BitGo's Strange Financial Report: 0.3% Profit Margin Coexists with 90% Debt Ratio

The actual business data is not as bad as it appears on the surface.

BitGo's actual business data is not as bad as it appears on the surface.

Written by: Eric, Foresight News

On Friday local time in the United States, cryptocurrency custody institution BitGo filed documents with the U.S. Securities and Exchange Commission (SEC) to apply for an IPO. As one of the largest cryptocurrency custodians in the Web3 industry, BitGo’s listing gives us a comprehensive look at a company that was once valued at $1.75 billions in its Series C financing round.

Founded in 2013, BitGo can be considered a pioneer in the custody business. Led by two technical founders, Mike Belshe and Ben Davenport, BitGo was the first to launch a Bitcoin multi-signature solution, and later developed the Threshold Signature Scheme (TSS), both of which remain the most widely used technologies in the digital asset security field. In 2018, BitGo established BitGo Trust to provide regulatory-compliant cold storage services, supplementing its existing hot wallet solutions. In 2020, BitGo expanded its original custody business to offer trading and lending services to clients through BitGo Prime.

BitGo’s two founders have very strong technical backgrounds. Mike Belshe worked as an engineer at HP as early as 1993, and in 2003 co-founded Lookout Software with Eric Hahn, focusing on email search. The company was later acquired by Microsoft and integrated into Outlook. After joining Microsoft, Mike Belshe became an early member of the Chrome team, co-invented the SPDY protocol, and promoted its adoption as the HTTP/2.0 standard.

Ben Davenport is not only the co-founder of BitGo but also its CTO. He has worked as an engineer at Microsoft, Google, and Facebook (now Meta). Ben Davenport was also the co-founder of the mobile group chat app Beluga, which was later acquired by Facebook. Its technology became the foundation of Facebook Messenger, and Ben Davenport became one of the founding team members of Facebook Messenger. In addition, Ben Davenport has participated as an angel investor in the financing of Lighting Labs, Paxos, and Kraken.

According to BitGo’s filings, institutions holding more than 5% of BitGo’s shares include Redpoint (11.4%), Valor (the lead investor in BitGo’s Series B round, holding 13.2%), Craft Ventures (7.8%), and Bridgescale (6.5%). These four major shareholders collectively hold 38.9%. Executives holding shares include founder Mike Belshe, CFO Edward Reginelli, COO Chen Fang, BitGo Trust COO and President Jody Mettler, and Chief Compliance Officer Jeff Horowitz. Sun Yuchen, who is rumored to have close ties with BitGo, is not among the disclosed shareholders.

BitGo’s status and influence in the industry are beyond doubt. In August 2023, BitGo completed a $100 millions financing round at a $1.75 billions valuation, but from the financial data, BitGo’s business is not as lucrative as imagined.

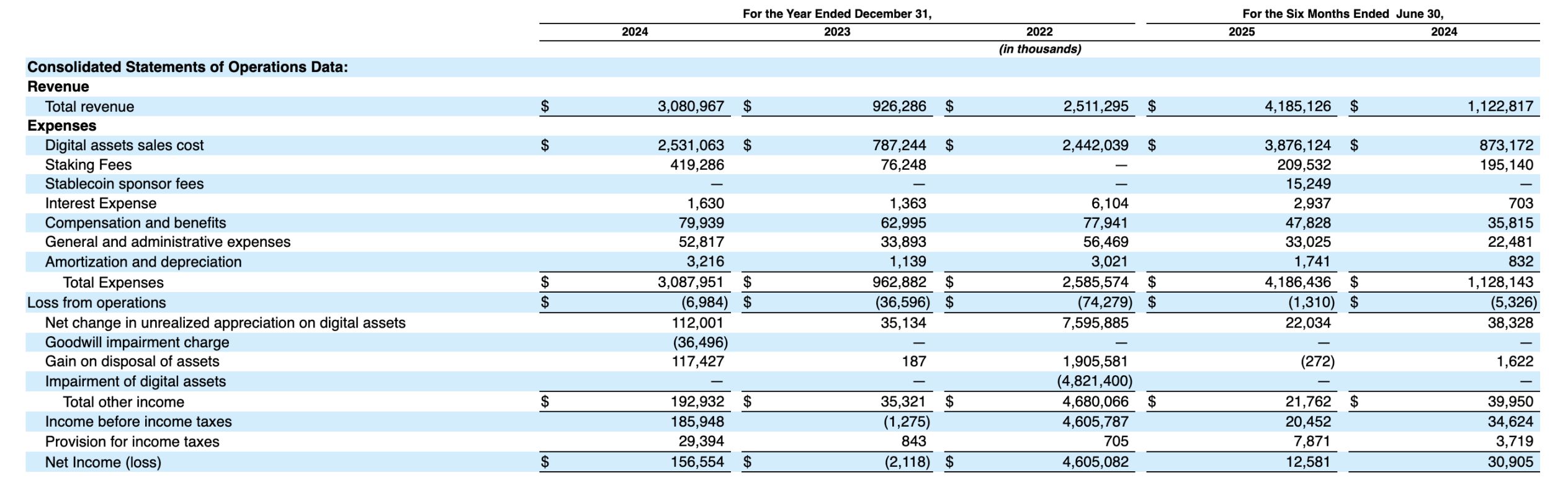

Just looking at this financial report table, it is almost impossible to draw any useful information. It is hard to believe that with $4.185 billions in revenue, there was actually an operating loss of $1.31 millions. To understand BitGo’s actual operating situation, we need to dig deeper into the details of the report.

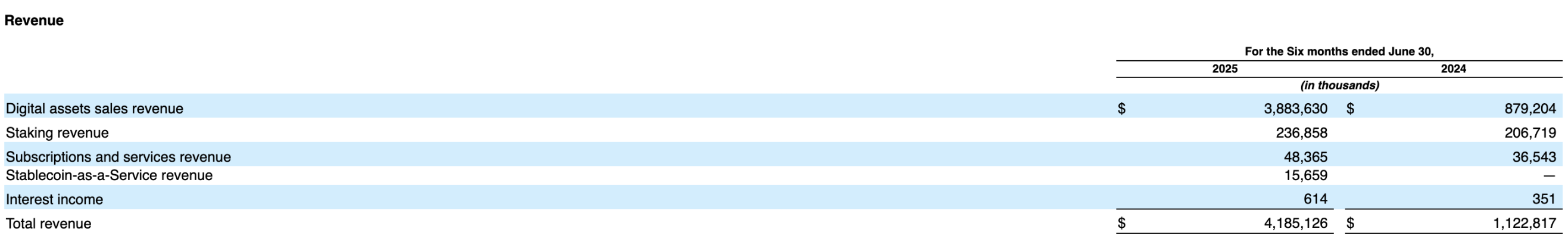

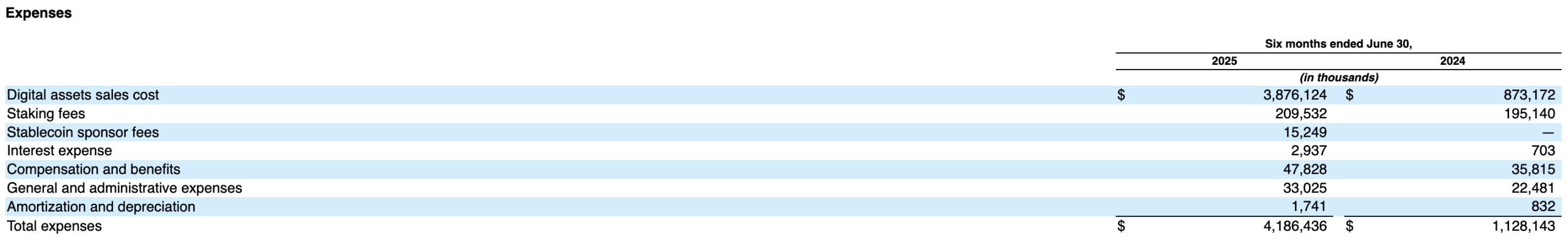

BitGo stated in the documents that, because it acts as the "accounting principal" in digital asset sales and staking businesses, it recognizes revenue on a gross basis. In other words, the $3.883 billions is not the company’s actual net income from digital asset sales, but rather the total amount received from selling digital assets. After deducting the cost of sales of $3.876 billions, BitGo’s actual income from digital asset sales is $7.506 millions.

The calculation method for the staking business is similar. BitGo’s actual income from staking business is $27.326 millions. The newly added stablecoin-as-a-service income this year is also similar, with actual income of $410,000. The income item representing its core business, including custody, is $48.365 millions.

Therefore, we can consider BitGo’s actual business income for the first half of the year to be $84.221 millions. Adding other income of $21.762 millions, the total income is about $105.6 millions, with a net profit of $12.581 millions and a net profit margin of about 11.9%. The data for the first half of 2024 is: business income of $54.505 millions, total income of $94.455 millions, net profit of $30.905 millions, and a net profit margin of 32.7%.

From the data, we can conclude that BitGo’s revenue continues to increase, losses are narrowing, but it has still not achieved profitability. The proportion of subscription and service income, which is BitGo’s main business, in operating income for the three periods in the table above is 57.4%, 53.7%, and 67%, with absolute values of $48.365 millions, $40.9 millions, and $36.543 millions, respectively. The absolute values of other operating income are $35.856 millions, $35.213 millions, and $17.962 millions, respectively.

Accordingly, BitGo’s trading, staking, and other business income did not grow in the first half of this year, and the growth of service income remained between 10% and 20%. In the future, we should continue to pay attention to whether service income can break through the growth bottleneck in operating income data, and whether other business income can achieve more significant growth. There is not much to note regarding cost and expenses.

In terms of other income, the main factor is still the price changes of held cryptocurrencies, as well as goodwill impairment and gains or losses from asset disposals. For example, in 2024, there was a goodwill impairment for the acquired alternative investment service provider Brassica, as well as gains from the sale of assets related to the WBTC solution. Of course, the main factor is still the price fluctuations of BitGo’s reserve assets. Using the appreciation of held crypto assets to drive profits into the black is also a traditional skill of Web3 companies.

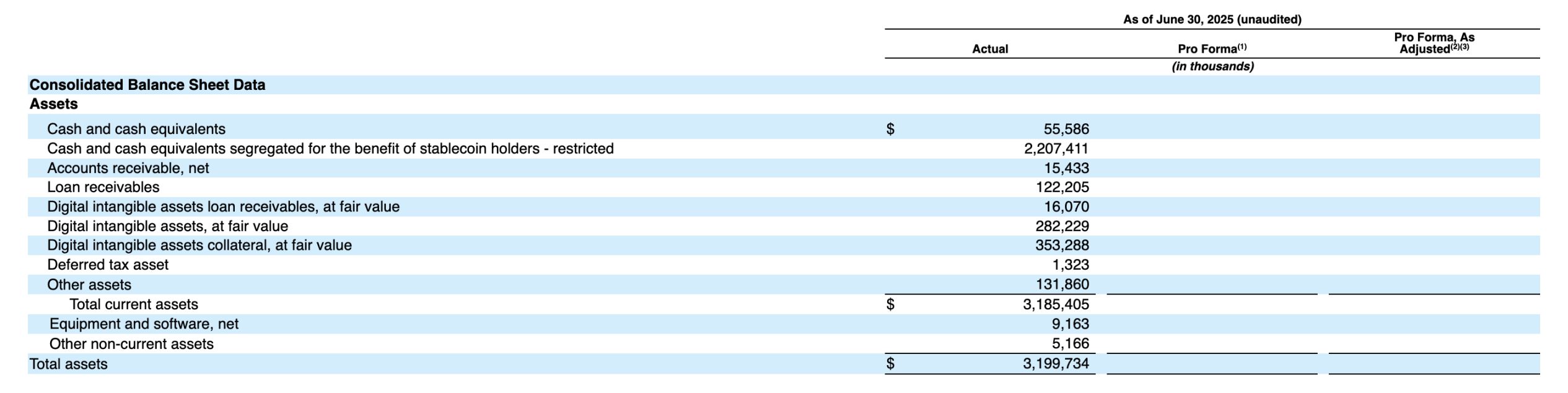

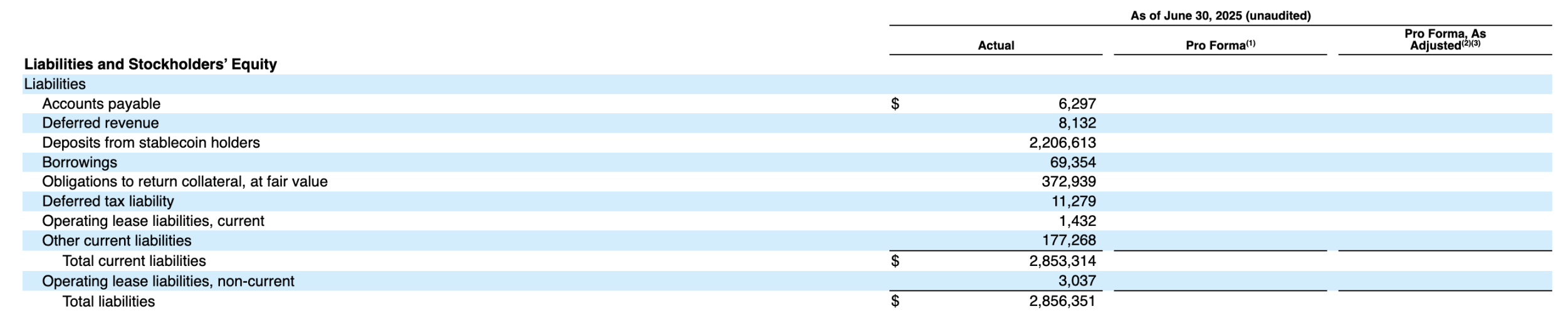

After explaining the business data, let’s look at the asset and liability situation.

The asset and liability situation is similar to the logic above. Excluding stablecoin reserve assets and collateral held on behalf of clients, BitGo’s assets are about $639 millions, and liabilities are about $277 millions. This means BitGo’s asset-liability ratio is about 43.3%, much better than the 89.3% calculated based on all data, and is also within a reasonable range.

According to data provided by BitGo, its adjusted EBITDA (excluding taxes, interest, digital asset value changes, etc., focusing on the business itself) for the first half of 2024, the second half of 2024, and the second half of 2025 are -$1.913 millions, $5.192 millions, and $6.864 millions, respectively. Although this data suggests that BitGo’s business is indeed growing, as we calculated in the first part, hedging against potential losses from digital asset volatility is also a basic skill that a financial business company should have. In this regard, the author believes that BitGo’s financial business still needs further improvement.

As of June 30 this year, BitGo had more than 4,600 clients, with a compound annual growth rate of 81.2% over the past two and a half years. However, the significant increase in the number of clients has not brought a corresponding increase in revenue data.

Overall, we believe that BitGo’s financial situation is not as bad as the surface data suggests, and the ratio of assets to liabilities remains within a reasonable range. However, as a large 2B business favored by investment institutions, BitGo’s business growth is relatively slow, and its future ceiling may also be limited. Without the addition of sufficiently attractive new businesses, BitGo’s market value has limited room for imagination.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nexus Institutional Roundtable Flash Report|Advancing the Future of Omni-Chain Finance】

Wintermute: The current macroeconomic landscape does not resemble a long-term bear market.

Arthur Hayes: Zcash is the last 1000x opportunity, all actions are just to accumulate more bitcoin

I believe in the long-term potential of a certain asset, but in the short term my goal is to maximize my bitcoin holdings.