Will MicroStrategy Become the Biggest Bitcoin Bubble? The Truth Behind 638,000 BTC and Potential Systemic Risks

Since 2020, MicroStrategy has gradually transformed itself from a software company into the world's largest corporate bitcoin holder. As of now, its holdings have reached 638,460 BTC, accounting for nearly 3% of the total circulating supply.

In the eyes of the public, this seems to be the strongest endorsement and belief in bitcoin; however, after an in-depth study of its financing structure and market logic, we must admit: this company may also be the biggest potential risk point in the bitcoin market.

From Software Company to “Bitcoin Fund”

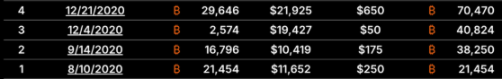

MicroStrategy’s bitcoin purchases began in 2020, when CEO Michael Saylor called bitcoin “digital gold.”

Since then, the company has raised more than $8 billions through bond and stock issuances, continuously increasing its bitcoin holdings.

Its average holding cost is close to $73,000 per BTC, which is higher than the current market price.

Essentially, MicroStrategy is no longer a traditional software company, but a highly leveraged bitcoin fund.

Stock Price and the Faith Bubble

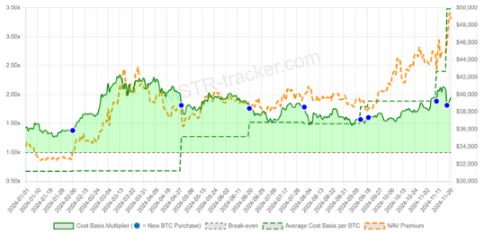

Before the launch of bitcoin ETFs, MicroStrategy stock (MSTR) once became an alternative channel for investors to gain BTC exposure:

Investors buying MSTR were essentially making an indirect bet on bitcoin.

The stock price has long traded at a premium of 2–3 times its net asset value (NAV) of held bitcoin.

This premium relies entirely on the market’s trust and enthusiasm for Saylor, rather than the company’s fundamentals.

Once market confidence wavers and the stock price premium evaporates, MicroStrategy’s refinancing channels will be instantly cut off.

Centralization Risk and the Paradox of Bitcoin’s Spirit

The core value of bitcoin lies in decentralization, yet MicroStrategy alone controls nearly 3% of the supply.

This centralization risk means: if the company is forced to sell due to debt or operational pressure, the market will face a systemic shock.

“If even MicroStrategy can sell, who wouldn’t?” This fear could trigger a chain reaction, similar to the market collapses of Mt.Gox or 3AC.

Leverage and the Countdown

MicroStrategy’s bitcoin purchases mostly rely on rolling debt and equity financing:

As debts gradually mature after 2026, the company will face enormous repayment pressure.

If the capital markets no longer support its stock issuance for fundraising, selling bitcoin is almost the only option.

Once liquidation begins, the impact of 638,000 BTC could directly crush market liquidity and trigger cascading panic.

Conclusion

The story of MicroStrategy reveals a paradox in the crypto market:

Its continuous buying has given bitcoin institutional legitimacy and accelerated global adoption;

But at the same time, it has also become the biggest centralization risk in the entire system.

Today, everyone is cheering for MicroStrategy’s buying, but at the same time, everyone is worried about one question: when it stops buying, or even starts selling, will it become the black swan that breaks the market?

The future of bitcoin may still be bright, but we must face the reality: MicroStrategy is not the eternal savior, and it could also be the trigger for the next crisis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens