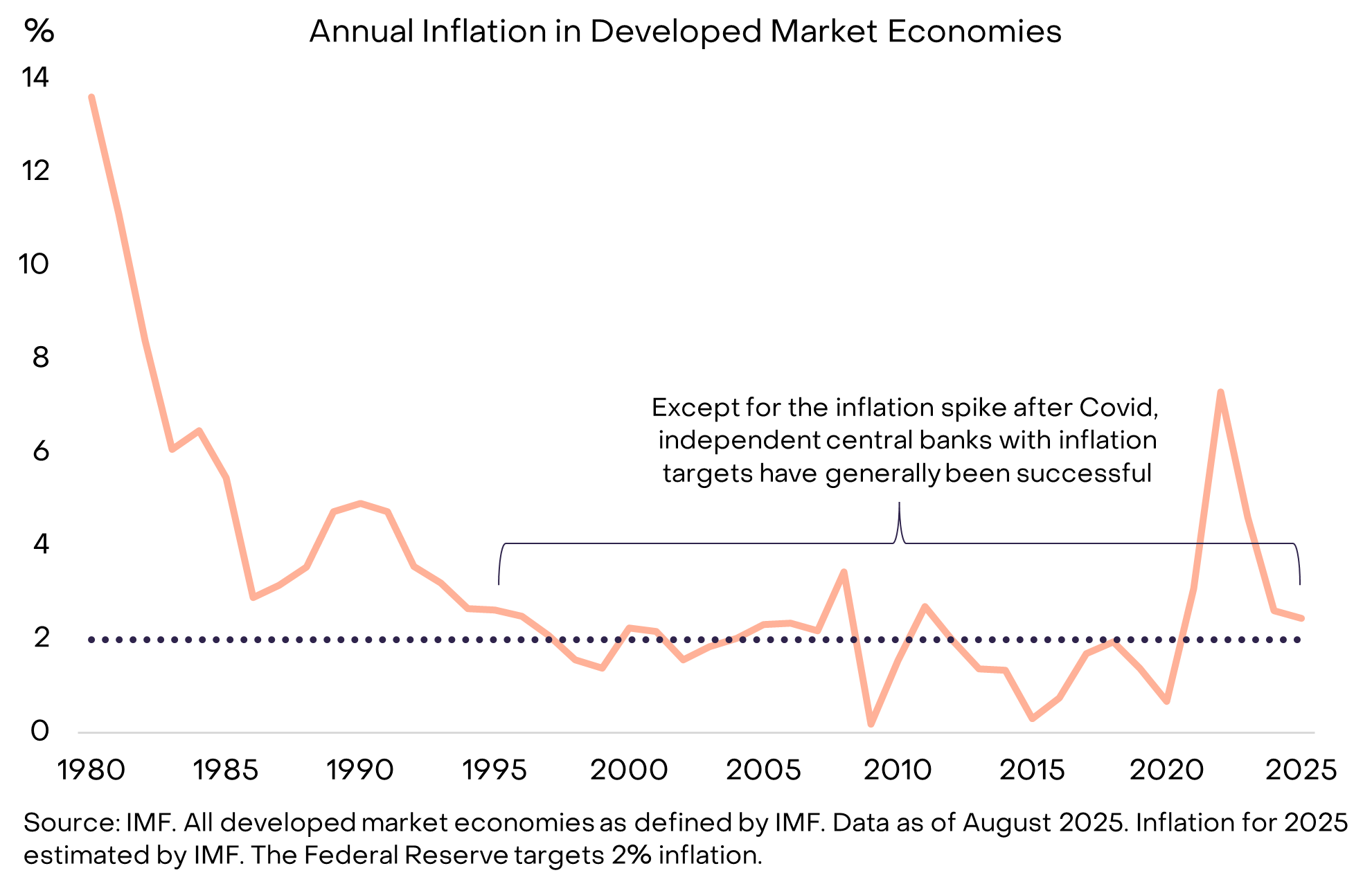

However, history is full of examples of governments breaking this trust: policymakers sometimes increase the money supply (causing inflation) because it is expedient at the time. As a result, money holders are naturally skeptical of empty promises to limit fiat money supply. To make commitments more credible, governments usually adopt some institutional framework. These frameworks vary by time and place, but today the most common strategy is to delegate responsibility for managing the money supply to an independent central bank, which then explicitly sets a specific inflation target. This structure, which has become the norm since about the mid-1990s, has been broadly effective in achieving low inflation (Chart 1).

Chart 1: Inflation targets and central bank independence help build trust

When Money Malfunctions

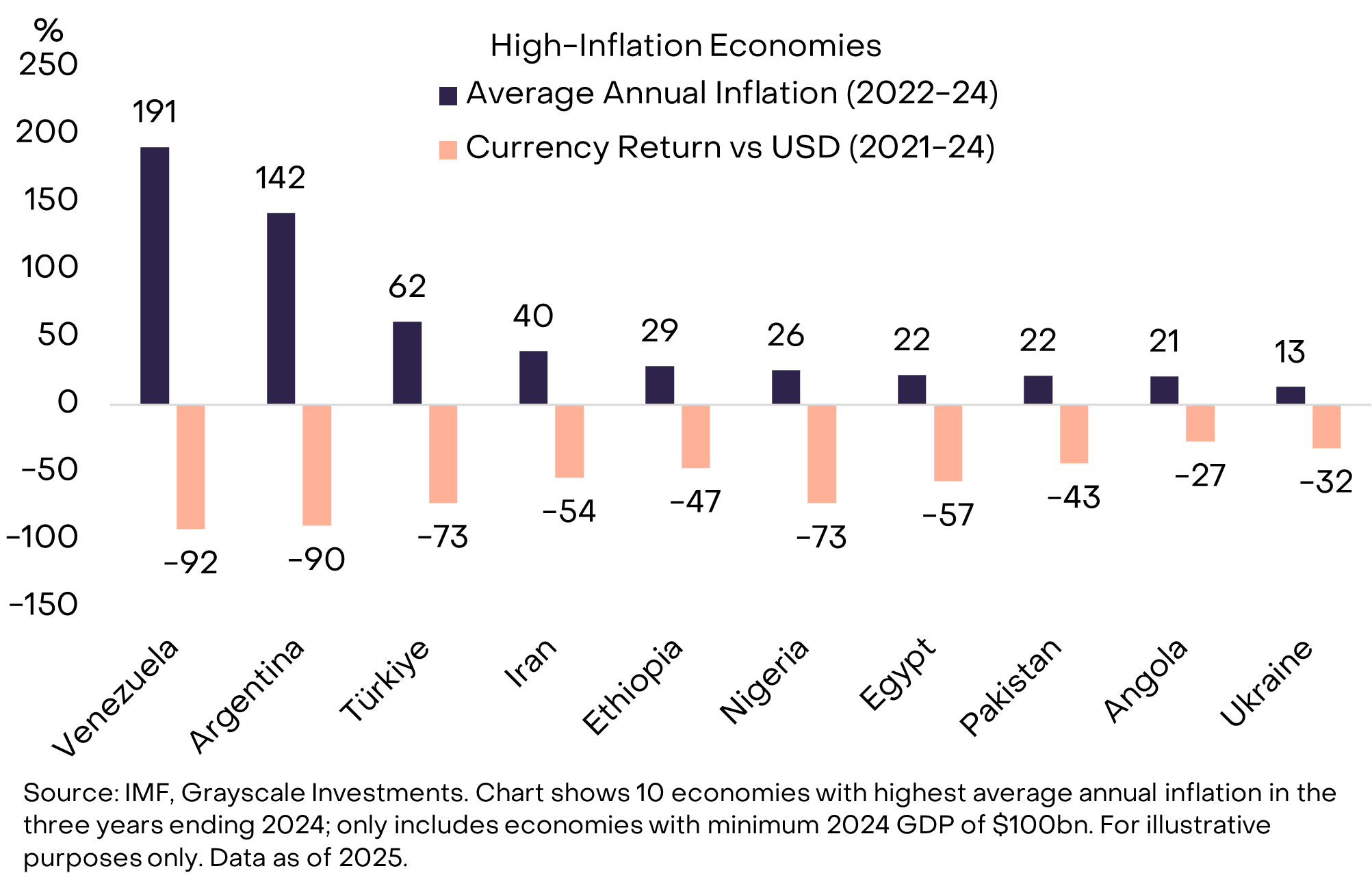

When fiat currencies are highly credible, the public does not pay attention to the issue. That is the goal. For citizens living in countries with a history of low and stable inflation, the idea of holding money that cannot be used for daily payments or to settle debts may be hard to understand. But in many parts of the world, the need for better money is obvious (Chart 2). No one questions why citizens of Venezuela or Argentina would want to hold part of their assets in foreign currencies or certain crypto assets—they have a very clear need for better stores of value.

Chart 2: Governments occasionally mismanage the money supply (Exhibit 2: Governments occasionally mismanage the money supply)

The ten countries in the chart above have a combined population of about 1 billion, many of whom have used cryptocurrencies as monetary lifeboats. This includes Bitcoin and other cryptocurrencies, as well as blockchain-based assets pegged to the U.S. Dollar—Tether (Tether, USDT) stablecoin. The adoption of Tether and other stablecoins is simply another form of dollarization—a shift from local fiat currencies to the U.S. Dollar—which has been common in emerging markets for decades.

The World Runs on Dollars

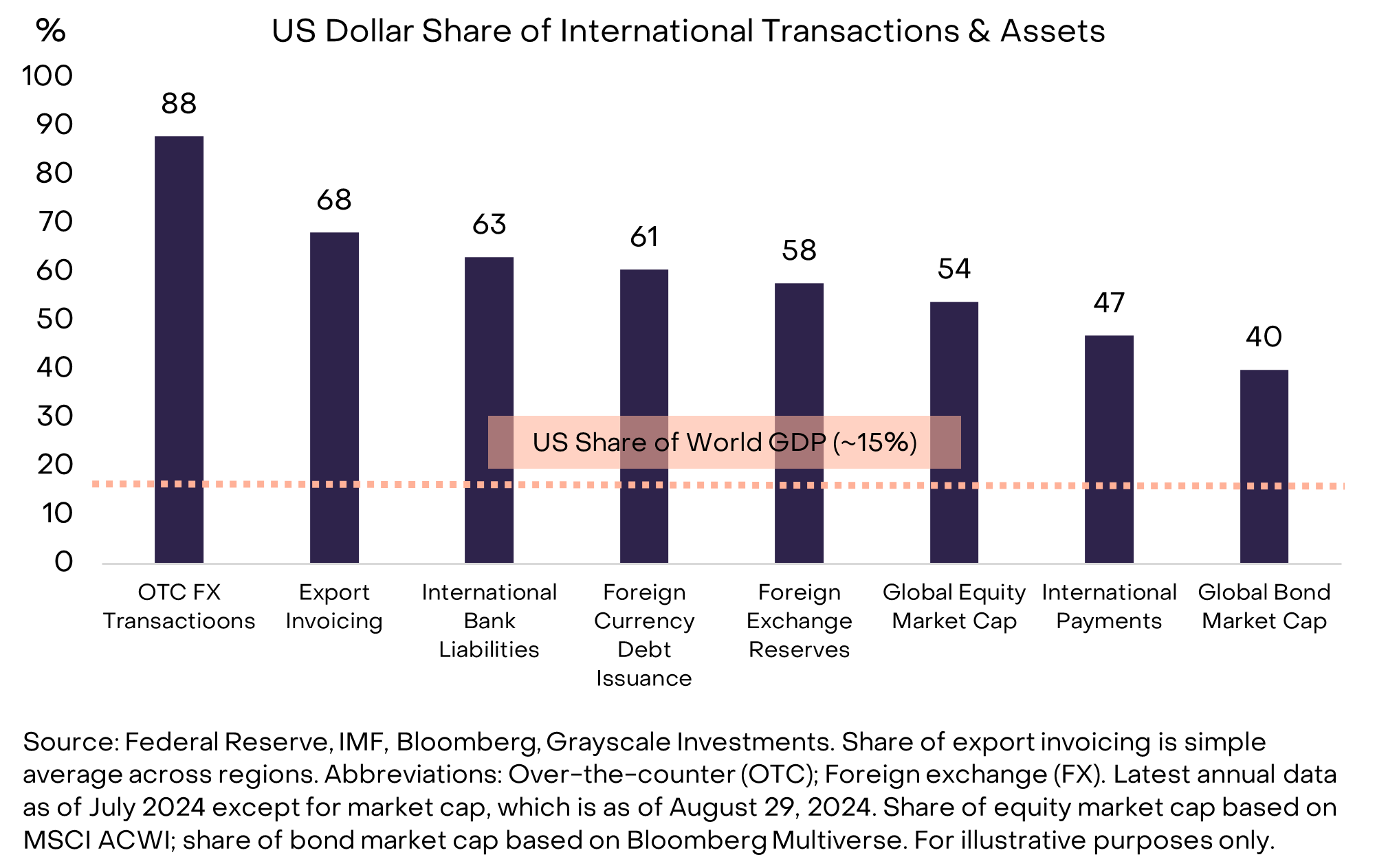

But what if the problem is with the U.S. Dollar itself? If you are a multinational corporation, a high-net-worth individual, or a sovereign nation, you cannot avoid the dollar. The dollar is both the domestic currency of the U.S. and the dominant international currency in the world today. According to various specific indicators, the Federal Reserve estimates that the dollar accounts for about 60%-70% of international currency usage, while the Euro accounts for only 20%-25%, and the Chinese Renminbi less than 5% (Chart 3).

Chart 3: U.S. Dollar is the dominant international currency today (Exhibit 3: U.S. Dollar is the dominant international currency today)

To be clear, the U.S. does not have the same kind of monetary mismanagement issues as the emerging market economies in Chart 2. However, any threat to the soundness of the dollar is significant because it affects almost all asset holders—not just U.S. residents using dollars for daily transactions. It is the risk to the dollar, not the Argentine peso or Venezuelan bolivar, that drives the largest pools of capital to seek alternatives like gold and cryptocurrencies. Compared to other countries, the potential challenges the U.S. faces in monetary stability may not be the most severe, but they are the most important.

At the Center Is a Debt Problem

Fiat currencies are based on promises, trust, and credibility. We believe the dollar is facing a newly emerging credibility problem: the U.S. government is finding it increasingly difficult to credibly commit to long-term low inflation. The root cause of this credibility gap is related to unsustainable federal government deficits and debt.

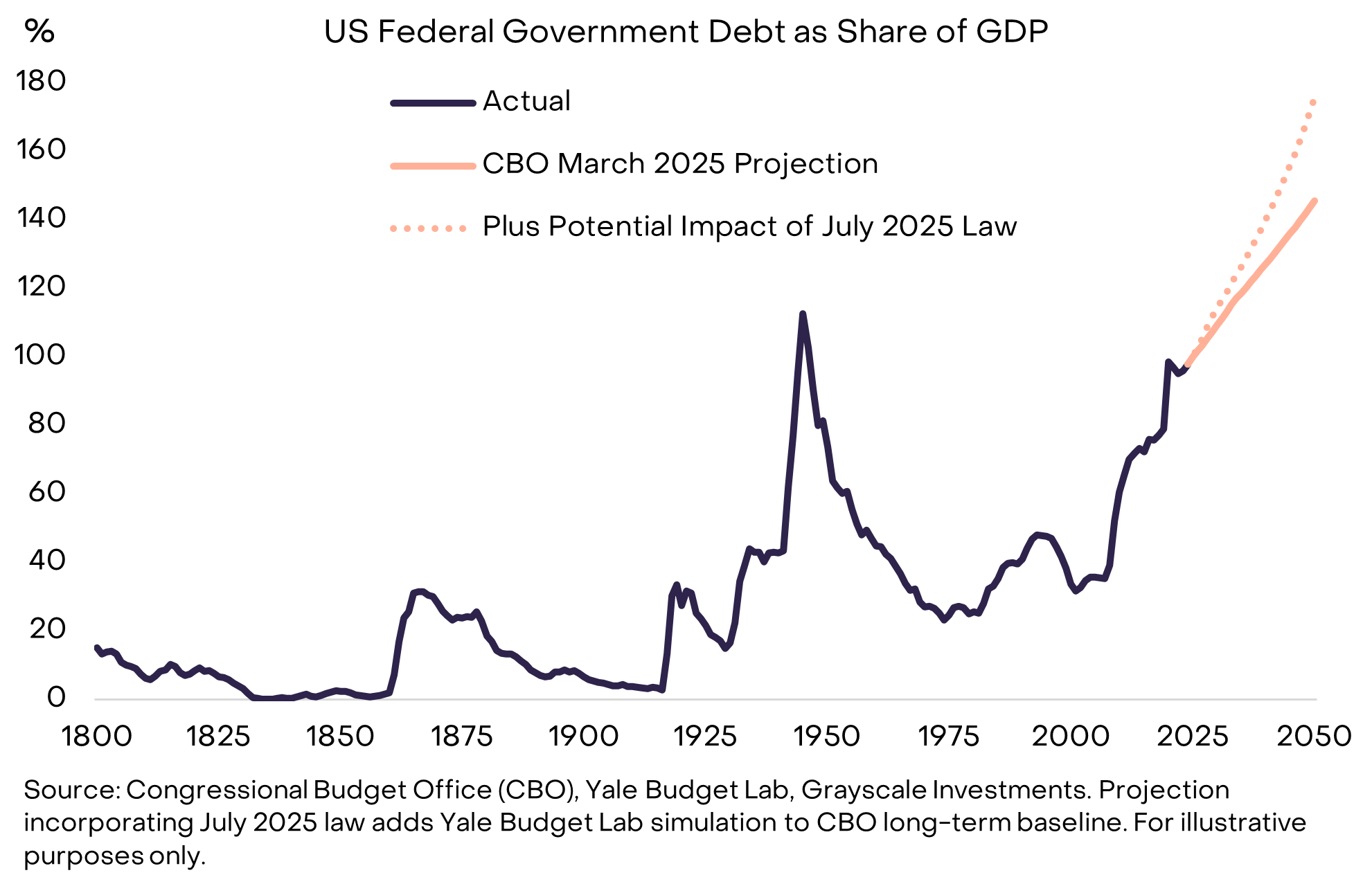

This imbalance began with the 2008 financial crisis. In 2007, the U.S. deficit was only 1% of GDP, and the debt stock was 35% of GDP. Since then, the federal government has run an average annual deficit of about 6% of GDP. National debt has now reached about $30 trillion, about 100% of GDP—almost equal to the last year of World War II—and is projected to continue rising sharply (Chart 4).

Chart 4: U.S. public debt on an unsustainable path higher (Exhibit 4: U.S. public debt on an unsustainable path higher)

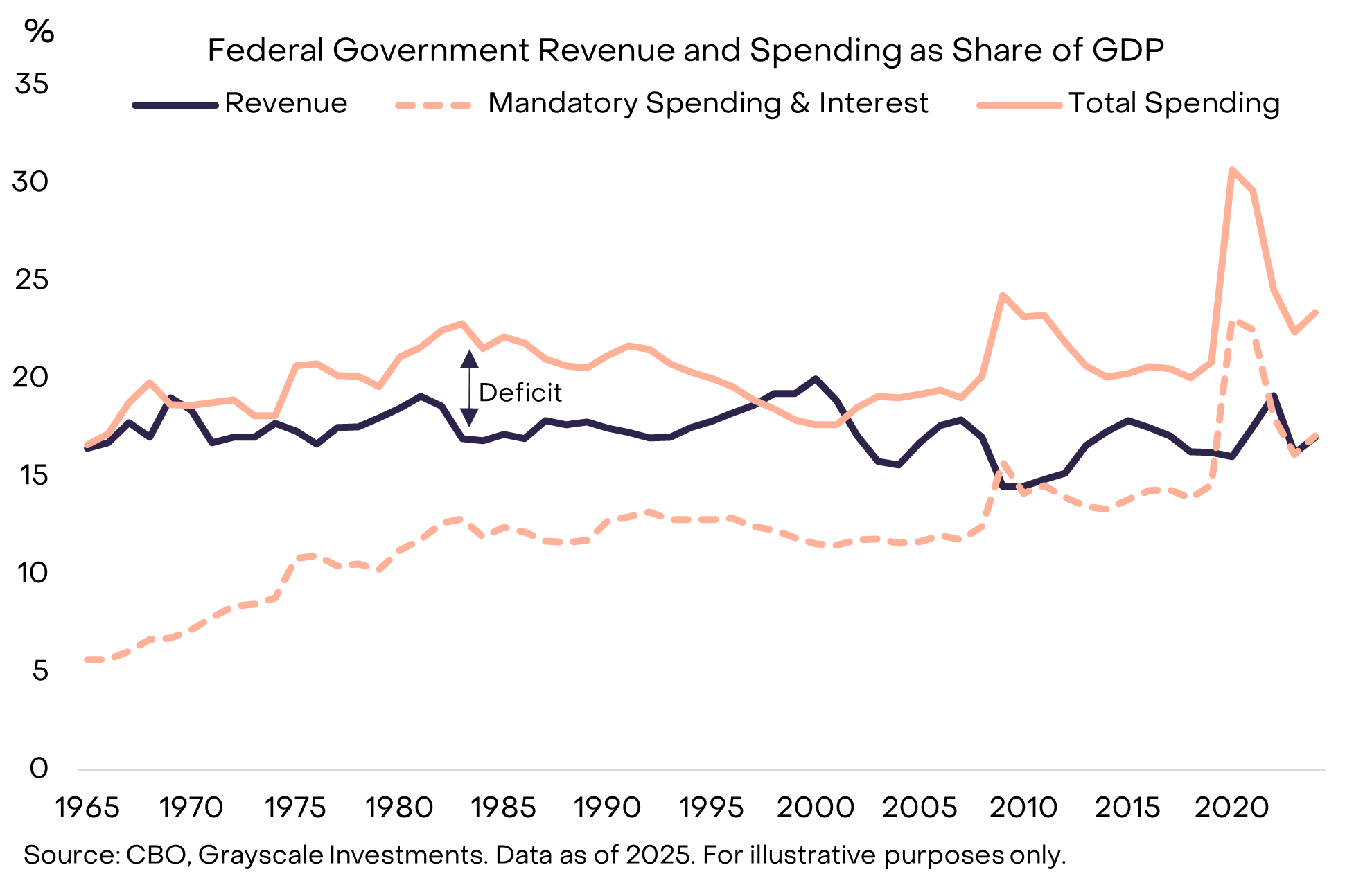

Huge deficits are a bipartisan problem and persist even when unemployment is relatively low. One reason modern deficits seem so intractable is that current fiscal revenues only cover mandatory spending (like Social Security and Medicare) and interest payments (Chart 5). Therefore, achieving budget balance may require politically painful spending cuts and/or tax increases.

Chart 5: Government revenues only cover mandatory spending plus interest (Exhibit 5: Government revenues only cover mandatory spending plus interest)

Interest Expense: The Binding Constraint

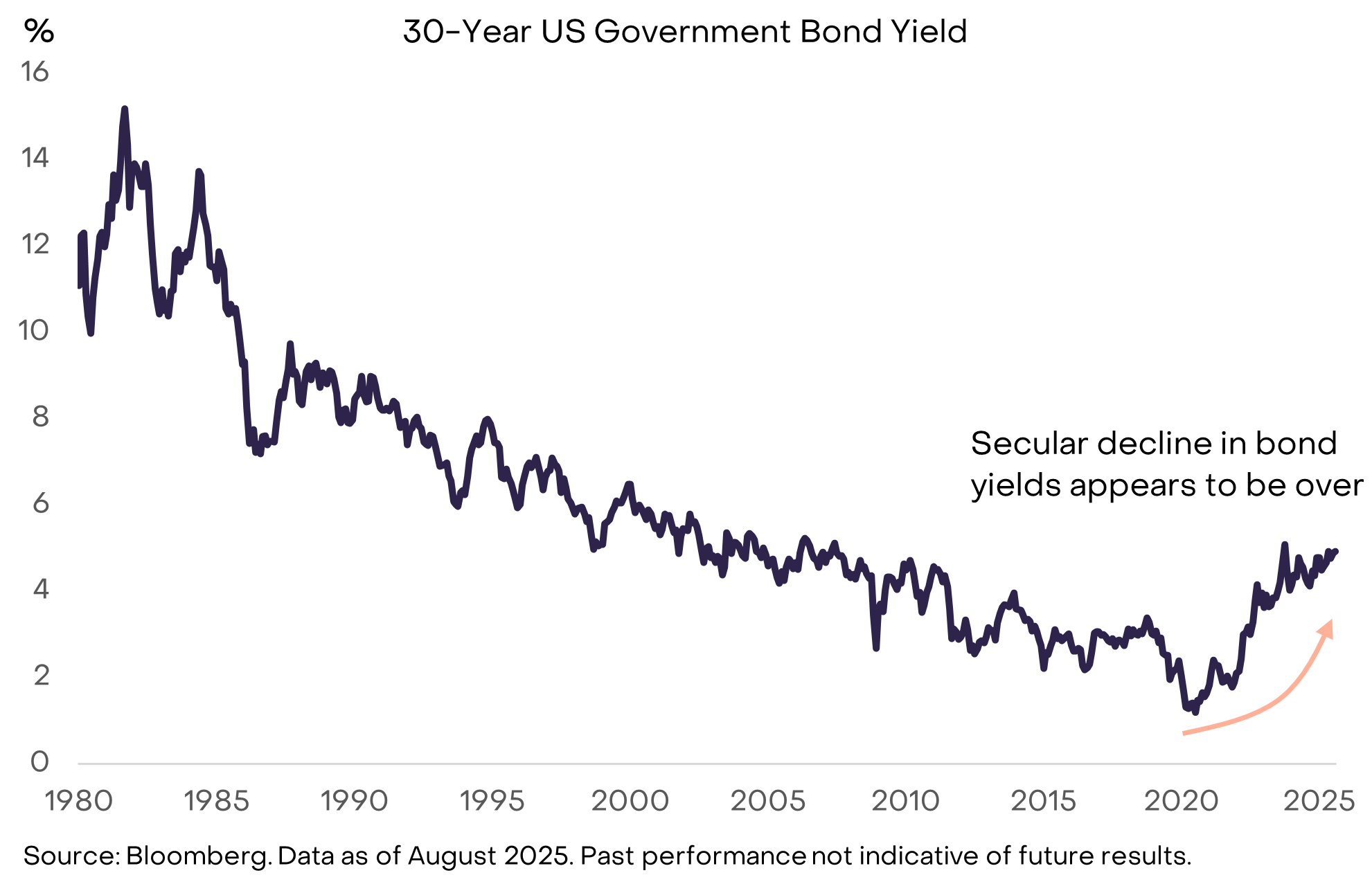

Economic theory cannot tell us how much government debt is too much. As any borrower knows, what matters is not the amount of debt, but the cost of financing it. If the U.S. government could still borrow at extremely low interest rates, debt growth might continue without materially affecting institutional credibility or financial markets. In fact, some prominent economists have taken a relaxed view of rising debt stocks in recent years precisely because low interest rates made financing easier. However, the decades-long trend of declining bond yields appears to have ended, so the limits of debt growth are starting to show (Chart 6).

Chart 6: Rising bond yields mean the constraints on debt growth are starting to bind (Exhibit 6: Rising bond yields mean the constraints on debt growth are starting to bind)

Like other prices, bond yields are ultimately a function of supply and demand. The U.S. government continues to supply more debt, and at some point in recent years, it seems to have satisfied (at low yields/high prices) the demand for that debt.

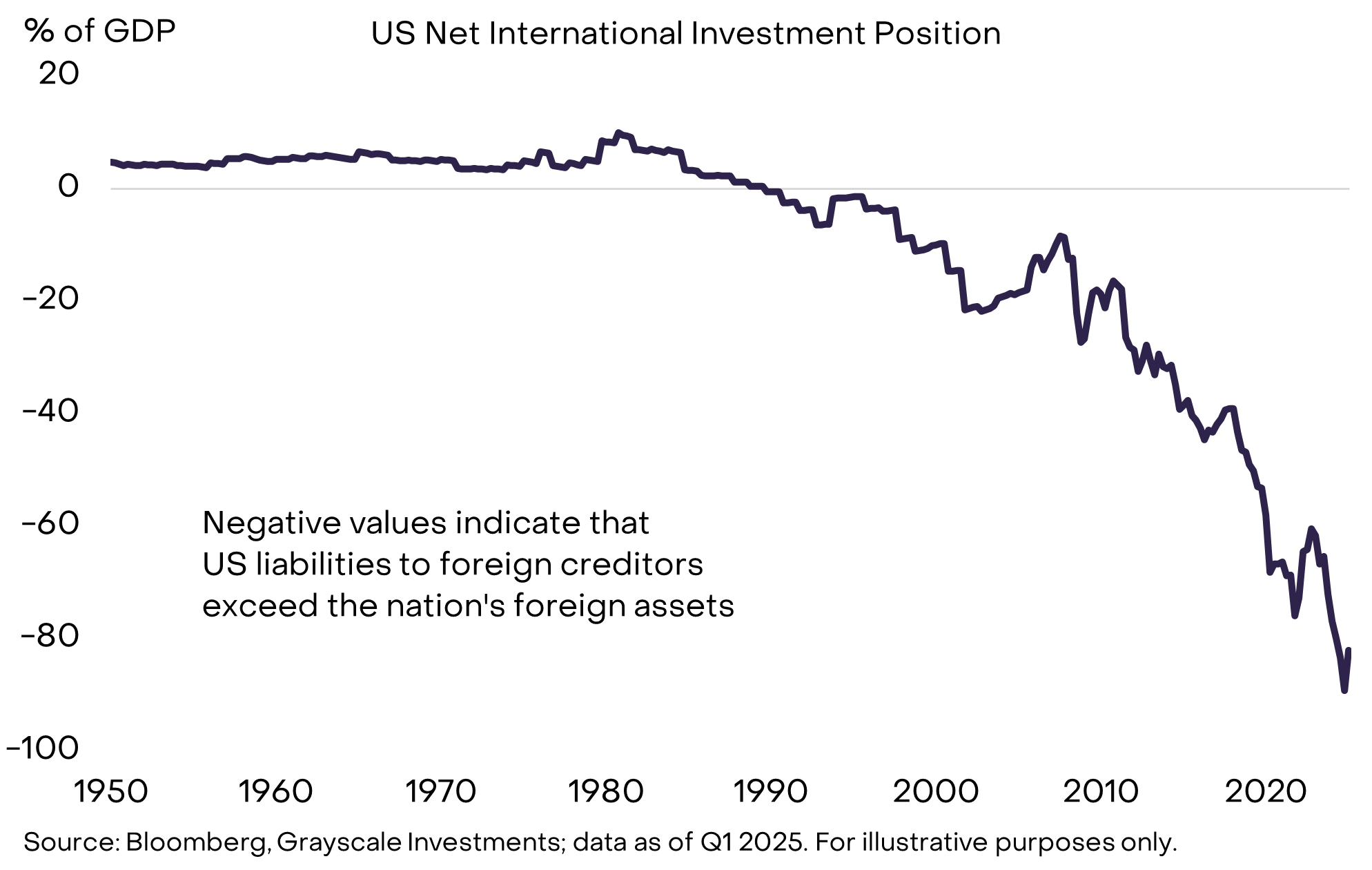

There are many reasons, but the key fact is that the U.S. government borrows from both domestic savers and foreigners. There is not enough domestic savings in the U.S. economy to absorb all borrowing and investment needs. As a result, the U.S. has both a huge public debt stock and a massive net debtor position in its international accounts (Chart 7). In recent years, various changes in foreign economies have meant that international demand for U.S. government bonds at extremely low interest rates has declined. These changes include a slowdown in official reserve accumulation in emerging markets and the end of deflation in Japan. Geopolitical realignment may also weaken structural foreign investor demand for U.S. government bonds.

Chart 7: The U.S. relies on foreign savers to finance borrowing (Exhibit 7: The U.S. relies on foreign savers to finance borrowing)

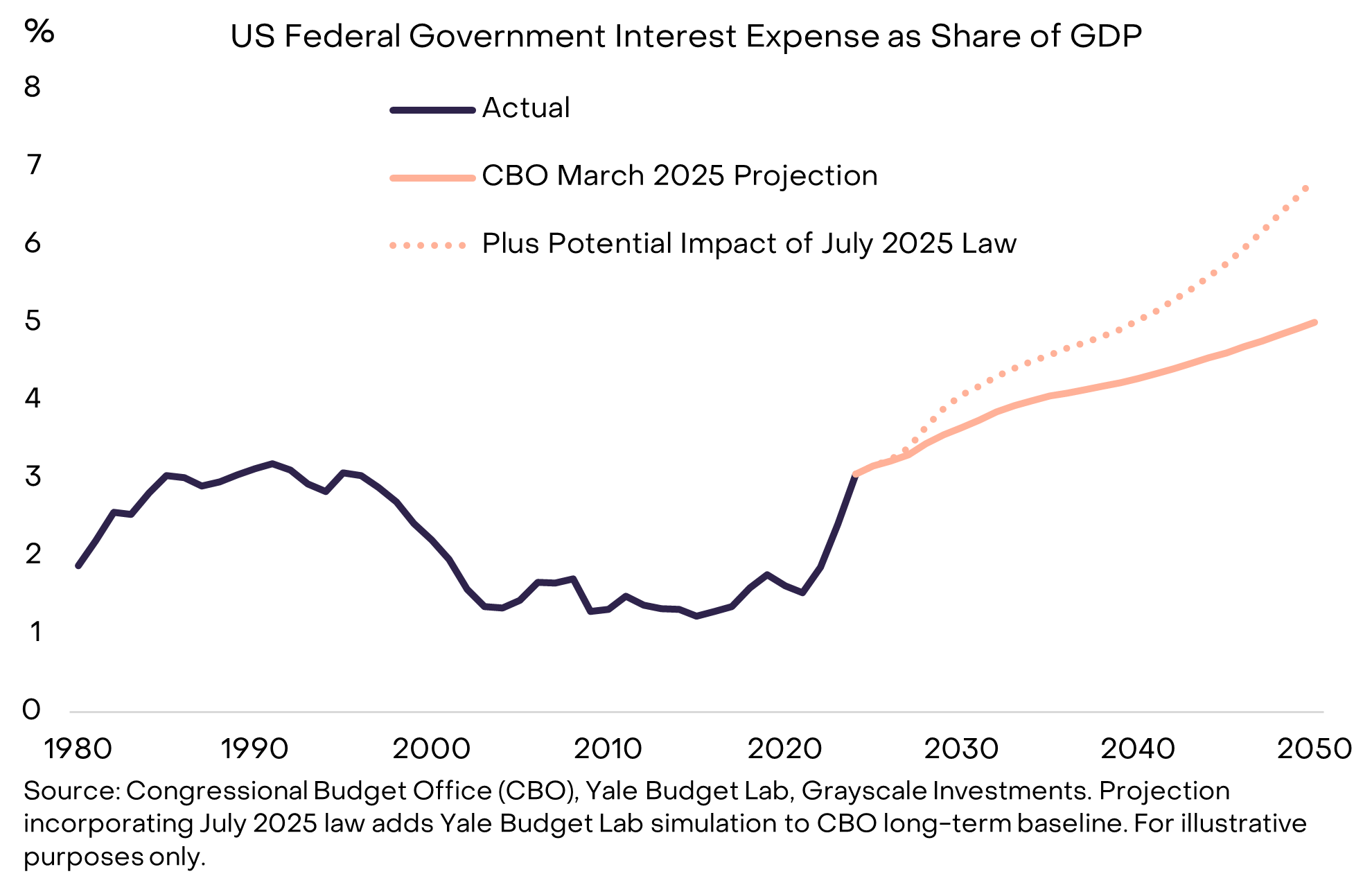

As the U.S. government refinances its debt at higher interest rates, a larger proportion of spending is devoted to interest expenses (Chart 8). Low bond yields allowed the debt stock to grow rapidly over the past 15 years without significantly impacting government interest expenses. But now that has ended, which is why the debt issue has become more urgent.

Chart 8: Higher interest expense is the binding constraint on debt growth (Exhibit 8: Higher interest expense is the binding constraint on debt growth)

Why Debts Can Snowball

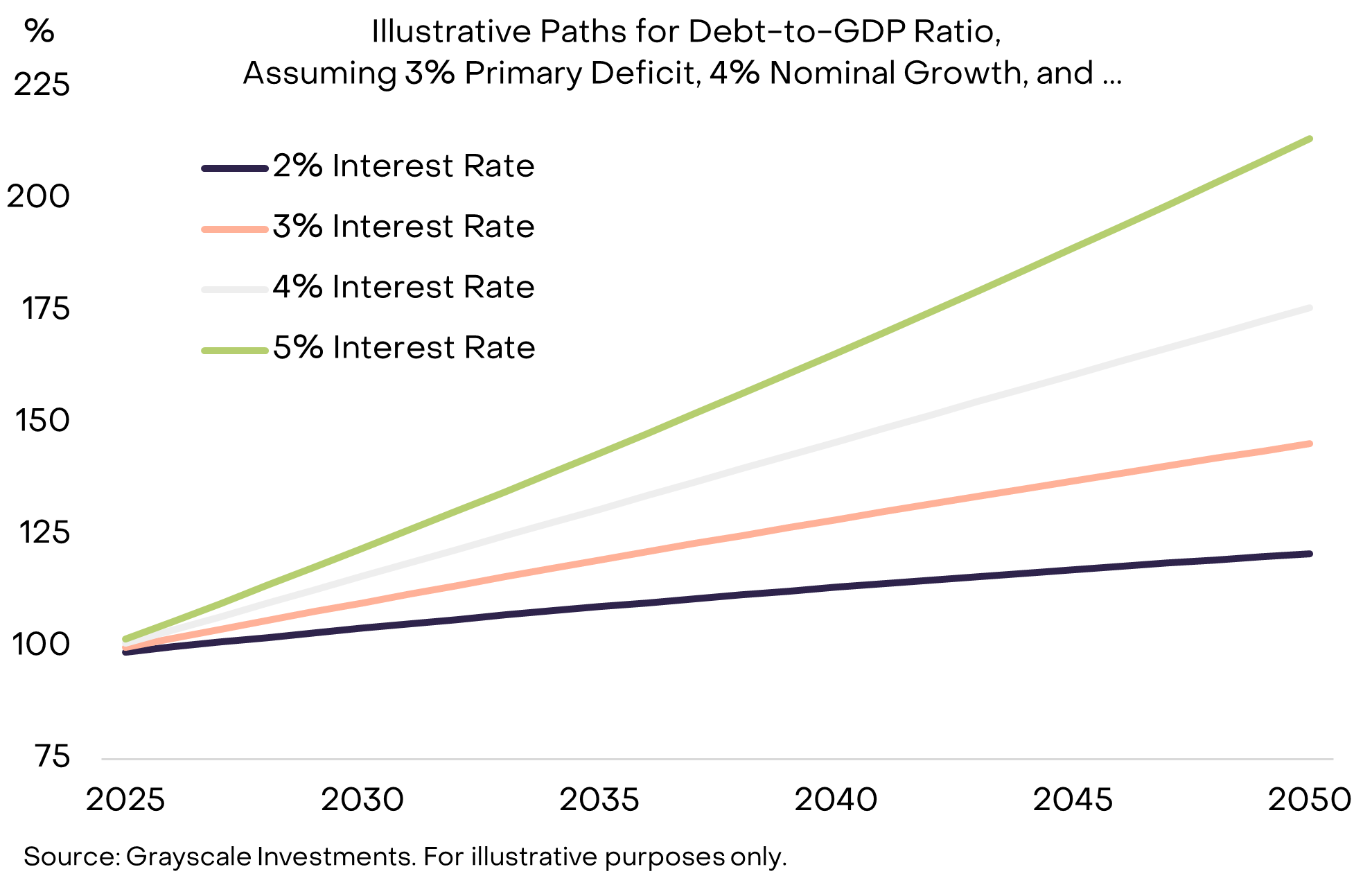

To control the debt burden, lawmakers need to (1) balance the primary deficit (i.e., the budget gap excluding interest payments), and (2) hope that interest costs remain low relative to the economy’s nominal growth rate. The U.S. is still running a primary deficit (about 3% of GDP), so even if interest rates are manageable, the debt stock will continue to rise. Unfortunately, the latter issue—what economists sometimes call the “snowball effect”—is also becoming increasingly challenging.

Assuming the primary deficit is balanced, the following holds:

- If the average interest rate on debt is lower than the nominal growth rate of the economy, the debt burden—defined as the share of public debt to GDP—will fall.

- If the average interest rate on debt is higher than the nominal growth rate of the economy, the debt burden will rise.

To illustrate how important this is, Chart 9 shows hypothetical paths for the U.S. public debt-to-GDP ratio, assuming the primary deficit remains at 3% of GDP and nominal GDP growth can be maintained at 4%. The conclusion: when interest rates are higher relative to nominal growth, the debt burden rises much faster.

Chart 9: Debt burden may snowball at higher interest rates (Exhibit 9: Debt burden may snowball at higher interest rates)

With bond yields rising, many forecasters now expect structural GDP growth to slow due to an aging workforce and reduced immigration: the Congressional Budget Office (CBO) projects that potential labor force growth will slow from about 1% per year now to about 0.3% by 2035. Assuming the Federal Reserve can achieve its 2% inflation target—which is an open question—lower real growth will mean lower nominal growth and faster debt stock growth.

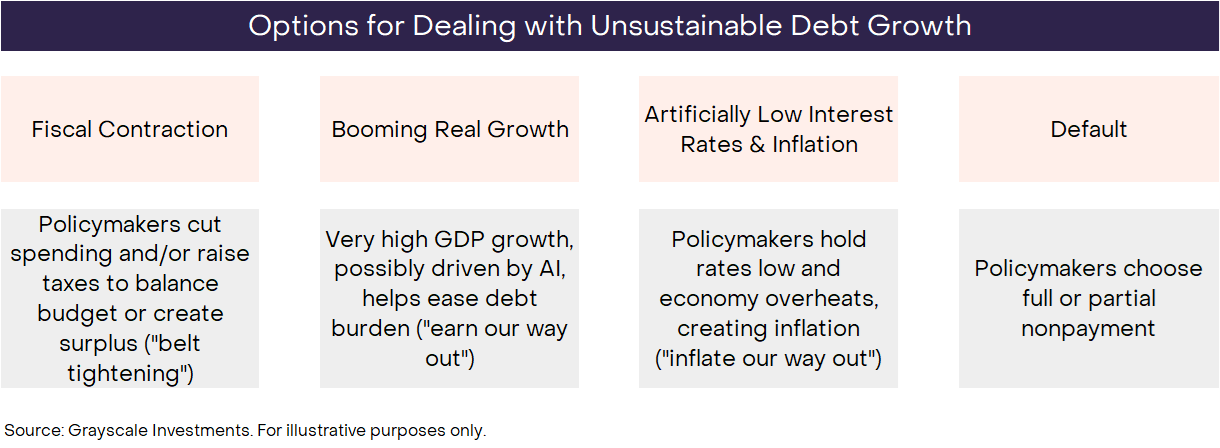

How the Story Ends

By definition, unsustainable trends cannot continue forever. The uncontrolled growth of U.S. federal government debt will end at some point, but no one knows exactly how it will end. As always, investors need to consider all possible outcomes and weigh their probabilities based on data, policymakers’ actions, and historical lessons. There are basically four possible outcomes, which are not necessarily mutually exclusive (Chart 10).

Chart 10: Investors need to consider the outcomes and weigh their probabilities (Exhibit 10: Investors need to consider the outcomes and weigh their probabilities)

The possibility of default is very small because U.S. debt is denominated in dollars, and inflation is usually less painful than non-payment. Fiscal contraction is possible in the future—and may ultimately be part of the solution—but Congress has just passed a “big and beautiful bill” that will keep fiscal policy in high deficit for the next 10 years. At least for now, reducing deficits through tax increases and/or spending cuts seems unlikely. Booming economic growth would be the ideal outcome, but growth is currently sluggish and potential growth is expected to slow. While not yet evident in the data, an unusually large productivity surge driven by AI technology would certainly help manage the debt burden.

This leaves artificially low interest rates and inflation. For example, if the U.S. could maintain about 3% interest rates, about 2% real GDP growth, and about 4% inflation, in theory it could stabilize the debt stock at current levels without reducing the primary deficit. The Federal Reserve’s structure allows it to operate independently to shield monetary policy from short-term political pressures. However, recent debates and policymakers’ actions have raised concerns among some observers that this independence may be at risk. In any case, it may be unrealistic to expect the Federal Reserve to completely ignore the nation’s fiscal policy issues. History shows that when things get urgent, monetary policy gives way to fiscal policy, and the path of least resistance may be to inflate away the problem.

Given the range of possible outcomes, the severity of the problem, and policymakers’ actions so far, we believe that strategies for managing the national debt burden over the long term are increasingly likely to result in average inflation above the Federal Reserve’s 2% target.

Bringing It Back to Crypto

In summary, due to the large debt stock, rising interest rates, and lack of other viable solutions, the U.S. government’s commitment to controlling money supply growth and inflation may no longer be fully credible. The value of fiat currency ultimately depends on the government’s credible commitment not to inflate the money supply. Therefore, if there is reason to doubt this commitment, all investors in dollar-denominated assets may need to consider what this means for their portfolios. If they begin to believe the dollar’s reliability as a store of value is declining, they may seek alternatives.

Cryptocurrencies are digital commodities rooted in blockchain technology. They come in many varieties, and their use cases are often unrelated to “store of value” currencies. For example, public blockchains can be used for everything from payments to video games to artificial intelligence. Grayscale classifies crypto assets according to their primary use case using our Crypto Sectors framework, developed in partnership with FTSE/Russell.

We believe that a small subset of these digital assets can be considered viable stores of value because they are widely adopted, have a high degree of decentralization, and have limited supply growth. This includes the two largest crypto assets by market capitalization, Bitcoin and Ethereum. Like fiat currencies, they are not “backed” by other assets to give them value. Instead, their utility/value comes from allowing users to make peer-to-peer digital payments without censorship risk, and from making credible commitments not to inflate supply.

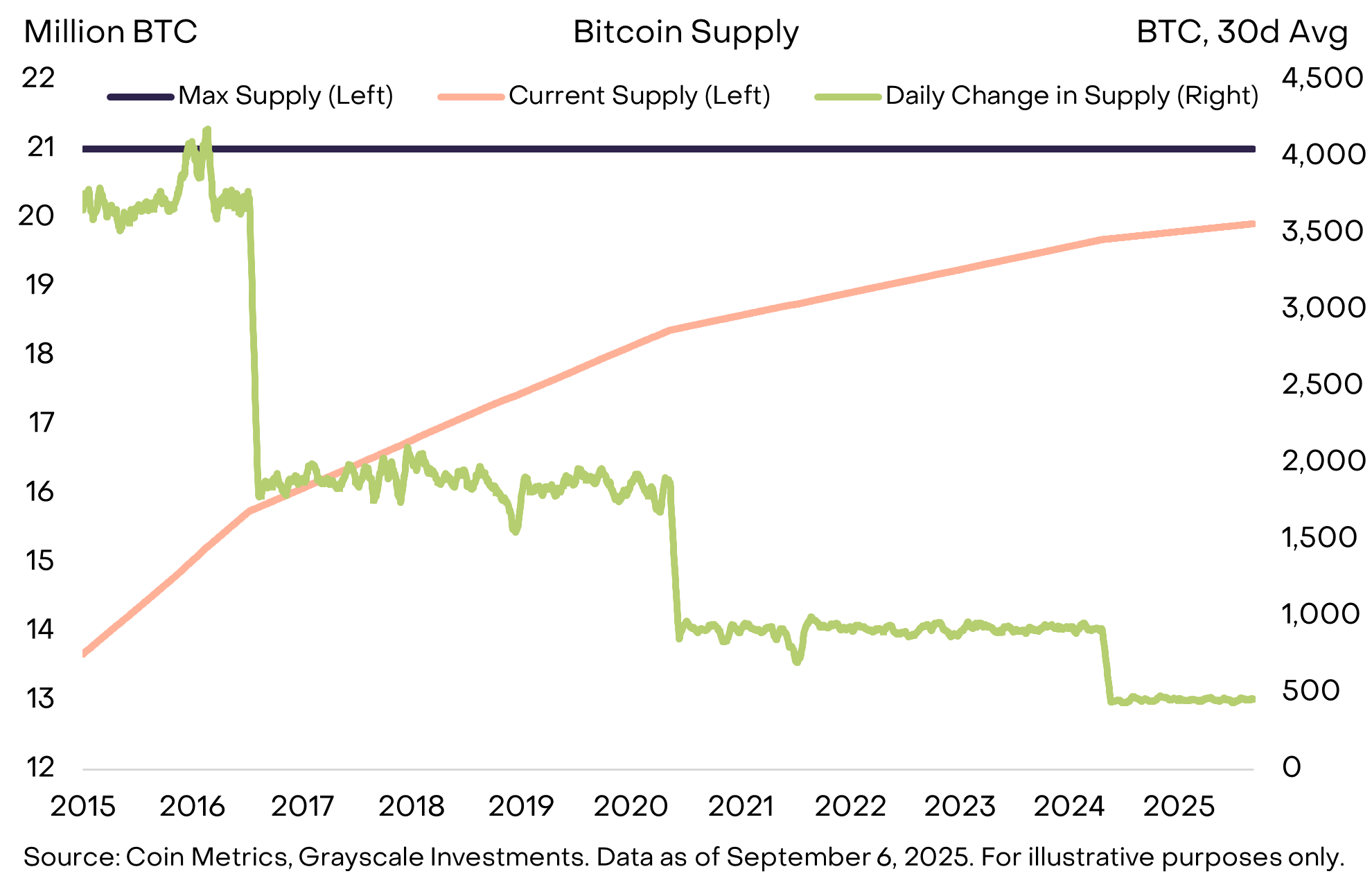

For example, Bitcoin’s supply is capped at 21 million coins, with the current supply increasing by 450 bitcoins per day, and the rate of new supply halving every four years (Chart 11). This is clearly specified in the open-source code and cannot be changed without consensus from the Bitcoin community. Moreover, Bitcoin is not subject to any external institution—such as fiscal authorities needing to repay debt—that might interfere with its low and predictable supply growth target. Transparent, predictable, and ultimately limited supply is a simple yet powerful concept that has helped Bitcoin’s market capitalization grow to over $2 trillion.

Chart 11: Bitcoin offers predictable and transparent money supply (Exhibit 11: Bitcoin offers predictable and transparent money supply)

Like gold, Bitcoin does not pay interest and is not widely used for daily payments. The utility of these assets comes from what they do not do. Most importantly, their supply does not increase because a government needs to repay debt—no government or any other institution can control their supply.

Today’s investors must navigate an environment full of major macroeconomic imbalances, the most important of which is unsustainable public debt growth and its impact on the credibility and stability of fiat currencies. The purpose of holding alternative monetary assets in a portfolio is to provide ballast against the risk of fiat currency devaluation. As long as these risks are rising, the value of assets that can hedge against such outcomes arguably should rise as well.

What Could Turn It Around

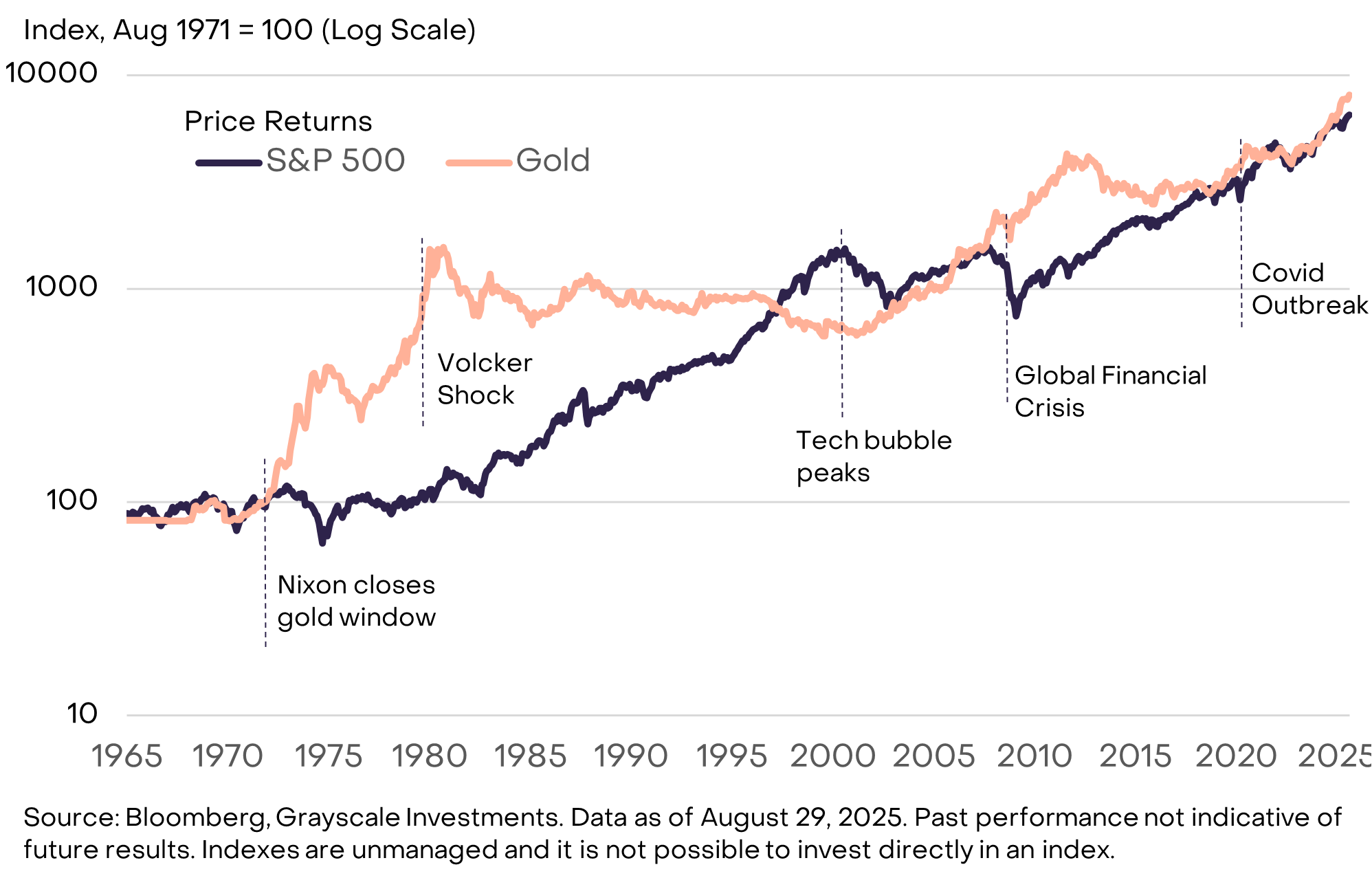

Investing in the crypto asset class involves a variety of risks, which are beyond the scope of this report. However, from a macro perspective, a key risk to the long-term value proposition of certain crypto assets may be that governments strengthen their commitment to managing fiat money supply in a way that restores public confidence. These steps could include stabilizing and then reducing the government debt-to-GDP ratio, reaffirming support for the central bank’s inflation target, and taking measures to support central bank independence. Government-issued fiat currency is already a convenient medium of exchange. If governments can ensure it is also an effective store of value, demand for cryptocurrencies and other alternative stores of value may decline. For example, gold performed well when U.S. institutional credibility was in question in the 1970s, but performed poorly in the 1980s and 1990s as the Federal Reserve brought inflation under control (Chart 12).

Chart 12: Gold performed poorly in the 1980s and 1990s alongside falling inflation (Exhibit 12: Gold performed poorly in the 1980s and 1990s alongside falling inflation)

Public blockchains offer innovation in digital currency and digital finance. Today, the highest market capitalization blockchain applications provide digital currency systems with characteristics different from fiat currencies—their demand is related to modern macroeconomic imbalances such as high public sector debt. We believe that over time, the growth of the crypto asset class will be driven by these macro factors and the adoption of other innovations based on public blockchain technology.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?