Rumors of token issuance intensify: A look at 10 ecosystem layouts of Polymarket

Author: Zhou, ChainCatcher

Original Title: Polymarket Hints at Token Launch, A Review of 10 Ecosystem Projects

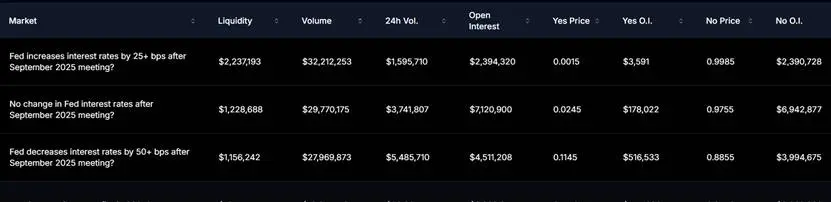

Polymarket has almost become synonymous with prediction markets. Public information shows that since the beginning of this year, Polymarket's monthly trading volume has repeatedly reached the $1 billion level, creating a significant gap with the second-ranked Kalshi. The project has not only received tens of millions of dollars in investment from Donald Trump Jr., but is also preparing to return to the US market and is advancing a new round of financing. The market even claims its valuation could reach $10 billion.

Against this backdrop, a batch of third-party ecosystems has emerged around Polymarket, including data/dashboards, social experiences, front-end/terminals, insurance, AI agents, and more. On September 12, RootData included some representative projects in its "Polymarket Ecosystem Projects" collection, which will be introduced one by one in this article.

Polysights|One-stop Analysis Dashboard

Polysights is a one-stop analysis dashboard centered around Polymarket. Users can quickly filter topics and expirations, and the page simultaneously provides key metrics such as price/trading volume history, order book depth and spread, and capital flows. The built-in AI summary and arbitrage/trading indicators help identify mispricing opportunities within or across markets. The platform supports watchlists and instant alerts, and offers trader/market leaderboards. It compresses "topic selection, analysis, and alerts" into one screen, reducing page switching and manual comparison, making entry decisions faster and cost estimates more intuitive.

Polymarket Analytics|Official Statistics Platform

Polymarket Analytics is the official statistics platform launched by Polymarket. Users can search for markets or addresses to pull up trading volume, open interest, price/trade history curves, as well as profit and loss and position changes for addresses, and can export CSV files for review. The platform does not pursue flashy visualizations, but excels in complete fields and stable metrics, making it suitable for media writing, investment research comparison, and monthly/quarterly report production, as well as for data forensics and chart generation.

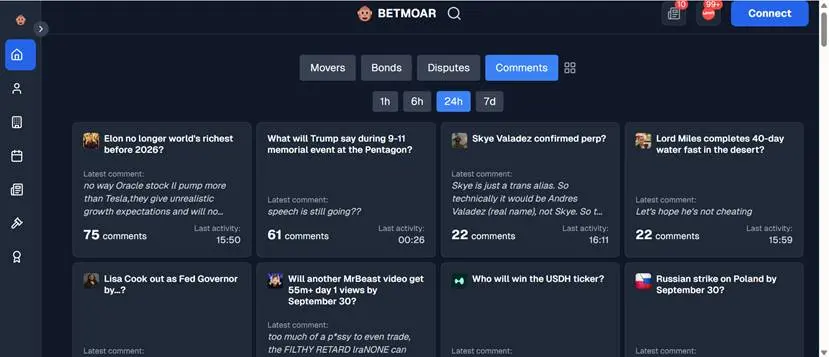

Betmoar | Third-party Discovery/Monitoring Frontend

Betmoar is a third-party discovery and monitoring frontend that aggregates Polymarket markets into a dashboard. Its homepage divides markets into four views: Movers (ranked by 1h/6h/24h/7d price changes and trading volume), Bonds (focusing on deposit/staking dynamics and risk capital changes), Disputes (markets in arbitration or judgment stages), and Comments (summarizing the latest comments and activity for each market). Users can filter with one click or sort by trading volume to quickly determine the hottest/newest events, but order placement still redirects to the official Polymarket page for completion.

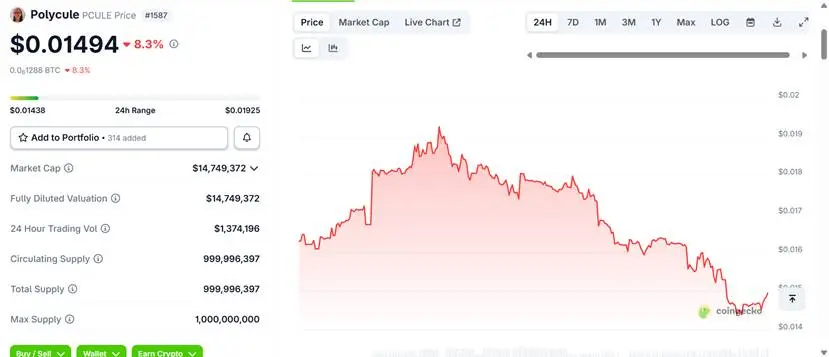

polycule|Polymarket's Telegram Trading Bot

polycule is a Telegram trading bot integrated with Polymarket, allowing users to search markets, view key order book data, and directly place YES/NO orders within the chat window, making it more suitable for mobile light-entry scenarios. For new users, polycule has a built-in Solana → Polygon bridge (using deBridge), and can automatically convert small amounts of SOL to POL for gas, reducing the cost and hassle of initial participation.

In May 2025, polycule issued the token PCULE, which currently has a market cap of about $14.75 million. In June, the team announced a $560,000 investment from AllianceDAO; in the same month, X and Polymarket announced an official partnership, boosting the exposure and distribution of prediction markets on mainstream social platforms. Such external traffic entry points also indirectly benefit tool-type products built around Polymarket.

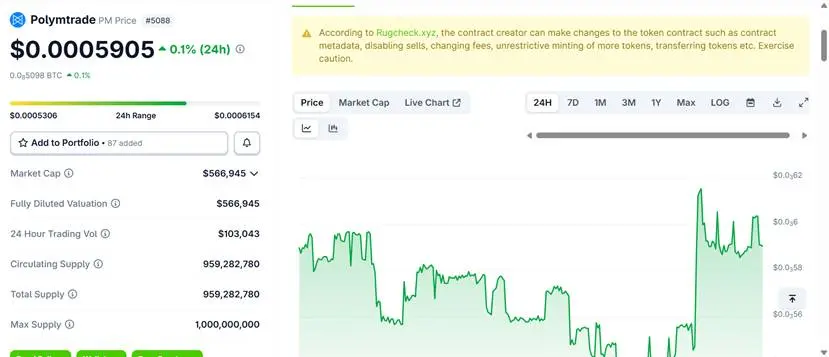

Polymtrade | Trading Terminal

Unlike polycule, Polymtrade is a heavy-duty trading terminal for Polymarket. It uses a multi-panel layout, placing market data, order book/depth, orders, and positions on the same screen, and supports keyboard shortcuts and batch order placement. In addition, its order window displays estimated slippage and fees, and the combined view can be sorted by topic or expiration, making it convenient for hedging and grid management. The project's value lies in compressing the "view market—place order—adjust position" process into a few steps, making the Polymarket experience closer to that of an intraday exchange. Its token PM was launched in July, currently with a market cap of about $560,000.

fireplace|Social Trading Information Feed

fireplace focuses on the social experience of Polymarket prediction markets, presenting the latest trading activities of accounts followed by users on Polymarket in an information feed format, and allows commenting, replying, and copying of any trade.

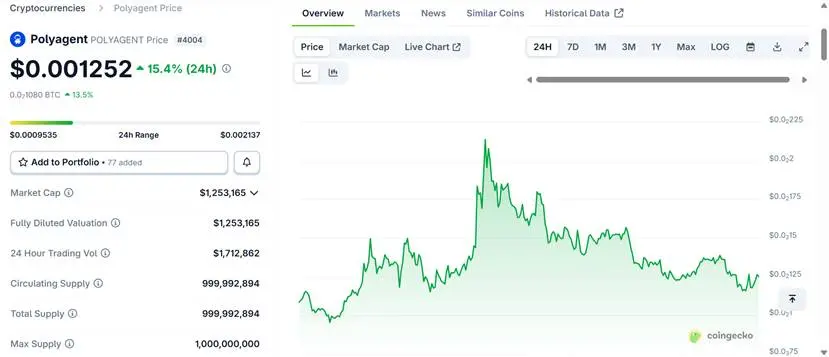

Polyagent | AI Assistant/Research Tool

Polyagent is an AI assistant/research tool built around Polymarket, focusing on intelligence aggregation and analysis. The platform emphasizes using models + retrieval to interpret market conditions. The official announcement states that over 1,500 Polymarket markets have been indexed, providing search and chat functions, and recently launched features such as tag search. Its token POLYAGENT was launched on September 8, currently with a market cap of about $1.25 million.

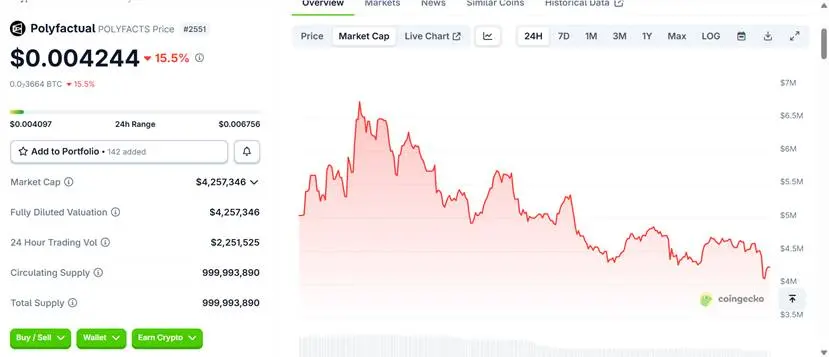

Polyfactual|Insurance + Arbitrage Dual Lines

Polyfactual is a risk control and strategy platform for prediction markets. The official business is currently split into two lines: using part of the funds to underwrite abnormal market risks, and using another part to profit from price differences between two platforms.

-

Insurance side (Project X): Issues tokens tied to specific event outcomes, with raised funds entering a "reinsurance/liquidity" pool. When a market experiences abnormal judgment/settlement, these funds provide protection for participants, essentially adding a buffer layer to the platform's judgment process. Token holders share premiums/returns according to rules, while also bearing corresponding risks.

-

Arbitrage side (Project Y): By running cross-platform bots, it continuously monitors Polymarket and platforms like Kalshi. Once it detects price discrepancies for the same event, it simultaneously buys and sells to lock in the spread, and the resulting profits are distributed to POLYFACTS holders/stakers according to their holdings/stake ratios. Its token POLYFACTS was launched on September 2, currently with a market cap of about $4.26 million.

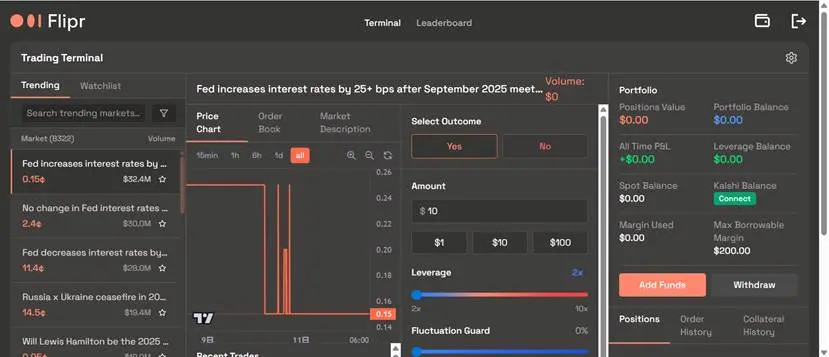

Flipr|Strategic Trading Bot

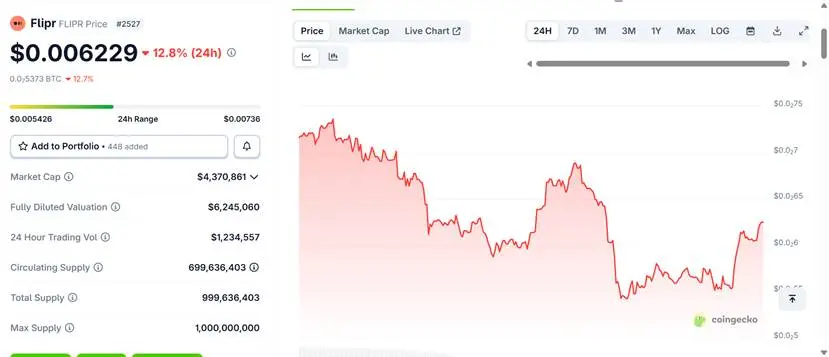

Flipr is a strategic Polymarket trading bot. Users can configure trigger conditions (price reached, spread narrowed, volume surged, keywords appeared, etc.) and execution rules (order quantity, slippage limit, batch entry/exit, auto position reduction before expiration), allowing it to run continuously in the background. For users who don't want to monitor the market but have clear rule-based trading strategies, Flipr can turn specific operational ideas into executable strategies. Its token FLIPR was launched on July 11, currently with a market cap of about $4.37 million.

Billy Bets AI|AI Agent for Sports Scenarios

Billy Bets AI focuses on AI agents for the sports sector. After selecting a league/team, the system directly summarizes recent performance, injuries, schedule, and market odds, provides probabilities and recommendations for win/loss/spread/over-under, and attaches links to related Polymarket sports events, allowing users to place orders with one click. The project's feature is connecting data and betting, making it a time-saving pre-game intelligence + execution combo for high-frequency sports users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Universal Exchange

This article will explore how Coinbase's diversified businesses work together to achieve its vision.

DeFi faces a potential $8 billion risk, but only $100 million has exploded so far

Interview with RaveDAO Head of Operations: Breaking Barriers with Music, Enabling Real Users to Onboard to Blockchain Seamlessly

RaveDAO is not just about organizing events; it is creating a Web3-native cultural ecosystem by integrating entertainment, technology, and community.

Behind the x402 Craze: How ERC-8004 Builds the Trust Foundation for AI Agents

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”