Bitcoiners chasing a quick Lambo are heading for a wipeout: Arthur Hayes

BitMEX co-founder Arthur Hayes says Bitcoin holders need to be more patient and stop worrying about stocks and gold hitting record highs, because asking why Bitcoin isn’t higher misses the point.

“If you thought you were buying Bitcoin and the next day you were buying a Lamborghini, you’re probably getting liquidated because it is not the right way to think about things,” Hayes told Kyle Chasse in an interview published to YouTube on Friday.

“I’m sorry that you bought Bitcoin six months ago, but anyone who bought it two, three, five, or 10 years ago, they’re laughing,” Hayes said, echoing the frustrations of recent Bitcoin (BTC) buyers who are asking why Bitcoin’s price isn’t trading at $150,000 yet.

“People need to readjust their perspective on this,” he said. Curvo data shows that Bitcoin has seen an average annualized return of 82.4% over the past ten years.

Hayes shoots down idea that Bitcoin is lagging behind

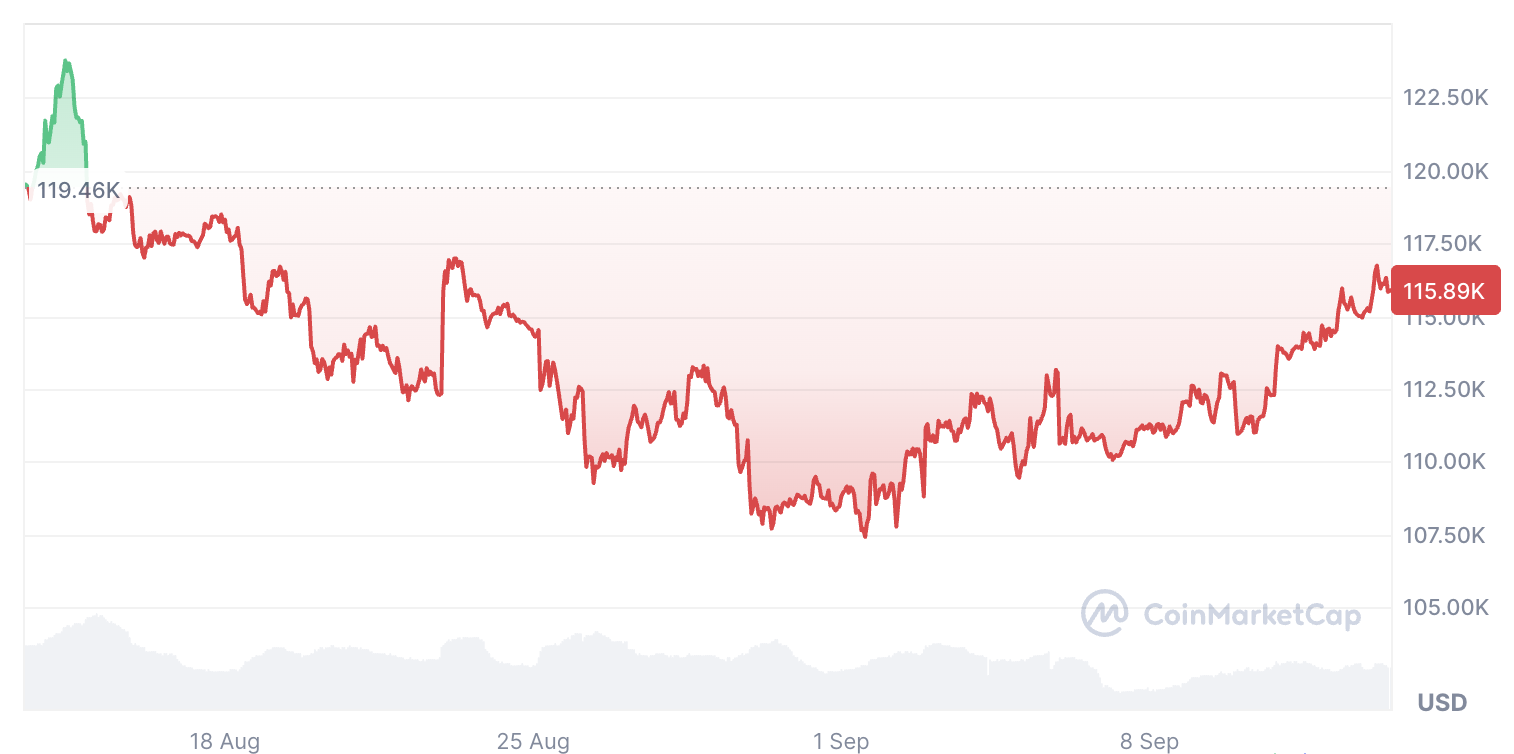

It comes as Bitcoin continues to trade below its all-time high of $124,100 reached on Aug. 14, currently sitting at $116,007 at the time of publication, according to CoinMarketCap.

Meanwhile, gold and the S&P 500 reached new all-time highs this week of $3,674 and $6,587, respectively.

Hayes dismissed the significance of these highs relative to Bitcoin and pushed back on a question from Chasse, about when Bitcoin and the broader crypto market might start attracting global M2 inflows, given that stocks and gold are hitting all-time highs.

“I think the premise of that question is flawed,” Hayes said. “Bitcoin is the best performing asset when you think about currency debasement ever,” Hayes said.

Bitcoin’s performance “is just so ridiculous,” Hayes says

Hayes said while the S&P 500 is “up in dollar terms,” it has still not recovered from 2008 when compared against the gold price. “Deflate the housing market by gold again and not anywhere close to where it was,” he added.

“Big US tech is probably one of the only things that have done well deflated by gold,” he said.

“If you deflate things by Bitcoin, you can’t even see it on the chart; it is just so ridiculous about how well Bitcoin has performed,” he said.

In April 2025, Hayes projected that Bitcoin would reach $250,000 by the end of this year, and just a month later, in May, Unchained Market Research Director Joe Burnett made the same prediction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...