Next Technology Holding Plans $500M Stock Sale to Expand Bitcoin Treasury Holdings

Contents

Toggle- Quick Breakdown:

- Next technology holding expands Bitcoin holdings strategy

- Market and regulatory context

Quick Breakdown:

- Next Technology Holding, China’s largest Bitcoin treasury firm, filed to sell $500 million worth of common stock to fund additional Bitcoin purchases.

- This move reflects a strategic attempt to increase Bitcoin holdings despite global regulatory pressures.

- The firm’s decision signals ongoing institutional confidence in Bitcoin’s long-term value, affecting market dynamics and investor perceptions.

Next technology holding expands Bitcoin holdings strategy

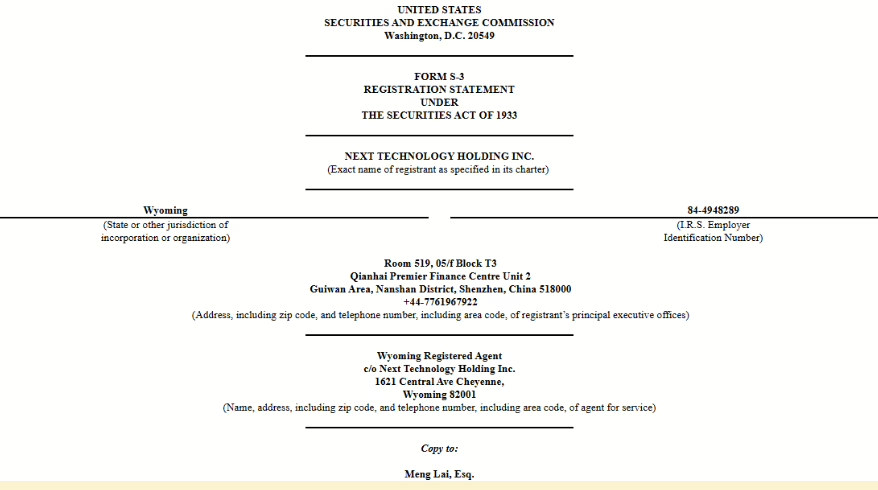

According to a SEC filing , Next Technology Holding, China’s biggest publicly traded Bitcoin treasury firm, has announced plans to sell up to $500 million in common stock. The capital raised will primarily support further Bitcoin acquisitions, reinforcing the company’s position as a significant institutional investor in the cryptocurrency space. This filing comes amid rising interest from institutional investors looking to deepen exposure to Bitcoin, despite recent global regulatory scrutiny and market fluctuations.

Source

:

SEC

Source

:

SEC

The firm’s recent move suggests a strong belief in Bitcoin’s long-term potential as a store of value, even as regulatory environments adapt and evolve. Increasing Bitcoin treasury reserves positions the company to capitalize on potential future price appreciation, underscoring a bullish outlook from a major market player.

Market and regulatory context

This decision unfolds as the broader crypto market navigates an environment marked by regulatory updates and new financial product launches, such as ETFs for XRP and Dogecoin. Concurrently, some firms face price volatility and bearish pressure. Next Technology Holding’s capital raising and planned acquisition strategy contrasts with these challenges, highlighting a diverging institutional approach based on conviction in Bitcoin’s fundamentals.

The strategic sale signifies not just an expansion of assets but also confidence in Bitcoin’s resilience amid market noise. Investors may read this as a signal of institutional-level endorsement of Bitcoin’s investment thesis. The firm continues to shape market sentiment by increasing its crypto treasury, potentially influencing other institutional players and portfolio managers.

In another development, the healthcare technology company, Semler Scientific, has announced an ambitious plan to significantly increase its Bitcoin holdings, aiming for 105,000 BTC by 2027. This strategy, despite a current slump in the company’s stock, is to be financed through equity, debt, and operational cash flow, reflecting a strong belief in Bitcoin as a corporate treasury asset.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.