Date: Sat, Sept 20, 2025 | 10:50 AM GMT

The cryptocurrency market is seeing a sharp retracement from its initial Fed-driven surge, with Bitcoin (BTC) and Ethereum (ETH) both sliding near 1% in the past 24 hours. Despite the broader weakness, Aster (ASTER) — the newly launched DEX platform publicly endorsed by Binance co-founder Changpeng Zhao — has remained in the spotlight after delivering massive gains.

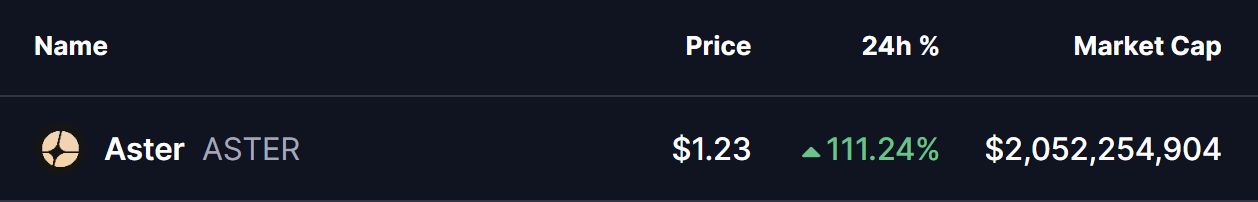

ASTER has skyrocketed nearly 111% in the past 24 hours, but beyond the price spike, a striking fractal pattern is emerging—one that could hint at what comes next for this fast-rising token.

Source: Coinmarketcap

Source: Coinmarketcap

ASTER Mirrors HYPE’s Listing Phase Structure

A comparative chart analysis reveals that ASTER is currently mimicking the late December 2024 price action of Hyperliquid (HYPE) during its listing phase with remarkable similarity.

On the left side of the chart, HYPE’s price surged inside a rising wedge formation, briefly broke down in a “fake-out” that triggered stop-losses, and then quickly reversed to print a new all-time high. This was followed by a cooling-off phase that eventually led to a broader correction.

HYPE and ASTER Fractal Chart/Coinsprobe (Source: Tradingview)

HYPE and ASTER Fractal Chart/Coinsprobe (Source: Tradingview)

On the right side, ASTER appears to be tracing the exact same path but on a smaller timeframe.

Since listing, ASTER has also surged in a rising wedge, staged a fake breakdown, and then bounced sharply to set a new all-time high at $1.25. At current levels, sellers are beginning to show activity around this peak—the same zone where HYPE started its correction after its initial run.

What’s Next for ASTER?

If the fractal continues to play out, ASTER could be nearing a local top. Given the explosive short-term gains, many traders may be inclined to take profits, which lines up with the fractal projection. In this scenario, ASTER could retrace towards its fakeout level near $0.93, representing a potential 25% decline from current prices.

However, it’s worth noting that this setup is being tracked on a lower 30-minute timeframe, making it more volatile and prone to false signals.