Solana breakout is approaching as support holds at $239 and $224, backed by institutional treasuries raising over $2 billion in SOL. Strong realized-price concentrations at these levels and heavy early accumulation create a firm base that increases the probability of a sustained upside move for SOL.

-

Support: $239 and $224 act as confirmed defense zones for SOL, backed by high realized volume.

-

Institutional demand: Treasuries and funds are raising $2B+ in SOL, increasing long-term bid.

-

Accumulation: Early ranges between $1–$150 show concentrated holdings, signaling robust network adoption.

Solana breakout: Support holds at $239 and $224 while treasuries raise $2B+ in SOL, increasing confidence and upside potential. Read analysis and key levels now.

Solana nears breakout as support holds at $239 and $224 while institutional treasuries raise billions, boosting adoption and confidence.

What is driving the Solana breakout setup?

Solana breakout setup is driven by two converging forces: confirmed support at $239 and $224 and rising institutional treasury accumulation. These price bands show concentrated realized-volume clusters, while treasury raises worth billions of dollars are increasing structural demand for SOL.

How do realized-price distributions confirm support levels?

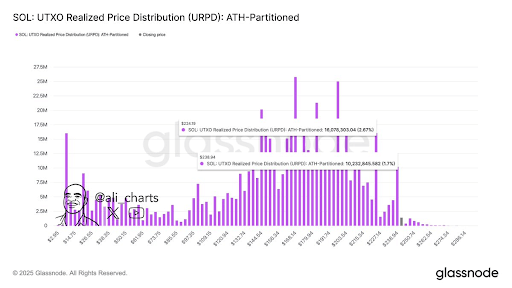

The UTXO Realized Price Distribution shows heavy volumes at key bands. At $224.19, over 16 million SOL changed hands (about 2.67% of supply). At $238.94, roughly 10 million SOL (≈1.7% of supply) transacted. These concentrations create liquidity zones that are commonly defended by long-term holders.

Source: Ali

How are accumulation zones shaping Solana’s market structure?

Early accumulation ranges provide the deepest market depth. Heavy trading between $50 and $150 reflects early breakout phases and creates a wide base for price discovery. Lower bands between $1 and $25 show the single highest concentration of realized prices, indicating widespread early participation in SOL.

Recent activity above $200 is more dispersed, which is consistent with profit-taking and portfolio rebalancing as institutional and retail holders adjust positions. That pattern can produce short-term volatility while preserving longer-term structural support.

Why do institutional treasuries matter for SOL’s outlook?

Institutional treasuries materially increase long-term demand and reduce circulating supply pressure. Pantera Capital is reported to be raising $1.25 billion for a Nasdaq-listed Solana treasury vehicle, starting with $500 million and adding $750 million via warrants. Separately, a consortium including Galaxy Digital, Jump Crypto, and Multicoin Capital is raising approximately $1 billion for another Solana-focused treasury.

Collectively, treasuries already manage over 11 million SOL—valued at up to $2.84 billion—according to market reporting. Some firms are staking holdings to earn yield, further tightening accessible supply and reinforcing price support.

Frequently Asked Questions

What are the key support levels for Solana right now?

The primary supports are $239 and $224, supported by high realized-volume clusters (16M SOL at $224.19 and 10M SOL at $238.94) that act as institutional and retail defense zones.

How much institutional capital is flowing into Solana treasuries?

Institutions and funds are raising more than $2 billion combined for Solana treasuries, including a reported $1.25 billion raise linked to Pantera and about $1 billion from a consortium of firms.

Does early accumulation increase breakout probability?

Yes. Heavy early accumulation between $1 and $150 created broad market depth and long-term holder conviction, which typically raises the odds of sustained upside when higher-level supports hold.

Key Takeaways

- Confirmed supports: $239 and $224 are defended by concentrated realized-volume clusters.

- Institutional demand: Treasuries raising $2B+ add durable buy-side pressure and staking activity.

- Accumulation base: Early ranges (especially $1–$150) provide a deep foundation for future price discovery.

Conclusion

Solana’s price structure, anchored by strong realized-price clusters at $224 and $239 and bolstered by multi-billion-dollar institutional treasuries, suggests a higher-probability breakout scenario for SOL. Traders should watch these support bands and treasury activity as leading indicators of durable market direction.