Fed Rate Cuts Ignite Institutional Bull Market: BTC Soars, ETH Revalued, Can SOL Take the Lead?

The article analyzes the current institution-driven trend in the crypto market, focusing on the institutional allocation logic, holding differences, and movements in crypto-related stocks for the three major coins: BTC, ETH, and SOL. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

The driving force behind this cycle's market trend comes from institutions.

The four major mainstream coins—BTC, ETH, SOL, and BNB—have all reached new highs, but only BTC and BNB continued to rise by more than 40% after breaking their historical peaks. SOL broke through at the beginning of the year thanks to the Trump token event, while ETH achieved a revaluation mid-year driven by DAT buying, but neither has continued to set new highs.

Last night, the Federal Reserve cut interest rates. How much further can this institution-led market trend go?

1. Institutional Allocation Logic for the Three Major Coins

The positioning of crypto assets directly determines their long-term value, with different positions corresponding to different institutional allocation logics.

Bitcoin: Digital Gold's Anti-Inflation Attribute

Positioned as "Digital Gold," its long-term logic is closely tied to the fiat currency inflation cycle. Data shows its market cap growth is synchronized with Global M2 and negatively correlated with the US Dollar Index. Its core value lies in "anti-inflation + value preservation and appreciation," making it the foundational target for institutional allocation.

Ethereum: Institutional Narrative Dividend of the World Computer

Positioned as the "World Computer," although the foundation's promoted "Layer2 scaling" narrative has not been recognized by the capital market, Ethereum has leveraged its ten-year zero-downtime stable system to catch the development wave of institutional narratives such as USD stablecoins, RWA, and US stock tokenization, thus escaping the impact of the collapse of the Web3 narrative. Coupled with the key push from DAT, it has achieved a market cap revaluation. Ethereum, with its stability and security, will become the settlement network for institutional-grade applications.

Solana: The Activity Advantage of the Network Capital Market

Positioned as "Internet Capital Markets" (ICM), which refers to the on-chain asset issuance, trading, and clearing system. After the FTX collapse crisis, it achieved a "rebirth from the ashes." Since the beginning of the year, it has accounted for 46% of on-chain trading volume, with daily active users consistently exceeding 3 million, making it the most active blockchain network at present. Solana, with its superior performance and high liquidity, will support the crypto-native on-chain trading ecosystem.

Their positions are distinctly different, so the institutional allocation logic also varies. Traditional financial institutions first understand the value of Bitcoin, then consider developing their institutional business based on Ethereum, and finally may recognize the value of on-chain trading. This is a typical path: doubt, understand, become.

2. Institutional Holdings of the Three Major Coins Show Gradient Differences

Institutional holding data for BTC, ETH, and SOL shows clear gradient differences, reflecting the degree and pace of institutional recognition for these three projects.

Table by: IOBC Capital

From the comparison, we can see: Institutional holdings of BTC and ETH account for > 18% of circulation; SOL is currently only at 9.5%, suggesting potential room for catch-up.

3. SOL DAT: New Trends in Crypto Concept Stocks

In the past month or so, 18 SOL DAT companies have successively emerged, directly pushing SOL up by more than 50% from its August low.

Notable SOL DAT companies:

Table by: IOBC Capital

Among the existing SOL DAT companies, Forward Industries, led by Multicoin Capital founder Kyle Samani, may become the leader in SOL DAT.

Unlike BTC DAT, which simply hoards coins, many SOL DAT companies build their own Solana Validators, making this not just a "NAV game." Instead of simply waiting for token appreciation, they continuously generate cash flow income through Validator operations. This strategy is equivalent to "hoarding coins + mining," aiming for both long-term gains and current profits.

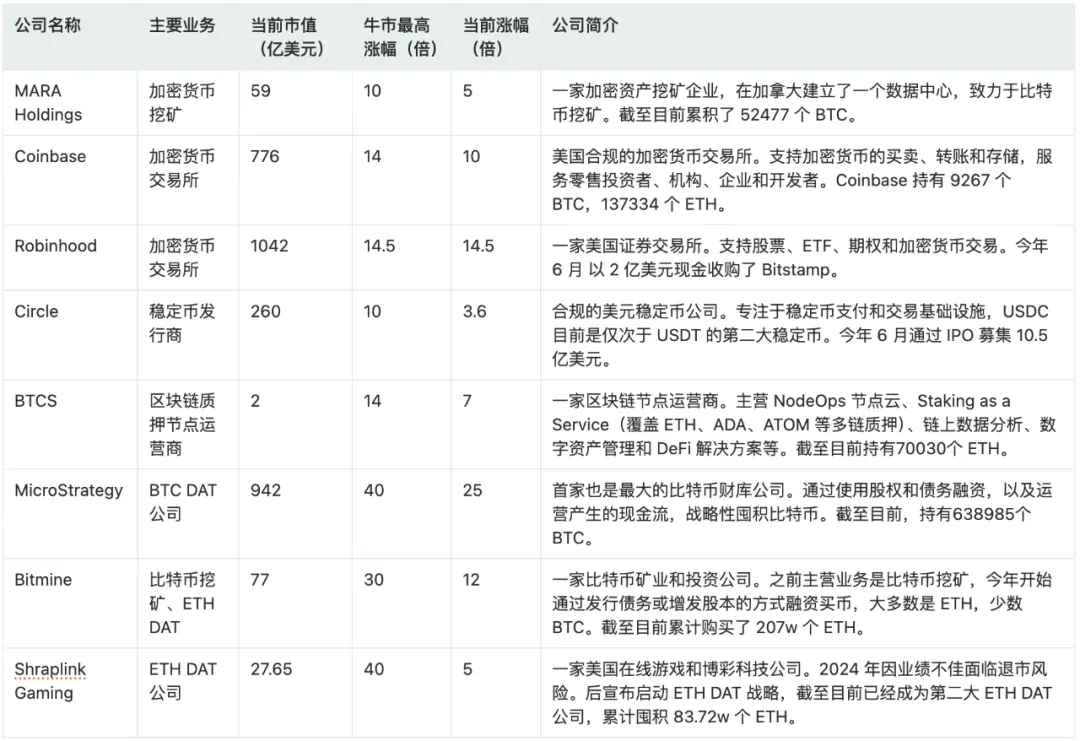

4. Crypto Concept Stocks: A Reflection of Capital Market Bets

Crypto concept stocks are a new bridge between traditional capital and the crypto market. The degree of recognition that traditional financial markets have for various crypto businesses is also reflected in the stock price performance of crypto concept stocks.

Table by: IOBC Capital

Reviewing the crypto concept stocks with outstanding gains this round, two common characteristics can be observed:

1. Only heavy bets can lead to revaluation. There are 189 listed companies holding BTC, but only 30 have holdings valued at 70% of their stock market cap, and only 12 hold more than 10,000 BTC—these 12 have seen considerable gains. ETH DAT listed companies show a similar pattern. A tentative DAT strategy can only trigger short-term stock price fluctuations and cannot substantially boost stock market cap and liquidity.

2. Business synergy amplifies commercial value. Turning single-point businesses into multi-faceted industry chain layouts can amplify commercial value. For example, Robinhood, by deploying crypto trading, real-world asset trading (RRE), and participating in USDG stablecoin and other businesses, forms a closed business loop for capital flow, with its stock price continuously reaching new highs. In contrast, Trump Media, although it has also made significant crypto business deployments (holding BTC, applying for ETH ETF, issuing Trump, Melania, WLFI, and other tokens), lacks synergy between its businesses, resulting in a rather lukewarm market response to both its stock and tokens.

Conclusion

The project philosophies of Bitcoin, Ethereum, and Solana respectively correspond to three human instincts when facing the future—survival, order, and flow.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.