How to Determine Whether an L1 Public Chain Token Is Reasonably Valued: Complete Methodology and Case Analysis

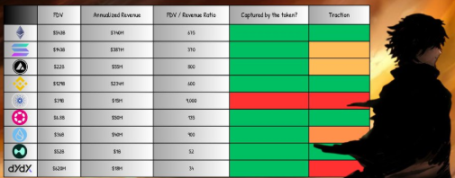

In the crypto market, assessing the true value of a token has always been a challenge for investors. Different types of tokens require different valuation frameworks and cannot be lumped together. This article will focus on valuation methods for L1 public chain tokens, further subdivided into General-purpose L1s (such as $ETH, $SOL, $BNB, $AVAX, $DOT, $ADA, $SUI) and Application-specific L1s (such as $HYPE, $dYdX, $OSMO, $RUNE, $RENDER, $TON, $RON).

1. Revenue

The first step in valuation is to examine revenue, but the key is whether the revenue truly accrues to the token.

✅ Includes: buybacks, burns, dividends to holders, funds used for protocol development.

❌ Excludes: revenue that completely flows out of the ecosystem or has no direct benefit to the token.

If the protocol has not been live for a full year, quarterly or monthly revenue can be annualized.

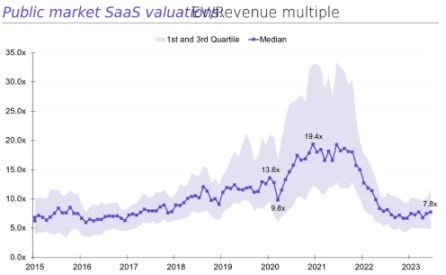

2. FDV/Revenue Ratio

The ratio of FDV (Fully Diluted Valuation) to revenue can quickly provide a first impression. In traditional tech companies, this ratio is usually between 8–15.

In the crypto world, this ratio is often higher, but it can still serve as a reference.

3. Growth & Traction

FDV/Revenue alone is not enough; on-chain usage must also be considered:

Number of active addresses

Number of transactions

Trading volume

TVL (Total Value Locked)

The absolute value is not the key; the trend is most important. A network with sustained growth, even if currently small in scale, will have its potential growth priced in advance in its valuation.

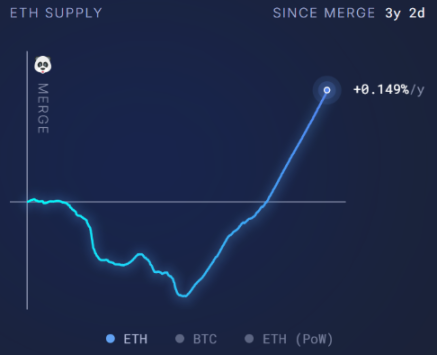

4. Security Budget

All L1s require a security budget, mainly sourced from transaction fees or token issuance. The key metric is the Net Issuance Rate:

Net Issuance Rate = (Tokens Issued − Tokens Burned) / Total Token Supply

If negative → Excellent, indicating more tokens are burned than issued, giving the token deflationary characteristics.

If positive → Inflationary pressure, which is unfavorable for the token.

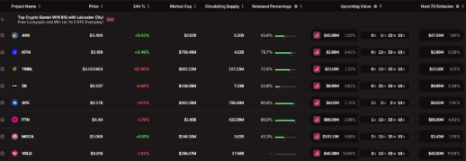

5. Future Unlocks

The token unlock schedule directly affects valuation:

Used for marketing or team compensation → Negative.

Used for development or rewarding holders → Positive.

Benchmarks:

<10% circulating supply → Mild pressure

10–30% → Moderate pressure

30% → High pressure

Tools such as @Tokenomist_ai can be used to track unlock data.

Case Studies

Ethereum ($ETH)

Revenue over the past year ≈ $740 million.

100% of revenue accrues to ETH (burns, staking rewards, MEV distribution).

FDV/Revenue ≈ 675, far above the traditional range.

Although the valuation appears high, ETH enjoys a structural premium due to its dual role as both a “store of value” and a “global settlement layer,” as well as its deflationary potential.

Solana ($SOL)

Revenue over the past year ≈ $387 million.

FDV ≈ $14.3 billion → FDV/Revenue ≈ 370.

The high valuation is mainly based on its high throughput and retail adoption potential.

Hyperliquid ($HYPE)

Unique mechanism: 100% of revenue is used for token buybacks, fully benefiting holders.

Revenue in the past 90 days ≈ $255 million → Annualized ≈ $1 billion.

FDV ≈ $5.2 billion → FDV/Revenue ≈ 52, much lower than ETH and SOL.

Currently accounts for only 4.9% of the CEX market share, leaving huge room for future growth.

Conclusion

The valuation of L1 public chain tokens will never be as straightforward as that of traditional companies. Revenue and fundamentals provide us with anchor points, but actual pricing is more driven by speculation and future expectations.

From the case comparisons, we can see:

Ethereum enjoys a long-term structural premium;

Solana’s valuation relies more on narrative and adoption potential;

HYPE demonstrates the ideal model of revenue directly rewarding holders.

Overall, there is still a significant disconnect between the value currently delivered by most L1 projects and their market capitalization, and the market remains highly speculative. When evaluating, investors should look at hard metrics (revenue, unlocks, security budget) as well as understand soft logic (growth trends, narrative premium).

In other words, the real driving force behind crypto market pricing is still the bet on the future, rather than current cash flow.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?