Date: Mon, Sept 22, 2025 | 05:40 AM GMT

The cryptocurrency market continues to show signs of weakness after the Fed-driven surge, with Ethereum (ETH) sliding below $4,300 following a 4% daily decline. This broader pullback has weighed on major altcoins as well, including decentralized exchange token Hyperliquid (HYPE).

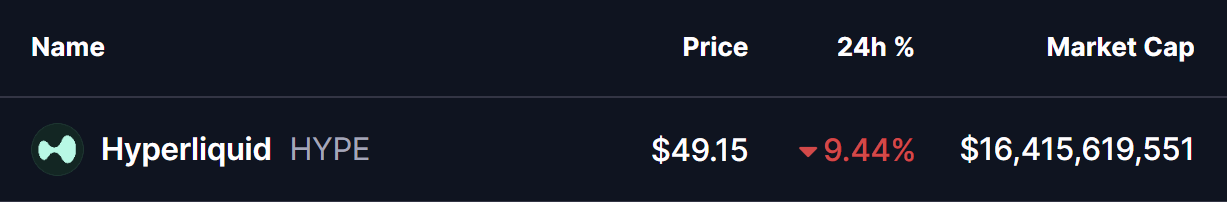

HYPE is down over 9% today, but despite the drop, the bigger picture reveals a healthy bullish structure: a breakout from an ascending triangle that is now undergoing a textbook retest.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting the Ascending Triangle Breakout

On the daily chart, HYPE had been coiling inside a well-defined ascending triangle pattern, marked by rising higher lows against a flat horizontal ceiling near $49.

Earlier this month, bulls broke through that ceiling with force, sending HYPE up nearly 66% from its $35.53 base to a local high of $59.45. The breakout confirmed strong accumulation and momentum.

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

However, price has since corrected more than 17%, now trading back around $49.09. Importantly, this zone represents the exact breakout level — a classic case of resistance turning into support. Retests like this often serve as a launchpad for the next bullish move if buyers step back in.

What’s Next for HYPE?

The $48.50–$50 band is now the make-or-break level. If bulls successfully defend it, HYPE could rebound strongly and aim for a retest of its recent high at $59.45. A decisive breakout above that high would pave the way toward the measured target of $64.23, representing a potential 30% upside from current levels.

On the other hand, a failure to hold the $48.50 zone would weaken the bullish case and expose HYPE to a deeper pullback, with the 100-day moving average near $44.18 acting as the next support.