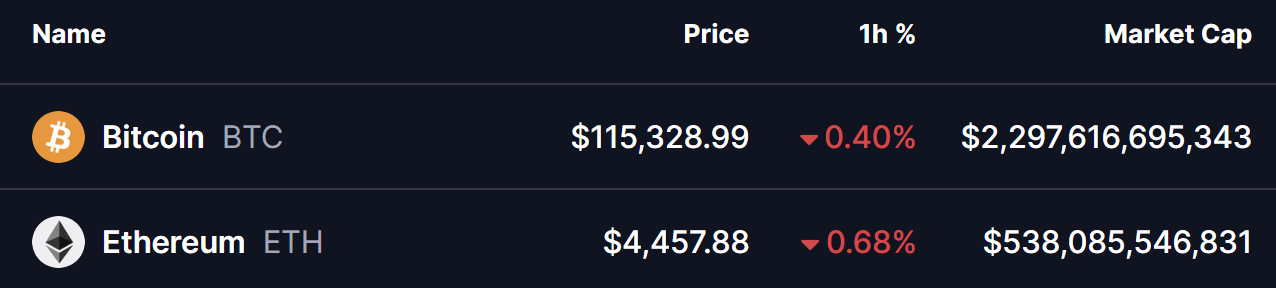

The cryptocurrency market is feeling a sudden surge in volatility as Bitcoin (BTC) and Ethereum (ETH) both slipped into red territory in the last trading hour, reacting sharply to the latest policy decision from the U.S. Federal Reserve.

Source: Coinmarketcap

Source: Coinmarketcap

Fed Cuts Rates by 25 Basis Points

In a long-awaited move, the Federal Reserve’s Federal Open Market Committee (FOMC) announced a 25 basis point (0.25%) cut to its benchmark federal funds rate on Wednesday, lowering it from the 4.25%-4.50% range to 4.00%-4.25%.

This marks the first rate reduction of 2025 and signals a clear policy shift, as the central bank looks to support growth amid a cooling labor market and moderating inflation.

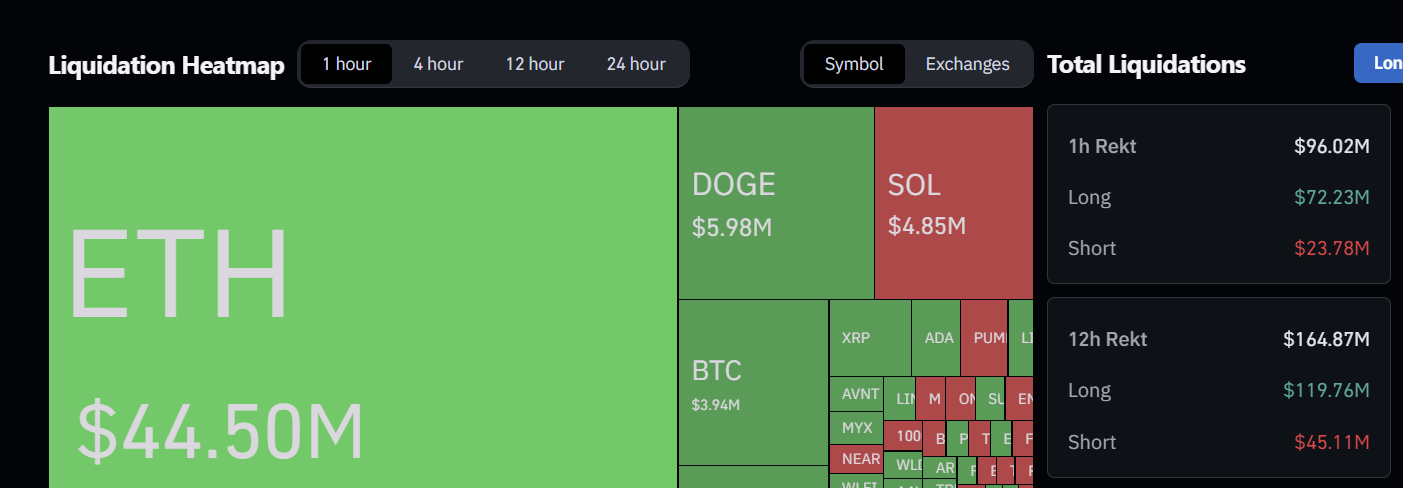

Leveraged Liquidations Spike

According to Coinglass data, the sudden swings in price during the past hour led to a sharp wave of liquidations totaling $72 million.

Most of these losses came from long traders who were caught off-guard by the post-announcement volatility. Out of the total liquidations, around $49 million were longs, while shorts accounted for just $23 million.

Crypto Liquidations/Source: Coinglass

Crypto Liquidations/Source: Coinglass

The largest single liquidation occurred on the ETH/USDT pair, where a massive $44 million position was wiped out in one order. This underscores how vulnerable traders relying on excessive leverage can be during high-impact macroeconomic events.

What’s Next for Crypto?

Despite the short-term chaos, analysts note that the Fed’s move is broadly supportive for risk assets like crypto. Lower rates generally ease liquidity conditions and encourage risk-taking, which could benefit Bitcoin, Ethereum, and altcoins over the coming weeks.

However, in the immediate term, volatility is likely to remain elevated as traders digest the policy shift and position themselves ahead of further economic data. A strong defense of BTC’s $113K-$115K support zone and ETH holding above $4,430 will be critical in maintaining the short term uptrend.