I will sell all my crypto assets at the end of October: Analysis of historical cycle warnings and market top signals

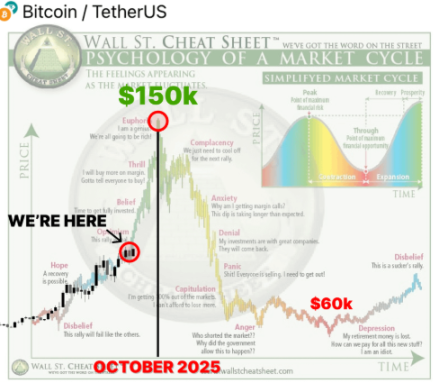

In the midst of market frenzy, many people may think that "selling" is a foolish decision. However, based on historical experience and current market signals, the end of October may be the key turning point of this crypto cycle. Just like in 2021, I will choose to fully exit the market at this time.

1. The Liquidity Effect of Federal Reserve Rate Cuts

Recently, the Federal Reserve announced a 25 basis point rate cut. Capital has started to withdraw from the low-yield bond market in search of higher returns, making cryptocurrencies a natural first choice. This is highly similar to the situation in 2021, when rate cuts and loose liquidity drove bitcoin to accelerate upward in the short term, only to quickly peak and reverse.

2. Seasonality and Historical Cycles

Historically, the crypto market often enters an accelerated upward phase in October, peaks in November, and then experiences a sharp correction in December:

2017: Started in October, bubble burst in December.

2021: Rallied in October, peaked in November, declined in December.

The trend in 2025 almost overlaps with previous years, with the only difference being—due to larger capital inflows, the cycle may exhaust itself even faster.

3. The Market Sequence of Capital Flows

This round of the market also shows a typical flow sequence:

Bitcoin rises first, establishing market confidence;

Ethereum follows, spreading liquidity;

Finally, altcoins explode, with risk appetite reaching its peak.

We are currently in the "altcoin frenzy" stage, which usually means the market is nearing its end.

4. A Mirror Replay of 2021

In 2021, the market completed its climax and turning point within just one month:

BTC peaked first;

ETH continued to surge;

Altcoins saw a brief explosive rise;

Then the entire market generally fell by 60%–80%.

At that time, many greedy investors waiting for "just a bit more" lost everything within weeks.

5. On-chain Signal Warnings

On-chain data further confirms the market is overheating:

The growth rate of active addresses and transaction volume is slowing;

Exchange inflows are increasing, whales are preparing to cash out;

Contract funding rates are high, and the market is in an over-leveraged state.

6. "Seemingly Strongest" Often Means "Most Dangerous"

There are indeed several seemingly extremely bullish signals at present:

ETFs are absorbing large amounts of liquidity;

Exchange bitcoin reserves are at a five-year low;

The scarcity narrative is being reinforced.

But precisely because of this, market sentiment becomes extremely optimistic, and this "everyone is bullish" state is often a precursor to a cycle top.

7. Red Alerts from Classic Indicators

Indicators historically used to judge market tops are entering dangerous territory:

NUPL has entered the extreme profit zone;

MVRV is above safe levels;

SOPR is likely to break its long-term trend.

In 2017 and 2021, these indicators all gave similar signals right before the market peaked.

Conclusion

Combining historical patterns, on-chain data, and macro liquidity signals, the end of October is highly likely to be the endpoint of this crypto bull market. Choosing to exit calmly amid market frenzy may be ridiculed as "foolish," but it is precisely this restraint that preserves millions of dollars in profit at the end of the cycle.

In the crypto market, the biggest risk is not missing out on gains, but being unable to exit safely. Greed leads to ruin, while exiting early is the only way to truly secure your wealth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH price fluctuates violently: the hidden logic behind the plunge and future outlook

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

Bitcoin ‘risk off’ signals fire despite traders’ view that sub-$100K BTC is a discount

Trending news

MoreETH price fluctuates violently: the hidden logic behind the plunge and future outlook

[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.

![[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.](https://img.bgstatic.com/multiLang/image/social/dd58c36fde28f27d3832e67b2a00dab41764952203123.png)