ADA Price Today: Is the Next Big Rally About to Begin?

Cardano (ADA) price has been moving with increased volatility, and the timing could not be more critical. With the SEC finally approving Grayscale’s Digital Large Cap Fund (GDLC) ETF , which includes Cardano alongside Bitcoin, Ethereum, Solana, and XRP, ADA has fresh institutional exposure. The charts show mixed signals: a strong mid-term uptrend facing resistance, while short-term candles suggest consolidation. Let’s break it down.

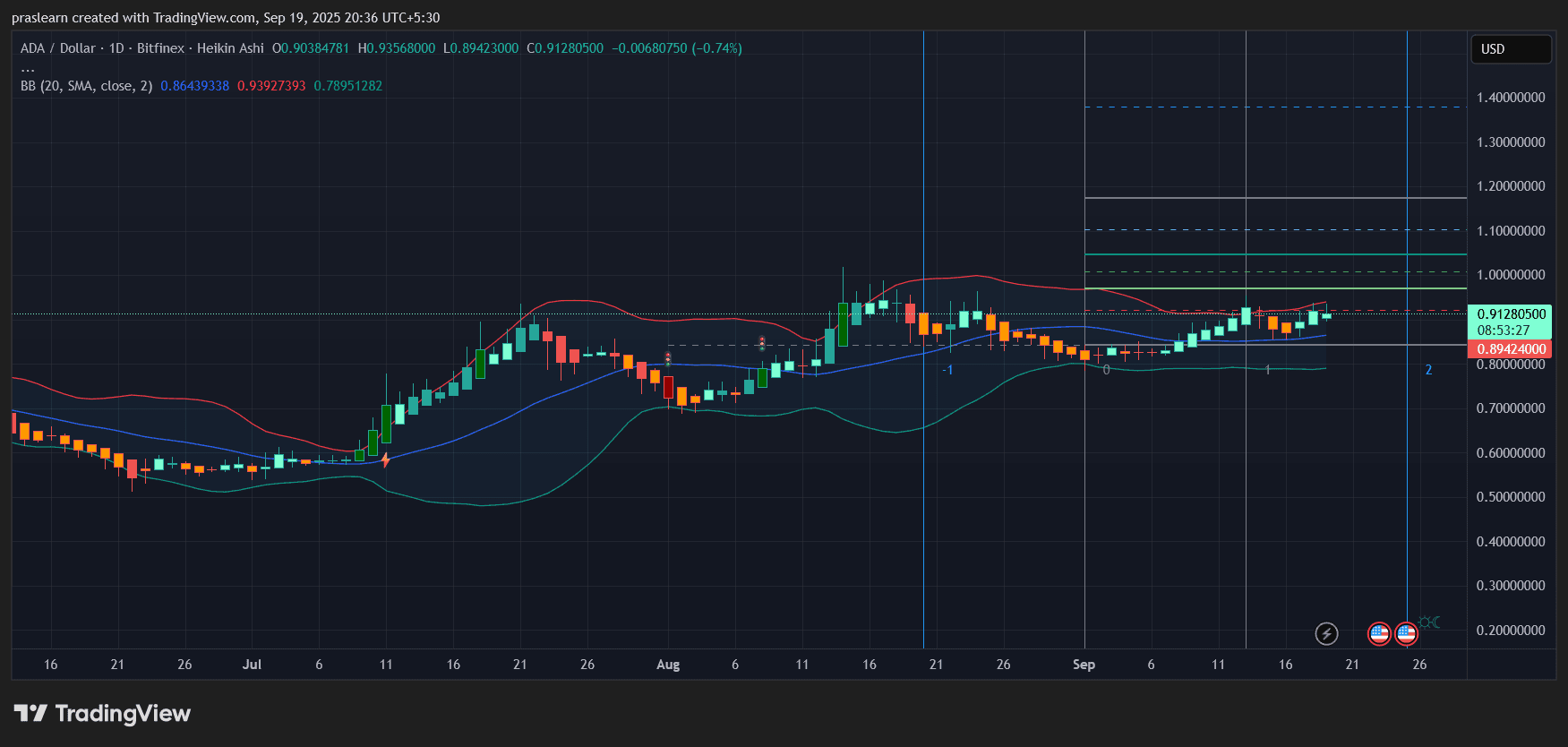

Cardano Price Prediction: The Daily Price The Bigger Picture

ADA/USD Daily Chart- TradingView

ADA/USD Daily Chart- TradingView

The daily ADA/USD chart shows ADA price climbing steadily from its September lows, trading now around 0.91. Price action has been testing the middle of the Bollinger Band range, suggesting ADA is not in overbought territory. Importantly, ADA recently bounced off the 20-day moving average, a bullish sign that buyers are still defending the uptrend.

Key resistance sits at 1.00, a psychological and Fibonacci level, while support remains around 0.86. A breakout above 1.00 could open the path toward 1.10 and even 1.25 if ETF-driven momentum continues. On the downside, losing 0.86 risks pulling Cardano price back toward the 0.78 zone.

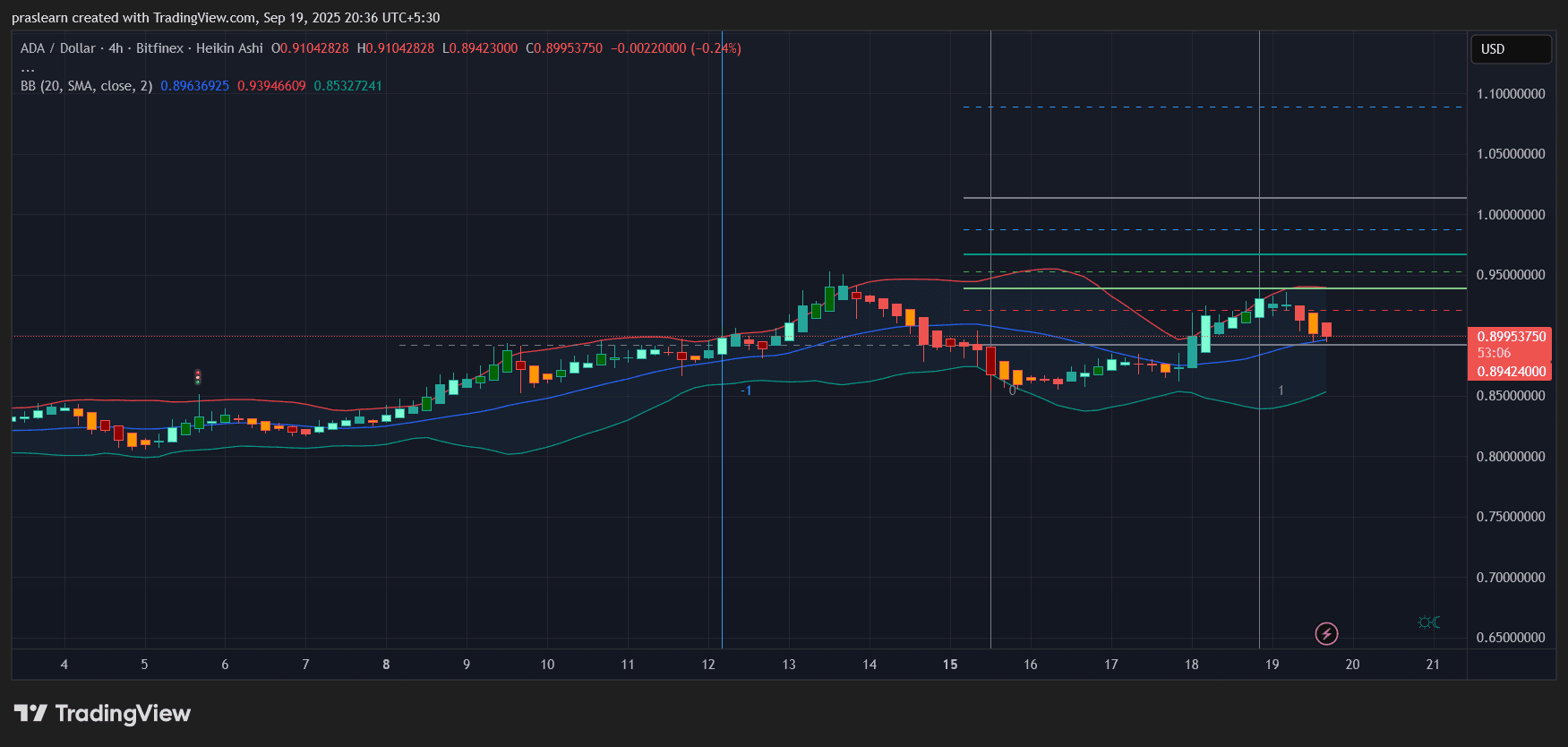

4-Hour Chart: Momentum Cooling

ADA/USD 4 Hour Chart- TradingView

ADA/USD 4 Hour Chart- TradingView

The 4-hour chart shows ADA price had a strong run-up but is now facing resistance at 0.95 and rolling over slightly. The Heikin Ashi candles show consecutive bearish closes, hinting at short-term profit-taking. The Bollinger midline is being tested, and holding above it will be key to avoiding a deeper correction.

If Cardano price can reclaim 0.93–0.95, the next stop remains 1.00. If not, ADA could drift toward 0.87–0.88 in the near term, where the lower Bollinger Band sits as a cushion.

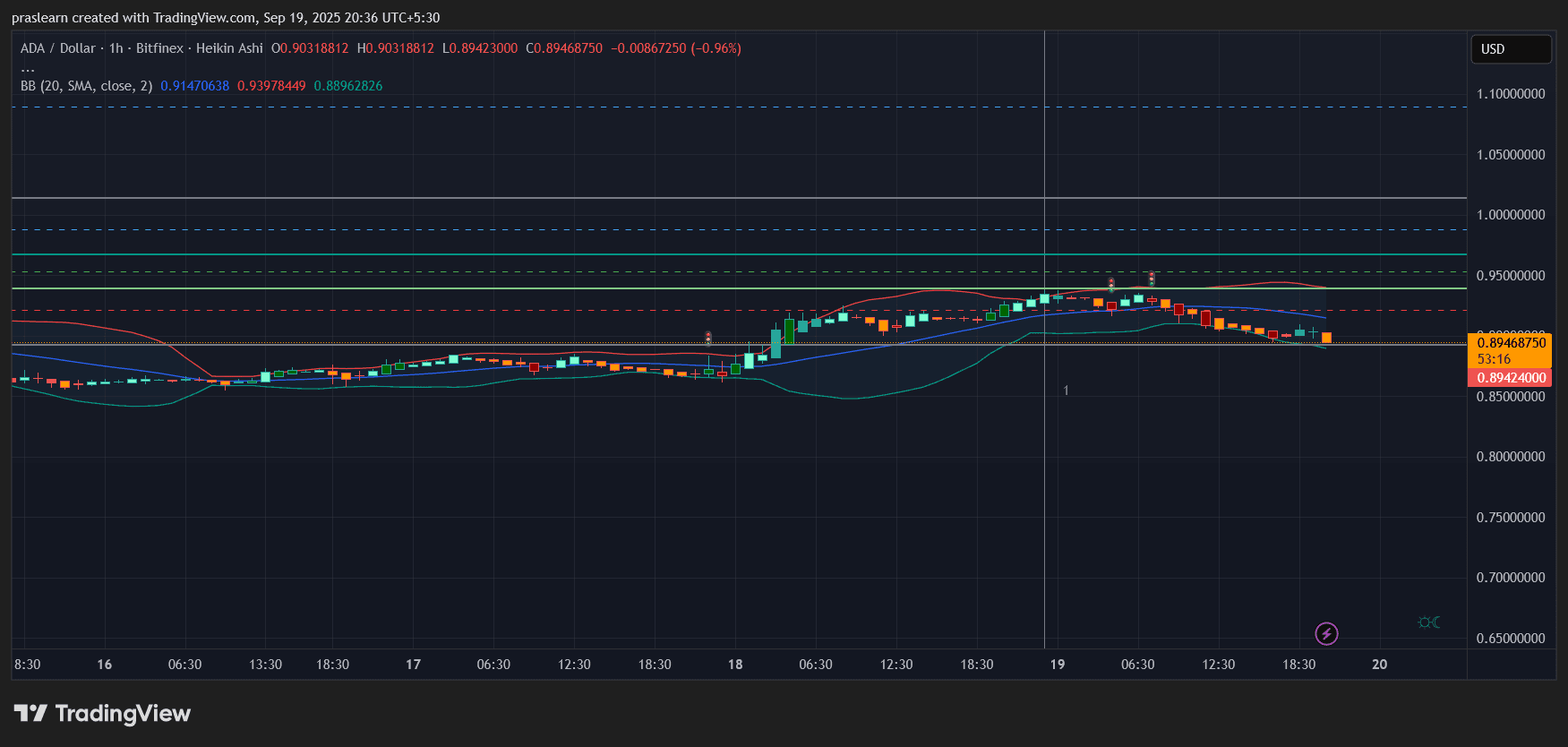

1-Hour Chart: Short-Term Consolidation

ADA/USD 1 Hr Chart- TradingView

ADA/USD 1 Hr Chart- TradingView

On the 1-hour timeframe, ADA price is losing steam after hitting 0.95 earlier in the week. The candles show a series of lower highs and lower closes, meaning intraday traders are booking profits. The immediate support zone lies at 0.89, which lines up with the short-term Bollinger Band floor. Resistance overhead remains heavy at 0.93.

This suggests Cardano price is likely to chop sideways between 0.89 and 0.93 until either a catalyst (like strong ETF inflows) or broader market strength drives a breakout.

ETF Impact: Why It Matters?

The Grayscale ETF listing changes the liquidity profile of Cardano . For the first time, U.S. stock market investors can gain indirect exposure to Cardano without buying the coin directly. This is likely to increase demand gradually rather than cause a sudden pump. It also cements ADA’s credibility alongside Bitcoin and Ethereum as a long-term blockchain play.

Cardano Price Prediction: Bullish but Cautious

The charts suggest ADA price is at an inflection point :

- Bullish case: If ADA price holds 0.89 and pushes back above 0.95, a retest of 1.00 is highly likely. A clean break could extend toward 1.10 and 1.25 in coming weeks.

- Bearish case: If ADA price fails to defend 0.89, downside risks open up to 0.86 and then 0.78.

Given the ETF approval, the balance of probability leans bullish, but momentum indicators show ADA price needs fresh buying to push higher.

$ADA is consolidating after a strong run, and ETF-driven institutional flows could be the spark that propels it past 1.00. In the short term, traders should watch the 0.89 support and 0.95 resistance as the critical battle zone.

📈 Want to Trade Cardano?

Start now on Bitget: Sign Up Here

Check Live ADA Chart: ADA/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.