Seven Days, Seven DAOs: Proposal for Governance and Market Flows

From Scroll’s governance suspension to Hyperliquid’s USDH battle and Ronin’s Ethereum migration, this week’s DAO proposals could reshape liquidity, incentives, and investor sentiment across DeFi.

Seven major DAO proposals emerged during a turbulent week, including Scroll’s governance shift and the USDH ticker dispute on Hyperliquid. Strategic moves from Ronin and dYdX also contributed to the significant proposals.

These decisions impact their respective ecosystems and could directly affect investors.

DAOs Heat This Week

Over the past seven days, key proposals and debates across major DAOs have painted a volatile picture of on-chain governance. From a Layer-2 (L2) project suspending its DAO operations to crucial votes deciding the future of stablecoins and buyback trends being considered by multiple protocols, the DAO market is hotter than ever.

One of the most shocking announcements came from Scroll, which revealed it would suspend its DAO and change to a more centralized model. This move raises significant questions about the balance between development speed and the philosophy of decentralization. In an era where L2 networks are fiercely competitive, Scroll’s “taking the reins” could allow faster upgrades — but also stir community concerns over transparency and user participation.

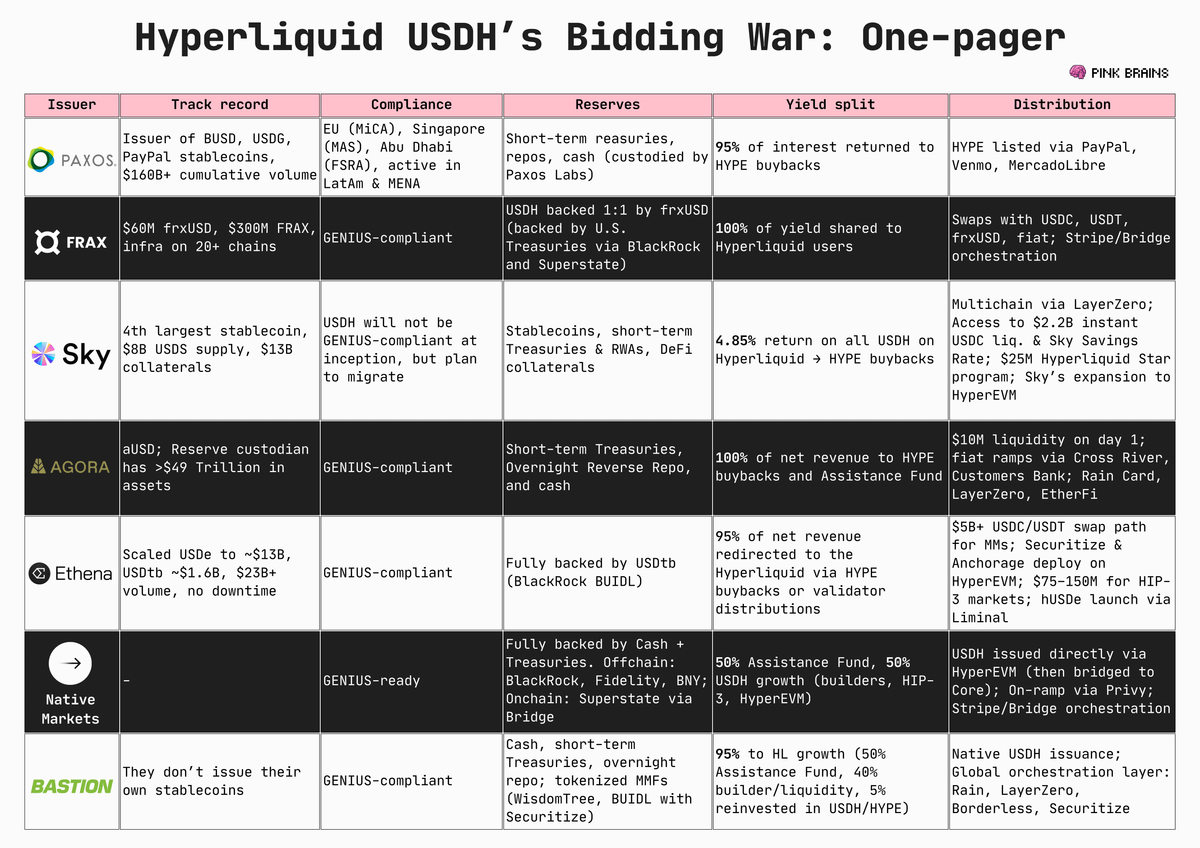

The second central focal point is the validator vote on Hyperliquid (HYPE) to determine ownership of the USDH ticker — one of the platform’s most liquid stablecoins. If control ends up in the hands of a specific group, it could directly impact stablecoin development strategies and trading fees. This battle may reshape capital flows on Hyperliquid and influence the broader DeFi ecosystem.

USDH ticker war. Source:

USDH ticker war. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes’ New Article: BTC May Drop to 80,000 Before Kicking Off a New Round of “Money Printing” Rally

The bulls are right; over time, the money printer will inevitably go “brrrr.”

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.