Written by: arndxt

Translated by: Luffy, Foresight News

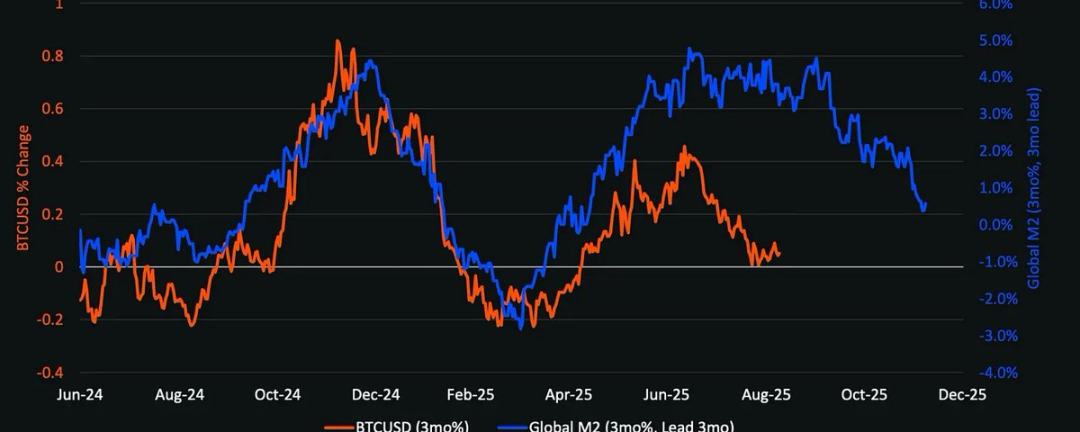

Global M2 and Bitcoin Price Chart

The most critical structural conclusion is: cryptocurrencies will not decouple from the macroeconomy. The timing and scale of liquidity rotation, the Federal Reserve's interest rate trajectory, and patterns of institutional adoption will determine the evolution path of the crypto cycle.

Unlike in 2021, the upcoming altcoin season (if any) will be slower, more selective, and more institutionally focused.

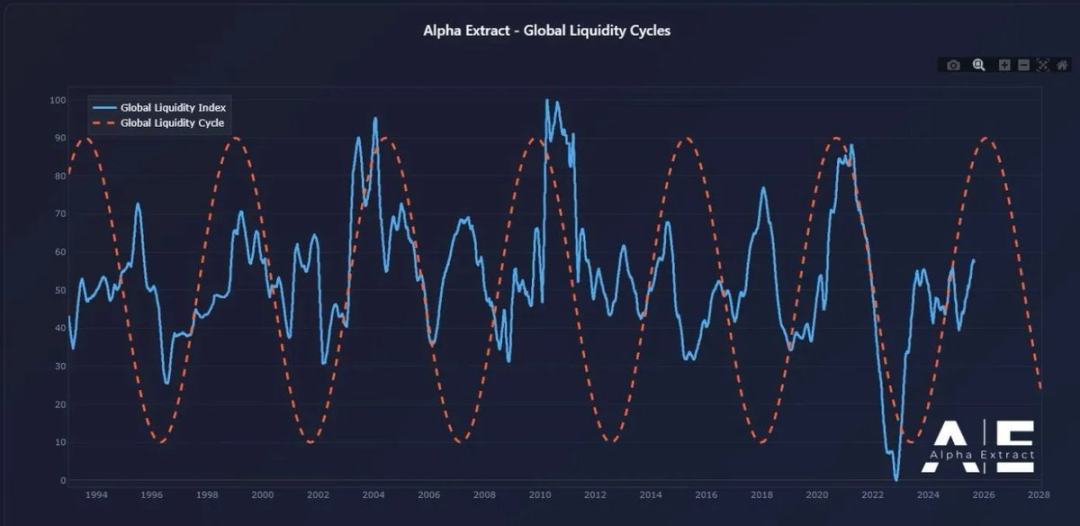

If the Federal Reserve releases liquidity through rate cuts and bond issuance, while institutional adoption continues to rise, 2026 could become the most significant risk asset cycle since 1999-2000. Cryptocurrencies are expected to benefit, but their performance will be more normalized rather than explosive.

Divergence in Federal Reserve Policy and Market Liquidity

In 1999, the Federal Reserve raised rates by 175 basis points, yet the stock market continued to rise to its 2000 peak. Today, forward markets expect the opposite: a 150 basis point rate cut by the end of 2026. If this expectation materializes, the market will enter an environment of increasing rather than tightening liquidity. From a risk appetite perspective, the market backdrop in 2026 could resemble 1999-2000, but with a completely opposite interest rate trend. If so, 2026 may become a "more intense 1999-2000."

The New Context for the Crypto Market (Compared to 2021)

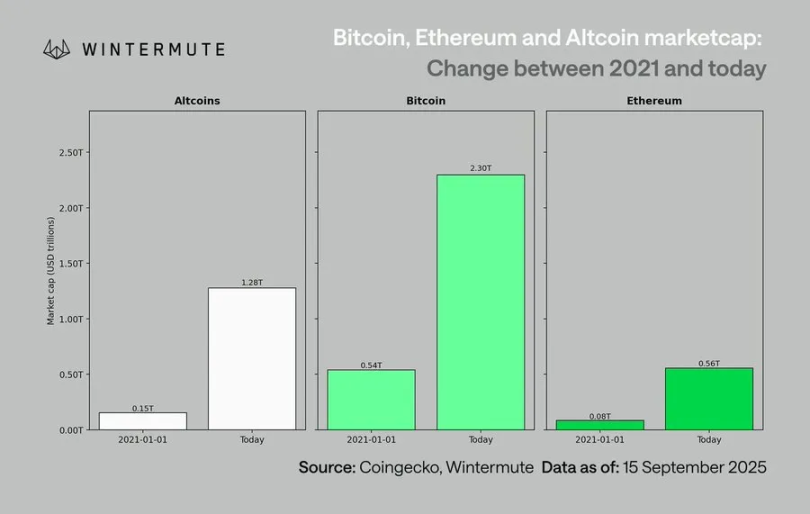

Comparing the current market to the last major cycle, the differences are significant:

-

Stricter capital discipline: High interest rates and persistent inflation force investors to be more cautious in selecting risk assets;

-

No COVID-level liquidity surge: Lacking a surge in broad money supply (M2), industry growth must rely on increased adoption and capital allocation;

-

Market size expanded 10x: A larger market cap base means deeper liquidity, but the possibility of 50-100x excess returns is much lower;

-

Institutional capital inflows: Mainstream institutional adoption is now entrenched, with capital inflows becoming smoother, driving slow market rotation and consolidation rather than explosive rotation between assets.

Bitcoin's Lag and the Liquidity Transmission Chain

Bitcoin's performance lags behind the liquidity environment because new liquidity is trapped "upstream" in short-term Treasuries and money markets. As the asset at the far end of the risk curve, cryptocurrencies only benefit after liquidity is transmitted downstream.

Catalysts for strong crypto performance include:

-

Bank credit expansion (ISM Manufacturing Index > 50);

-

Outflows from money market funds after rate cuts;

-

The Treasury issuing long-term bonds, lowering long-term rates;

-

A weaker dollar, easing global funding pressures.

Historical patterns show that when these conditions are met, cryptocurrencies typically rally late in the cycle, after stocks and gold.

Risks Facing the Baseline Scenario

Although the liquidity framework appears bullish, several potential risks remain:

-

Rising long-term yields (triggered by geopolitical tensions);

-

A stronger dollar, tightening global liquidity;

-

Weak bank credit or a tightening credit environment;

-

Liquidity trapped in money market funds, not flowing into risk assets.

The core feature of the next cycle will no longer be "speculative liquidity shocks," but rather the structural integration of cryptocurrencies with global capital markets. As institutional capital flows in, prudent risk-taking and policy-driven liquidity shifts combine, 2026 may mark the transformation of cryptocurrencies from a "boom-bust" model to one with "systemic relevance."