XRP Rally Collapses; Futures Bets Signal More Pain Ahead

Ripple’s XRP is losing momentum as traders pile into shorts and key support levels face pressure, raising the risk of a deeper pullback.

Ripple’s XRP has tumbled since reaching a 30-day high of $3.18 on Saturday, losing nearly 10% in just three days.

The pullback has raised fresh concerns with on-chain and technical data suggesting that the decline may not be over yet.

XRP Bears Take Charge

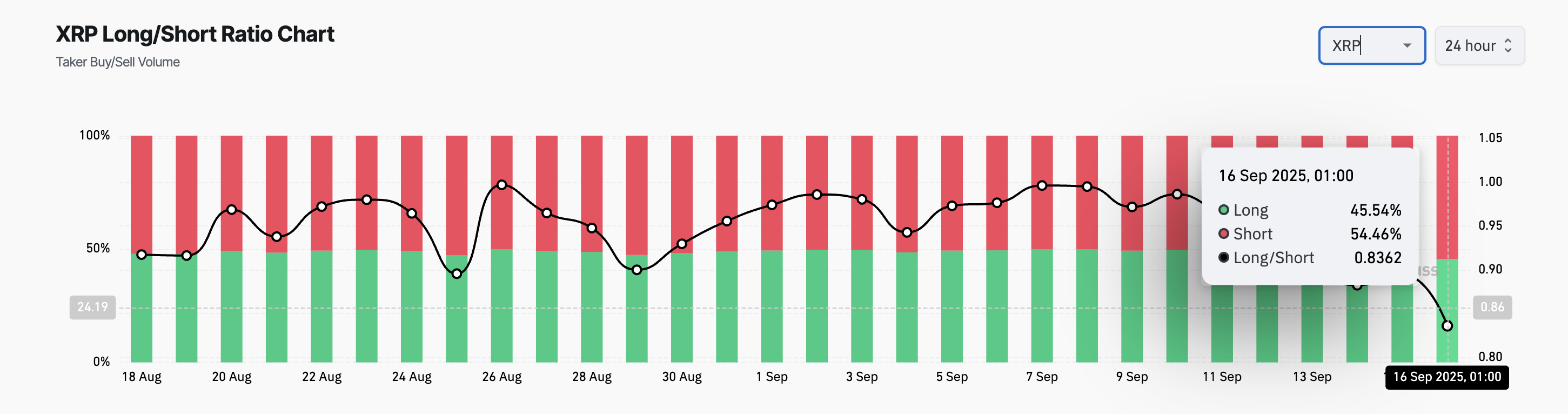

Data from derivatives markets indicates mounting bearish pressure. Per Coinglass, XRP’s long/short ratio has dropped to a 30-day low of 0.83, suggesting that many traders are betting on further downside through short positions.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

XRP Long/Short Ratio. Source:

Coinglass

XRP Long/Short Ratio. Source:

Coinglass

An asset’s long/short ratio compares the number of its long and short positions in the market. When its value is above 1, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

Conversely, as is the case with XRP, when the ratio is under one, most traders are positioning for a price drop. This indicates that its futures traders no longer view the token’s momentum as sustainable. Instead, they are gearing up for a deeper retracement.

Moreover, readings from the XRP/USD one-day chart show that the altcoin is trading near its 20-day Exponential Moving Average (EMA) and appears poised to break below it.

XRP 20-Day EMA. Source:

TradingView

XRP 20-Day EMA. Source:

TradingView

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When prices hold above this moving average, it reflects underlying bullish momentum and investor confidence.

However, XRP’s current struggle near this level signals that buyers are losing control. A decisive breach of the 20-day EMA would confirm a bearish flip in market sentiment, opening the door for more losses as selling pressure worsens.

XRP at Risk of July Lows if Bulls Fail to Hold Support

A break below the 20-day EMA could trigger an XRP price decline toward $2.8786. If the bulls fail to defend this support floor, the altcoin could face a further dip to $2.6371, a low it last reached in July.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, an uptick in fresh demand would invalidate this bearish outlook. In this scenario, XRP could regain strength and climb to $3.2226.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gemini 3 arrives late at night: surpasses GPT 5.1, the era of Google large models has arrived

Google has defined it as an “important step towards AGI” and emphasized that it is currently the world’s most advanced agent in terms of multimodal understanding and depth of interaction.

Cloudflare Outage Sparks Global Disruptions Across Crypto Platforms and Major Web Services

U.S. Moves Toward Joining Global Crypto Reporting Network as CARF Review Reaches White House

Crypto: Trump Prepares a Global Tax Hunt