Date: Sat, Sept 13, 2025 | 09:00 AM GMT

The cryptocurrency market continues to show strength amid the anticipated potential US Federal Reserve rate cuts, with Ethereum (ETH) reclaiming the $4,700 mark today. Following this, several major altcoins are flashing bullish signals — including Aptos (APT).

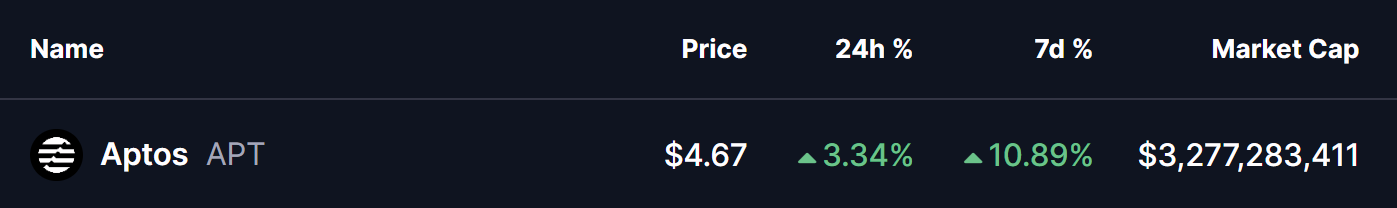

APT has turned green with a 10% gain over the past week, and more importantly, its chart is beginning to flash a bullish fractal setup that mirrors the recent explosive rally seen in Worldcoin (WLD).

Source: Coinmarketcap

Source: Coinmarketcap

APT Mirrors WLD’s Fractal Setup

WLD’s earlier price action provides a strong roadmap for APT’s potential trajectory.

- WLD first broke out of a falling wedge pattern

- Followed by a descending triangle breakout

- Once it cleared the 100 and 200-day MA barriers, the token ignited a sharp rally, reclaiming multiple resistance levels and ultimately delivering a 121% move higher.

APT and WLD Fractal Chart/Coinsprobe (Source: Tradingview)

APT and WLD Fractal Chart/Coinsprobe (Source: Tradingview)

Now, APT appears to be tracing a nearly identical setup.

The token has also broken out of both a falling wedge and descending triangle while reclaiming the 100-day MA ($4.62). Currently trading near $4.68, APT is flashing early signs of structural strength — much like WLD did before its surge.

What’s Next for APT?

If this fractal continues to play out, holding above the 100-day MA ($4.62) and breaking above the next resistance at the 200-day MA ($4.98) could act as the springboard for the next rally. In that case, potential upside targets lie around $5.66 and $6.28.

On the flip side, if APT loses the 100-day MA support, the bullish fractal setup would weaken, leaving the token vulnerable to another round of consolidation.