Ethereum Tests Support: Holder Conviction Sets Stage for a Rebound to $4,775

Ethereum price slipped below $4,500, but nearly $8 billion in maturing ETH supply signals strong investor conviction. If ETH reclaims support, a rally toward $4,775 and new highs could follow.

Ethereum has seen a 4% decline in recent days, pulling the altcoin king just under $4,500.

While this short-term dip may concern some traders, the long-term outlook remains bullish as strong fundamentals and investor behavior suggest resilience ahead.

Ethereum Supply Is Maturing

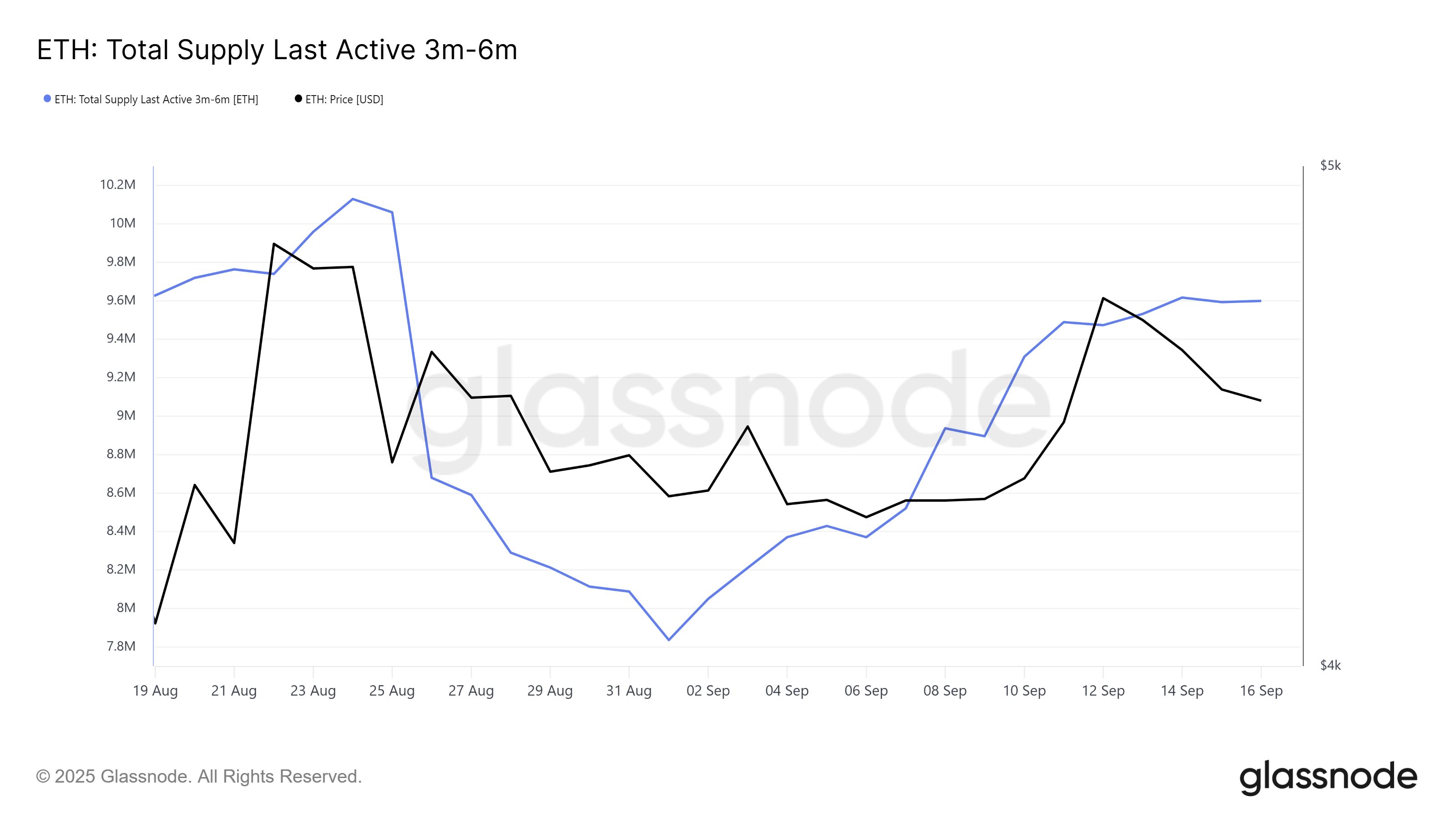

Ethereum supply has matured significantly, reinforcing investor confidence in the asset’s long-term strength. Since the beginning of the month, the 3-6 month-old supply has grown by 1.76 million ETH, now valued at nearly $8 billion. This indicates that holders refrained from liquidating even during market volatility.

Such conviction suggests that investors anticipate higher prices and are willing to ride out short-term declines. By keeping ETH locked, these holders are reducing the circulating supply, which can create favorable conditions for upward price momentum when demand returns. This behavior is a bullish foundation for Ethereum’s growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

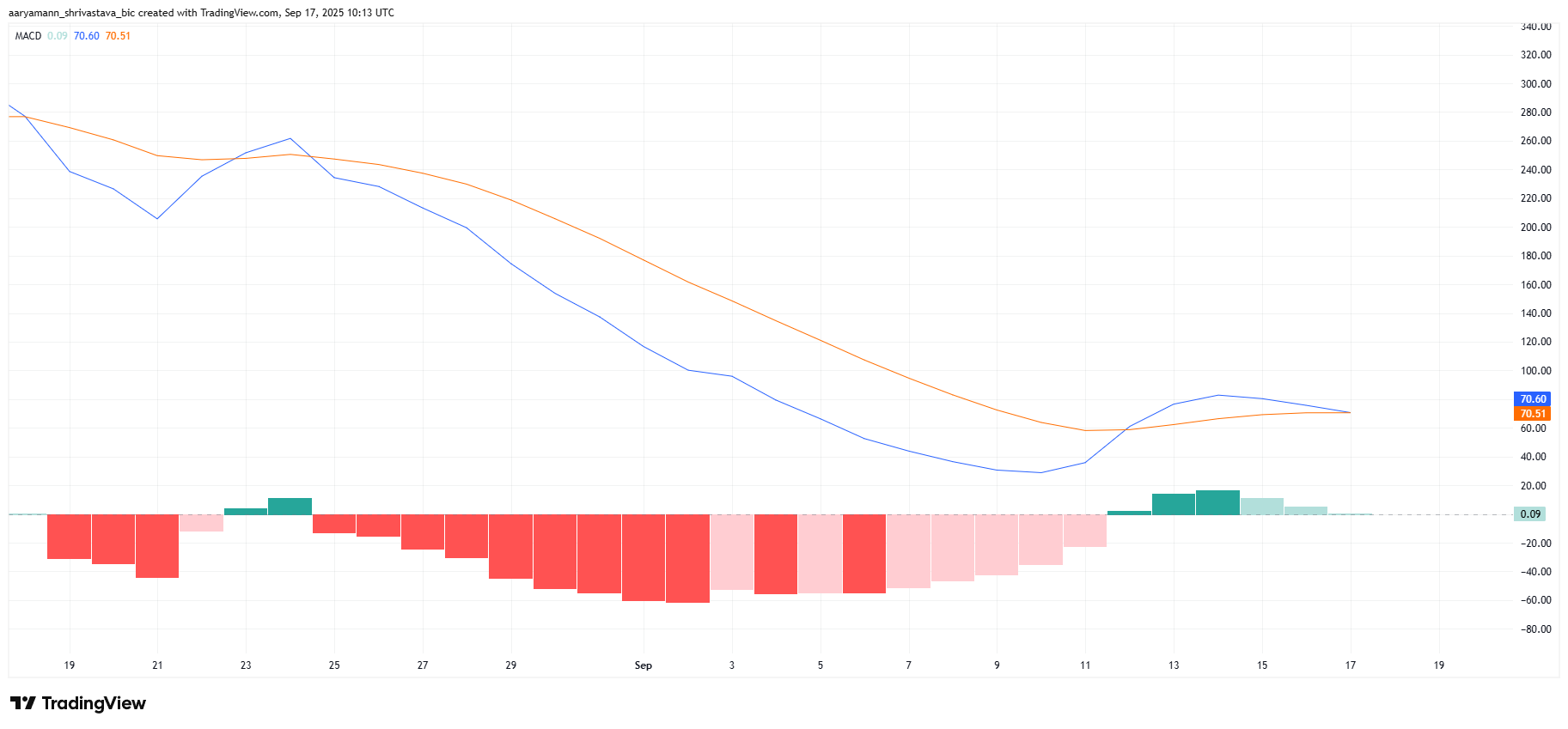

On the technical side, Ethereum’s momentum appears mixed in the near term. The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover, signaling the possibility of short-lived downside pressure. This aligns with ETH’s recent price slip below the $4,500 level.

However, the broader market cues remain constructive. Even if the MACD confirms a bearish crossover, investor sentiment and maturing supply could support a quick recovery. Such dynamics highlight that any decline would likely be temporary, with ETH primed for a strong rebound soon after.

ETH MACD. Source:

TradingView

ETH MACD. Source:

TradingView

ETH Price Could Bounce Back

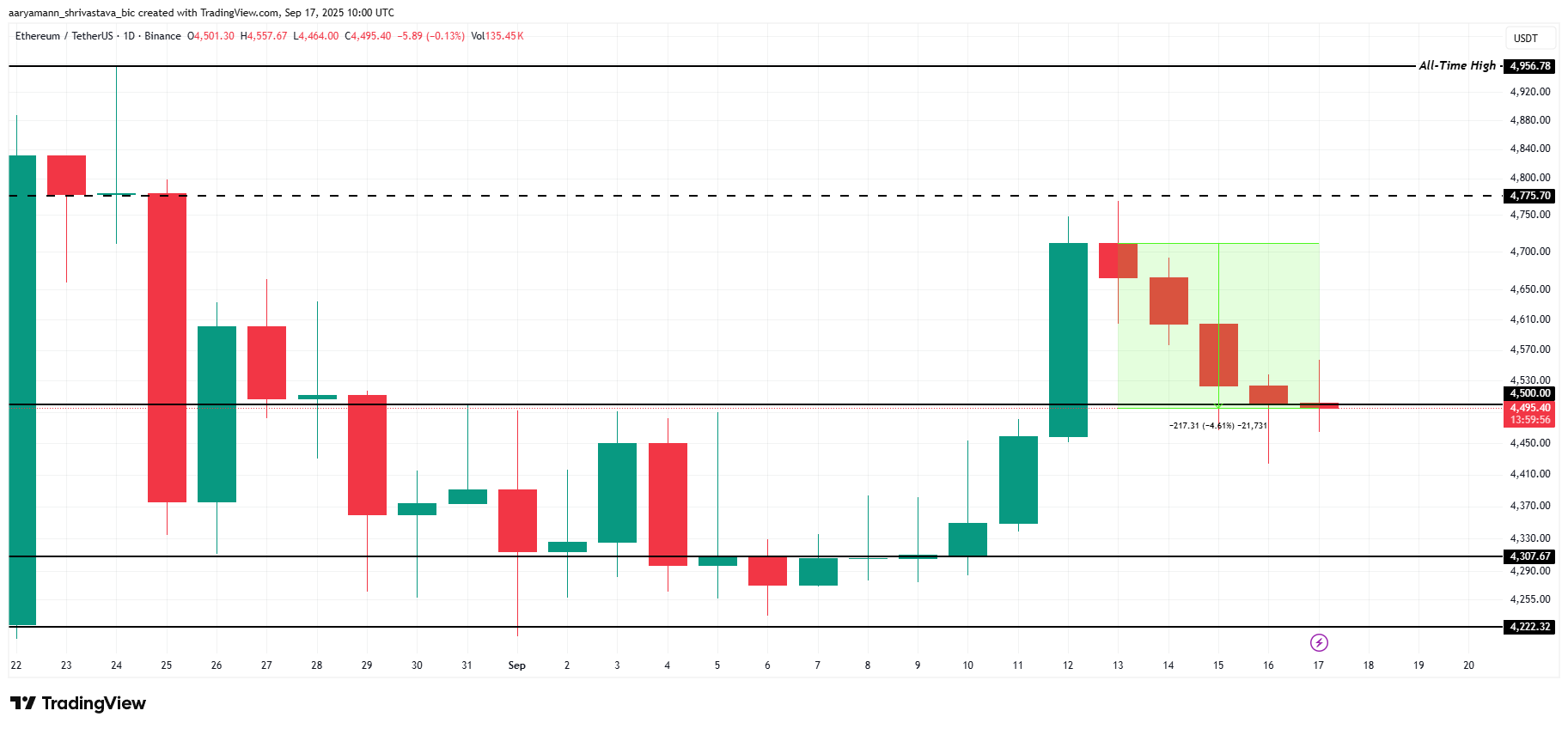

Ethereum is currently trading at $4,495, just below the $4,500 support line. It has not yet closed below $4,500, so the support is still valid.

The maturing supply and bullish long-term outlook indicate that Ethereum could bounce from the support. With fewer coins entering circulation, the altcoin has structural support for renewed upward momentum to $4,775 despite short-term volatility.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if the price closes below the support, ETH may slip toward $4,307, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.