Many people instinctively adopt this narrative: "Traditional card trading is inefficient, and on-chain solutions address this issue." But if you delve into the TCG market, you'll find that's not the case.

1. The TCG Secondary Market Was Standardized in the Internet Era

The secondary market for trading card games (TCG) has long been very mature in Europe and the US. There is a closed loop of: "Grading—Vault—Trading—Supporting Services" .

1) Grading: Provides authentication and condition assessment, and assigns a grade.

Unlike authentication in the second-hand luxury or vintage market—which is more about "sellable/not sellable + general condition" and serves as a price reference, with obvious price arbitrage across regions—TCG grading is almost an absolute price anchor, with clear price ladders between grades.

Main participants include:

- @PSAcard The world's largest grading agency

- @beckettcollect Known for a more detailed grading system

- @CGCCards Started with comic book grading, fast and cheap

2) Vault: Provides card storage to avoid risks from cross-border shipping.

These vault providers are often deeply integrated with trading markets. Most vault service providers have their own auction platforms or are directly connected to trading markets, allowing users to "consign with one click" after vaulting. This model is similar to how traditional art auction houses (like Christie's and Sotheby's) have their own storage vaults seamlessly linked to their auction business. Main participants include: - @FanaticsCollect Owns an auction house, has high-end card inventory

- @GoldinCo Under PSA, high-end card auctions + vault

- @eBay Integrates trading and vaulting, highest coverage

3) Marketplaces: The main venues for price discovery and liquidity aggregation for cards.

TCG trading markets are divided into two types: one is direct trading markets, where both buyers and sellers can place orders, and buyers can also choose to buy directly at the seller's listed price—essentially the same experience as NFT trading markets, except card market pricing is anchored and referenced by grading, making it more orderly. The other is auction markets, where transactions are completed through bidding. High-end cards are often sold via auction, which sets the price and then transmits it to the entire market. Main participants include:

- @eBay The world's largest, with massive transaction data

- @TCGplayer North America, aggregates offline store inventory

- @CardmarketMagic Europe's largest card market

- @GoldinCo PSA's high-end card auction venue

- @FanaticsCollect High-end collectible auctions and direct sales

4) Supporting Services (Data, Insurance, Logistics): Supporting links and infrastructure for trading services.

Main participants include:

- Data platforms: PokémonPrice, eBay, etc.

- Insurance: Collectors Insurance Service, etc.

- Logistics: FedEx, DHL, etc.

2. The Real Growth Driver for TCG RWA: Blind Boxes

In a trading market that relies heavily on network effects and liquidity scale, and where most card users are already accustomed to traditional channels like eBay, it's extremely difficult to compete for pricing power and price discovery on-chain.

And if you actually visit the Marketplace pages of these TCG RWA platforms, you'll find that transaction activity is generally very low, further illustrating that replacing traditional trading markets on-chain is not so easy—especially in RWA categories where user experience is highly dependent on offline infrastructure (grading, vaulting, logistics, insurance), making it even more challenging.

Moreover, most core players in the TCG industry chain often span multiple segments (grading + vault + integrated auction/trading), which means that simply building an "on-chain trading market" will not create a moat. So where is the real source of these platforms' rapid growth? The answer is: Blind Boxes (Hypergamblification)

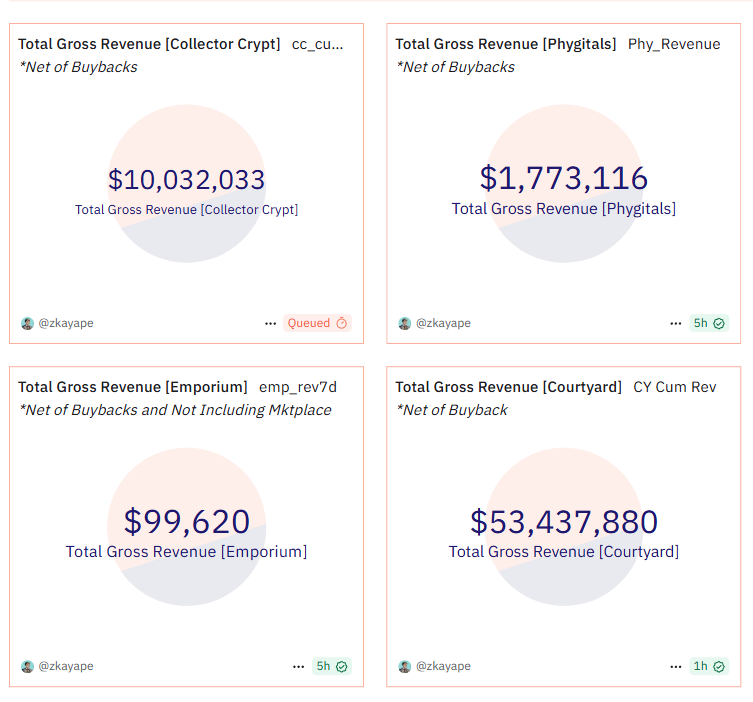

That is, they are not providing a card trading market, but are selling financial blind boxes that have been repackaged. This provides a gambling-like unboxing experience, allowing users to pay for uncertainty and sensory stimulation. For example:

- @Courtyard_io Closer to "on-chain unboxing," digitizes physical card packs, and users open the pack and get results immediately after purchase;

- @Collector_Crypt , @Phygitals , @TCG_Emporium directly introduce the Japanese gashapon/vending machine mechanism, where users "insert coins" to randomly draw cards.

So where do the cards in these blind boxes come from? Some come from platform inventory (pre-purchased graded cards), and some come from user consignment (the platform offers a guaranteed minimum selling price).

In addition, since these platforms only sell graded cards with clear scores, price references, and liquidity, the platforms often provide buyback/resale guarantees: if users are not satisfied with the card they draw, they can sell it back to the platform at a preset price, and the platform will repackage the card into a new blind box for the next user to try their luck, creating a cycle. So once you start, it's hard to stop.

3. Opportunities Amid Cultural Differences and Regulatory Gaps

But can't web2 internet do card blind boxes? Of course it can, but there are significant restrictions, especially in Europe and the US. On the live e-commerce platform @Whatnot in the US, although some streamers do card breaks, there are very strict rules that explicitly prohibit any gambling-related "repackaged" probability-based gameplay.

As for major platforms like eBay, they emphasize transparency and compliance even more, prohibiting the sale of "mystery blind boxes" or "guaranteed packs," and only allowing standardized trading. In other words, in the European and American markets, any gameplay involving probability + monetary consideration quickly touches the gambling regulatory red line.

In East Asian markets, however, the situation is completely different:

- Japan is completely different. Lucky bags and gashapon culture are deeply ingrained and have become part of the entertainment industry, with local online blind box card-drawing platforms like Clove, and card-drawing gameplay is almost second nature to users.

- China previously had KAYOU, then Pop Mart, and Xianyu dominates the second-hand circulation market. This type of gameplay is often classified as a consumer product rather than a financial product. Searching for "card unboxing" on Douyin yields a plethora of live unboxing streams running 24/7. Some even offer "betting pack" modes (e.g., open several packs in a row, guaranteeing at least one premium card), and some streamers provide a resale option. Under the continuous hype and atmosphere created by attractive streamers, there are countless people spending lavishly just to win a rare card.

However, East Asia's infrastructure (grading, vaulting, insurance, etc.) is not well developed, price transparency is lacking, and trading scale is limited. At the same time, the popular IPs for card unboxing in China are mostly local content, which is disconnected from globally popular IPs like Pokémon and MTG, making the market even more fragmented. This indirectly gives these TCG RWA platforms an opportunity. In the context of regulatory ambiguity and the difficulty of on-chain regulation, they graft East Asian-style gambling blind box culture onto TCG cards, package it as "RWA innovation," and find a new growth logic under the banner of "on-chain trading market."

4. Hypergamblification Has Become a Trend What TCG RWA is essentially doing is using financialization to help the traditional card market with distribution and user acquisition.

After users draw cards, if they don't resell them to the blind box platform, they will most likely go back to Web2 platforms like eBay or TCGplayer to cash out. But their momentum confirms a trend: hypergamblification. That is, everything can be wrapped in an "entertainment, financialization" shell and packaged as a new product.

Gambling is no longer an accessory, but has become the core. This provides a new narrative for IP monetization: not just "physicalization," but a combination of "finance + entertainment." Not just "consumer goods," but "financial experience goods."

If in the past, we tended to believe: After NFT-ization and going on-chain, the ultimate goal was DeFi-ization, such as using it as collateral for loans, which was considered the "final use case." Now and in the future, we can completely believe: Adding a "financialized gaming experience" can itself be the end goal.

The value of NFTs does not necessarily have to extend into lending or derivatives markets, but can directly form an independent and sustainable consumption scenario through "entertainment + finance," as already validated by Pop Mart and blind box card unboxing. In the crypto-native context, this trend has a huge impact:

IP Companies: Greatly enhance the profitability of native crypto IPs.

For example, it will greatly inspire the card series issued by penguin @pudgypenguins ecosystem project @Ocapgames @vibes_tcg and serve as a model for the subsequent commercialization of the acquired @moonbirds series NFTs.

NFT Infrastructure: Massive on-chain issuance will directly drive demand for upstream NFT protocols and tools.

For example, @metaplex on Solana, which is not only the NFT issuance standard, but also a full-stack tool for minting and circulation.

Gamblification Tech Stack

With the rise of gamblification, Gamblification itself needs to develop a set of "hypergamblification engines" covering probability mechanisms, incentive distribution, and other abstract layer designs. @multiplierfun is a representative project focused on this field. Although it is currently only experimenting with fungible tokens, its mechanism can be horizontally applied to NFTs, cards, collectibles, and other scenarios, thus becoming a universal gamblification underlying module.

Original Link