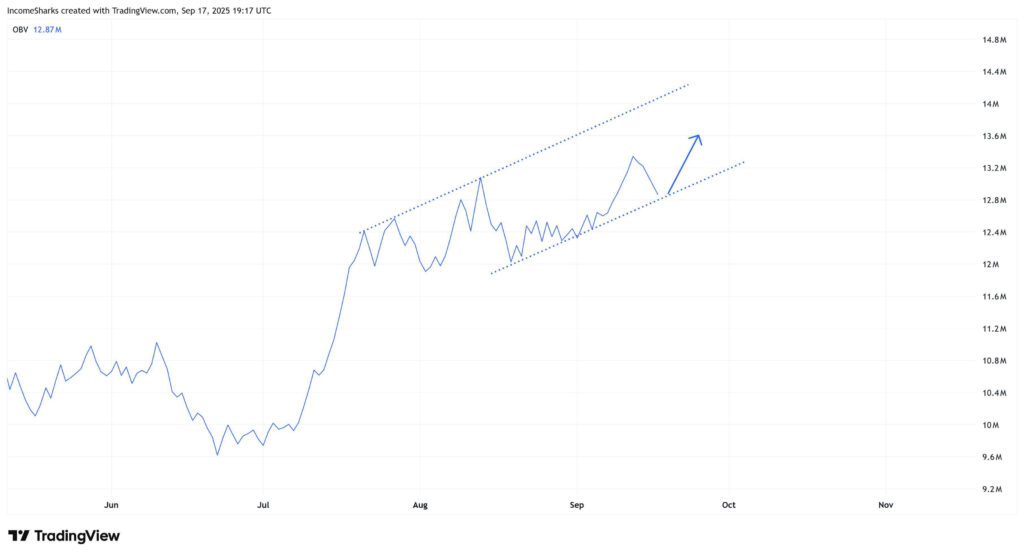

Ethereum’s On‑Balance Volume (OBV) is trading inside an ascending channel near 12.87M, signaling steady accumulation; a newly observed bullish cross combined with rising OBV increases the probability of a move above $5,000 within weeks if support holds.

-

OBV inside ascending channel near 12.87M, indicating accumulation.

-

Analyst ZYN highlights a bullish cross; past crosses preceded 60% and 24% rallies.

-

Higher OBV lows confirm demand: OBV rose from ~10.8M to ~13.0M in late July–early August.

Ethereum OBV bullish cross signals steady accumulation; monitor support at 12.4M to gauge continuation. Read analysis and watch key levels — COINOTAG report.

Ethereum shows strong OBV trends and a new bullish cross, with analysts eyeing a potential move above $5,000 this month.

- Ethereum’s OBV trend is inside an ascending channel, with levels holding near 12.87M despite minor pullbacks.

- Analyst ZYN notes a bullish cross, noting past patterns led to 60% and 24% gains in July and August.

- Volume and price moves align as higher lows in OBV show steady accumulation and continued market demand.

Ethereum’s market momentum is under focus after analysts noted strengthening On‑Balance Volume (OBV) trends and a newly formed bullish cross. The asset’s OBV has held inside an ascending channel since August, suggesting continued buying activity.

Historical patterns show earlier bullish crosses in July and August preceded notable price surges. These repeating signals are prompting traders to test whether Ethereum can reclaim levels above $5,000 before the month concludes.

What is the current OBV structure and why does it matter?

On‑Balance Volume (OBV) is a cumulative volume indicator that links volume flow to price movement. Ethereum’s OBV has been rising inside a defined ascending channel, which indicates sustained net buying pressure and supports a bullish price outlook if channel support near 12.4M holds.

How did OBV move through mid‑year?

Between June and mid‑July, OBV oscillated between approximately 10.0M and 10.8M, showing muted momentum. A breakout in late July propelled OBV from ~10.8M to nearly 13.0M by early August, reflecting increased accumulation and stronger demand.

How significant is the bullish cross pattern?

The bullish cross cited by analyst ZYN refers to a short‑term momentum crossover that historically coincided with sharp rallies in July (+60%) and August (+24%). While pattern history is not a guarantee, its concurrence with OBV’s rising channel strengthens the technical case for further upside.

What levels should traders watch?

Key support: OBV mid‑channel near 12.4M. Near‑term resistance: OBV zone 13.6M–14.0M. Price targets referenced by market participants include the psychological level of $5,000, contingent on OBV and price maintaining alignment.

Ethereum OBV chart, Source: IncomeSharks on X

Why do volume and price alignment reinforce the outlook?

Volume‑based confirmation is critical. Higher lows in OBV indicate repeated net buying on dips, while price action that respects support and posts higher highs confirms the upward bias. The current alignment suggests demand is outpacing supply across recent sessions.

How should traders manage risk?

Maintain OBV support near 12.4M as a technical threshold. Use tight risk controls and size positions so that a clear breakdown below the ascending channel (sustained move under 12.4M) triggers reassessment. Consider multiple timeframes for confirmation.

Frequently Asked Questions

How reliable is OBV for forecasting Ethereum moves?

OBV is a reliable volume‑based confirmation tool when used with price action. It signals whether volume supports directional price moves, but should be combined with other technical and on‑chain metrics for higher confidence.

What triggered the recent OBV rise?

The rise followed a late‑July breakout, where OBV climbed from ~10.8M to nearly 13.0M by early August, reflecting higher net inflows and persistent buying interest across multiple sessions.

Key Takeaways

- OBV confirms accumulation: Ethereum’s OBV sits in an ascending channel near 12.87M, showing sustained buying.

- Pattern precedents matter: Past bullish crosses correlated with significant rallies; current cross warrants attention.

- Watch support and volume: Maintain OBV support near 12.4M; failure below the channel negates the near‑term bullish thesis.

Conclusion

This COINOTAG analysis finds Ethereum’s rising OBV and a new bullish cross present a constructive technical picture. Front‑loaded volume support near 12.4M is the key condition for a potential extension toward $5,000. Monitor OBV, price action, and risk thresholds for confirmation.