Mixed Fortunes for PUMP Traders: Nearly Half in Profit, Others Deep in the Red

Pump.fun rolls out its “Project Ascend” reforms, aiming to strengthen its ecosystem and boost PUMP’s token price.

On-chain data shows that nearly half of Pump.fun’s PUMP token holders are in profit, while the other half are sitting on steep losses.

On September 12, blockchain analytics platform Bubblemaps, citing Dune Analytics data, reported that out of more than 270,000 wallets, roughly 130,000 addresses are in profit, while a slightly larger share remains underwater.

On-chain Data Reveals Sharp Divide in PUMP Traders’ Profits and Losses

According to the firm, the numbers reveal how profits and losses diverge across different tiers of traders.

Bubblemaps pointed out that nearly 10,000 traders have cleared over $1,000, totaling around $332 million. Another 2,000 wallets crossed the $10,000 threshold, with cumulative profits above $311 million.

50% of $PUMP traders are now in profit270k+ onchain traders• 1 made $10M+ (Wintermute)• 30 made $1M–$10M• 400 made $100k–$1M• 2,000 made $10k–$100k• 10,000 made $1k–$10k• 120,000 made <$1k

— Bubblemaps (@bubblemaps) September 12, 2025

At the top, just under 400 wallets earned over $100,000, generating $264 million, while 28 wallets exceeded $1 million in returns. Meanwhile, one major trader alone has captured more than $10 million in profits.

Yet the gains tell only half the story.

According to Bubblemaps, the steepest losses came from nearly 9,000 wallets that each dropped more than $1,000, together forfeiting $332 million. Another 1,800 traders lost more than $10,000 apiece, with their combined red ink totaling $312 million.

Meanwhile, 343 traders have each lost an average of over $100,000, which amounts to more than $265 million. At the same time, 30 traders have lost more than $1 million each, and their total losses equal $177 million.

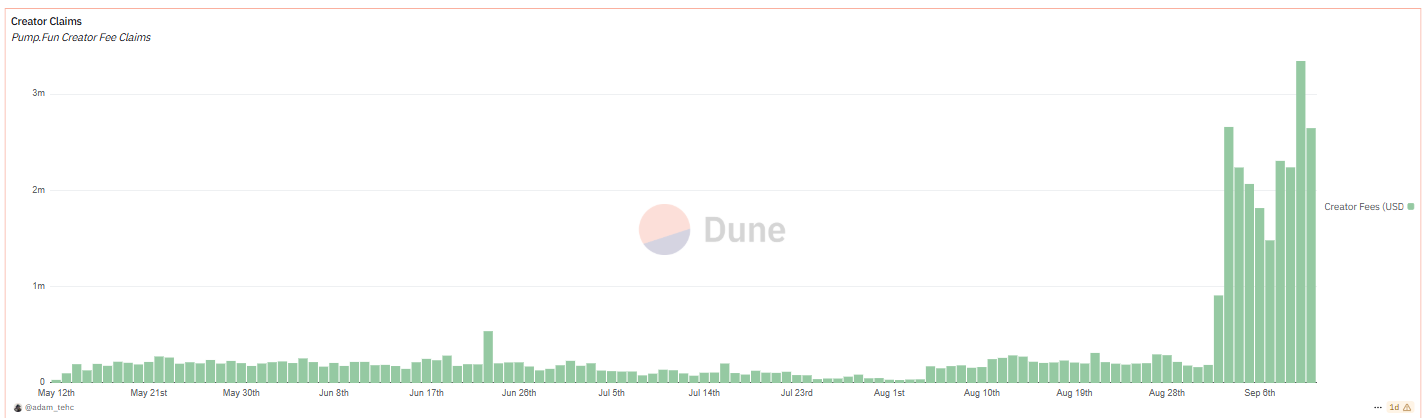

The uneven distribution of wins and losses comes as Pump.fun rolls out Project Ascend, a reform initiative launched in early September.

A key feature of the upgrade, “Dynamic Fees,” lowers project costs as their market caps expand. This mechanism is designed to deter short-term rug pulls and other exploitative launches.

By linking fees to market performance, Pump.fun is betting that stronger projects will thrive while low-quality scams become less attractive to deploy.

The program has already distributed nearly $20 million to token creators and played a pivotal role in Pump.fun’s recent market ascension.

Pump.Fun’s Creator Claims. Source:

Pump.Fun’s Creator Claims. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

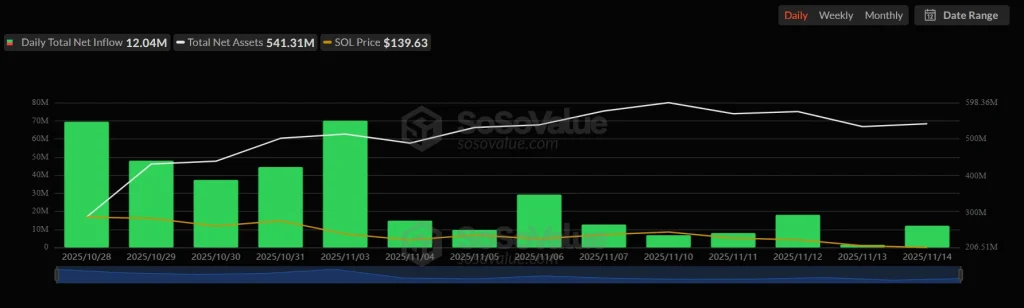

Solana Price Drops to $140, Is a Fall to $134 the Next Move?

Dogecoin Price Sinks to New Lows, Can Bulls Regain $0.171 Soon?

Is Ethereum Starting Its Own Bitcoin-Style Supercycle? Tom Lee Weighs In

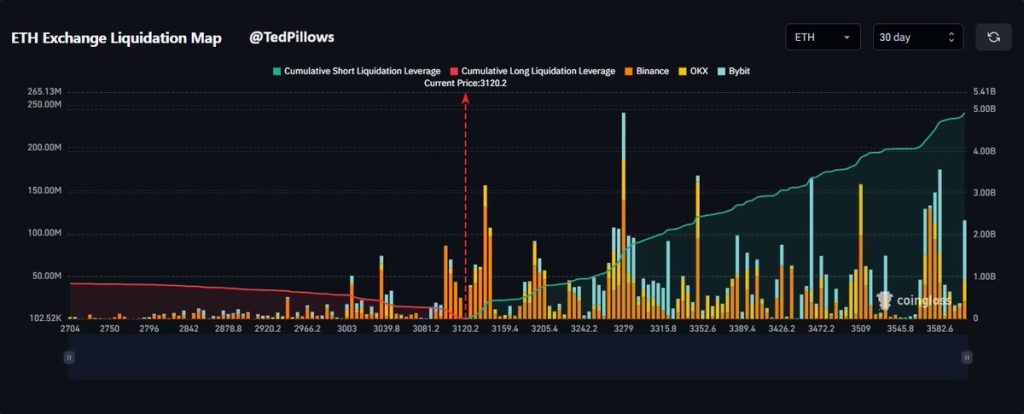

Ethereum Price Analysis: ETH Eyes $3,600 Liquidation Zone as BTC Crashes—Is a 12% Rebound Coming?