Australia adopts licensing exemption for stablecoin intermediaries

- ASIC allows distribution of stablecoins without additional license

- Catena Digital and AUDMA listed as first participants

- Measure paves the way for national stablecoin legislation

The Australian Securities and Investments Commission (ASIC) has announced a measure that makes it easier for stablecoin intermediaries to operate in the country. The new class exemption allows already licensed entities to distribute stablecoins without the need for additional regulatory approvals. The regulatory relief will come into effect once registered in the Federal Register of Legislation.

Stablecoin intermediaries include cryptocurrency exchanges, brokerages, and trading platforms that offer these assets to users without issuing their own digital currencies. According to the ruling, companies licensed by the Australian Financial Services (AFS) will be able to offer fiat-pegged stablecoins without an additional market or clearing license.

According to ASIC , the measure reduces temporary licensing barriers while ensuring consumer protection. The exemption is part of the Stablecoin Distribution Exemption Instrument, which temporarily exempts secondary distributors from certain obligations, provided specific conditions are met, such as the requirement to provide retail customers with the Product Disclosure Statement. The rule expires on June 1, 2028.

In the initial version of the instrument, Catena Digital Pty Ltd and its stablecoin AUDMA were included as the first "Nominated Stablecoin." ASIC noted that it may expand the measure to other issuers as new stablecoins obtain AFS licenses.

The initiative is temporary and seeks to create a bridge until national legislation is approved. The government's draft policy, released in March 2025, proposed a two-track model covering both digital asset platforms (DAPs) and payment stablecoins. The plan indicates that full financial markets licensing will not be required for the offering of certain stablecoins and wrapped tokens.

Globally, stablecoin regulation is advancing rapidly. In the United States, under President Donald Trump, the GENIUS Act was passed, the first federal oversight framework for the sector. Hong Kong and China are also working on their own approaches, reinforcing the international movement toward defining specific rules for the stablecoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

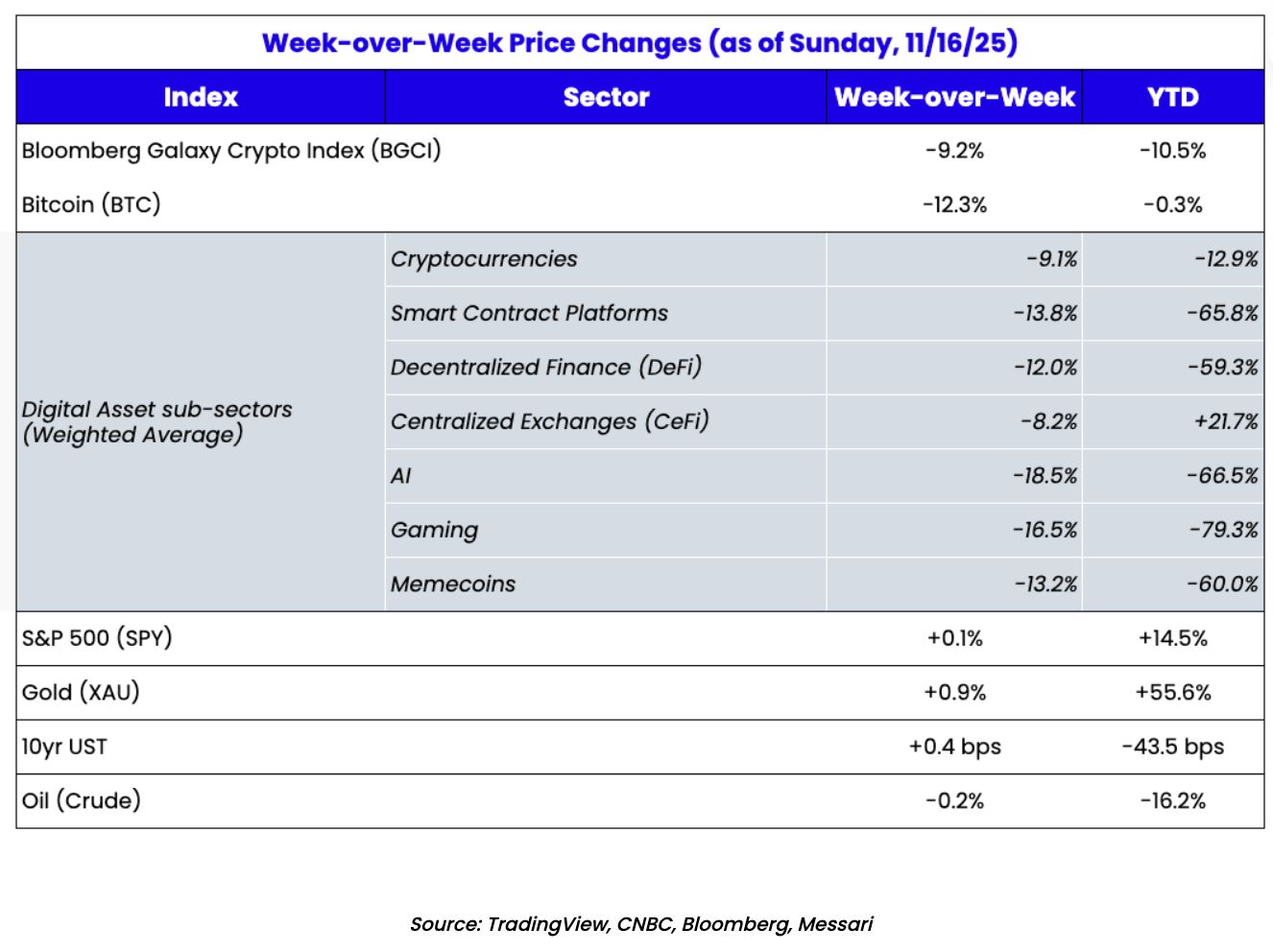

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.