Author: rafi

Translation: TechFlow

Key Points

-

Dominance of Singapore Dollar-Pegged Stablecoins: XSGD is the only issuer of stablecoins pegged to the Singapore dollar. With partnerships with Grab and Alibaba, XSGD dominates the Southeast Asian local stablecoin market.

-

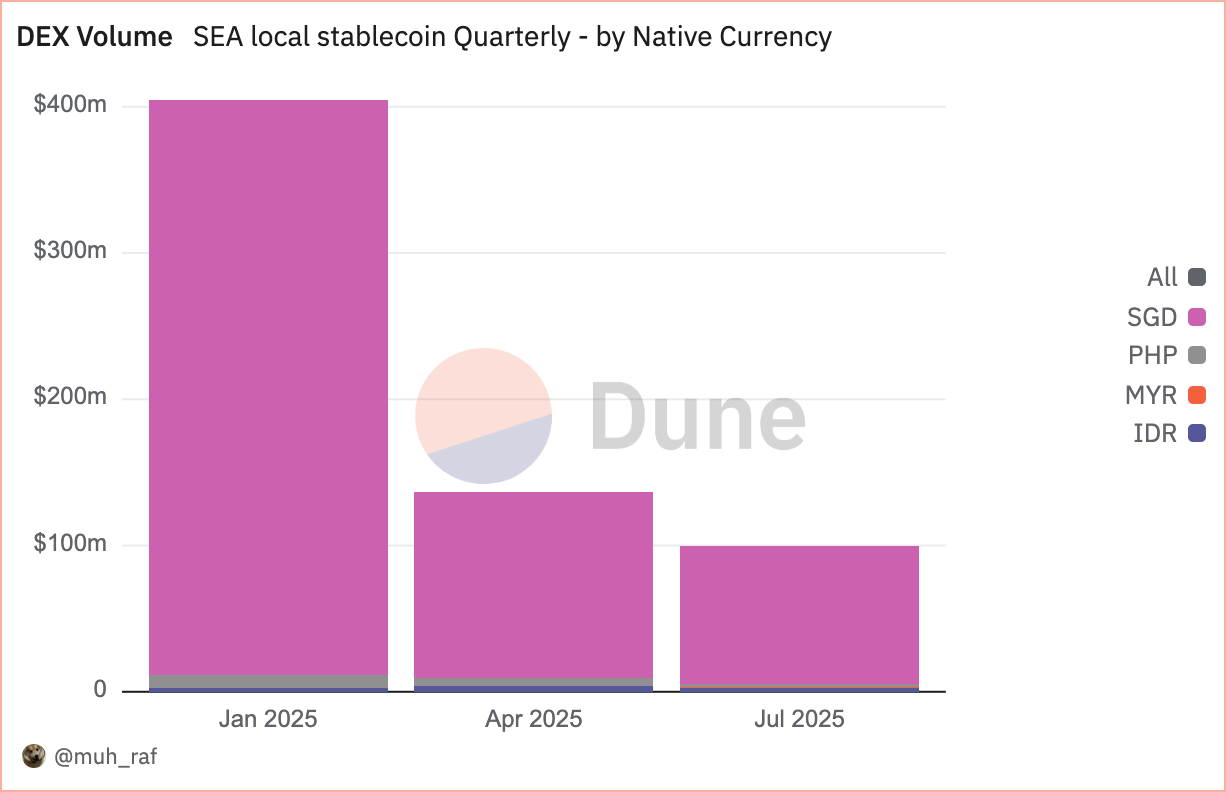

Market Indicators: Operating on more than 8 EVM chains, with 8 issuers and support for 5 local currencies. In Q2 2025, decentralized exchange (DEX) trading volume reached $136 million (mainly on Avalanche and in SGD), down 66% from Q1’s $404 million.

-

Regulatory Progress: The Monetary Authority of Singapore is advancing a stablecoin framework for SGD and G10 currency-pegged SCS; Indonesia and Malaysia have launched regulatory sandbox trials.

-

Cross-Border Trade: In 2023, only 22% of Southeast Asia’s trade occurred within the region, with overreliance on the US dollar resulting in costly delays and fees. Local stablecoins can streamline settlements by providing instant, low-cost transfers, further accelerated by the ASEAN Business Advisory Council’s (ASEAN BAC) regional QR code payment initiative.

-

Financial Inclusion: Over 260 million people in Southeast Asia remain unbanked or underbanked. Non-USD stablecoins, once integrated into super app wallets like GoPay or MoMo, can expand access to affordable financial services, supporting remittances, microtransactions, and daily digital payments.

The combined GDP of Southeast Asia (SEA) is $3.8 trillion, with a population of 671 million. As the world’s fifth-largest economy, it competes with other major economies and boasts 440 million internet users, driving digital transformation.

Against this backdrop of economic vitality, non-USD stablecoins and digital currencies pegged to regional or basket currencies offer transformative tools for Southeast Asia’s financial ecosystem. By reducing reliance on the US dollar, these stablecoins can enhance cross-border trade efficiency, stabilize intra-regional transactions, and promote financial inclusion among diverse economies.

This article explores why non-USD stablecoins are vital for Southeast Asian financial institutions and policymakers aiming to shape a resilient, integrated economic future.

Trading

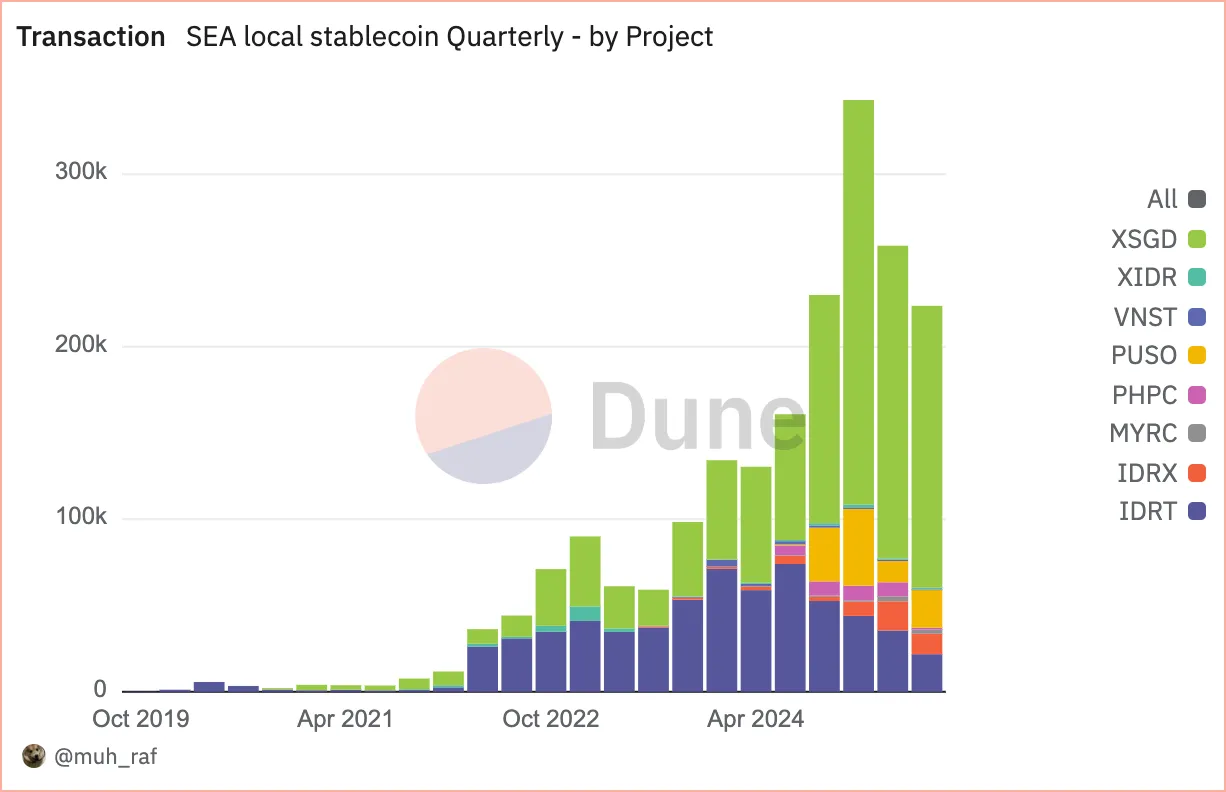

Since January 2020, the adoption rate of non-USD stablecoins in Southeast Asia has risen rapidly, growing from just 2 projects initially to 8 projects by 2025. This growth is driven by increased trading volume and the use of diverse blockchain platforms.

In Q2 2025, non-USD stablecoins in Southeast Asia saw 258,000 transactions, with stablecoins pegged to the Singapore dollar (SGD)—especially XSGD—accounting for 70.1% of the market share, followed by stablecoins pegged to the Indonesian rupiah (IDR) (IDRT and IDRX), which made up 20.3%. This reflects robust regional economic activity and regulatory support, highlighting their key role in Southeast Asia’s digital economy.

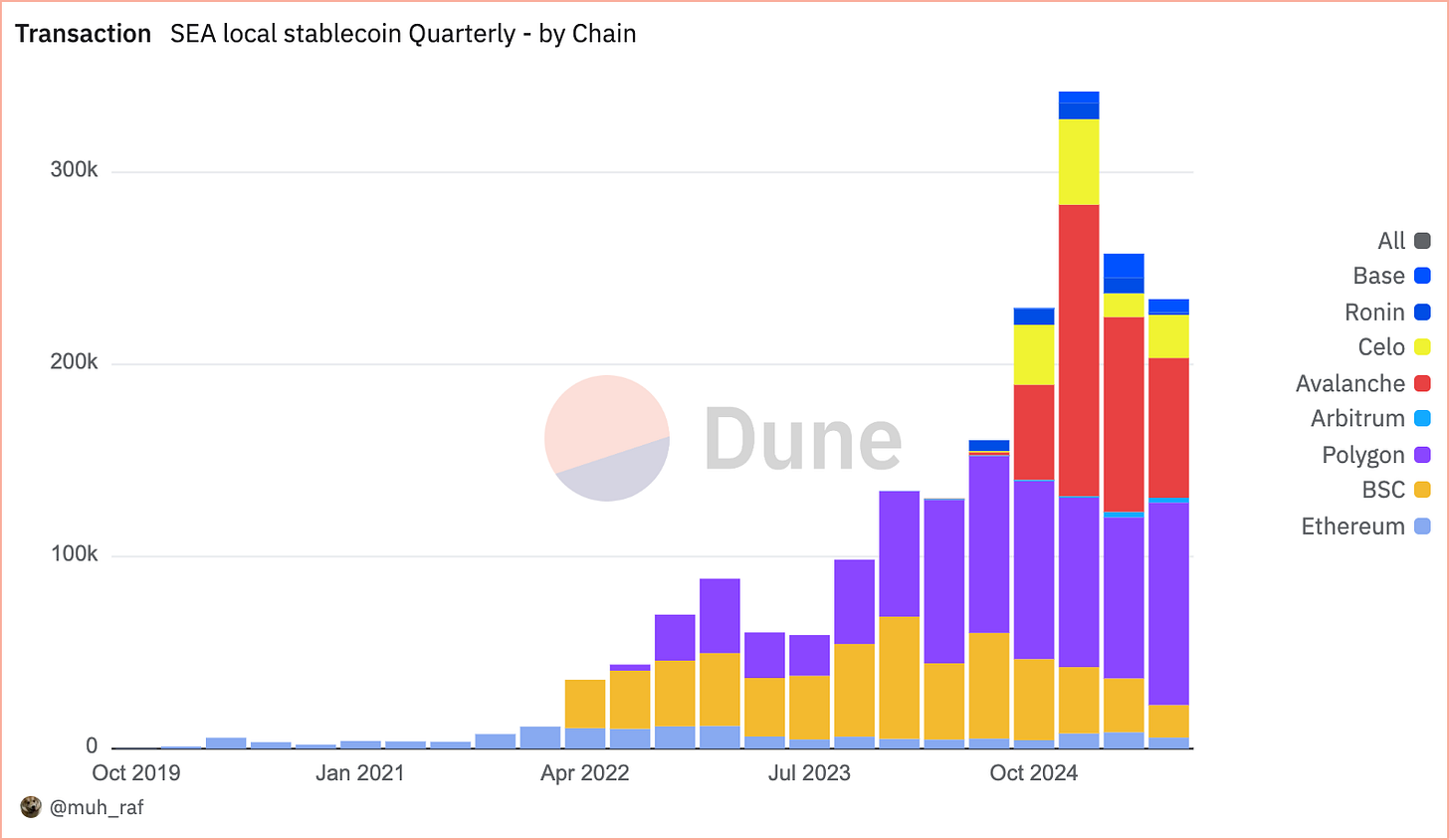

Over the past four years, since 2020, non-USD stablecoin transactions in Southeast Asia have exceeded 1 million, thanks to widespread adoption and strong exposure on EVM chains, which have continued to lead market share growth quarter by quarter. In Q2 2025, Avalanche led with a 39.4% market share (101,000 transactions), followed by Polygon (83,000 transactions, 32.5%) and Binance Smart Chain (28,000 transactions, 10.9%). Avalanche’s rapid rise is mainly attributed to the XSGD project, currently the only stablecoin operating on Avalanche, which has gained significant traction since its launch. XSGD is a stablecoin pegged 1:1 to the Singapore dollar, issued by StraitsX. StraitsX is a major payment institution licensed by the Monetary Authority of Singapore (MAS).

Active Addresses

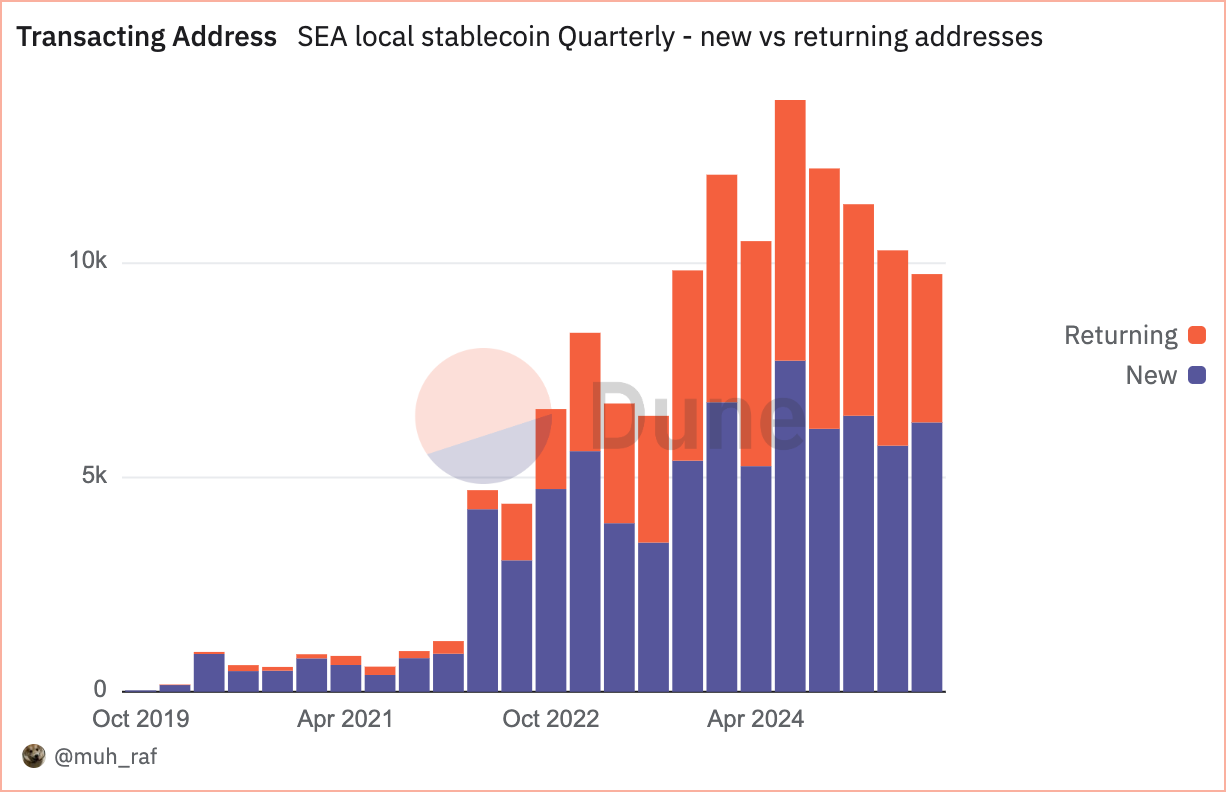

Since Q2 2025, non-USD stablecoins in Southeast Asia have seen widespread adoption, with the number of active (transaction) addresses increasing significantly to over 10,000, including 4,558 returning addresses and 5,743 new addresses, indicating steady growth and increased engagement among stablecoin users.

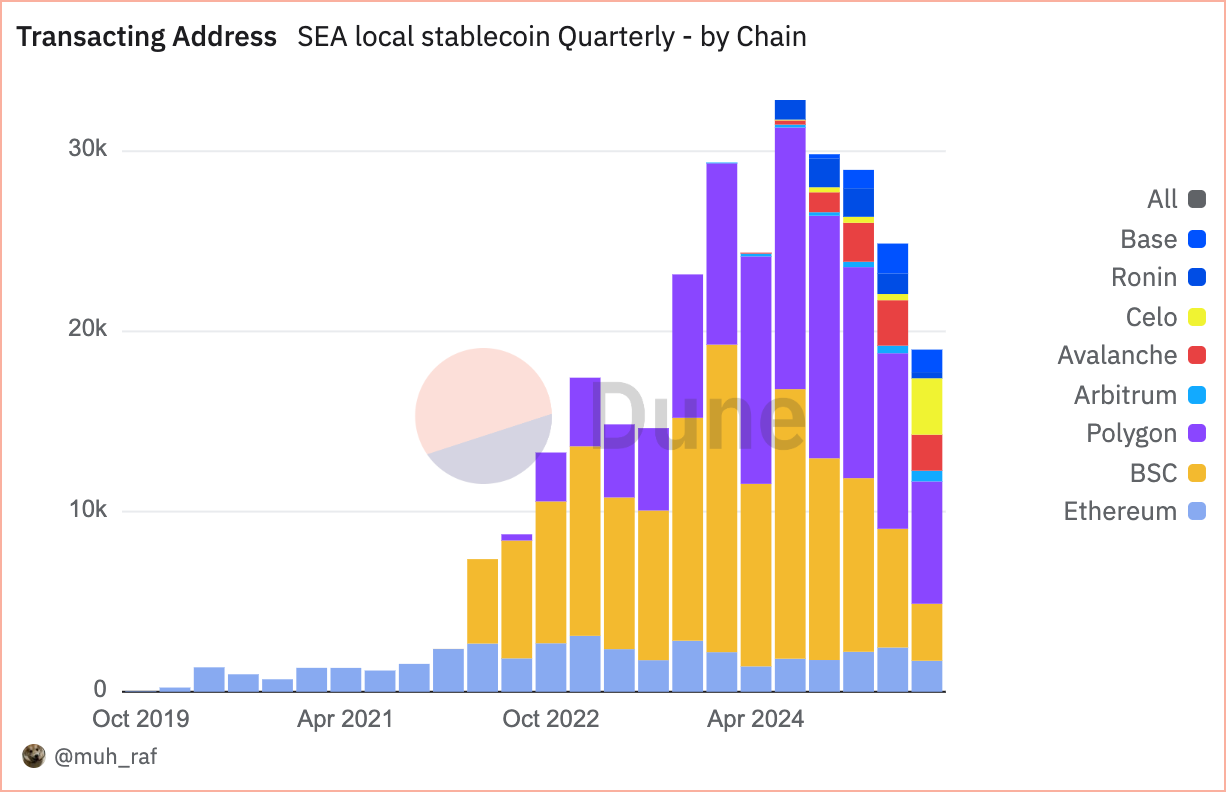

Unlike transaction counts, which reflect overall activity, active (transaction) addresses indicate user engagement and adoption. In Q2 2025, among non-USD stablecoins in Southeast Asia, Polygon led with a 39.2% share, followed by Binance Smart Chain (BSC) with 23.1%, and Avalanche with 10.1%.

Note: In the “grouped by chain” view, addresses transacting stablecoins across multiple chains (such as Polygon and Base) are counted as separate addresses on each chain, so the total is higher than in the “ungrouped” (deduplicated) view.

DEX Trading Volume

In Q2 2025, DEX trading volume fell 66% from $404 million in Q1 to $136 million. Avalanche led with a 51% share ($69 million), followed by Polygon at 33% ($45 million), and Ethereum at 9% ($12 million). This decline highlights the trend toward blockchain scalability, with Avalanche and Polygon taking the lead.

As previously mentioned, in Q2 2025, DEX trading volume denominated in local currencies reached $132 million, with Singapore dollar-pegged stablecoins dominating the Southeast Asian non-USD stablecoin market. SGD-denominated assets accounted for 93.1% ($127 million), followed by Philippine peso (PHP) at 3.9% ($5 million), and Indonesian rupiah (IDR) at 2.7% ($3.6 million). This underscores the dominance of the Singapore dollar in regional DEX activity.

Southeast Asian Stablecoins: Opportunities and Challenges

Opportunities

-

Enhancing Cross-Border Trade Efficiency

In 2023, intra-regional trade in Southeast Asia accounted for 22% of total trade, but transactions typically go through US dollar-based correspondent banks, resulting in high fees and delays of up to two days. Stablecoins pegged to Southeast Asian currencies offer a more efficient alternative, enabling near-instant settlement at lower cost. Building on this, the ASEAN Business Advisory Council (BAC) has adopted cross-border QR code payments settled in local currencies. BAC’s collaboration with Southeast Asian stablecoin issuers is expected to further reduce remittance costs and improve exchange rates.

-

Promoting Financial Inclusion

Southeast Asia has 260 million people who are unbanked or underbanked. Non-USD stablecoins can fill the gap in financial services. Mobile-based stablecoin wallets integrated with platforms like Indonesia’s GoPay or Vietnam’s MoMo can enable low-cost remittances and microtransactions.

Challenges

-

Regulatory Uncertainty and Fragmentation

The region’s diverse regulatory frameworks create uncertainty for stablecoin issuers and users. National policies vary greatly—for example, Singapore’s approach is more progressive, while other countries have stricter regulations—which may lead to compliance challenges and uneven adoption.

Recommendation: Southeast Asian policymakers should collaborate to develop a unified regulatory framework for stablecoins, with clear guidelines on licensing, consumer protection, and anti-money laundering (AML) compliance to build trust and consistency.

-

Market Volatility and Currency Peg Risks

Stablecoins pegged to regional currencies are susceptible to local currency fluctuations, which may undermine their stability and user confidence. Insufficient or poorly managed reserves can further exacerbate risks.

Recommendation: Stablecoin issuers should maintain transparent, fully-backed reserves and undergo regular independent third-party audits. Diversifying the basket of pegged currencies can also mitigate volatility risks.

Conclusion

In Q2 2025, the Southeast Asian non-USD stablecoin market saw significant growth, led by XSGD—the only issuer pegged to the Singapore dollar—driven by partnerships with Grab and Alibaba. Operating on more than 8 EVM chains, with 8 issuers and support for 5 local currencies, DEX trading volume reached $136 million, mainly on Avalanche and in SGD, but down 66% from Q1’s $404 million. The Monetary Authority of Singapore (MAS) advanced a stablecoin framework for SGD and G10 currencies, while Indonesia and Malaysia introduced regulatory sandboxes.

This growth highlights the potential of non-USD stablecoins to enhance cross-border trade and financial inclusion in Southeast Asia. However, regulatory fragmentation, currency volatility, cybersecurity risks, and uneven digital infrastructure must be carefully managed to achieve sustainable development.