Why Bitcoin Is Falling Today: Traders Analyze $BTC Price Action

- Cryptocurrency liquidations surpass $1,5 billion

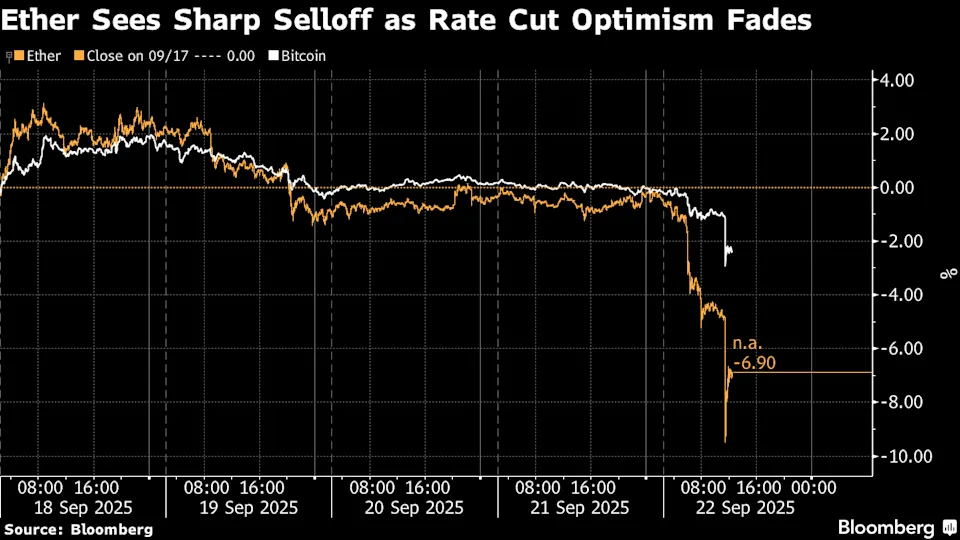

- Ether Falls 9% as Leveraged Positions Pressured

- Bitcoin fluctuates between $110 and $120

The week began with strong pressure on the cryptocurrency market, marked by billion-dollar liquidations that directly affected Bitcoin, Ether, and other major tokens.

The reason for Bitcoin's drop on Monday is bullish derivatives positions, which totaled more than $1,5 billion in liquidations, putting downward pressure on the price of BTC and ETH.

Ether was the biggest drag, falling as much as 9% to trade near $4.075. Coinglass data indicates that nearly half a billion dollars in leveraged long positions in the asset were liquidated in just one day. Bitcoin, meanwhile, fell about 3%, briefly reaching $111.998, while Solana, Algorand, and Avalanche followed suit.

According to the platform, it was the largest wave of liquidations in the sector since March 27. The correction occurred after weeks in which exchange-traded funds focused on accumulating tokens propelled Bitcoin and Ether to all-time highs in August. However, this momentum has lost momentum as shares of companies exposed to digital assets, such as Michael Saylor's Strategy and Japan's Metaplanet, also fell.

"It appears the market needs a break, with some participants concerned that the DAT trade is losing steam and there are no more significant entries on the horizon," said George Mandres, senior trader at XBTO Trading.

The data also shows that more than 407 traders had their positions liquidated in just 24 hours. This movement reduced the total market value of cryptocurrencies to less than $4 trillion, according to CoinGecko.

CryptoQuant reported that the funding rate for Ether perpetual futures has turned negative, the lowest level since the yen carry trade reversal in 2024. This scenario signals dominance by short sellers, who are paying buyers to maintain their positions.

Despite the pressure, Bitcoin has remained within the $110.100-$120.000 range since July. During this period, Ether and Solana have accumulated significant gains of 74% and 52%, respectively. Meanwhile, gold continues to stand out, breaking successive records and reaching $3.720 per ounce, while silver has also seen gains.

Bitcoin Price Analysis Today

Bitcoin is back to trading near $112.000, and three prominent analysts have shared their views on the asset's next moves.

Ali (@ali_charts) – Bullish

Ali highlighted that the retraction was already expected and could open space for a resumption of growth.

Ali highlighted that the retraction was already expected and could open space for a resumption of growth.

According to him, Bitcoin/BTC has pulled back to $112.000 as predicted. Now watch for buying pressure to build on the right shoulder ahead of a breakout to $130.000! Their analysis suggests the formation of a technical pattern that, if confirmed, could lead BTC to reach $130.

Ted (@TedPillows) – Bearish in the short term, bullish in the long term

Ted highlighted the immediate downside risk if Bitcoin fails to reclaim key support levels. "$BTC has lost another important support level. If Bitcoin fails to reclaim the $113.500 level, a drop towards the $106.000 region could occur." Despite this bearish short-term reading, he also projects a positive cycle through the end of 2025. According to the trader, after a 10% to 15% correction, eliminating overly optimistic buyers, BTC could reach $150 in the fourth quarter, following gold's upward trend.

$ BTC has lost another key support level.

If Bitcoin doesn't reclaim the $113,500 level, a dump towards a $106,000 region could happen.

— Ted (@TedPillows) September 22, 2025

Donald Dean (@donaldjdean) – Bullish

Donald Dean maintained focus on technical breakout targets.

For him, Bitcoin – Retest of the breakout price target: $123, $131. The price is currently near the volume platform. If support holds, BTC should rise to the next target at $123. After that, $131 in the Golden Ratio. This reading points to consistent progress if current support is preserved.

$ BTC $ BTCUSD Bitcoin – Retest of the Breakout

Price Target: $123k, $131k

Bitcoin continues to retest the breakout right at the trendline. Price is currently close to the volume shelf. If support holds, BTC should be on its way higher to the next target at $123k.

After that is…

— Donald Dean (@donaldjdean) September 22, 2025

With these readings, Bitcoin finds itself at a balance point between short-term downside risks and bullish projections that see the asset heading towards new highs as early as 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services