WLFI Buyback and Burn Goes Live, Supported by Treasury

WLFI’s new buyback-and-burn proposal aims to cut supply and revive price momentum. Analysts predict a breakout, but investor trust and transparent execution will decide if this becomes a true recovery or a short-lived pump.

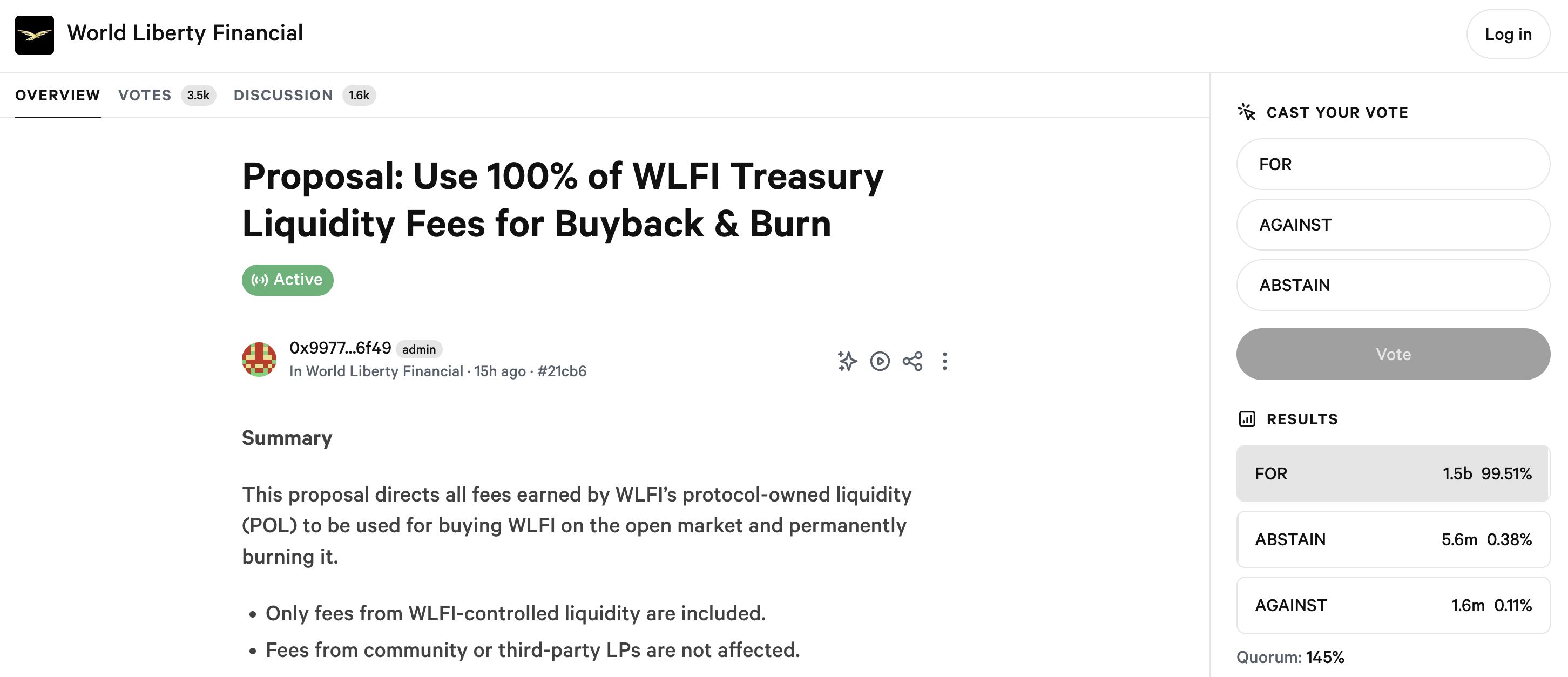

The WLFI buyback and burn proposal has just gone live. It promises to turn treasury fees into direct buying pressure and permanently reduce supply across the network.

Could WLFI soon witness a 50% price surge as the treasury officially “pours money” into buying and permanently burning tokens?

Catalyst: ‘Buyback & Burn’ on WLFI

World Liberty Financial (WLFI) has just launched a key proposal: redirect 100% of treasury liquidity fees to market-buy WLFI tokens and permanently burn them across multiple chains. In fact, this route fees – market-buy – permanent burn approach is a well-known catalyst used by projects like HYPE, PUMP, and TON.

From an economic perspective, buyback & burn is an effective deflationary mechanism. The “automatic” demand generated by protocol activity (liquidity fees) will purchase tokens on the spot market, and burning will permanently reduce the total supply. As a result, assuming demand remains stable or increases, prices could re-rate upward.

However, its full impact depends on two key factors: the amount of fees collected by the treasury and the frequency/timeline of the buybacks. The buyback impact will be limited if daily/weekly fees are still small relative to market liquidity. Conversely, the mechanism can deliver a significant effect if the treasury generates large and consistent fee flows.

WLFI proposal voting rate. Source:

WLFI

WLFI proposal voting rate. Source:

WLFI

If approved and executed transparently, this buyback-and-burn mechanism could help revive WLFI’s price, which has been severely depressed following governance risks and centralization concerns. Since launch, the controversy surrounding Justin Sun has sharply lowered WLFI’s price. At the time of writing, WLFI is trading at $0.1996, down 40% from its previous ATH.

However, implementing a buyback mechanism will not help boost token prices. Some analysts argue that crypto buybacks are seen as value-destroying rather than value-creating. They burn revenue that could have fueled growth through product development and user acquisition.

With emerging regulatory dynamics and a maturing industry, the focus should be on building transparent, efficient tokens for long-term investors. These tokens should act as on-chain equity, driving sustainable value over time.

“The market doesn’t need more buybacks. It needs productive tokens and patience.” The Moonrock’s founder commented.

Technical View

From a technical analysis perspective, several analysts on X note that WLFI is currently in a falling wedge pattern and may be nearing its bottom. Price action suggests a sharp reversal may be imminent, with upside potential of up to 50%, targeting $0.26.

WLFI price action. Source:

Smith on X

WLFI price action. Source:

Smith on X

In another analysis, a user on X observed that WLFI is testing the Point of Control (PoC) value zone after breaking out of a descending bearish channel on lower timeframes.

“A strong breakout above this PoC could spark a 30–40% short-term rally, with rising volume confirming momentum — one to watch closely!” CryptoBull stated.

WLFI price action on the 1H chart. Source:

CryptoBull on X

WLFI price action on the 1H chart. Source:

CryptoBull on X

These observations all suggest that a reversal may be very close. However, WLFI must still secure a confirmed close above key resistance and sustained trading volume to validate this move.

Moreover, while the burn mechanism is attractive, market confidence in governance (who controls the treasury, who signs buyback transactions, and how transparently burn reports are published) will largely determine its long-term effectiveness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.