Fed's Powell Dismisses Expectations of Sharp Rate Cuts, U.S. Treasury Yields Rise

ChainCatcher news, according to Golden Ten Data, Federal Reserve Chairman Jerome Powell stated that Wednesday's rate cut was a risk management decision, and there is no need to adjust rates quickly. As a result, market expectations for a significant rate cut have been dispelled. U.S. Treasury bonds subsequently declined, and Treasury yields rose. Gennadiy Goldberg, Head of U.S. Rates Strategy at TD Securities, pointed out that Powell was reluctant to express an overly dovish stance, which affected the movement of interest rates.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik: We need an on-chain gas futures market

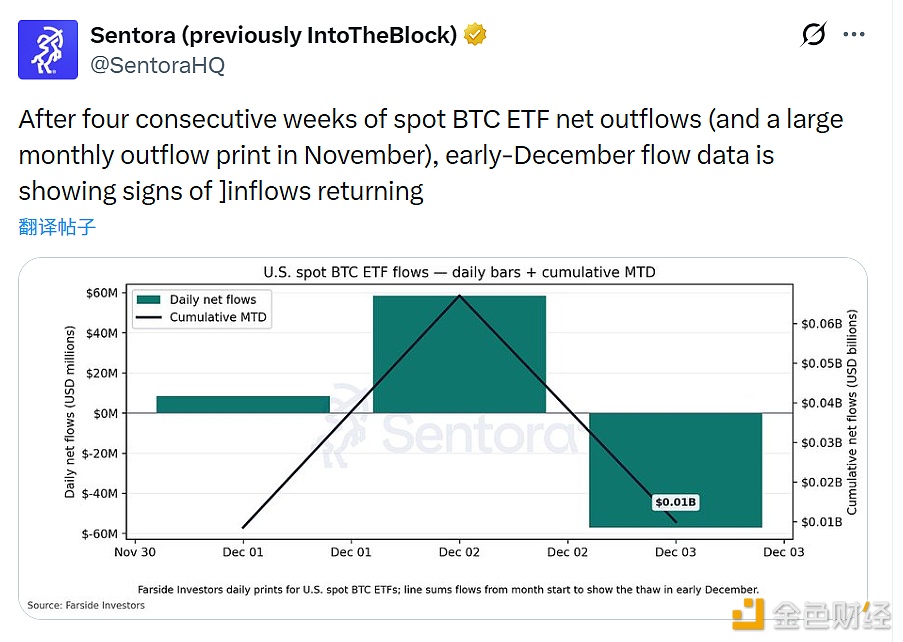

Bitcoin spot ETF fund flows in early December show signs of inflows recovering